EasyMyTrip IPO Details:

- IPO Date: Mar 8th to Mar 10th, 2021

- Total Shares for subscription: ~2.7 Crore

- IPO Size: ~Rs. 510 Cr

- Lot Size: 80 shares

- Price Band: Rs. 186-187 /share

- Market Cap: 2,000 Crore

- Recommendation: Subscribe

Purpose of Easy Trip Planners Limited (EaseMyTrip) IPO

- Offer for Sale for existing investors/promoters

- The company will not receive any proceeds from the offer.

About the Easy Trip Planners Limited

Easy Trip Planners Ltd is an online travel agency that offers a range of travel products and services and end-to-end travel solutions including airline tickets, rail tickets, bus tickets, taxis, holiday packages, hotels, and other value-added services i.e. travel insurance, visa processing, etc. The company offers these services through its website and Ease My Trip android and iOS mobile app.

The company was incorporated in 2008 and ranked 2nd among the Key Online Travel Agencies in India in terms of booking volume in the 9 months ended December 2020 and 3rd among the Key Online Travel Agencies in India in terms of gross booking revenues in FY20.

The company follows B2B2C (business to business to customer), B2C (business to customer), and B2E (business to enterprise) distribution channels to offers its services. As of November 2019, the firm has served customers with more than 400 domestic and international airlines, and 1,096,400 hotels. As of March 2019, it had 49,494 registered travel agents across major cities of India.

Services provided by Easy Trip Planners Limited

- Airline tickets, which consists of the sale of airline tickets as well as airline tickets sold as part of the holiday packages;

- Hotels and holiday packages, which consists of standalone sales of hotel rooms as well as travel packages. This includes hotel rooms, cruises, travel insurance, and visa processing; and

- Other services, which consist of rail tickets, bus tickets, taxi rentals, and ancillary value-added services such as travel insurance, visa processing, and tickets for activities and attractions.

The company has been providing customers with the option of “no convenience fee”, such that customers are not required to pay any service fee in instances where there is no alternate discount or promotion coupon being availed.

Management of Easy Trip Planners Limited:

The company was incorporated as ‘Easy Trip Planners Private Limited’ in June 2008. The company was promoted by Nishant Pitti, Rikant Pittie, and Prashant Pitti. They collectively hold 10.86 Crore equity shares, aggregating to approximately 100% of the pre-Offer issued, subscribed, and paid-up Equity Share capital of the company.

Nishant Pitti is the Promoter, Whole-time Director, and CEO of the company. He has ~12 years of experience in the travel and tourism sector. He is responsible for the overall management of the company, business development, and the financial aspect of the company’s business.

Rikant Pittie is the Promoter, Whole-time Director of the company and has been on the Board since 2011. He is also one of the Promoters and has been responsible for operations, sales, marketing, human resources, and technology in the company. He has ~9 years of experience in the travel and tourism sector.

Prashant Pitti is the Promoter, Whole-time Director of the company, and has been on the Board since April 2016. He is one of the Promoters and has been responsible for technology, infrastructure, branding, and media management in the company. He has ~9 years of experience in the travel, tourism, and construction sectors.

Financials of Easy Trip Planners Limited:

The company has historically financed its working capital requirements and the expansion of its business primarily through funds generated from its operations. At times the equity infusion from Promoters and debt financing was undertaken.

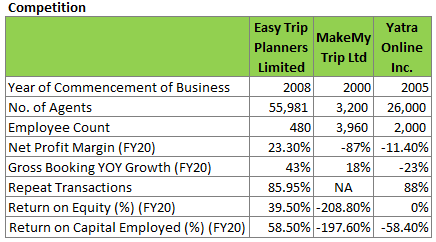

The company has developed a streamlined, efficient, and lean organizational structure relative to the size of its business operations. As of March 31, 2020, they had 480 full-time employees and they had the lowest number of employees among the Key Online Travel Agencies in India during the period.

Strengths:

- Leading position in the online travel agencies

- Strong brand name and distribution network

- In-house technology infrastructure

- Consistent financial track record and operational performance.

Valuation Easy Trip Planners Limited:

Online travel booking is an emerging trend in India. It is expected that the Indian online ticketing market will increase at a CAGR of ~3-4% to reach ₹ 1,600 billion to ₹ 1,620 billion in FY23. Accordingly, there are significant opportunities to further expand the company’s customer base and, at the same time, increase its market share in India.

With growing smartphone penetration, increasing disposable income, and a young population, there is a long-term sector tailwind despite temporary setbacks like Covid.

The company has only an online presence and operates under an asset-light model. As the usage of digital transaction increase travel and holiday booking, online ticketing business can grow without the need of additional capital.

We find sheer high cash flow model bodes well for wealth creation in the platform business.

The only listed Indian peer for the company is Makemytrip which is listed in the US in Nasdaq is still a loss-making company as it is rapidly expanding into new areas.

At a market cap of Rs. 2,000, the stock trades at ~10-12x normal year sales. We find this price reasonable for a business model with strong growth and high free cash flows ~ 40% of sales at scale.

We believe the company already has the reasonable scale to capitalize on industry tailwind. Hence we recommend Subscribe to this IPO.

However, key risk comes from cutthroat competition, which makes us nervous about long-term prospects as price wars can lead to deterioration in profits quickly.

However, it may list at a very high price, we recommend avoiding fresh buy post listing.

Note: We do not recommend buy just because the IPO market is hot. We do not earn any commission or fee for promoting IPOs so expect an honest review from us on the business model and valuation.

| IPO Activity | Date |

| IPO Open Date | 8th March 2021 |

| IPO Close Date | 10th March 2021 |

| Basis of Allotment Finalisation Date | 16th March 2021 |

| Refunds Initiation | 17th March 2021 |

| A credit of Shares to Demat Account | 18th March 2021 |

| IPO Listing Date | 19th March 2021 |

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 80 | ₹ 14,960 |

| Maximum | 13 | 1040 | ₹ 194,480 |

| Date | QIB | NII | Retail | Total |

| Mar 8, 2021, 05:00 | 0.00x | 0.15x | 12.58x | 2.33x |

| Mar 9, 2021, 05:00 | 0.28x | 4.05x | 32.71x | 7.20x |

| Mar 10, 2021, 05:00 | 77.53x | 382.21x | 70.40x | 159.33x |

When will the EaseMyTrip IPO open?

EaseMyTrip IPO will open for subscription on Monday, March 8, and will close on Wednesday, March 10.

What is the price band of EaseMyTrip IPO?

The price band for EaseMyTrip IPO is Rs. 186-187.

What is the lot size for EaseMyTrip IPO?

Retail investors can subscribe to the IPO minimum lot size is 80 shares, up to a maximum of 13 lots i.e. Rs. 1, 94,480.

What is the issue size of EaseMyTrip IPO?

The total issue size is ~2.7 cr shares raising Rs. 510 Cr.

What is the quota reserved for retail investors in EaseMyTrip IPO?

The quota for retail investors in EaseMyTrip IPO is fixed at 10% of the net offer.

When will the basis of allotment be out?

Allotment will be finalized on March 16 and refunds will be credited by March 17. Shares allotment will be credited in Demat accounts by March 18.

What is the listing date of EaseMyTrip IPO?

The tentative listing of EaseMyTrip IPO is March 19.

Where could we check the EaseMyTrip IPO allotment?

One can check the subscription status on Kfin Technologies.

Who are the leading book managers to the issue?

Book running lead managers to the IPO are Axis Capital Limited & JM Financial Consultants Private Limited.

What does EaseMyTrip do?

Easy Trip Planners Ltd is an online travel agency that offers a range of travel products and services and end-to-end travel solutions including airline tickets, rail tickets, bus tickets, taxis, holiday packages, hotels, and other value-added services i.e. travel insurance, visa processing, etc. The company offers these services through its website and Ease My Trip android and iOS mobile app.

Who are the peers of EaseMyTrip?

The peers of EasyMyTrip are Makemytrip, Yatra.com, Goibibo, Cleartrip. All these are an online travel agency that offers a range of travel products and services.

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our PRO solution which has strong 10 companies. The MoneyWorks4me PRO is below Rs. 5000 product which provides you with a recommendation for stocks, index fund, and mutual fund.

Know more: Indian IPO Historic Data 2021

MoneyWorks4me Solutions:

If you liked what you read and would like to put it into practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Why MoneyWorks4me | Why Register | Call: 020 6725 8333 | WhatsApp 8055769463