This article covers the following:

Performance

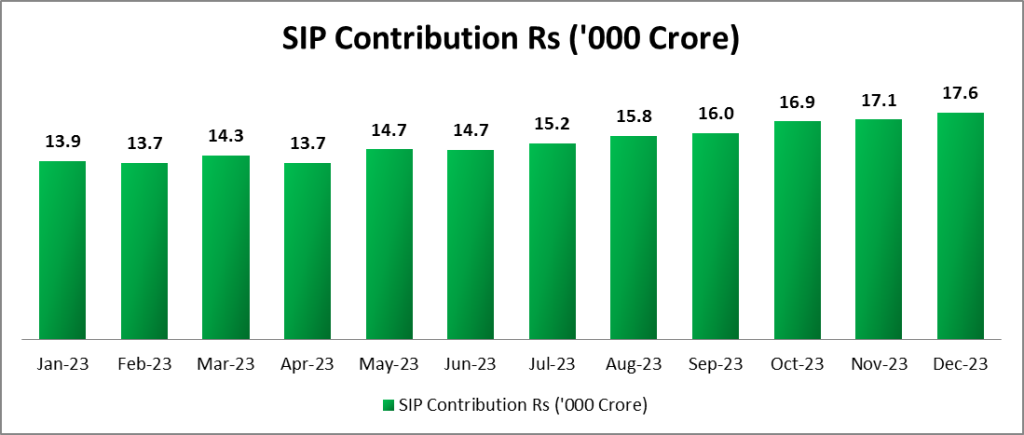

Source: NSE, BSE

Sensex has given 7.84% returns in the last month and 18.10% on a yearly basis

As we write this note in January, Sensex has given 7.84% returns in the month of December and 18.10% returns in the last one year. The major contributors to this growth in the last month were PSU, Metal and Capital Goods stocks. And the major performing sectors in the last one year were Realty, Capital Goods and PSU.

Source: CDSL, NSE, BSE

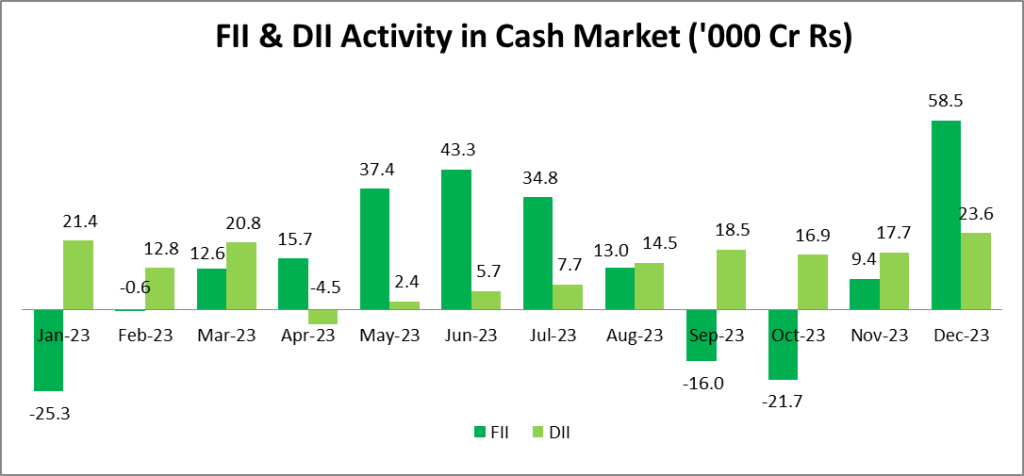

FIIs and DIIs concluded the year on a highly positive note, contributing significantly to the momentum in the Indian equity market, leading to new highs for Sensex and Nifty in 2023. The reversal in FII sentiments was driven by favorable political factors, strong GDP figures, and the overall growth of the Indian economy. In December, FIIs remained net buyers, buying a total of ₹58,498 Crore, while DIIs continued their positive trend, being net buyers and purchasing ₹23,627 Crore in the preceding month.

In 2023, global equity markets saw substantial investor returns, with the Dow Jones index rising by 13.7% and the NASDAQ index surging by 43.4% in the US. In Europe, the DAX in Germany increased by 20.3%, the CAC 40 in France surged by 16.5%, and the FTSE100 in the UK grew by 3.8% over the year.

Forecasts indicate a global growth slowdown with GDP growth dropping to 2.4% in 2024, marking the third consecutive year of deceleration. This reflects the delayed and ongoing impacts of implementing restrictive monetary policies to address prolonged high inflation, constrained credit conditions, and sluggish global trade and investment. In the short term, there is a divergence in prospects, with major economies experiencing subdued growth, while emerging market and developing economies (EMDEs) with strong fundamentals are seeing improving conditions.

China is expected to experience a decrease in economic growth, with estimates pointing to a decline from 5.3% in the previous year to 4.7% in 2024. Similarly, Japan is projected to witness a slowdown in economic growth, moving from 1.7% in 2023 to 1.2% in 2024, despite the implementation of accommodating monetary and fiscal policies.

Crude oil prices are rising due to intensifying war conditions. Oil tankers are increasingly changing routes in the Red Sea due to U.S. and British airstrikes on Houthi targets in Yemen, responding to Iran-backed group attacks on shipping. Although the diversions were anticipated to increase the cost and duration of oil transportation, the supply has not been affected so far.

Despite global economic volatility, along with challenges such as food and oil supply shocks contributing to elevated inflation, there is optimism regarding India’s growth momentum in 2024. Having surpassed China as the most populous nation in 2023, India is poised to benefit from its young population and increasing middle-class incomes. The country’s growth is supported by a robust combination of government capital expenditure and strong domestic consumption.

Source: MoSPI

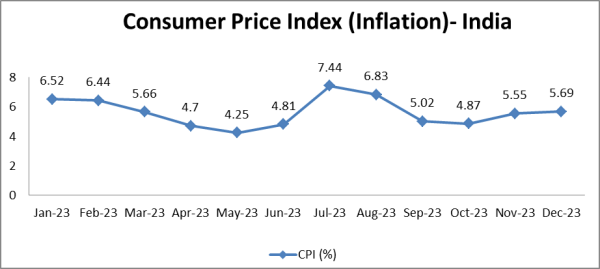

In December, India experienced a four-month peak in its headline retail inflation rate, reaching 5.69%, stayed well within manageable limits. An unfavourable base effect was the key driver of inflation in December. A particularly satisfying aspect of India’s inflation dynamics has been the significant reduction in core inflation, which is typically more challenging to regulate. Although India may not have reached the RBI’s long-term target of 4% inflation, there is a downward trajectory.

Source: MoSPI

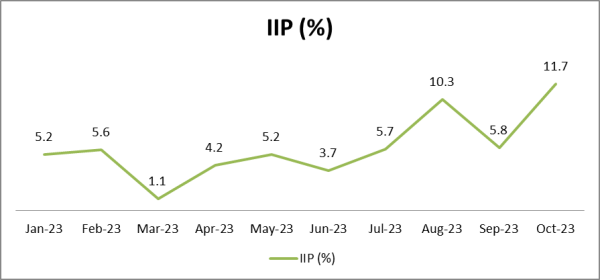

On the flip side of the coin, the country experienced robust growth in GDP and IIP. In the second quarter of FY24, India recorded a GDP growth of 7.6%, following a 7.8% growth in the first quarter. Consequently, the RBI raised its growth projection for FY24 by 50 basis points, shifting from 6.5% to 7.0%. This implies that India is likely to maintain its position as the fastest-growing major economy this year, further propelling its progress towards the coveted $5 trillion GDP milestone.

Source: PIB

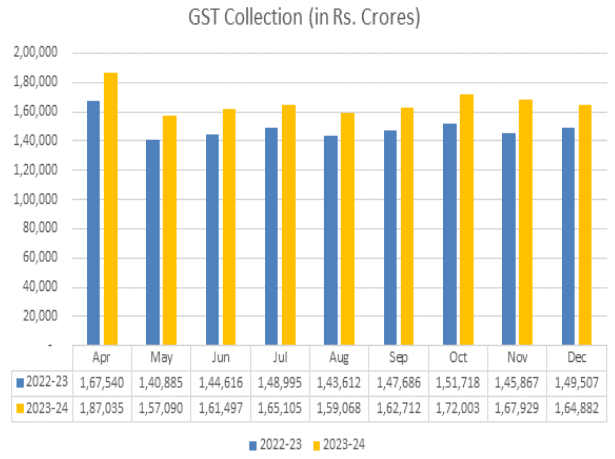

In December, the combined GST revenue collected by central and state governments amounted to ₹1,64,882 crore (₹1.65 trillion). While this figure is slightly below the monthly average of ₹1.66 trillion for the year, it reflects a significant 10.3% increase compared to the same period last year. In December 2022, the combined revenue collection for the Centre and states stood at around ₹1.5 trillion.

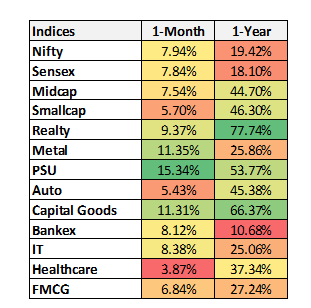

Source: AFMI

The inflows into SIPs continued their upward trend, reaching a record high of ₹17,610 crore in December, compared to ₹17,073 crore previously. Interestingly, the cumulative SIP inflow for the year has surpassed ₹1.42 lakh crore. In December 2023, the Indian Mutual Fund Industry achieved a significant milestone, with the Average Assets Under Management (AAUM) reaching ₹51,09,072 crore, surpassing ₹50 lakh crore in total assets managed.

Indian equities continue to drive the global growth engine. In the midst of myriad domestic and global challenges, the Indian stock market stood as a beacon of strength, surpassing many of its international counterparts with an impressive display of strength and resilience.

India’s economic growth is expected to experience a slight dip to 6.2% this year, down from the projected 6.3% expansion in 2023, as per UN reports. However, it will continue to retain its status as the fastest-growing major economy globally. The resilient domestic demand and robust growth in both the manufacturing and services sectors are anticipated to uphold India’s growth momentum, even amidst a projected significant slowdown in the global economy.

Indian economy continues to be a steady ship in choppy waters

India appears to be in a favourable position compared to the rest of the world, both in terms of cyclical and structural factors. Healthy growth in various domestic high-frequency indicators, such as GST collections, retail spending, consumer demand, credit growth, and PMI, indicate a significant level of economic activity.

Projections suggest that India is expected to be among the fastest-growing economies in 2024. Recent policy reforms, government-led capital expenditure focus, and stronger corporate balance sheets have potentially established a robust foundation for sustained growth over multiple quarters. However, in the short term, volatility may persist until global uncertainties subside.

Nifty is trading above long-term averages

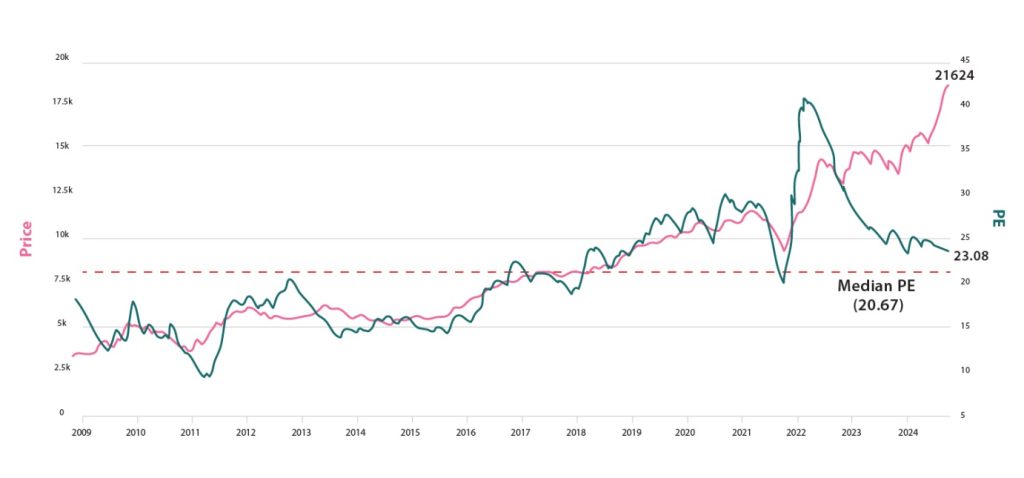

Source: Trendlyne

On a PE basis, Nifty is trading at 23.08, above the historical median of 20.67. It shows positive sentiment and bullishness in the market.

What is MoneyWorks4me’s action plan for its subscribers?

We stay on course to look at individual securities with strong future outlooks and growth. While taking a portfolio view to diversify and make the most of the rising economy.

Our portfolio companies have performed well this calendar year, in such bullish markets we advise you to move towards resilient companies. Please check the companies recommended in the BUY zone as per subscribed plans.

Best Stocks From:

Undervalued Nifty 50 Nifty 500 – Quality with Price Strength Screener Alpha Cases 5 Stars Rated Stocks from Nifty 500 Business Houses Group

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | About | WhatsApp: 9860359463

*Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

*Disclaimer: The securities quoted are for illustration only and are not recommendatory