The top 10 stocks for 2024 are the stocks of companies that are scaling up a business or enjoying tailwinds in their respective sectors that will continue to grow and the stock prices will follow the same.

Which are the best Indian stocks for 2024 you can own to make a return? Let us check out the story in each of the companies one by one.

Top 10 Picks for 2024

Here are the top 10 stocks that can keep performing in 2024 and are worth exploring

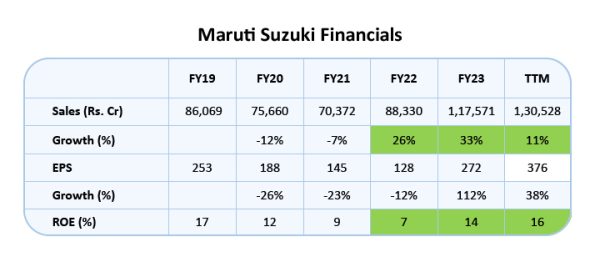

1. Maruti Suzuki (MSIL):

It is the largest Passenger vehicle maker in the country with its service network across 4,000 touch-points in the country covering 1,989 towns and cities. This is the widest service network offered by any automobile brand in the country.

MSIL has maintained its strong financial profile with estimated net worth and liquidity of ~Rs.65,000 crore and ~Rs.50,000 crore, respectively, as on Sept 2023.

A strong SUV lineup helped in achieving a market share of ~21% in the SUV segment (as of 9M FY2023-24). Margins were significantly higher last quarter at 13% with operating leverage and RM cost reduction coming into the picture. The company has been successfully improving on getting back its market share, backed with operating leverage; we believe fundamentals shall improve further for MSIL in FY25.

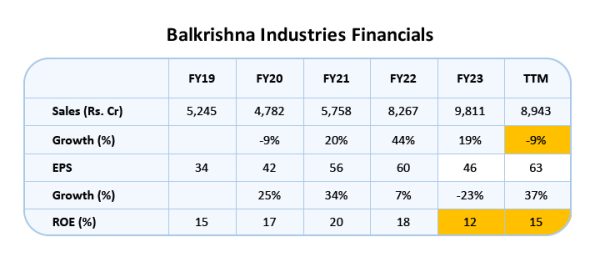

2. Balkrishna Industries (BKT):

It is India’s Leading player in the Global ‘Off Highway Tire (OHT)’ market. The company sells its tyres in 160+ countries through its distribution network in Europe, America and Australia. It receives 46% of its sales from Europe; followed by India (28%), Americas (17%) & Rest of the World (10%). BKT has successfully focused on specialist segments such as agricultural, construction wherein it caters to the aftermarket segment.

The current achievable capacity is 360,000 MTPA post-commissioning of the Waluj brownfield project. Currently, the company is facing headwinds in exports to Europe. Its sales volume has decreased 8% to 210,543 MT in 9M FY24. Margins are stable for the quarter at 24% from highs of 25-28% historically. With a recovery in exports, a company should do well in the coming year.

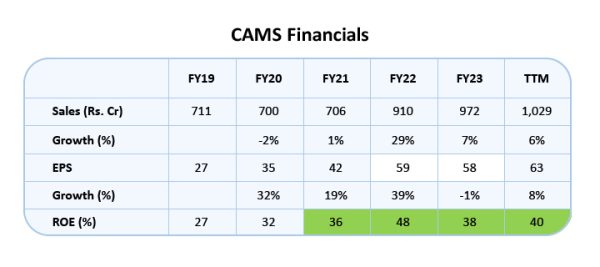

3. Computer Age Management Services (CAMS):

It is the leading Registrar and Transfer Agency (RTA) to the Indian Mutual Fund industry with ~68% market share and has a strong presence in the AIF and PMS RTA segment (50% market share among funds utilizing RTA services). The company currently provides technology-based services including dividend processing, transaction origination interface, payment transaction execution, intermediary empanelment, report generation, investor interface, settlement and reconciliation, compliance-related services, and brokerage computation.

CAMS is venturing into new venues for growth like Account Aggregation, Payments, Insurance and KYC Services. Improving margins, very high return ratios and incremental growth coming from new business should bode well for the company going ahead.

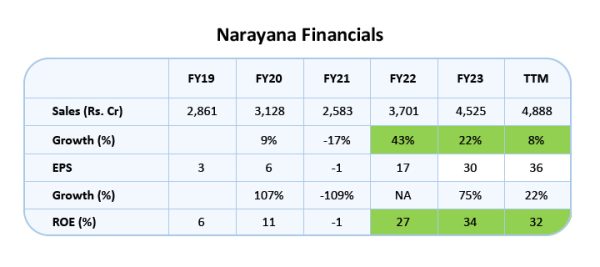

4. Narayana Hrudayalaya (NHL):

It operates a chain of multispecialty, tertiary and primary healthcare facilities. It was established by Dr. Devi Shetty, who has over 37 years of medical experience, in the year 2000. The Group, which originally focused on cardiac and renal sciences, expanded to additional areas of focus such as cancer care, neurology and neurosurgery, orthopedics, and gastroenterology and was rebranded as “Narayana Health” in 2013. NHL has a strong presence in Karnataka and eastern India, with an emerging presence in western, central and northern India. It has a network of 40 healthcare facilities, including 18 owned/operated hospitals, 1 managed facility, 3 heart centres, 17 primary healthcare facilities and 1 hospital in the Cayman Islands. It had 5,821 operational beds and a capacity of 6,096 beds as of Sept 2023.

Narayana has seen significant operating leverage benefits with bed capacity and utilisations increasing post-Covid. The company has recently received its Insurance license and is also planning to set up a 1,000-bed super speciality hospital in Kolkata in the next two years. The healthcare sector has significant headroom to grow in India and Narayana remains our top pick.

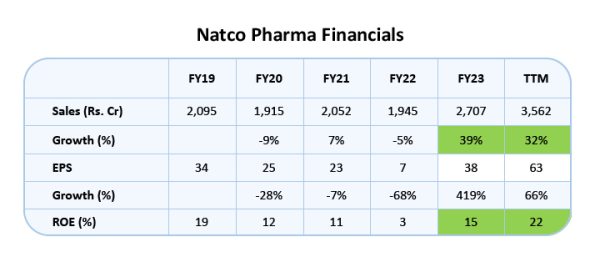

5. Natco Pharma (Natco):

It is a well-established player in the oncology segment (cancer-related) with brands catering to diseases including breast, bone, lung and ovarian cancer. It is a vertically integrated player, targeting niche molecules placing emphasis on R&D, operating in domestic and export markets. Compared to other pharma players, this focused approach where barriers to entry are high and customers are stickier aids the company.

In export formulation, its business model is to challenge innovators’ drug patents (niche Para IV/Para III filings/First to file) and capture a large market of generic versions of such drugs. Management has shown the capability of navigating complex legal and regulatory challenges to do the same. Natco mainly sells FDF in the US, India, Canada, Brazil, and over 50 other countries.

Natco has a differentiated business model with capable management who have a strong execution history wherein they are challenging innovators for complex generics. Ramp-up and market share gains from Revlimid as well as diversifying revenues through entry into Crop Health Sciences are the key triggers this year.

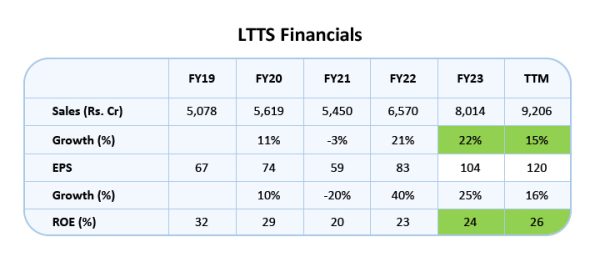

6. L &T Technology Services (LTTS):

It is a leading pure-play R&D outsourcing provider based in India, is poised to capitalize on the increasing technological adoption in R&D and NPD (New Product Development). With a diverse business portfolio and low client dependence, LTTS boasts higher resilience to industry fluctuations compared to its peers in the ER&D (Engineering Research and Development) sector.

While the IT and ER&D services industries are of similar size, the ER&D sector is expected to exhibit higher growth led by double-digit growth in digital. The company has demonstrated impressive growth in its digital offerings, which now account for approximately 50% of its revenue. LTTS’ comprehensive solution offerings across five major verticals enhance its competitiveness in the market. A better outlook for the ER&D services industry compared to the broader IT services and the growing outsourcing of ER&D services presents favourable growth prospects for LTTS.

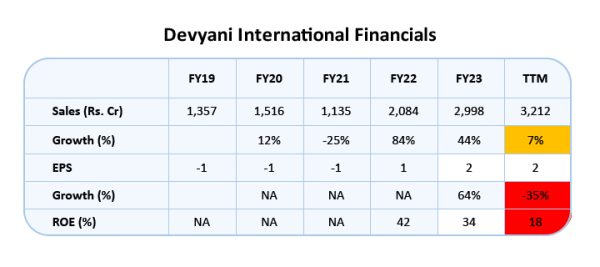

7. Devyani International (DIL):

It is a quick-service restaurant (QSR) player. DIL has well-recognized global brands KFC, Pizza Hut, Taco Bell, and The Habit Burger Grill in its portfolio and are amongst the large operators of QSRs in India. DIL is the largest franchisee of KFC and Pizza Hut in India, Nigeria and Nepal. DIL is also a franchisee for the Costa Coffee brand and stores in India. KFC, Pizza Hut and Costa Coffee together comprise its core brands. In addition to that, DIL has established in-house brands such as Vaango (South Indian Cuisine) and Food Street.

DIL has been consistently expanding its store network over the years. Along with greater brand accessibility, the substantial operating synergies across brands, innovative product offerings, strong technology adoption and robust supply chain management have further strengthened its business model and leadership position in the QSR segment in India. Business performance has been stagnant and same-store sales growth (SSSG) has been negative for some quarters now. We believe this performance shall improve going forward.

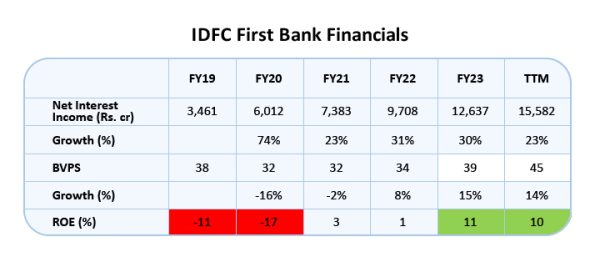

8. IDFC First Bank (IDFCFIRST):

It was established through the merger of two entities: IDFC Limited, a well-known Domestic Financial Institution, and Capital First Limited, a successful NBFC specializing in Retail & MSME financing. The bank’s initial goal was to diversify from infrastructure and corporate loans by merging with a profitable retail franchise. However, at the time of the merger in December 2018, IDFC First Bank faced several challenges. These included low CASA ratio, NIM, and Pre-Provisioning Operating Profits (PPOP). The majority of deposits and borrowings were institutional, with only a small portion being retail deposits. Additionally, the bank had substantial exposure to infrastructure and corporate loans. The company is now transforming from a corporate-focused low NIM bank to a retail-focused high NIM bank. Financial performance has been improving significantly since FY22.

Bank recently came up with Guidance for the next 5 years wherein: It targets to (a) Increase branch size to 1700-1800 from current 897. (b) Triple customer deposits to Rs. 585,000 Cr from the current Rs. 176,000 Cr. (c) Grow Loans and advances to Rs. 500,000 Cr with a CAGR of 20%. (d) Improve ROE to 17-18% from the current 10.7%. With smaller size in comparison to large banks, aggressive growth with good management, IDFC First Bank remains a good company to buy.

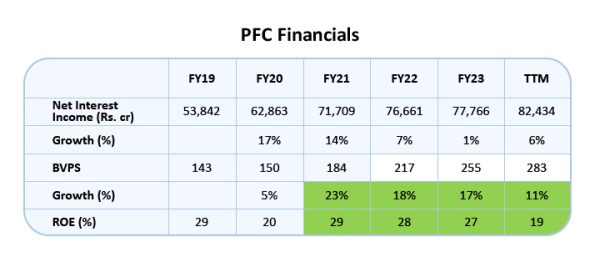

9. Power Finance Corporation (PFC):

It is a Non-Deposit taking NBFC registered with the RBI as an Infrastructure Finance Company. The company finances infrastructure projects in the Indian Power sector (Generation, Transmission and Distribution). This includes:

A) Fund-Based Products: Project Term loans, Lease financing for the purchase of equipment, Short/Medium Term loans to equipment manufacturers, Debt refinancing, etc.

B) Non-Fund Based Products: Deferred payment guarantee, Letter of Comfort (LoC), Policy for a guarantee of credit enhancement, etc

Capital expenditure (capex) initiatives by major players like NTPC and Power Grid Corporation drive growth prospects for entities like PFC. Power Grid Corporation foresees substantial investments exceeding Rs. 4 lakh crore in the transmission sector over the next 7 to 8 years, estimating its transmission capex at Rs. 1.71 lakh crore up to 2032. We remain optimistic on PFC for its aggressive loan book growth, reducing NPAs and strong industry tailwinds.

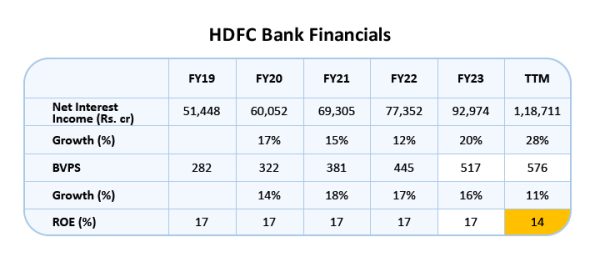

10. HDFC Bank:

It is the largest private sector bank in India which offers a wide range of banking services, including commercial and transactional banking in the wholesale segment, and branch banking in the retail segment, with a focus on car finance, business banking loans, commercial vehicle finance, credit cards, and personal loans. HDFC Bank has an impeccable execution track record for year-on-year growth as it scaled up from a low base in the previous decade and limited impact from an economic slowdown. Granular, short-term loans in highly profitable industries are the reason for its strong track record on asset quality.

With more than 18% CAGR in income over the last 5 years, HDFC Bank is going through some slowdown currently. Currently, FII selling and a slowdown in growth has caused HDFC Bank’s share price underperformance creating an opportunity for long-term investors. Post-merger issues shall show improvement in the next 2-3 quarters. Current valuations are much better than the historical multiples it trades at. HDFC Bank should give decent returns in CY24.

Disclosure- The above stocks are shared for further study and shouldn’t be construed as investment advice. Current prices might be high, reach out to advisors for the right price or wait for market volatility. Our clients may or may not be holding the stocks mentioned above.

Top 30 Performing Stocks of 2023

The year 2023 has been a roller coaster year in every context and the stock market is no exception to that. It appeared as if market cycles that generally occur over 10 years or more, were force-fit into 10 months or so. The year 2023 has seen all of it; Expansion, Recession, Recovery and Boom in such a short span.

Let us have a look at the stocks that contributed to this party. Following is the list of the top 30 stocks that have generated maximum returns in the past 1 year.

| S.N. | Stock Name | 1 Year Return |

|---|---|---|

| 1 | Suzlon Energy | 443% |

| 2 | Indian Railway Finance Corporation | 436% |

| 3 | BSE | 396% |

| 4 | NBCC (India) | 354% |

| 5 | SJVN | 347% |

| 6 | Housing and Urban Development Corporation | 332% |

| 7 | REC | 317% |

| 8 | Ircon International | 304% |

| 9 | Olectra Greentech | 303% |

| 10 | JBM Auto | 302% |

| 11 | Power Finance Corporation | 301% |

| 12 | Rail Vikas Nigam | 297% |

| 13 | Jindal Saw | 280% |

| 14 | Cochin Shipyard | 270% |

| 15 | Mangalore Refinery And Petrochemicals | 268% |

| 16 | NLC India | 263% |

| 17 | ITI | 251% |

| 18 | Apar Industries | 232% |

| 19 | Kaynes Technology India | 225% |

| 20 | Engineers India | 214% |

| 21 | Bharat Heavy Electricals | 212% |

| 22 | Adani Power | 211% |

| 23 | Prestige Estates Projects | 211% |

| 24 | Welspun Corp | 201% |

| 25 | Zomato | 197% |

| 26 | Birlasoft | 196% |

| 27 | The Fertilisers and Chemicals Travancore | 190% |

| 28 | Mazagon Dock Shipbuilders | 190% |

| 29 | MMTC | 190% |

| 30 | Hindustan Copper | 183% |

During the bull market, all stocks, good and bad, may rise. However, if a company is not fundamentally sound or if it has not grown, the stock will give away all the returns it earned during the liquidity rally.

Which stocks are likely to do well over the next year? We believe that stocks of companies that are scaling up a business or enjoying tailwinds in their respective sector will continue to grow and the stock prices will follow the same.

Stock Investing Faqs:

Which companies give the highest return?

We believe that stocks of companies that are scaling up a business or enjoying tailwinds in their respective sector will continue to grow and the stock prices will follow the same. Over the long term, it is observed that stock prices follow the earning trajectory of the company. Hence to generate high returns, it is important to track the earnings of the company and the stock price follows. Here are the top 5 stocks that performed well in the last year.