Worldwide, there is a lot of hues and cry over high mutual fund expense ratio that investment management firms charge for generating better than the market return.

Globally, funds are moving out of active strategies to low-cost passive investing. The logic for these flows is often cited that value addition done by active mutual funds is small and uncertain vs the fees charged by them.

Talking in the Indian Context, The Securities and Exchange Board of India (SEBI) wants to review whether Indian mutual funds are overcharging their customers by imposing a high total expense ratio (TER).

In another report by Morningstar, a mutual fund advisory said that India was among the most expensive markets when it comes to expense ratios.

In Mint newspaper, some industry leaders opine expense ratio must be looked in the context of maturity of markets and/or outperformance of the scheme.

Nilesh Shah, Managing Director, Kotak Asset Management Co. Ltd comments, “Mutual funds should be allowed to link fees with performance. It is a win-win situation for investors and fund houses as performance gets incentivised. However, there should be appropriate checks and balances.”

Radhika Gupta CEO, Edelweiss Asset Management Ltd. comments, “The ‘right expense ratio’ is one that is fair to an investor, given the value that is being delivered by the asset manager”

At Moneyworks4me.com, we second his opinion that better performance rewards investors and investment managers. This is in lines with Economics 101, which says higher value addition deserves higher pricing. So as a fiduciary how does one actually find this?

To determine the fair expense ratio, we compute 3 years prior to total excess returns generated by a mutual fund above its benchmark by adding back the expenses to it. This is the excess return pre-expenses.

We then check how much is the current expense ratio as a percentage of the total excess returns pre expenses. If it is less than 25% it commands a Green Rating.

If it is more than 50%, it is labeled as Red and anything in-between is Orange. This way of assessing expense ratio signals that investors should be comfortable with a higher expense ratio provided it is Green i.e it has generated higher excess returns to justify it.

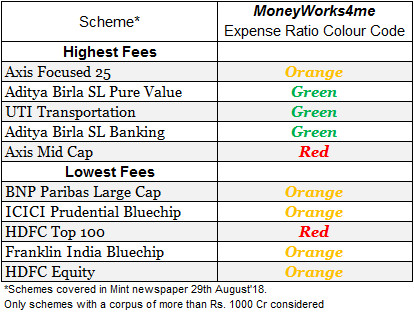

We check the 5 funds that charge the most and the least fees as mentioned in the Mint article and found that only one in each is Red.

However, Jimmy Patel, CEO, Quantum MF points out, “Mutual fund fees should not be based on performance. Such a fee structure may tempt a fund manager to take undue short-term risks.”

Rightly, Jimmy highlights another economic principle. Incentives may lead to perverse consequences, even, in some cases, causing people to work against the very goal you were trying to achieve.

At MoneyWorks4me, we address this by taking stock of the quality of stocks a mutual fund holds in a portfolio. With our ability to assign color-code to an individual stock listed in the market, we arrive at portfolio Quality Rating.

This rating highlights risks in the portfolio. This would help investors identify funds that may have generated high returns but have taken high risk.

A multi-cap fund may have earned very stellar returns, but if you look closely at the portfolio you may observe it holds small cap stocks. Small cap stocks are risky and outperformance is nothing but compensation for that risk. In this case, if the expense ratio may look low but investor knows the risk taken by the fund by looking Quality of the portfolio.

On the contrary, consider another multi-cap fund that may not have earned very high returns but mostly held good quality stocks. In this case, if the expense ratio is less than 25% of excess returns, it deserves a better rating and worth considering despite lower returns vs the former.

To summarize, expense ratios seen as a percentage of the total excess returns generated are win-win. It gives the benefit of charging higher fees to funds generating higher performance without complicated regulations.

Investors too would be willing to pay the incremental higher fees for higher returns provided they are also able to assess the quality of the fund’s portfolio. Which may not be possible for all investors and hence Advisor Zaroori Hai.

In the meantime, you can check out funds based on the above method on our site Moneyworks4me.com. Look for Green or Orange colored funds on Quality. Observe whether Expense ratio color cells are largely Green to take better decisions.

Read the article to know: Avoid Mutual Funds with Hidden Costs

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: