Aditya Birla Sun Life AMC Ltd IPO Details:

IPO Date: Sept. 29th – Oct 1st 2021

Total Shares for subscription: ~4 Cr

Lot Size: 20 shares

Price Band: ₹ 695-712/ share

Issue Size: ₹ 2,768 Cr

Market Capitalization: ~Rs. 20,000 Cr

Recommendation: Subscribe for listing gains

Purpose of Aditya Birla Sun Life AMC IPO:

- Selling out by existing shareholders. The company will not receive any proceeds from the offer.

Listen to MoneyWorks4me Podcast – Aditya Birla Sun Life AMC IPO

About the Aditya Birla Sun Life AMC

Business

The Company is currently set up as a joint venture between Aditya Birla Capital Limited (ABCL) and Sun Life AMC. ABCL is the listed non-operating holding company of the financial services businesses of the Aditya Birla Group, a Fortune 500 global conglomerate. Through its various subsidiaries, ABCL managed a total AUM of ₹3,432.66 billion, had a consolidated lending book of over ₹571.82 billion, and an active customer base of over 25 million customers, as of June 30, 2021. Sun Life Financial Inc., the ultimate holding company of Sun Life AMC, is a leading international financial services organization providing insurance, wealth, and asset management solutions to individual and corporate clients. Sun Life Financial Inc. had a market capitalization of C$37.43 billion and a total AUM of C$1,360.69 billion, as of June 30, 2021.

Aditya Birla Sun Life AMC Limited is ranked as the largest non-bank affiliated AMC in India by Quarterly Average Assets Under Management (“QAAUM”) since March 31, 2018. The company has managed a total AUM of ₹2,936.42 billion under a suite of mutual funds (excluding the domestic Fund of Funds), portfolio management services, offshore and real estate offerings, as of June 30, 2021. It has achieved this leadership position through its focus on consistent investment performance, extensive distribution network, brand, experienced management team, and superior customer service.

Since its inception in 1994, the company has established a geographically diversified pan-India distribution presence covering 284 locations spread over 27 states and 6 union territories. The distribution network is extensive and multi-channeled with a significant physical as well as digital presence, and included over 66,000 KYD-compliant MF Distributors, over 240 national distributors, and over 100 banks/financial intermediaries, as of June 30, 2021.

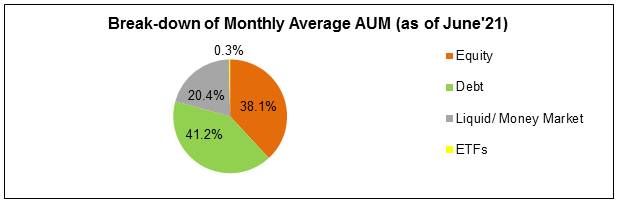

The company has managed over 118 schemes comprising 37 equity schemes (including, among others, diversified, tax saving, hybrid, and sector schemes), 68 debt schemes (including, among others, ultra short-duration, short-duration, and fixed-maturity schemes), 2 liquid schemes, 5 ETFs and 6 domestic FoFs, as of June 30, 2021. Its flagship schemes include Aditya Birla Sun Life Frontline Equity Fund and Aditya Birla Sun Life Corporate Bond Fund, both of which have grown to become leading funds in India.

Size & Market Share

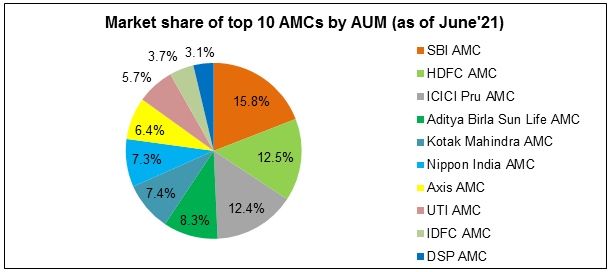

During the past decade, the top 5 AMCs have held an average of approximately 55% of the industry’s AUM. HDFC AMC, ICICI Prudential AMC, and Aditya Birla Sun Life AMC have consistently featured in the list of top 5 AMCs by AUM, supported by their wide distribution channels and parentage of large corporate entities.

Aditya Birla Sun Life AMC was the 4th largest fund house as of June 2021. The company’s AUM recorded a CAGR of ~15% between March 2016 and June 2021, slightly lower than the industry growth of ~19% CAGR during the same period. Aditya Birla Sun Life AMC retained its market share (in terms of overall AUM) of ~10% between March 2016 and March 2019. However, its market share, in terms of monthly average AUM, declined slightly between March 2016 and June 2021. The company however ranked as the largest non-bank affiliated AMC in India by Quarterly Average AUM since March 2018, and among the 4 largest AMCs in India by QAAUM since September 2011.

Source of Revenue

The bulk of revenue is generated from the management fees for the funds managed. The management fees from funds account for ~90% of the total income of the company.

Reach Points

As of June 30, 2021, the company had 194 branches in India (and 3 outside India), spread over 27 states and 6 union territories. As of the same date, it had 50 branches (25.70% of total locations) located across North India, 46 branches (24.65% of total locations) located across South India, 40 branches (21.13% of its total locations) located across East India, and 58 branches (28.52% of total locations) located across West India.

Its distribution network included over 66,000 KYD-compliant mutual fund distributors, over 240 national distributors, and over 100 banks/financial intermediaries, as of June 30, 2021. Of its total equity, debt and liquid QAAUM as of June 30, 2021, the direct marketing efforts contributed to 46.86%, MF Distributors contributed to 30.18%, national distributors contributed to 14.37%, and banks/financial intermediaries contributed to 8.59%.

Promoter

Aditya Birla Capital Limited (holding 51% stake) and Sun Life (India) AMC Investments Inc. (holding 49% stake) are the company promoters.

Positives:

- Reasonably large AUM size to enjoy the benefit of operating leverage

- Present in the industry with growth tailwind in long term.

- Strong Promoter backing

Negatives:

- AMC being a cyclical business performs poorly during bear markets

- The increase in popularity of low margin products like ETFs and index funds has reduced the profitability

- Regulatory caps can impact growth/profitability.

Moneyworks4me Opinion:

Asset management is in a secular growth phase. With 95% of Indian assets tied up in physical assets like Gold and Real Estate, we believe there is a lot of potential from these assets to convert into financial assets with banks and asset management companies. Though this sector has long-term growth, it is a cyclical industry. When the markets are in a boom, inflows are high, and as well as AUM value is high as market prices move up. But in the down cycle, outflows and lower market prices take AUM down significantly. Since the AMC can charge only as % of AUM, hence it faces more cyclicality in sales versus bank or insurance companies.

In the US, a developed market, asset management companies do not make very high profits as competition is high and a lot of financialization is already behind them. Shift towards i) low-cost passive funds ii) Fund managers and analysts have more bargaining power who take away a higher share of fees in salaries iii) Competition is high and fragmented as the market size is huge.

While this might be true in the Indian context too eventually, for now online and financial awareness is increasing to opt for financial assets over physical assets, AMCs with better distribution will have an edge for several years before their profitability drops. AMCs have high operating leverage since fixed costs are high and almost no variable costs. A small drop in Revenues can lead to a large drop in profits.

In the asset management business, the key competitive advantages come from i) Scale ii) Distribution iii) Low Cost.

Aditya Birla Sun Life AMC has a scale as it is the top 7 asset management with a 8% market share, but the distribution network is average versus peers who have sister banks to promote/cross-sell funds.

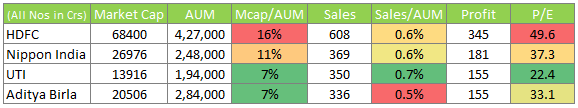

The current valuation of Aditya Birla Sun Life AMC is 33x of FY21 EPS. Alternatively, as a % of AUM, ABSL AMC is priced at ~7% of AUM which appears reasonably priced for a company based on past deal values however on the cheaper side if we compare listed player valuations. In past, AMC was acquired by informed buyers at 5-7% of AUM.

For long-term investing, we would prefer HDFC AMC or ICICI AMC over Aditya Birla Sun Life AMC due to better distribution. However, currently most of the stocks in this space are fully priced to overpriced. We will revisit these companies in the next cycle.

Currently, we recommend SUBSCRIBE on Aditya Birla AMC only for listing gains. It may not be a great buy today for long-term investing.

| IPO Activity | Date |

| IPO Open Date | Sep 29, 2021 |

| IPO Close Date | Oct 1, 2021 |

| Basis of Allotment Date | Oct 6, 2021 |

| Refunds Initiation | Oct 7, 2021 |

| A credit of Shares to Demat Account | Oct 8, 2021 |

| IPO Listing Date | Oct 11, 2021 |

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 20 | ₹ 14,240 |

| Maximum | 14 | 280 | ₹ 199,360 |

| Date | QIB | NII | Retail | Others | Total |

| Sep 29, 2021 | 0.00x | 0.14x | 1.09x | 0.31x | 0.56x |

| Sep 30, 2021 | 0.06x | 0.40x | 2.00x | 0.71x | 1.08x |

| Oct 1, 2021 | 10.36x | 4.39x | 3.22x | 1.68x | 5.24x |

When will the Aditya Birla Sun Life AMC IPO open?

Aditya Birla Sun Life AMC IPO will open for subscription on Wednesday, September 29th, and closes on Friday, October 1st.

What is the price band of Aditya Birla Sun Life AMC IPO?

The price band for Aditya Birla Sun Life AMC IPO is Rs. 734-744/share.

What is the lot size for Aditya Birla Sun Life AMC IPO?

Retail investors can subscribe to the IPO minimum lot size is 20 shares, up to a maximum of 13 lots i.e. Rs. 1,85,120/-.

What is the issue size of Aditya Birla Sun Life AMC IPO?

The total issue size is ~ Rs. 2768 Cr.

What is the quota reserved for retail investors in Aditya Birla Sun Life AMC IPO?

The quota for retail investors in Aditya Birla Sun Life AMC IPO is fixed at 35% of the net offer.

When will the basis of allotment be out?

Allotment will be finalized on October 6th and refunds will be initiated by October 7th. Shares allotment will be credited in Demat accounts by October 8th.

What is the listing date of Aditya Birla Sun Life AMC IPO?

The tentative listing date of Aditya Birla Sun Life AMC IPO is Monday, October 11th .

Where could we check the Aditya Birla Sun Life AMC IPO allotment?

One can check the subscription status on Link Intime India Private Ltd.

What does Aditya Birla Sun Life AMC do?

Aditya Birla Sun Life AMC is an asset management company, that manages funds across equity, debt, and ETF.

Who are the peers of Aditya Birla Sun Life AMC?

HDFC AMC, Nippon AMC, and UTI AMC are listed on the stock exchange. Other peers include ICICI AMC and SBI MF.

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me Core Superstars which helps you build a strong portfolio right away. It offers a Model Portfolio of high-quality stocks and Buy/Sell alerts on Quality stocks at a reasonable price and SIP recommendations on stocks. You get all this for a price that can be as low as Rs. 4,999 under a limited period offer. With the help of MoneyWorks4me Core Superstars, you would have picked winners like Asian Paints, Divis Labs, Titan, Pidilite, Cipla, Airtel, ICICI Bank.

Click here, for the Recent IPO complete list and IPO Historic data 2021.

If you liked what you read and would like to put it into practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | WhatsApp: 8055769463