Dear Readers,

Welcome to our weekly company result update note. We understand the importance of staying up-to-date with the latest financial developments of the companies you have invested in. That’s why we are committed to providing you with short and insightful information about the earnings and performance of the companies in our coverage.

In addition to the weekly company result update, after the end of the earnings season, we will also be sending you a quarterly sector result review. This will give you a broader understanding of how these sectors are performing and help you make informed decisions about your investments.

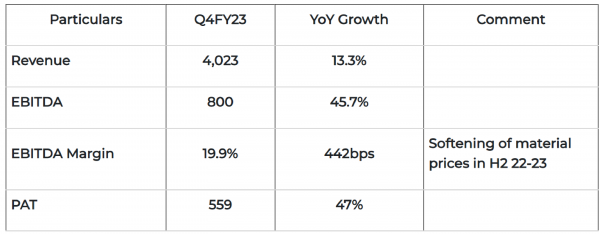

Britannia Industries Ltd

Strong numbers. Despite aggressive price hikes Britannia sustained its volumes and improved its margin performance.

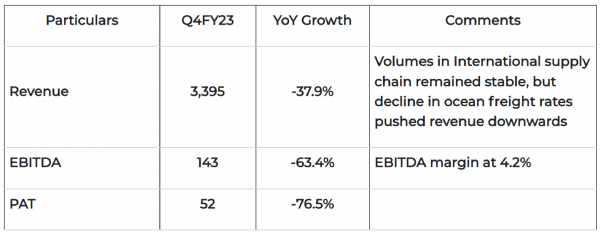

Allcargo Logistics

Results were on-par, EBITDA margin expansion key catalyst going forward. GATI business seeing positive traction.

Adani Ports

Good results, with improving volumes guidance and debt reduction to help strengthen fundamentals.

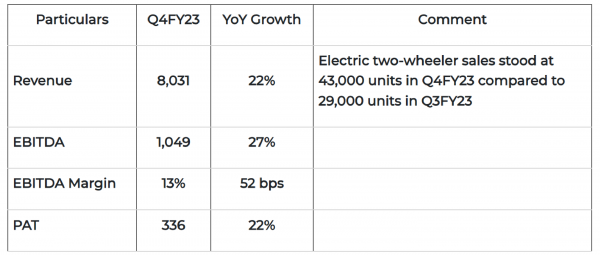

TVS Motors

Slightly better than estimated results led by improvement in margin even after higher sales from its low margin EV iQube.

Bata India Ltd

Good result. Revenue growth will be supported by an increase in the casual and premium portfolio, along with a strong expansion strategy through franchising, distribution channels, and own e-store.

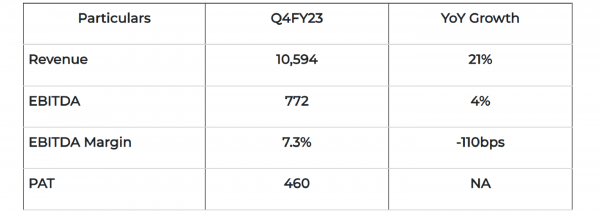

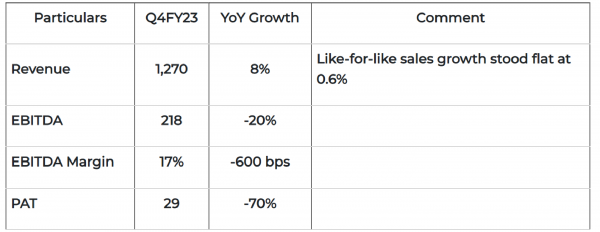

Avenue Supermarts Ltd

Muted Results on account of lower consumer spending in general merchandise and apparel persisted, impacting the margin mix.

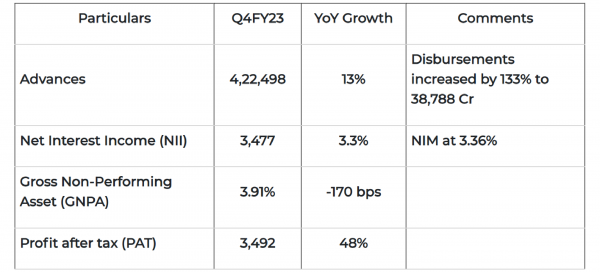

Power Finance Corporation

Good results with stable NIM & reduction in NPAs. Infrastructure sector lending up to 30% of advances to help diversify & grow loan book.

Jubilant Foodworks

Weak numbers, Margin contraction on account of Agri inflation. Company is reluctant to pass on full inflation in order to secure volumes.

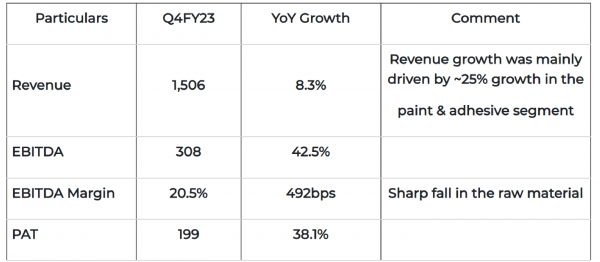

Astral Ltd

Good numbers on account of strong traction in plumbing and P&A segments.

Apollo Hospitals Enterprise Ltd

At par result. Revenue growth is mainly supported by healthcare as well as HealthCo (Pharmacy) business.

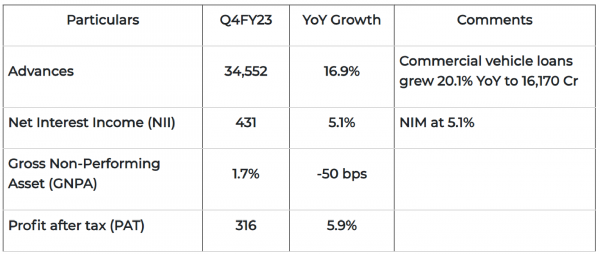

Sundaram Finance

Good results driven by advanced growth & improvement in asset quality.

Eicher Motors

Earnings beat estimates on the back of increasing ASP as well as an improved mix.

Aegis Logistics

Results were subpar, with positive improvement in liquid & LPG distribution segments.

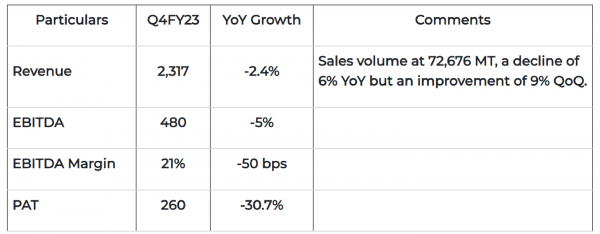

Balkrishna Industries

Below par result impacted by margin contraction due to high raw material costs. Sharp rise in depreciation and Interest cost has impacted PAT.

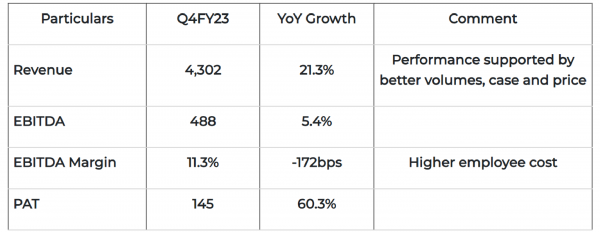

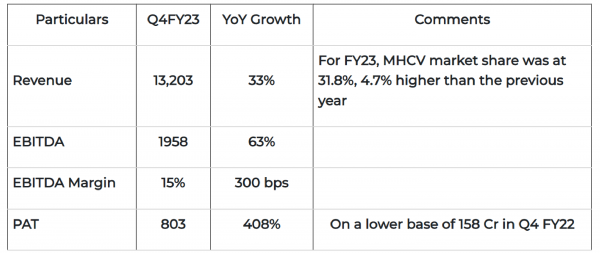

Ashok Leyland

At par result with improvement in MHCV market share, however LCV segment remains a reason to with increased competition.

Best Stocks From:

All Weather Alpha Case Screener Alpha Cases Business Houses Group

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | Ebook | WhatsApp: 9860359463

*Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

*Disclaimer: The securities quoted are for illustration only and are not recommendatory