This article covers the following:

Review

For the year ending Jun’21, Nifty closed at 15,721, around 53% higher than last year. In the last 3 years, Nifty is up 47%; ~13.6% CAGR.

The last 1 year saw a massive shift in stock performance versus the prior 2 years where only Nifty stayed flat while the rest of the market saw correction. In the last 1 year, every segment of the market, small, mid, value, cyclical did better than Nifty. Low interest rates globally and high investor participation in the global market have led to good gains in stocks.

Performance of small/mid-cap, capital goods, and PSU was encouraging and playing a catch up with the rest of the market.

Incremental macro data was improving but has hit a pause to fresh lockdown across key states. However, companies are in better shape to handle lockdown versus the past as they learned from experience to operate under such circumstances. We are seeing listed companies are facing lesser financial stress than small and medium scale enterprises (MSME).

Outlook

Nifty 50 index trades above its fair value while there are pockets of extreme overvaluation and undervaluation. Nifty – led by a concentrated portfolio of Top 10 stocks – is around 31% higher than its fair price, while the same is not true for all stocks. (Nifty@MRP 11,864 Dec’20 numbers). The next update will be done after the June Quarter results.

If we see growth improving next year, we may see an upward revision in our estimates. We have made upward revisions in sectors where we are seeing a sustained recovery in earnings and cash flows. This may bring down overvaluation down by ~5-10%.

As of date, the average upside of our coverage universe is likely to be closer to 10% CAGR over the next 5 years basis based on a current estimate. Similar to Nifty, the average upside of our universe is low due to few stocks showing < 0% CAGR while the rest showing > 15% CAGR upside potential.

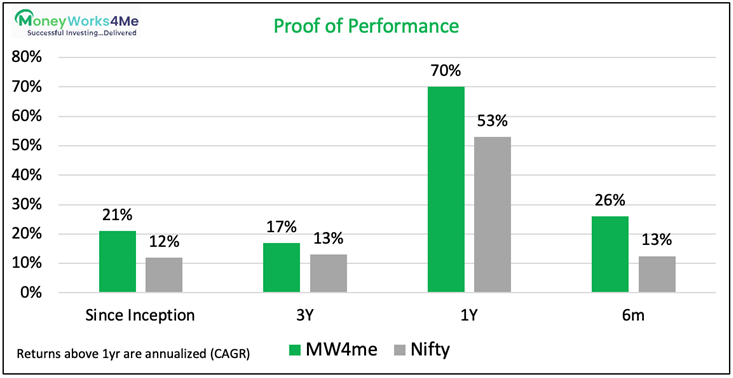

MoneyWorks4me performance was strong last year as we saw the market recognized undervaluation in pockets where we were invested. Even if we return before Covid correction, there are good versus Nifty’s performance as the market rally was broad-based.

We expect our margin of outperformance will increase in the future as Nifty’s concentration in few stocks and lot of overvalued stocks versus our recommendations across sectors and reasonable valuation. Nifty has low representation of sectors with valuation comfort and sectoral tailwinds.

Today, we are looking at opportunities in infrastructure, building materials, export-oriented capital goods, PSUs, and import substitute ideas. We have incrementally added stocks in capital goods and logistics as we started seeing sustained growth versus volatile growth earlier. We continue to remain positive on existing companies that are delivering good growth. Stocks in IT and Pharma have moved up ahead of their earnings growth, we are reducing our allocation in the same.

We look at companies that have good earning triggers over the next 2 years. We are investing in companies i) coming out of sector consolidation/debt reduction, or ii) introducing new products, or iii) commissioning new capacities, or iv) executing orders in hand. v) Export-oriented companies as economic recovery is better in western countries. This gives certainty of growth rather than plain anticipation.

We recommend avoiding stocks/sectors that have run up much ahead of their earnings growth over the last 3-4 years. While the company may continue to do well but stocks may not earn good returns or turn into losses over a 3-year holding period.

We have often seen that popular stocks tend to lag over time as prices reflect all the future growth. We have seen that many consumer facing companies & Financials that performed well pre-covid have lagged Nifty by large margin in last 1 year.

Risks

Indian Economy

GDP data saw two-quarters of year-on-year decline, while the recent quarter was more reasonable 7.5% versus the previous quarter decline of 23%.

The second lockdown has dampened the sentiment for industries and consumers alike. However, the expectation is that economy will recover faster than before as lockdown opens up. Lockdowns are being lifted partially or fully depending on the positivity rate. We will monitor signs of turnaround by looking at volume growth/capacity utilization/inventory-sales ratio. Vaccination rate is another metric to track as it means faster normalization of economic activities. As per Google Data, 21% population has received atleast 1 dose and 4.9% population has completed both the doses.

This time opening up may not see a U-turn in discretionary spending, unlike last year which was linked to pent-up demand. We remain cautious in Consumer stocks including Auto, FMCG, and Durables. Also, fully priced valuations have kept us away from these sectors.

Banking and financial services are again at the forefront to face the brunt of slow economic recovery. Leading private sector banks and NBFC both have warned of delinquencies over the next few quarters. We remain cautious and recommend owning only selective ones where we can estimate the worst-case scenario and still earn reasonable returns over the medium term. As the dark clouds get clear, we will see good wealth creation in banking stocks.

India’s corporate debt profile is very good versus the world. Most sectors have few strong players and highly indebted companies are already written off. This reduces risks in the country and financial system.

The Indian corporate sector is in the best position to gain pricing power and balance sheet strength. The majority of the sectors have seen consolidation. We are seeing this across sectors: Power, Telecom, Cement, Banks, NBFCs, Real Estate, building materials, Paper, pharma, capital goods, consumer durables, etc. This will give strong profitability for incumbents due to the high barrier to entry for the next few years.

Inflation from rising commodity and oil prices can spark fear in economic recovery. However, with lower utilization in various sectors, inflation might not be passed on completely to take advantage of higher volumes and favorable operating leverage.

Global Economy

Western countries are reporting better outlooks as vaccination is picking up pace. This can lead to economic recovery over the next 6 months. Large stimulus checks are handed over to citizens has led to cash flowing into bank accounts. As people get vaccinated, they will spend this on shopping and traveling. This will help in economic recovery. We are already seeing huge pent-up demand causing shortage and inflation. Tight logistics and raw material supply is causing a spike in commodity and widgets prices. It is still uncertain whether inflation is transitionary or structural. We have recommended Gold as allocation in a recent post to our subscribers.

There are signs of speculation in US markets and Cryptocurrencies. A lot of trading activity has led to an increase in leverage and higher trading volume. This is a risk to the market if not the economy. It may happen that the market comes off as the economy recovers as the benefit from fiscal stimulus will fade off. Also, a new draft on widening the definition of corporate tax and tightening regulations around FAANG stocks can cause volatility. We are seeing regulatory tweaking by Chinese authorities in Chinese tech companies that serve large population and control consumer data. We may see snowballing effect on global level which can impact stocks markets as technology companies are dominant part of Global Indices.

*There is always some risk but every risk doesn’t materialize. It is important to keep an eye on risks but it may not require an action everytime.

Frequently Asked Questions

How have MoneyWorks4me Thematic Portfolios performed?

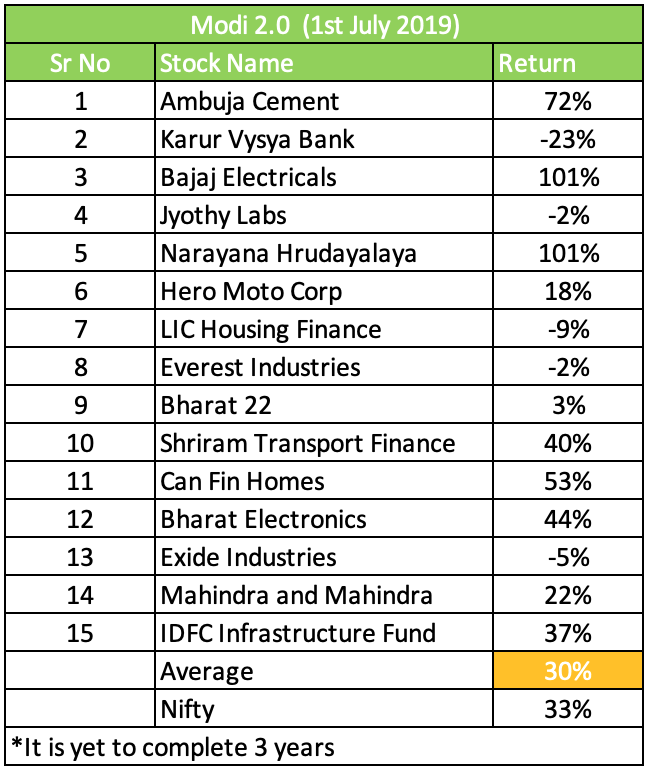

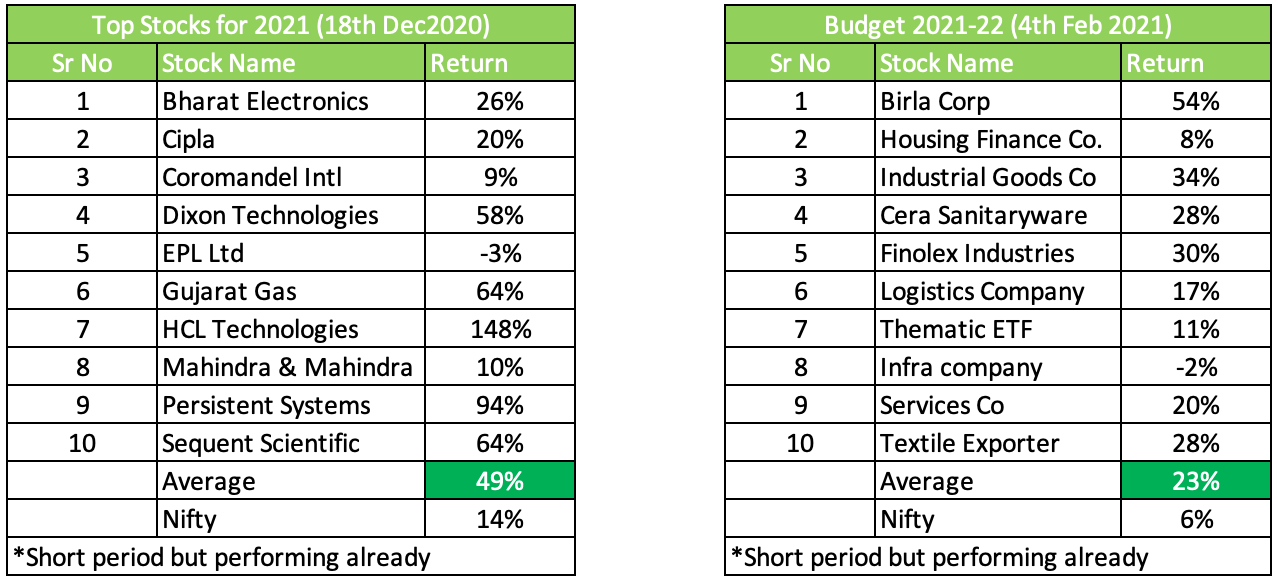

Depending on the opportunity set available with Analysts, we recommend a thematic portfolio. This can be over and above recommendations mentioned in Core or Booster Superstars.

Analysts come across few stock opportunities, at times riskier, so can’t be part of a Long-term portfolio but only tactical. We share our take on these stocks for our aggressive clients either in detailed or capsule format.

We recommend investing only a portion of investable surplus in one theme and not hold beyond few years. Returns from these themes add up to overall portfolio returns. Use our Thematic portfolio tool to buy/sell portfolios in one shot on a number of broker websites.

Aggressive Investor: “Few stocks are making big moves why are we investing cautiously or selectively?”

Today we are seeing run-up not-so-good quality stocks while Quality stocks are more or less flat. Today’s fast rising stocks are of inferior quality or cyclical in nature. These are not great buys for the long term, at best trading plays. We believe these are not good buys for retail investors and must be avoided at all costs. If you come across any stock tip or report, refer our 10-Year X-Ray and you will notice that the colour code of companies is either RED or mostly Red cells.

We believe in sticking to the process of Quality at reasonable price for Core portfolio. It may pinch to see others making more money in short run, but in long term survival is more important than short term returns.

For long term success we prefer caution over aggression, balanced versus bold, sustainable growth versus temporary.

“A principle is not a principle until it costs you something.” – William “Bill” Bernbach

On similar lines, “A process is not a process until it costs you something (or pinches you).”

Conservative Investor: “Shall we stay invested or sell equity?”

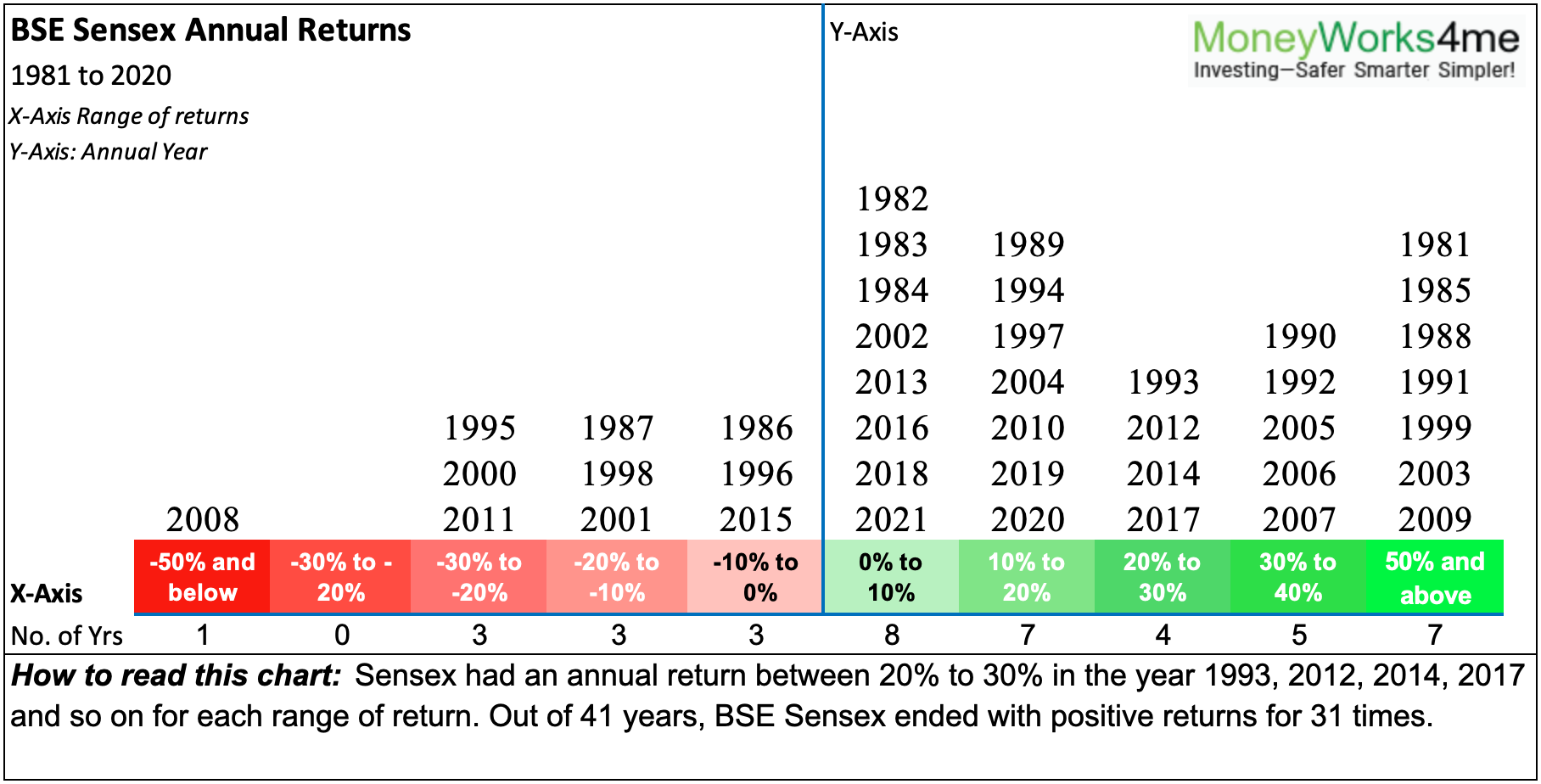

Odds are highly in favour of staying invested rather than exiting or delaying fresh addition.

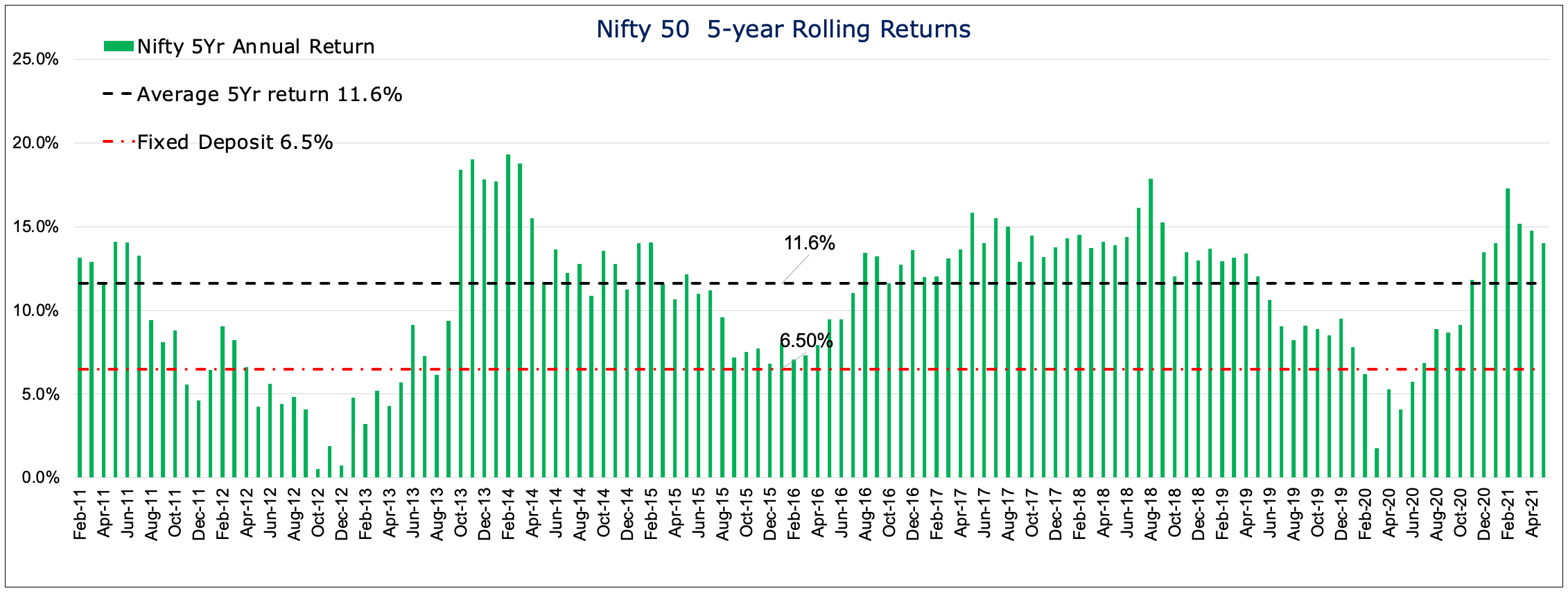

We do not find any merit in second-guessing what’s going to happen in the next 6 months-1 year. If we look at past data, there was an 85% chance of beating FD return on 5 year period. If your time horizon is long-term (5 years+), the current valuation will matter less and near-term events become irrelevant.

By booking profits (term used by speculators, not investors), you will park funds in Fixed Income till market correction (We do not know when and how much). But chances are very high that Equity will beat Fixed income over 5 year period.

So we prefer to choose our funds and stocks carefully, avoid pockets where excitement is the highest and prices may have risen without similar fundamental growth backing it.

Do not disturb equity portion in your asset allocation. Changing your asset allocation will reduce long-term returns or increase the risks of missing the target corpus. If you have decided to stay with 60% Equity and 40% debt, you can rebalance but do not deviate much from 60% in Equity. Use our Financial Planning tool to find your target corpus and required asset allocation/monthly saving.

We have diversified our stocks portfolio, we have diversified assets and we have a long-term horizon. Together this takes care of all potential risks in investing.

What are we reading?

- Patient investing is hard (https://www.evidenceinvestor.com/patient-investing-is-hard/)

Patient investing is the ability to endure long periods of underperformance — adhering to your well-thought-out plan in the form of an investment policy statement — in hopes of achieving your investment objective. Unfortunately, my more than 25 years of experience in advising investors has taught me that when it comes to judging the performance of investment strategies involving risk assets, far too many investors believe that three years is a long time, five years a very long time and 10 years an eternity.

Almost all outperforming traditional active equity managers and equity factors have frequent periods of underperformance relative to the equity market, some of which are long in duration and large in magnitude.

- Top Ten Rules for Money (https://ritholtz.com/2021/07/top-10-rules-for-money/)

Investing Is Both Simple and Hard: The basic premise behind successful investing is easily understood: “Invest for the long term, be diversified, watch your costs, and let compounding work its magic.” But following through can be challenging. Humans are plagued by an inability to just “sit there and do nothing.”

Behavior Is Everything: The inability to manage emotions and behavior is the financial undoing of many. To paraphrase William Bernstein, “the extent you succeed in finance is based on your ability to suppress your limbic system. If you can’t do that, you’re going to die poor.”

Risk and Reward Are Inseparable: Risk is best defined as the probability of your returns differing from your expected outcomes.2 The problem is that many investors want better-than-market returns while assuming minimal risk. But returns are a function of the risks assumed.

- The Unicorn Boom: Shareholder Issues (https://www.business-standard.com/article/opinion/the-unicorn-boom-shareholder-issues-121052401554_1.html)

What is now clear is that the vast majority of the tech-enabled, disruptive unicorns are targeting an IPO over the coming 12-18 months. One decision point for most of these unicorns is where should they list. In the US or in India?

You should list in India. If this type of company tries to list globally, it runs the risk of being orphaned, with no following or research coverage.

Another fear among many entrepreneurs is whether they can get a higher valuation by listing overseas. I would argue the opposite. The Indian markets are willing to pay very high multiples for well-governed, scalable companies with high returns on capital across sectors, be it financials, FMCG, paints, chemicals, automobiles, and classifieds, etc. the most expensive company in the world in the sector is listed in India.

Another point to keep in mind is the need to attract the right shareholder base, whether in India or globally. One of the biggest competitive advantages that an Amazon or a Netflix had was a shareholder base that gave the management the flexibility to build out their business and not worry about short-term profitability.

- The Value of Predictions, or Where’d All This Rain Come From? (https://www.oaktreecapital.com/docs/default-source/memos/1993-02-15-the-value-of-predictions-or-where-39-d-all-this-rain-come-from.pdf)

The motivation for trying to guess the direction of stocks or bonds is easy to understand. Observers have for years noted the wide price swings, calculated the value of a dollar invested at the bottoms and disinvested at the tops and compared the result against the value of a dollar invested under a “buy-and-hold” strategy. The difference is always temptingly large. The problem, however, comes from the fact that none of the forecaster’s attempts to capture the swings have any value unless his or her predictions are right.

Being “right” doesn’t lead to superior performance if the consensus forecast is also right. At least twenty-five years ago, it was noted that stock price movements were highly correlated with earnings [growth]. So people concluded that accurate forecasts of earnings were the key to making money in stocks. It has since been realized, however, that it’s not earnings [growth] that cause stock price changes, but earnings changes which come as a surprise.

When interest rates stood at 8% in 1978, most people thought they’d stay there. The interest rate bears predicted 9%, and the bulls predicted 7%. Most of the time, rates would have been in that range, and no one would have made much money. The big profits went to those who predicted 15% long bond yields. But where were those people? Extreme predictions are rarely right, but they’re the ones that make you big money.

Not only must a profitable forecast have the event or direction right, but it must be correct as too timing as well. Let’s say you accepted the forecast that the Big Three would come to again own 100% of the U.S. market, and you bought the stocks in response. What if a year later their share was lower (and their stocks too)? Could you continue to hold out for the long term, or would your resolve weaken? What if their shares (and stocks) were unchanged five years later? Wouldn’t you give up? And wouldn’t that be just in time to see the prediction come true? In investing, it’s hard to hold fast to an improbable, non-consensus forecast and do the right thing…especially if the clock is telling you the forecast is off base. As I was told years ago, “being too far ahead of your time is indistinguishable from being wrong.”

MoneyWorks4me Outlook:

Investing successfully to reach your goals:

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Why MoneyWorks4me | Call: 020 6725 8333 | WhatsApp: 8055769463