After our accidental discussion on demat accounts, one fine Sunday, I thought my friends must have had enough of finance. In fact, I thought the discussion on online trading accounts will never see the light of the day. So, I was quite surprised when Amit called me the next Saturday to tell me that we were meeting on Sunday to finish our discussion. It was the weekend that the popular Bollywood movie ‘English Vinglish’ had hit the box office, and so my gang had met up to see Sri make her comeback into Bollywood. The show ended around 4.00 PM, just the perfect timing to make our dinner reservations for the day, and to move to our favorite café’ in the meantime.

After settling down in the café, Amit, seized the moment and inquired, “Surbhi, you were telling me about a trading account last time…tell me more about it?”

“Yes Amit, but before I go on explaining the trading account to you, I hope you remember the debit card analogy I had drawn last time we met?”

“Yes”, replied Amit.

“Cool, so like I said, a trading account is essential to transact on your demat account, just like you need a debit or credit card to transact on your online banking account. To buy and sell securities online, you need to have 3 essentials in place….”

“First, is your demat account, to serve as a repository of the securities you have bought or sold. Second is an online banking account, to enable you to make payment for the purchase of securities, and to receive payment for any sale of securities. And, third is your trading account. Trading account is that mechanism that helps you to transact in shares & other securities, online. It is also sometimes referred to as an online investing account.”

Megha exclaimed, “Yes! I know this. You’re talking about that 3-in-1 account that banks are offering these days, right?”

“Yes Megha”, I responded with a smile, “except that I am not selling such an account to you!”

“See Megha, this 3-in-1 account is a convenient way for the investors, and a more profitable way, for most bankers. It includes an online banking account, a demat account, as well as, a trading account. It is like a win-win situation, for both, as it provides convenience to the customers in the form of all 3 accounts at one place, as well as, increased business to the bank by the sale of a bouquet of services, together.”

Rachita probed, “So which company should I open my trading account with?”

“Rachita”, I said, “that would depend on 2 things, primarily:

One, the type of account you wish to open, which means, do you want to invest in just equity or do you also want debt, mutual fund, and /or commodities in your portfolio, and two, the charges applicable on the purchase and sale of securities.”

I started telling them the different charges, when Rachita said, “Surbhi, that’s getting too confusing. Can you write it down for us somewhere?’

“Of course”, I said, “Hey Prashant, can you please pass that tissue, so I can give Rachita a better idea about the kind of charges she would be facing in the event of opening such an account.”

“Here and here’s my pen”, said Prashant, passing the pen along-with tissue, knowing very well what I would have asked of him next.

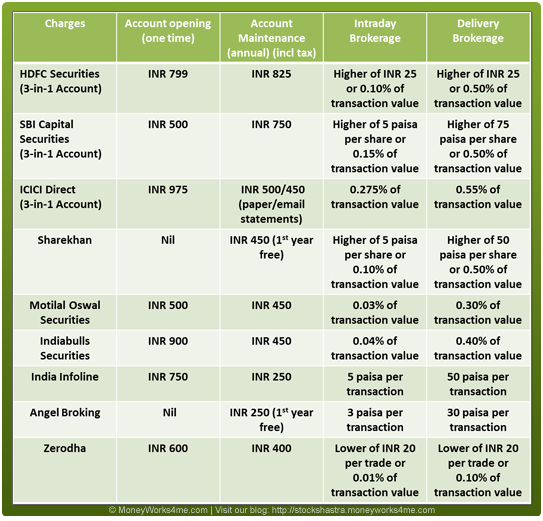

So, I quickly drew them up a chart with the comparative rates I had in mind for an equity shares trading-cum-demat accounts.

“But”, I added, “do remember to inquire from your banker or broker about the best deal he can offer to you , because the intraday brokerage and delivery brokerage charges are generally negotiable, and tend to decrease for higher value trades.”

“I think I know what you all want to know next”, I continued, “what are intraday brokerage and delivery brokerage charges?”

“Very simply put, intraday brokerage is the amount you pay on the trading amount of your purchase or sale of shares. It applies only to those trades that settle in a days’ time. Where, you wish to hold the shares for any period longer than a day, the delivery brokerage charges will be applicable, which are 5 to 10 times the intraday brokerage charges.”

“What if I want to invest in debt or mutual fund schemes?” questioned Ankur.

“In that case”, Ankur, “you simply have to ask your broker to add that account to your current account, and you may begin buying and selling other securities, just like you were buying and selling equity shares. The brokerage charges, however, will be different in such case, and, generally on a higher scale. But, you can view your total investment in various asset classes, all at one place.”

“Let me give you a checklist to consider while choosing an online investing account”, I continued, pulling together another tissue to scribble on.

Amit finally seemed satisfied to have most of his queries relating to online investing resolved.

The others had started giving me ‘the look’.

Well! It was time to honor our dinner reservations.

By now, each of my friends seemed convinced about the advantages of an online demat-cum-trading account.

They were more confident with respect to using an online demat & trading account to our benefit, for easier, safer, economical and more convenient investing. And I was happy to be able to help them being the financial geek of the group.

But what I now know is that we were going to have many such discussions once my friends started investing!

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

1 comment