Star Health & Allied Insurance IPO details:

IPO Date: Nov. 30th to Dec 2nd 2021

Total Shares for subscription: ~8.1 Cr

Lot Size: 16 shares

Price Band: Rs. 870-900 / share

Issue Size: Rs. 7,249 Cr

Market Capitalization: ~Rs. 51,806 Cr

Recommendation: Subscribe for listing gains

Proceeds of the offer:

- To augment the company’s capital base and insolvency level. (Rs. 2000 Cr)

- Offer for sale: Existing investors selling their shares (Rs. 5249 Cr)

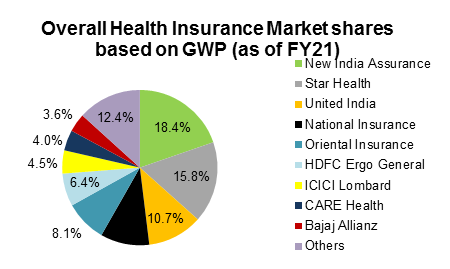

Size & Market Share:

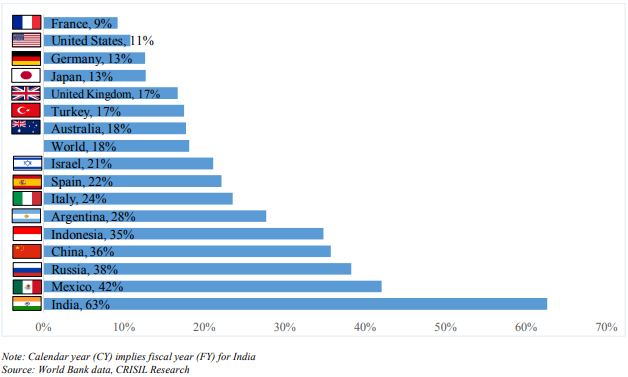

The retail health market segment is expected to emerge as a key growth driver for the overall health insurance industry in India after the COVID-19 crisis in India due to low penetration of health insurance, high out-of-pocket expenses for healthcare costs, and since only 10% of the population has insurance policies outside of government plans. The Indian health insurance market is underpenetrated, with a health insurance penetration of only 0.36% of GDP in 2019, compared to the global average of 2% of GDP.

A number of demographic factors, including increasing life expectancy, per capita GDP, and population growth in India, as well as the high portion of out of pocket expenses as a percentage of total healthcare expenditure by patients in India (63% in 2018), are driving the need of healthcare services and the growth in the health insurance industry in India. Awareness of health insurance in India has been growing, including as a result of measures taken by the Government of India, and this trend has been accelerated by the prospect of hospitalization due to COVID-19, as well as the rising cost of medical care in private hospitals and the need for health insurance.

The retail health insurance segment, which accounted for 9% of the total number of lives covered by health insurance in India in FY20, contributed 45% of the total health GWP generated in the overall health insurance market in FY21. This was primarily due to retail health’s higher premium per person compared to other health insurance segments. Profitability in the retail health insurance segment is also being driven by customer loyalty, which is higher than other health insurance segments, as well as lower claims ratios, which were 73% in retail health, compared to 99% in group health and 92% in government-sponsored health schemes in FY20. In addition, SAHI insurers only had a claims ratio of 59% in relation to their retail health business in FY20, compared to 67% and 92% for the private sector and public sector insurers, respectively.

About the Star Health and Allied Insurance Company Ltd

The company was incorporated as ‘Star Health And Allied Insurance Company Limited’, in June 2005. Rakesh Jhunjhunwala, Safecrop Investments India LLP, and WestBridge AIF (I) are the Promoters of the company and currently hold ~59.32% of the pre-Offer issued.

Business

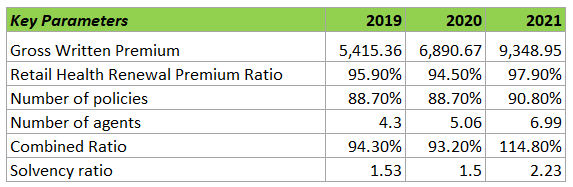

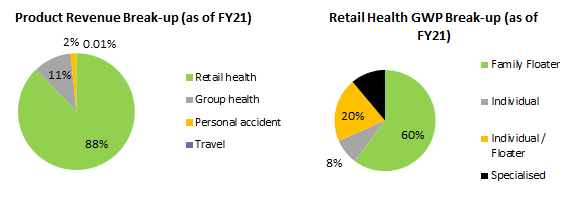

Star Health and Allied Insurance Company Limited is the largest private health insurer in India with a market share of 15.8% in the Indian health insurance market (as of FY21). The company was the first Standalone Health Insurance (“SAHI”) company established in India in 2006 and now has grown into the largest SAHI Company in the overall health insurance market in India. Their comprehensive health insurance product suite insured 2.05 crore lives as of FY21, in retail health and group health, which accounted for 89.3% and 10.7%, respectively, of their total health Gross Written Premium in FY21. Focused on the retail health market segment, the company has been consistently ranking 1st in the retail health insurance market in India based on retail health GWP over the last 3 years.

Product Offering

Star Health offers a range of flexible and comprehensive coverage options primarily for retail health, group health, personal accident, and overseas travel, which accounted for 87.9%, 10.5%, 1.6%, and 0.01%, respectively, of its total GWP in FY21. The products target a variety of customer segments, as well as persons with pre-existing medical conditions across the broader middle-market customer segment. The products include family floater products. In these products, the sum insured covers the entire family on the payment of a single annual premium. The individual products are tailored to the needs of the individual. And specialized products focus on customers with pre-existing conditions after taking into account the associated risks. The company has a claims processing experience of ~6 million claims processed since its inception until Sept’21. From FY18 to Sept’21, the company has launched 56 new products (including all variations of policies).

Distribution & Network

Star Health distributes their health insurance policies primarily through individual agents, which accounted for 78.9% of their FY21 GWP. As of FY21, it had the largest number of individual agents among SAHI insurers, at ~3 times that of the SAHI Company with the next highest number of agents.

As of Sept’21, the company has sponsored and trained 70,000 individual agents, representing 14.7% of the total number their individual agents. Their agency distribution channel also includes their corporate agent banks and other corporate agents. Star Health has led the non-public health insurance market in terms of a number of new branch openings since FY18, and their branch network was over higher 2.5x the number of the next largest non-public health insurance provider (as of Mar’21). Their other origination channels include distribution by direct online sales through telemarketing and their website, brokers, insurance marketing firms, and web aggregators.

The company has built one of the largest health insurance hospital networks in India, with more than 11,778 hospitals as of Sept’21. Out of the total number of hospitals in their network, they have entered into pre-agreed arrangements with over 7,741 hospitals, or 65.7%, of the total number of hospitals in their network as of Sept’21. In FY’21 and the 6 months ended Sept’21, they processed 55% and 62%, respectively, of their total number of cashless claims, through their agreed network hospitals.

Promoter

The key management members include their founder, Venkatasamy Jagannathan, Subbarayan Prakash, and Anand Shankar Roy, who has been with the company since their first year after inception. They have played a critical role in achieving their strong business performance through their thought leadership and industry expertise.

Venkatasamy Jagannathan is the Chairman and CEO of the company. He has more than 47 years of experience in the insurance industry. He has previously worked with United India Insurance Company in the capacity of chairman cum MD.

Subbarayan Prakash is the MD of the company. He has several years of experience as a surgeon and has previously worked with Saudi Operation & Maintenance Co Ltd as a specialist in general surgery/traumatology.

Anand Shankar Roy is the Managing Director of the company. He has 21 years of experience in the insurance industry and has previously worked with American Express Travel Related Services and ICICI Lombard General Insurance Co Ltd.

Nilesh Kambli is the CFO of the company. He has previously worked with Bharti AXA General Insurance Co Ltd, Citicorp Finance (I) Ltd, and ICICI Lombard General Insurance Co Ltd. He joined the company as the CFO in 2020.

Aneesh Srivastava is the Chief Investment Officer of the company. He has over 25 years of experience in fund management and the insurance industry. He has previously worked with Bajaj Allianz Life Insurance Co Ltd, IDBI Fortis Life Insurance Co Ltd, India Advisory Partners Pvt Ltd, and Sahara India.

The company is supported by their Promoters, which include Rakesh Jhunjhunwala, Safecrop Investments India LLP, and WestBridge AIF I.

Positives:

- The largest private health insurance company with a focus on the retail health segment

- One of the largest and well-spread distribution networks in the health insurance industry

- Strong risk management focus with domain expertise driving a superior claims ratio

Risks:

- A steep rise in claims in a bad year can lead to large losses to be funded from investment or capital raising.

- Increasing competition can reduce the margins

- Low-interest rates can keep investment income in check

Moneyworks4me Opinion:

How is the business model, Good, bad, gruesome?

Bad. General Insurance is a highly competitive and low margins business. However, based on opportunity size and edge in distribution individual companies can earn high returns on equity over the long term. Except for ICICI Lombard, HDFC Ergo, SBI General, Tata AIG, and Star Health, other health insurance companies are reporting underwriting losses.

Star Health and Allied Insurance company have large distribution with a large share from retail health insurance. Health insurance is underpenetrated and as income grows, people will opt for health care and need health insurance.

In terms of retail business, the number of lives covered increased from 25 million in fiscal 2015 to 43 million in Fiscal 2020, increasing the proportion of lives covered from 1.9% to 3.1% during the same period.

Currently, the majority of the healthcare expenses are borne by the patients (60%+ in India) versus less than 20% in developed countries. Over the next 10 years, we will see an increase in health care insurance premiums for reducing out-of-pocket expenses.

Star Health Insurance has grown at 25% CAGR over the last 18 years. Over the next 5 years, the industry is likely to grow at 18% CAGR. Other reasons for growth include advancement in diagnosis, rising income levels, increase in old age population over next decade, etc.

With strong distribution and focus on retail insurance, Star is likely to grow faster than the industry. Retail business has a lower claim ratio as products are rightly priced versus group insurance where pricing is aggressive. With more than 80% premium from retail, it can not only clock a higher growth rate but also profitably.

Valuation

We expect more than 20% CAGR in premium over the next 5-10 years. Given the steep growth rate, premiums can rise 6x in 10 years. With 6,500 Cr in shareholder funds and cash (incl. IPO funds raised), and discounting underwriting profit for the next 15 years we arrived at a valuation of Rs. 435-496 assuming double stage discounted cash flow model (20% for five years and 15% for next year) and single-stage discounted cash flow model (20% for 10 years) respectively.

We recommend investing in IPO for listing. It is unlikely to get a reasonable size allotment. Clearly, the IPO pricing appears higher. We will seek a better price after listing to make it part of Core holdings.

Note: We do not recommend buy just because the IPO market is hot. We do not earn any commission or fee for promoting IPOs so expect an honest review from us on the business models and valuation.

Disclaimer: MoneyWorks4me Employee(s) may be participating in the above IPO.

Edited 02-12-2021 (13:48 Hrs)

Note- We had recommended “Subscribe for listing gains” for high risk investors on Star Health IPO. The chances of making any listing gains have become low. In the current environment, the market doesn’t seem to be rewarding IPO with expensive valuation. If possible unsubscribe or avoid the IPO altogether.

We like the business and are still bullish on its long term growth; however, the valuation is expensive. As long term investors, we would like to buy at 30-50% discount to its IPO price.

| IPO Activity | Date |

| IPO Open Date | Nov 30, 2021 |

| IPO Close Date | Dec 2, 2021 |

| Basis of Allotment Date | Dec 7, 2021 |

| Refunds Initiation | Dec 8, 2021 |

| A credit of Shares to Demat Account | Dec 9, 2021 |

| IPO Listing Date | Dec 10, 2021 |

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 16 | ₹ 14,400 |

| Maximum | 13 | 208 | ₹ 187,200 |

| Date | QIB | NII | Retail | Employee | Total |

| Nov 30, 2021 | 0.00x | 0.01x | 0.64x | 0.03x | 0.12x |

| Dec 01, 2021 | 0.07x | 0.02x | 0.89x | 0.05x | 0.20x |

| Dec 02, 2021 | 1.03x | 0.19x | 1.10x | 0.10x | 0.79x |

When will the Star Health and Allied Insurance Company Ltd IPO open?

Star Health and Allied Insurance Company Ltd IPO will open for subscription on Tuesday, November 30th, and closes on Thursday, December 2nd.

What is the price band of Star Health and Allied Insurance Company Ltd IPO?

The price band for Star Health and Allied Insurance Company Ltd IPO is Rs. 870-900/share.

What is the lot size for Star Health and Allied Insurance Company Ltd IPO?

Retail investors can subscribe to the IPO minimum lot size is 16 shares, up to a maximum of 13 lots i.e. Rs. 1,87,200/-.

What is the issue size of Star Health and Allied Insurance Company Ltd IPO?

The total issue size is ~ Rs. 7,249 Cr.

What is the quota reserved for retail investors in Star Health and Allied Insurance Company Ltd IPO?

The quota for retail investors in Star Health and Allied Insurance Company Ltd IPO is fixed at 10% of the net offer.

When will the basis of allotment be out?

Allotment will be finalized on December 7th and refunds will be initiated by December 8th. Shares allotment will be credited in Demat accounts by December 8th.

What is the listing date of Star Health and Allied Insurance Company Ltd IPO?

The tentative listing date of Star Health and Allied Insurance Company Ltd IPO is Friday, December 10th.

Where could we check the Star Health and Allied Insurance Company Ltd IPO allotment?

One can check the subscription status on Link Intime India Private Ltd.

What does Star Health and Allied Insurance Company Ltd do?

Star Health and Allied Insurance Company Ltd is a private health insurance company that offers a range of flexible and comprehensive coverage options primarily for retail health, group health, personal accident, and overseas travel.

Who are the peers of Star Health and Allied Insurance Company Ltd?

One of the listed company peers for Star Health is ICICI Lombard. However, health forms a lower part of ICICI Lombard’s business.

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me Core Superstars which helps you build a strong portfolio right away. It offers a Model Portfolio of high-quality stocks and Buy/Sell alerts on Quality stocks at a reasonable price and SIP recommendations on stocks. You get all this for a price that can be as low as Rs. 4,999 under a limited period offer. With the help of MoneyWorks4me Core Superstars, you would have picked winners like Asian Paints, Divis Labs, Titan, Pidilite, Cipla, Bharti Airtel, ICICI Bank.

Click here, for the Recent IPO complete list and IPO Historic data 2021.

How Model Portfolio can help you invest Successfully in Stocks?

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | WhatsApp: 8055769463