The first time I learnt about the Stock markets, I closely associated it with a roller coaster. Constantly going up and down, moving up slowly but crashing down in a hurry, inducing great excitement and even greater fear. And the end result of riding both was invariably the same – You end up in a bad state!

When was the last time you saw Sensex remain stable? Not fluctuating much, slowly and steadily moving up or down… Most probably never! Infact we have become accustomed to see the Sensex fluctuating everyday, due to some or the other news. With this in mind, knowing whether the market is correctly valued or not becomes almost impossible. And, similar is the case with stocks. Buying stocks at the wrong price can lead to your entire capital being wiped out. In such a high stakes scenario, what we need is a tool to ascertain what is the MRP or intrinsic value of a stock or for that matter the entire market. This is what Stocks@MRP and Sensex@MRP offers – a stable benchmark primarily driven by the earnings.

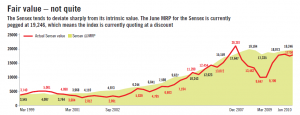

So, once you know the benchmark what do you do? Quite easy. If the actual value of a stock or Sensex is considerably below the MRP, it indicates a great buying opportunity. However, if the value goes considerably above the MRP, it is time to get out, as there is a very high possibility of a correction happening. This is the biggest benefit that you get from the MRP concept : Clear “BUY” and “SELL” signals based on fundamentals.

Click the Sensex@MRP graph given below to see the values for a period of 10 years. What is quite evident is the Sensex can fluctuate considerably on a day-to-day basis but eventually over a long term it will move towards the Sensex@MRP. During the tech boom in 2000, this is exactly what happened. Sensex went considerably above the Sensex@MRP and soon corrected to drop below it. For most part of 2002, Sensex was at a discount to the Sensex@MRP indicating a good opportunity to buy. In 2004 and 2005 Sensex once again flirted close to Sensex@MRP. And most recently, January 2008, saw Sensex going well above its MRP – a clear SELL indication. Following the crash Sensex was quoting at a considerable discount to its MRP in March 2009. More on this in the next blog.

So, this was about Sensex@MRP. But as investors we cannot invest in the Sensex, can we? Can we then use a similar concept for individual stocks. Yes. We can. Infact, our article gives you more information about how we have used this concept for individual Sensex companies. Also, it gives you information about some stocks which you should consider buying and selling in the current scenario. So, do read the article in Outlook Profit.

Our subsequent articles will give you information about some of these stocks.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

We cannot buy Sensex but we can certainly can buy NIFT through ETFs, can we have similar sutdy on the current price of the NIFTY

Yes you are right! Nifty ETFs can be bought and sold in the market. And that is our next target. To have a Nifty@MRP similar to Sensex@MRP. Stay tuned in for further updates on this.

We are pleased to tell you that we have released our report on Nifty@MRP as we had promised. All you need to do to get the free report on Nifty@MRP is join our Fanpage on Facebook! Please click on the link given below to go to our fanpage!

http://bit.ly/a1xoOK

what is the basis of arriving at the intrinsic value of sensex?

Please check out the article on Sensex@MRP published in Outlook Profit (Page No. 46). It will give you detailed information about how we have calculated the intrinsic value i.e MRP of Sensex.

actually I have been doing this for the Nifty, from the last year onwards. this helped me to get into the market (through an etf) from aug 2008 till apr 2009 ,when I decided to stop, since the market seemed overvalued from may 2009 and exit completely last month (june 2010). by my calculation, for Nifty (as on 10/6/2010),

max price level : 3483.94

Margin of safety price level : 2787.15

how to calculate the sensex mrp

The MRP of a stock is dependent on the earnings capacity of the company. For calculating Sensex@MRP, we calculate the individual MRPs of the composite 30 companies and then assign the respective weight depending on their free float market capitalisation. You can get the detailed method here. http://bit.ly/cUvnGM

Click on the link to access the article on Sensex@MRP published in Outlook Profit magazine.

But what is the MRP?

vivek