Utpal Sheth is one of India’s most prominent investors. As the CEO of Rare Enterprises, the firm founded by the late Rakesh Jhunjhunwala, Utpal Sheth has played a pivotal role in continuing the legacy of one of India’s most legendary investors. With a career spanning several decades, Sheth has amassed extensive experience in various facets of finance, including investment banking, portfolio management, and strategic advisory.

Under his leadership, Rare Enterprises has thrived, leveraging Sheth’s keen ability to identify undervalued stocks and make astute investment decisions. His differentiated insights and deep understanding of the Indian equity market have earned him a reputation as a thought leader in the industry. Sheth’s investment philosophy, termed as ‘Gorilla Investing’, often revolves around a long-term perspective, focusing on fundamental analysis and value investing.

His speech called ‘Unlock Value Chain of Long-Term Investing’ at an event hosted by Samco Securities has provided excellent insights into the nature of long-term investing, which forms the basis of this article.

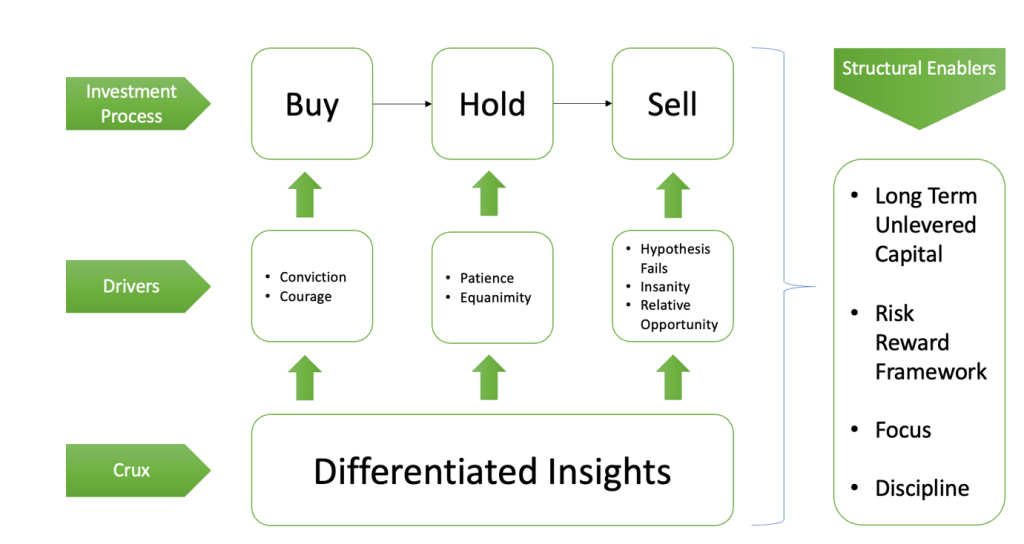

This blog is divided into two parts. Part 1 explains the process of long term investing and the drivers that accompany each step, while Part 2 highlights the foundational requirement for long term investing and the structural enablers that aid the process.

Let’s dive into Part Two.

Differentiated Insights

The success of the investment process is based on the possession of differentiated insights. First, the insight helps an investor gain courage and conviction in buying a stock, irrespective of market conditions and the opinions of other investors. Second, it is this insight that gives an investor the patience to hold onto the investment for the required period and the equanimity to hold through volatile periods in the market. Third, the insight makes an investor a better seller by understanding if the hypothesis has failed or if a different investment opportunity provides better differentiated insights that make these new opportunities better investments.

While insight helps an investor to understand an investment in depth, it is of limited use when the market reflects similar beliefs. It is only when one’s insights differ significantly from the understanding of others that an investor can make a great investment. If the market reflects an investor’s insight, it is unlikely that the view is not reflected in the price.

Structural Enablers

Access to Long-Term Unlevered Capital

No matter the courage and conviction an investor has in their buying decisions, and the patience and equanimity as shown through their ability to hold, an investor requires access to long-term unlevered capital. Markets are unpredictable and stock prices can correct abruptly. Levered investors would face margin calls in such cases, forcing them to sell their holdings at a low price. Investors with a huge capital base may not need to use leverage, but investors with a small capital base often believe that they need to use leverage to increase their investment corpus to meaningful levels. However, when risks materialise before rewards, the investors with smaller capital bases may lose a large portion of their already limited capital.

Risk Reward Framework

Investing is a probabilistic exercise. Investors must always weigh the probability of being right versus the probability of being wrong. For the same stock, an investor with a 10% portfolio allocation would make decisions differently than an investor with a 50% portfolio allocation. The latter investor may develop anxiety due to the sheer size of their holding. An investor must assess the risk-reward ratio while deciding the weightage to be given because it is not the returns that the stock generates, but the allocation of the stock in the portfolio that makes the biggest difference.

Focus & Discipline

To be successful, an investor must have a focused portfolio where an investor has conviction in their research. An overdiversified portfolio with 80 stocks suggests low allocation to holdings, which is a sign of low conviction, and an investor may lack the ability to track the developments in such a large number of companies. Additionally, an investor must focus on churn, as high churn suggests a lack of patience and a lack of inherent understanding of the investment decisions.

Assuming an investor finds a great opportunity and allocates a meaningful portion to this investment, their discipline would be tested over time as this stock grows and becomes a disproportionately large part of their portfolio. The discipline to hold such a company through feelings of anxiety and the fear of losing unrealised gains separates a successful investor from the rest of the herd.

Focus and Discipline cannot be taught, but must be learned. While the importance of focus and discipline can be taught, cultivating focus and discipline requires introspection, self-belief, conviction, and faith. It is these elements that can make an investor successful.

The Value Chain as a Cycle

Investing successfully is not a one-time investment decision, but rather a series of investment decisions. Investors must keep iterating over this journey, and learn from mistakes made over the course of these iterations. As a result, each decision is interdependent on other decisions. No investor is a one stock wonder, even if it is only one decision that has yielded all the returns. It is a result of all the knowledge an investor has gained over the course of their investing journey.

To continue exploring this topic and dive deeper into our insights, don’t miss out on Part 1 of our blog series. Click here to access it now!

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | Ebook | WhatsApp: 9860359463

*Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

*Disclaimer: The securities quoted are for illustration only and are not recommendatory