ABG Shipyard: Will this shipbuilder also build your portfolio??

ABG Shipyard: Company Highlights

ABG Shipyard –An Indian Shipbuilding Industry major

Market View of ABG Shipyard Stock Price (as of 12/08/2011)

Latest Stock Price: Rs. 373.55

Latest Market Cap: Rs. 1902.58 (Mid Cap Stock)

52 Week High Stock Price: Rs. 498.25

52 Week Low Stock Price: Rs. 226.20

Latest P/E: 9.57

Latest P/BV: 1.50

Tell me more about ABG shipyard…

ABG Shipyard is the largest private sector shipbuilding yard in India. The primary business of the company is Shipbuilding and Ship Repairing. It has broad clientele base in countries like Egypt, UAE, Saudi Arabia, Norway, Holland, and prides itself with supplying vessels to the Indian Coast Guard. Since 1991, ABG Shipyard has supplied 138 vessels of various sizes to clients across the globe. It has one facility at Surat, which is spread over 55 acres and can make 44 vessels simultaneously and another one at Dahej, which can make 12 vessels and 6 jack-up rigs simultaneously. The company can cater to a demand ranging from off-shore vessels to bulk carriers.

Business Model of ABG Shipyard:

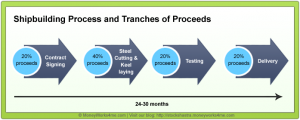

Revenue booking and Proceeds in relation to the ship building process:

ABG Shipyard gets its proceeds depending on the stage of completion of ship building. 20% is received on signing of contract, whereas another 20-40% is advanced on keel laying (laying the foundation of the ship, on which the frames are attached). The balance is paid on Tests and Delivery. (Click on the image to enlarge)

Manufacturing Process:

For a typical ship building company, the cost of building majorly comprises of Bill of material which forms 60% of the cost, Labour which comprises 10-15% and Design Costs which comprises 5-6% of the cost. In Bill of materials the major components are steel plates/ ship grade steel and bought out items like engines and propellers. These bought out items are to be ordered 12-18 months in advance, whereas a year’s worth of steel is stocked. ABG more or less functions on the same lines.

How has the Financial Performance of ABG Shipyard been? Here’s the review….

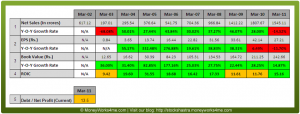

The 10 Year X-Ray (Click on the above image to enlarge) of ABG shows that the performance of the company over the past 10 years has been very impressive. The company has registered good growth rates in Net Sales, except for negative growth in 2003, with the lowest Y-o-Y growth of 28%. Over the past 5 years, Net Sales of ABG has grown steadily at a CAGR of 36.85% whereas its EPS has grown at a CAGR of 25.12%.

It has been observed that, in the last 3 years, the company had low EPS growth in 2009-10 and negative growth in 2010-11. In FY 2009, the low growth in EPS was because of increased interest cost on account of increased debt for the Greenfield Dahej Facility,whereas the negative growth in EPS has been chiefly because of raw material price stock adjustment and increased depreciation on account of commissioning of Dahej Plant. The BVPS of the company has grown stably at a CAGR of 47.37% over the past 5 years.

Though the average 5 year ROIC of ABG has been 15.16%, it has been on the lower side in the last few years, chiefly due to increased debt. However, as the company starts to reap profits from this investment, this number is expected to go up. The average ROE has been 19.49% but has reduced slightly in the last two years due to increased interest payments.

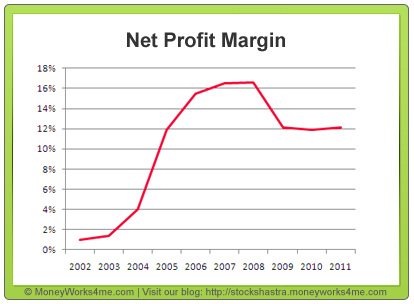

The profit margins of ABG Shipyard have fallen from 17% in 2008 to 12% in 2009 and have remained at the same levels ever since.

The debt to net profit ratio which has been just above 3 till 2008 jumped up considerably and sits at 15.5 as of March 2011. This debt has been incurred chiefly for setting up the Dahej facility. With a good order book, and maturity of debt in 2012-13, it is expected that ratio will reduce. (Read about the debt details below, in the para titled ‘Debt Maturity and adequate funds for repayment)

Thus, considering this, we can say that the 10 YEAR X-RAY of ABG Shipyard is Orange (‘Somewhat Good’)

What can we expect in the future? Here is the fundamental analysis of ABG Shipyard…

In the short term:

Latest quarterly results – Profits decline despite sales growth

In the last two quarters, viz. quarters ended Dec 2010 and March 2011, the Net Sales of ABG Shipyard have increased by 9.89% and 7.65%.However, this increase in Net Sales has not been accompanied by a corresponding increase in EPS. In fact, there has been negative growth on Y-o-Y basis wherein the EPS has declined by 23.03% from 16.16 to 10.35 and 35.02% from 10.38 to 7.99 in respective quarters. This has been caused chiefly by raw material stock adjustment, caused by price fluctuations and increase in depreciation due to commissioning of the Dahej Plant. However, with more deliveries lined up in 2011-12 and projects nearing completion coupled with increased capacity utilization at the Dahej Plant, it is expected the EPS will again show an increasing trend.

Debt Maturity and adequate funds for repayment

The total debt of ABG Shipyard stands reduced at Rs.2391 Cr. as on March 2011 from Rs.2897.44 Cr as on March 2010. Debentures to the tune of Rs. 33.33 Cr. are to be redeemed in December 2011, whereas Rs.400 Cr. including the above mentioned debentures will be due in the next four quarters. The cash and cash equivalents of ABG Shipyard of Rs.663 Cr. suggest that the company has adequate funds to repay the debt. The delivery schedule for ABG in the next 12 months is 20 vessels, which shall translate into enough funds thereby reducing the working capital funding requirements of the company.

Thus, considering all these factors we can say that the Short term future prospects of ABG Shipyard are Orange (‘Somewhat Good’).

In the Long term:

Diversified Product range and moving up the value chain

ABG Shipyard has constructed and delivered globally, vessels which include Specialized and Sophisticated vessels and has successfully delivered three highly sophisticated 5th generation specialized carriers. Company’s diverse product portfolio includes different vessels like Barges, Anchor vessels, Newsprint, Cement, Cranes and Bulk carriers. Recently, ABG has been awarded industrial license for design and construction of defence ships (naval warships and naval support ships) from Ministry of Commerce and Industry. ABG is slowly moving up the value chain which is expected to result in better realisations. The Diversified Product Range of ABG Shipyard ensures that risks arising out of reduction in demand for one class of vessel are reduced.

Order Book: Visible Revenue and Excellent Execution Record

ABG has a strong revenue visibility and execution capability. It has an order book of Rs. 14890 Cr. providing revenue visibility for the next 4-5 years. ABG has a diverse order book-mix and almost half of it constitutes of offshore segments, which is a high-margin segment. The company has a significant international client base. This includes the contract for a total of Rs. 1335 Cr. for the supply of 3 cement carriers (Rs.365 Cr), and 2 naval ships (Rs .970 Cr) which have been bagged in Q1 FY2012. With the operational status of the Dahej, Gujarat facilities, ABG can construct 45+ vessels at a time. With an adequate capacity and a good track record for timely deliveries, it is expected that ABG shipyard shall not have any issues with completion of orders, or cancellation of orders due to non-completion.

Orders from ABG group

ABG Group, the promoter, has ventured into ship-ownership. The group has four special purpose companies to own and operate ships, which spans all segments such as offshore support ships, oil drilling rigs, crude tankers and bulk carriers. The group has placed orders to build ships with ABG Shipyard. Currently it has 18 vessels under construction at ABG shipyard and meant for offshore oil industry. This model of forward integration is operational in countries like Indonesia, Malaysia and China. ABG shipyard is expected to have a steady flow of orders from this model, which may stand it in good stead in bad times.

ABG Shipyard to Venture into building Oil Exploration Platform

ABG Shipyard is venturing into building Oil Exploration platforms for oil and gas drilling, which has a size of Rs.15000 crores (Yearly) in India, and dominated by foreign shipping companies. ABG wants to enter the business through a partnership, with a player who has expertise in the field. Or ABG is expected to get business to the tune of Rs. 3000 Cr. initially. The new business is expected to yield 22-23 percent margins. This is expected to add considerable revenue and earnings to ABG Shipyard. However, the down side to this is that ABG will need equipment to the tune of Rs.400 Crores which will add to the already considerable debt on the books.

Rising crude prices

Crude oil touching new highs has revived the offshore oil industry. The number of rigs under operation has been rising. This has led to the demand for offshore vessels going up, thus impacting companies like ABG Shipyard positively. The revival in the E&P activities is likely to spur the demand in the OSV (offshore supply Vessels) segment which represents huge replacement demand. The sharp recovery in crude oil prices have also encouraged oil companies to carry out exploration and production, providing a fillip to deepwater rig contractors. Demand for younger vessels by these companies is increasing and will result in volume growth of the company. It is expected that ABG will benefit from this increase in demand from the high margin segment.

Key Concerns:

- Oversupply of Large ships: It should be noted that fleet owners globally are currently hit by overcapacity. World trade growth is currently unlikely to absorb the incremental fleet capacity expansion. Though ABG’s clients are mainly small size ship owners relatively less affected by this over-capacity, large ship owners are the most affected. This will not allow ABG to move up the value chain in the short term.

- Increasing Input Prices: Ship Grade Steel prices are subject to fluctuation. Any increase in steel prices, will adversely affect ABG shipyard as there are no price escalation clauses in contracts. Even the suppliers of engines and propellers, being few, have considerable bargaining power over ship builders like ABG.

- Debt shall remain on books for considerable time: ABG reduced debt to the tune of Rs.500 Cr. in Q4 FY11 and targets to reduce another Rs.400 Cr by end FY12. However, with an order book of Rs.15000 Cr. the company will need working capital finance to the tune of Rs.1200 Cr. for execution of the order over the next 4-5 years. It is expected to keep the profitability of ABG Shipyard down.

- Low freight rates to hamper demand: Shipping industry is mainly dependent on export-import activities. In booming economic situation, high export-import activities lead to high demand for shipping services, which in turn result in high freight rates. High freight rates induce shipping companies to order new ships/vessels to meet high demand, which in turn benefits the ship building companies like ABG. Presently, shipping industry is still recovering from last recession and freight rates are still very low compared to pre-recession rates. In uncertain economic times, low freight rates are expected to persist for few more quarters. Low freight rates coupled with overcapacity may cause slow demand for new ships.

Thus, considering all these factors we can say that the Long term future prospects of ABG Shipyard are Green (‘Very Good’).

So, is it an investment- worthy company?

Good revenue visibility, a diverse product range and a strong clientele augur well for ABG’s future. However, the huge debt is a cause of concern.

Yes, ABG Shipyard is an investment worthy company, but only at the right price. Being a mid-cap stock (Market cap of ~ Rs. 2014 Cr.), ABG Shipyard is considered to be a relatively high risk stock as compared to large cap stocks. Hence, it should be bought at a hefty discount to its MRP.

Currently, its stock price is at Rs. 395.70 (as on 4th August’ 2011). But, does this price offer an attractive discount to its right value (MRP) or is it over-priced? It is always best to invest at an attractive discount to its MRP, to get maximum returns at minimum risk. Become a member of MoneyWorks4me.com to know its sensible buy- price and hence take the right action for this company.