One of the things that analysts and investors frequently look for while analyzing a company is the capital expenditure. With many Indian companies on a growth track, capex activities like building a new factory, buying new machinery etc are constantly going on. But with purchase of new assets comes the frequently heard term i.e. depreciation! All of us must have heard about depreciation and know that it is deducted before arriving at Net Profit. However, not many of us are aware of its nitty-gritty’s and the part that it plays in determining the profits of a company. Infact many of us completely ignore analyzing this important parameter. However, with considerably flexibility over how depreciation is calculated, it is one of the easiest figures to manipulate for the companies.

One of the things that analysts and investors frequently look for while analyzing a company is the capital expenditure. With many Indian companies on a growth track, capex activities like building a new factory, buying new machinery etc are constantly going on. But with purchase of new assets comes the frequently heard term i.e. depreciation! All of us must have heard about depreciation and know that it is deducted before arriving at Net Profit. However, not many of us are aware of its nitty-gritty’s and the part that it plays in determining the profits of a company. Infact many of us completely ignore analyzing this important parameter. However, with considerably flexibility over how depreciation is calculated, it is one of the easiest figures to manipulate for the companies.

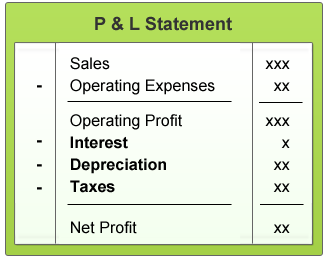

But before we start with all the techniques used to manipulate depreciation let’s understand what it actually means. To start with, have a look at the table that gives you an idea about where depreciation actually features in the Profit & Loss statement.

So what is Depreciation?

Mr. A. has a small bakery which produces the finest bread in town. Recently, he purchased a new oven for baking his delicious bread. The machine costs Rs. 10,000, which is an expense. However, the oven that Mr. A has purchased will be used not only in this year but also in the years to come. Let’s assume that it can be used for a period of 5 years. So, the cost or expense incurred by Mr. A in purchasing the machine should be distributed over a period of 5 years and then subsequently deducted from the respective sales figures for these 5 years. This cost of the machine to be deducted annually is nothing but depreciation.

There are two methods by which Mr. A can calculate the annual amount that should be deducted as depreciation: Straight-line method (SLM) and Written-down value (WDV) method.

Straight Line Method:

This method involves distributing the total cost of the machine equally during the useful life of the machine. If the useful life of the oven bought by Mr. A was 5 yrs, the cost of the machine (Rs. 10,000) will be equally distributed over a period of 5 years i.e. Rs. 2000. Thus, Mr. A will charge depreciation of Rs. 2000 every year for the next 5 years.

Written down Value:

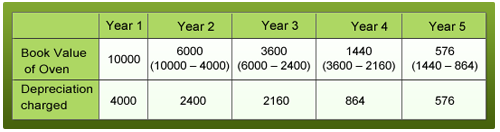

Let’s assume that the oven Mr. A purchased is going to be used more in the initial years than later. In this case, the best way would be to calculate depreciation using the WDV method. In this method, there is a fixed rate at which depreciation will be charged. Let’s say 40% for our oven. So, in the first year the depreciation charged will be 40% x Rs. 10,000 = Rs. 4000. Now, the book value of the asset will decrease by Rs. 4000 and the next year depreciation will again be charged at 40% of residual book value of Rs. 6000; this works out to Rs. 2400. This will continue until the total cost of the machine is expensed and the book value becomes 0. The table below gives a glimpse of depreciation calculated by WDV method for the oven.

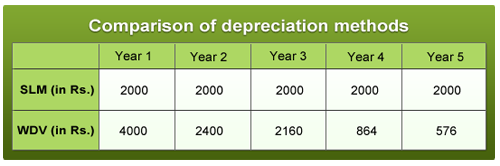

Now, let’s have a look at the depreciation calculated each year on the oven using both the methods:

The above table shows that although it is the same machine that is being depreciated, there is a lot of difference in the depreciation amount calculated by using the two methods. While the amount is constant if calculated using SLM, it goes on decreasing if calculated using WDV. WDV leads to lower profits in the initial years and is therefore a more conservative method of calculating depreciation. Majority of the companies follow this method. However, which method is the most appropriate will depend on the asset and its use.

Concluding, there are three major factors that affect the amount of depreciation being charged, viz.

- Method of calculation

- Rate of depreciation

- Useful life of the asset

Understandably then, companies because they have relatively more control on these 3 factors can toy around with them and manipulate depreciation. Let’s have a look at how exactly these manipulations are done.

The techniques used for manipulation….

Management can make a firm appear more profitable and fundamentally strong than it really is by understating or overstating its depreciation expense. This can be done in following ways:

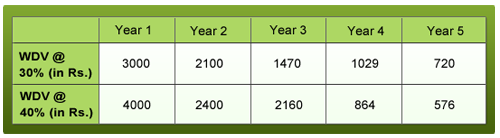

1) Charging less depreciation on the assets: In the above example, if Mr. A charged 30% depreciation instead of 40 % his depreciation charges would have reduced substantially, as shown in the table below. The result of this would be higher profits!

Infact there are some ways in which companies can lower the depreciation rates within the framework of the law and need not even explain the reason for reducing the rate.

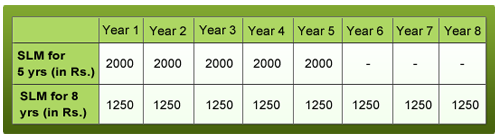

2) Increasing the life span of an asset: If Mr. A decided that the oven can be used for 8 years instead of 6 years, the depreciation charges would have reduced considerably in the beginning years, as given in the table below.

An example in case is MTNL, that changed the useful life of its apparatus, plants, cable lines and wires with effect from 1st Apr’03 leading to a abnormally high profit of Rs. 482 Cr in Q3 FY04.

3) Change in the method of calculation can alter earnings. A recent example is Jet Airways that changed its depreciation policy from WDV to SLM and wrote back Rs. 920 crore into its profit and loss account, which helped it report profits during the first quarter of 2009. Conversely, Nahar Industrial Enterprises Ltd changed the method of charging depreciation from SLM to WDV method during 2003-04, resulting in enhanced depreciation charge of Rs. 37 Cr. However, companies have to disclose a change in depreciation calculation method and hence it is easier to find this out.

4) Keeping no longer used assets on its balance sheet: Suppose the oven that Mr. A bought broke down and became obsolete in its third year itself. Assuming that depreciation was calculated using SLM, after the third year, the book value of the oven would be Rs. 4000. In this case, it would be required that Mr. A disposes off the machine and records the remaining book value i.e. Rs. 4000 as a loss. But Mr. A decides to continue showing (falsely) that the oven is in working condition and keeps on charging normal depreciation. This way he does not have to record losses and disappoint shareholders!

5) Revaluing Assets: Mr. A’s bakery is going great guns and the customer lines keep on getting longer and longer. People believe that Mr. A’s oven is a special oven and no other oven can produce better bread than Mr. A. They are willing to buy the oven for much more than its original cost, if only Mr. A would sell it. Mr. A realizes that the value of his oven has increased and accordingly increases the value of the asset to Rs. 15,000 on his balance sheet. Understandably then, the depreciation charged will also change. Some companies do not change the method of depreciation but regularly revalue their assets, resulting in additional charge of depreciation. For e.g. Alembic Ltd revalued some items of plant and machinery on a selective basis rather than for a class of assets.

This clearly shows that the flexibility conferred in preparation of accounts can be misused a lot by companies. Some of them keep hopping from SLM to WDV and vice versa. Other companies go for frequent revaluation of assets and accordingly re-calculate the depreciation for previous years. There are also instances where companies have taken special permission to not charge depreciation at all for some years or wrongly classified assets such as hotel as a plant thus charging incorrect depreciation.

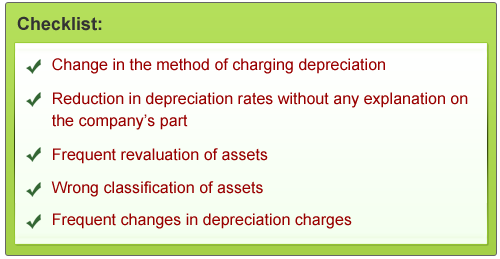

To summarize, given below is a checklist of the red flags that’ll help investors avoid investing in such companies.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

All that is explained is accurate.

Thanks for the appreciation! Do keep reading and posting your feedback.

very well written.

Thanks a lot for the appreciation! Do keep reading and posting your feedback.

Isn’t there a prevalent socitey which would set guidelines for depreciation in terms of methods, percentage, and so on?

Clearly, the law system system to check for deprciation manipulation is not in place.

We have The Institute of Chartered Accountants of India that has issued guidelines regarding depreciation calculation in accounting standard 6. Apart from this companies also have to adhere to The Companies Act, 1956 and The Income Tax Act. However, it is the flexibility conferred by these guidelines, that is being taken advantage of by the companies. Investors can find this information in the notes to accounts of the annual report.

We have The Institute of Chartered Accountants of India that has issued guidelines regarding depreciation calculation in accounting standard 6. Apart from this companies also have to adhere to The Companies Act, 1956 and The Income Tax Act. However, it is the flexibility conferred by these guidelines, that is being taken advantage of by the companies. Investors can find this information in the notes to accounts of the annual report.