This article covers the following:

Review

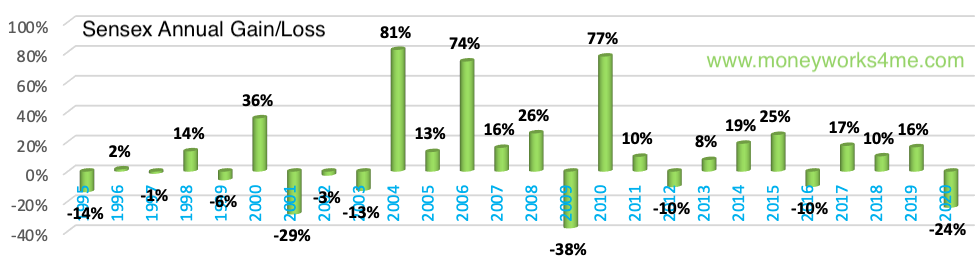

Nifty has fallen 26% in the last 1 year ending Mar’20 and -6% CAGR in the last 3 years.

Nifty has corrected more than -31% while most of the stocks are already down 40-50% and close to 7-10 year lows.

Equity inflows were the highest in the last 3-4 years which means that an average investor’s portfolio hasn’t earned good returns from equity for a long time.

The very risk in equity investing is that returns don’t come in a predictable fashion.

The overall sentiment is low due to consistent FII selling and fear of contagion from CoronaVirus.

From the previous month, lockdown in the entire country has led to severe cuts in earnings estimates for many businesses. While there is a concern on a slowdown in the economy, drop in prices are way more than actual impact on long term earnings.

Outlook

As on date, the average upside of our coverage universe is likely to be more than 15% CAGR over the next 3 years.

Just a handful of companies will be delivering earning growth due to existing slowdown and further lockdown to contain COVID-19 spread.

Some pockets of the market like consumer staples and insurance/AMCs are trading at stretched valuation. Since consumer staples have a more resilient business even during a slowdown, they will remain high for some more time.

This trend will reverse as other sectors start showing signs of improvement. We recommend to avoid pockets of euphoria and be patient.

Do not chase recent performers as it can lead to big disappointment in the future even if there is no price correction seen in a recent market correction.

All the gainers of last year are either consumer or pharmaceutical stocks.

We find that Nifty 50 now trades 10-12% below its fair value as stocks with large weightage in the index have come down drastically while some stocks that were already cheap got cheaper.

Unlike 2008, we are coming off already sombre business performance. This has made valuations very cheap on long term basis with just 30% fall in index. Due to current lockdown anything into the future looks hazy but once we see stability, we can expect a lot of improvement in business and valuation.

We are looking at companies that have good earning triggers over the next 2 years as we are not certain whether broad-based recovery will happen immediately. We are investing in companies i) coming out of sector consolidation, or ii) introducing new products, or iii) commissioning new capacities or iv) executing the order in hand. This gives some certainty as to why there will be growth when things go back to normal post lockdown.

An investor can consider investing in value and high dividend yield stocks like capital goods, high-quality PSUs, private sector corporate banks, pharmaceuticals, and select NBFCs. Now as more sectors are correcting, we will recommend it as they reach our desired price.

We are avoiding sectors or stocks that may have become cheap but they have high debt or they operate in highly cyclical sectors.

Our reasonable exposure to pharma stocks, high dividend yield stocks and liquid funds has led to lesser than market correction. Use our portfolio manager to account for dividends/stock splits and computing portfolio returns.

We are buying small and mid-cap stocks selectively, however, we do not find merit in going overboard in these stocks as we are seeing the very sluggish economy and limited growth triggers in most sectors. A SIP product may work in such a small & mid-cap but we recommend caution on lump-sum purchases till we don’t see broad-based earnings recovery in mid and small-cap companies.

Risks

CoronaVirus – Global

As on date, total infected cases have crossed 1,360,247 and 75,000 deaths from CoronaVirus. A lot of countries are under lockdown and businesses are affected.

China is seeing business activities pick up gradually upto 80% while businesses in US/Europe/India are affected.

With public awareness and government’s precautionary measures in immigration and quarantine of infected patients and most recent lockdown, we believe the spread will be contained. The timeline of the same remains the uncertain factor.

China and South Korea have already seen a steep fall in new cases due to self-quarantine measures. Now Italy and UK are seeing plateauing in new cases while US is seeing exponential rise as it was late in imposing lockdown.

Financial Market contagion

Worldwide the central banks are taking measures to ensure better liquidity in the system and reducing the interest rates to soften the blow from a slowdown in business activities.

It is to be seen whether this will actually result in desired effects or will it further scare the markets. Banks and investors are shying away from making risky investments into corporate bonds, etc.

US markets have become very risk-averse as investors are selling stocks and moving the funds to bonds. 10 Y bond yield less than 0.5% p.a. and 2 Y yield is below 0%.

The US has had 10 years of economic expansion. A recession won’t be a surprise but its implication on the assets prices is rather sudden and across the board.

Even if US goes into recession and later slow recovery, the countries with limited trade with US don’t have an economic impact.

For example, a country like India exports less than $60 billion to US. The impact from the same will be quite limited to the overall Indian economy.

Most of the exports that happen from India lead to cost-saving for US businesses and citizens (ex. IT and Pharma). So in a way, this trade won’t be cut during a slow-growth period in the US. This makes us confident that India’s future prospects won’t be hit adversely from recession in US.

Only trouble seems to be FII investment in public markets of India can be sold out at a moment’s notice taking the stock prices lower in the short term. This leads to huge volatility without material change in the underlying business.

Opportunity for long term investors (Must Read)

- Equity return is already so poor, will it earn reasonable returns over next few years to compensate for past performance also?

- Is the market correction already over?

- I am adding money every month, what if I miss market bottom?

- Why is it so difficult to buy stocks in correction?

- What are there mad rallies now and then?

- How does having just 10-20% in liquid funds help?

- What the risks in equity?

We know you’ve more questions than we can answer. But we will answer all the key questions in the following paragraphs.

Equity returns are already so poor, will they make reasonable returns over next few years to compensate for past performance also?

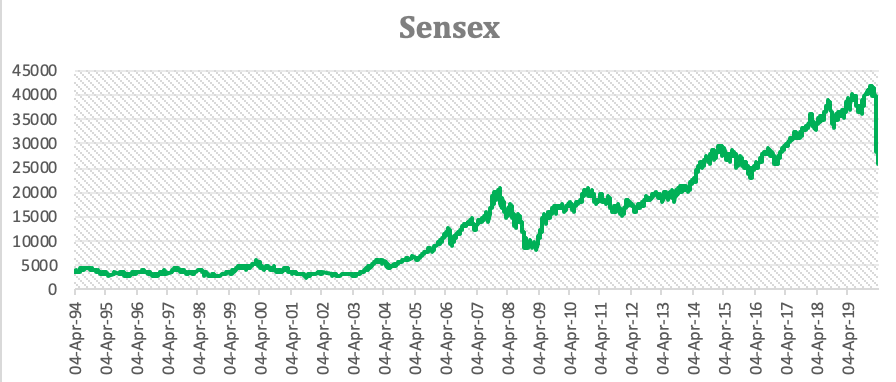

Long term investing means that we buy stocks for the underlying business. As far as a business does well, we can be sure the stocks would reflect the same growth over the long term. Near term events matter only for small period of time but over 3-5 years, it is business performance that wins.

Since most listed businesses weren’t doing great, their valuation weren’t very high. Falling from reasonable valuation have made them quite cheap. Unlike 2008, Indian market was trading at less than 19x P/E ratio (ex-consumer stocks) in 2019. Today it has fallen below 15x. We have assumed large cap companies will go back to earn normal profits in FY2022.

Imagine this way, if business valuation is 100/share and stock trades at 150 (bull market), it falls 50% to 75/share. It may close the gap with fair value of 100/share soon, but it may not recover to 150 soon as that price was way above its fair value. (US is staring at this scenario)

In India (also other emerging markets), stocks have fallen 30% from 100/share to 70/share. So we find that a lot of stocks have corrected from reasonable valuation rather than bull market valuation (P/E, P/S, P/B) making them as cheap as 2008 bottom.

(In 2008, Nifty was 28x P/E ratio on peak margins for most of the business, unlike 2019 where Nifty P/E was 27x on depressed profits of corporate banks, telecom and commodities – this is also the reason why Nifty remained more than 24x P/E for long time in past 5 years; besides, select stocks like HUL, Nestle, Bajaj Finance, Titan & Kotak Mahindra Bank as a group contributed to high P/E ratio of Nifty)

Is the market correction already over? I am adding money every month, what if I miss market bottom?

We are saying that Indian market has become very cheap with just 30% correction doesn’t mean they will not correct further. Timing the bottom is close to impossible and not crucial to make a good return. Buy good business at reasonably cheap price also make a very good long term return.

Why is it so difficult to buy stocks in correction?

The market correction has been the best time to add to stocks always. But it becomes difficult to add as our existing portfolio is also bleeding. This makes us nervous and ‘exaggerate risks’ in short term.

What are there mad rallies now and then?

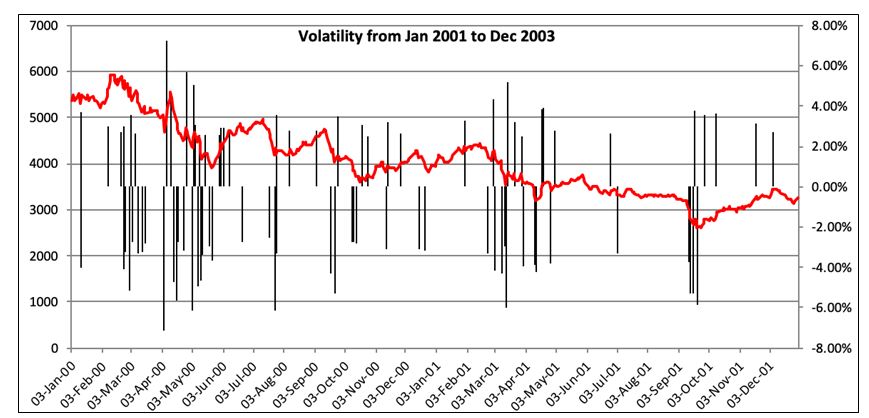

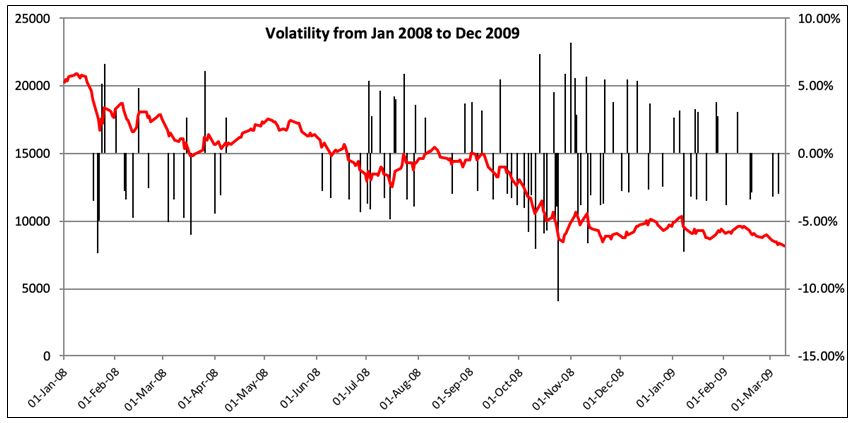

Whenever VIX is high, derived from market price estimates, the market volatility is the highest. To put it simply, usually whenever there is high uncertainty, markets tends to have wide price estimates. This leads to large moves in prices.

Uncertainty is the highest during market correction as it happens due to a big event. This leads to high volatility on upside as well as downside. This is in lines with past market corrections.

Above charts of Sensex show only more than 3% moves on either side during the correction period. We can’t ascribe any fundamental reason for such violent moves even if we do read in media random headline ‘XYZ lead to market rally/slump’.

How does having 10-20% in liquid funds help?

Let’s say you had 20% in liquid funds. These funds if invested carefully in stocks that have fallen 50% and have upside potential for 80-100% can alone add 15-20% return to overall portfolio in market recovery year, alternatively it will add around 3-4% CAGR to annual return over 5 year period.

Another way to look at it from current portfolio value; if we assume 80% equity portion has fallen 30% as much as the market, liquid portion has become around ~25% portfolio. This 25% portfolio today alone can earn 80-100% return and rest of the portfolio just recovers. Fresh investment needs to be invested very carefully to take advantage of cheap valuation, hence we recommend not to add to stocks that are already run up a lot in past few years. You can also think of adding fresh funds that you don’t need for next 5 years and bear short volatility on the same.

As on today we do not recommend to be fully invested. We will mention in our note the right time to go all in within equity portfolio.

What are the risks?

Risk of low returns:

Equity gives long term returns in the range of 7%-20% CAGR. We might be in one phase of 7% CAGR. We discard this possibility as we are right now at a very cheap valuation versus its historical average. As markets recover to fair price multiples, the returns would look better.

Risk of volatility:

We have already identified a certain portion of savings to be invested in equity. This was done exactly for such kind of volatility.

We have already taken care of the risk of volatility by committing only a portion of Equity. The rest of the savings are in Gold, Real Estate and Fixed income.

So getting afraid to add more funds is ‘double accounting’ for the same risk which has been taken care of.

The correct way to look at return is on aggregate including all your assets. This helps not getting carried away in good market nor worry too much during market correction.

Risk of delayed recovery:

We always say that only surplus funds, not needed for more than 5 years must be parked into equities. Even if recovery is at a later date, we don’t have to worry about delayed returns in equity.

Equity return often come in unpredictable manner and they can be very steep on either side. But they trend upwards as India’s economy keeps growing.

Risk from business:

Whatever the calamity, not all businesses get affected. Even a storm can’t destroy every house in a town. Stronger ones remain steady. The same applies while a building a portfolio in equity.

A stock can lose significant value but a portfolio of stocks doesn’t crumble altogether. Let those loser lose and winners recover.

As far as you keep checking your overall returns rather than individual stock, you will sail through the fears and come out strongly.

This is not the time to panic or putting hold on fresh investments. You must keep buying, albeit slowly as prices come off.

What are some of the positives?

For now, the spread in India appears lower than US or Italy. We hope (pray) that early lockdown would help contain spread of infections versus developed countries.

Rural economy seems less infected and can come out of lockdown sooner than urban areas. If rural economy starts doing fine, we may start seeing some optimism coming back to people and businesses.

Development of vaccines is happening at rapid pace. Even if people don’t get vaccinated, sooner vaccine develops, sooner things go back to normal.

Awareness of infections spread will make people follow social distancing and reduce the spread further. Before the lockdown, most people weren’t aware that they might be infected by the virus and likely to spread to others.

Government is aware of fallouts of lockdown and proactive enough to announce measures to combat slowdown. We find that such events are rare and we would know what would have been the best way out only in hindsight. For now, collaborative approach, acknowledgement of pain areas and support for rehabilitation is expected from the government. It appears it will be delivered since all the governments worldwide are doing the same.

Where do we go from here?

Overall markets may remain subdued until the time earnings growth kick in. But this doesn’t mean individual stocks won’t rise.

We expect superior returns from stock picking as average stock today is trading cheaper than Nifty itself.

Near term uncertainty in structural growth, story spells an opportunity for long term investors. Stocks are beaten down from fear of short term slowdown and the cuts are much more than actual impact on business.

We do not find any merit in second-guessing what’s going to happen in the next 6 months-1 year. We leave this field open for speculators, fear mongers, and punters.

We have often seen that after such a sudden fall, the rebound could be equally sharp whenever it happens. We recommend to stay put and not worry looking at prices.

We are managing only long term money and predicting near term events is futile.

We continue to recommend Gold Fund/Gold (up to 5-10% of the portfolio) as a hedge from contagion risks and some allocation to safe liquid funds/Fixed Deposits (10-20%) within in equity portfolio for capturing new opportunities.

Act on our calls and restrict your allocation to 3-5% in each stock. And not more than 25% in each mutual fund. This will keep you at peace, and not significantly dent your portfolio performance.

Beyond this, tinkering asset allocation will only reduce long term returns thereby missing one’s target corpus. We have diversified our stocks portfolio, we have diversified assets and we have long term horizon. Together this takes care of all potential risks in investing.

Happy Investing!

MoneyWorks4me Outlook:

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463