Anupam Rasayan IPO Details:

IPO Date: March 12th to March 16th, 2021

Total Shares for subscription: ~1.37 Crore

IPO Size: ~Rs. 760 Cr

Lot Size: 27 shares

Price Band: Rs. 553-555/share

Market Capitalization: Rs. 5,000 Cr

Recommendation: Subscribe for listing gains only

Purpose of Anupam Rasayan India Limited IPO

- To make prepayment/ repayment of the company’s indebtedness including accrued interest.

- To meet general corporate purposes.

About the Anupam Rasayan India Limited

Started in 1984, Anupam Rasayan is one of the leading companies engaged in the custom synthesis and manufacturing of specialty chemicals in India.

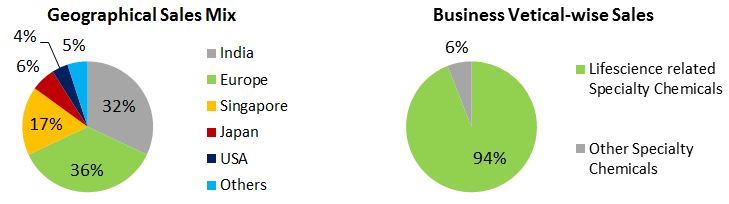

The business has 2 verticals-

- Life Science related specialty chemicals that are used in agrochemicals, personal care, and the pharmaceutical sector

- Other specialty chemicals i.e. pigment & dyes, polymer additives, etc.

Anupam Rasayan manufactures 41 products catering to diverse end-users. The company has a strong long-term relationship with many multinational companies like Syngenta Asia Pacific Pte Ltd, Sumitomo Chemical Company Ltd, and UPL Limited to expand geographical reach across countries like United States, Europe, Japan, and India.

Life Science-related Specialty Chemicals vertical comprise of Agrochemicals (including crop protection), Personal care & Pharmaceuticals. Other Specialty Chemicals vertical comprise of Specialty Pigments, Specialty Dyes & Polymer Additives.

As of December 31, 2020, Anupam Rasayan operated 6 multi-purpose manufacturing facilities in Gujarat, India, with 4 facilities located at Sachin and 2 located at Jhagadia, and an aggregate installed capacity of 23,438 MT. Given that their operations are primarily export-oriented, the close proximity to Adani Hazira Port of their facilities located at Sachin helps them in reducing freight and logistics costs.

In 2020, Anupam Rasayan manufactured products for over 53 domestic and international customers, including 17 multinational companies. Sales from exports accounted for 65% of the total sales.

The revenue generated from sales to their top 10 customers represented 86.65% of total sales in Fiscal 2020.

Management of Anupam Rasayan:

Mr. Anand S Desai, Managing Director of the company has 28 years of experience in the chemical industry and is actively involved in the operations of the company.

Dr. Kiran C Patel, Chairman, and Non-exec director is a business person in the healthcare sector and certified to practice medicine in the state of Florida.

Ms. Mona Desai has 18 years of experience and is actively involved in the operations of the company. She is associated with the board since the incorporation of the company.

Financials of Anupam Rasayan:

Strengths:

- Diversified customer base.

- Present in a growing sector

- Strategically located manufacturing facilities.

- Consistent financial performance track record.

MoneyWorks4me Opinion:

According to the F&S Report, India’s specialty chemicals industry is expected to grow at a CAGR of approximately 10% to 11% over the next 5 years, due to rising demand from end-user industries, along with tight global supply on account of stringent environmental norms in China. Further, India accounts for approximately 1% to 2% of the global exportable specialty chemicals, indicating a large scope of improvement and widespread opportunity.

The bulk of the revenue of the company comes from long-term agreements with its clients. The duration of these agreements ranges between 2-5 years. The customers in this industry are required to register their manufacturer with regulatory bodies and hence they select with careful review. Hence the customer acquisition is a 12-24 month process. Also to restrict the spread of confidential information, the customers prefer to limit the number of manufacturers.

We believe that Indian chemical and pharmaceuticals ingredients manufacturers will gain market share globally as Chinese companies are cutting down their capacities due to pollution concerns. With help of scale and government incentives, we will see growth in the chemical sector which bodes well for growth in the sector.

Valuation

Anupam Rasayan has a reasonable scale to take advantage of chemical manufacturing increasing in India.

In the latest quarter, the growth rate of the company was 36% annualized. It falls into faster-growing chemical manufacturers. With the repayment of debt post issue, the profit growth is likely to be higher from lower interest costs.

We believe that at around EV/sales of 6-7x i.e. ~45x EPS, the IPO is very aggressively priced. Its competitor PI industries also trades at a similar valuation in the public market, hence the steep pricing.

Except for listing gains, we do not see merit investing at IPO or listing day price. Since it belongs to the market’s favorite growth sector, we recommend subscribing for listing gains.

Risks are high that the growth rate might moderate as growth is limited to capacity expansion done by the companies, unlike asset light/outsourcing companies.

Note:

- We do not recommend buy just because the IPO market is hot. We do not earn any commission or fee for promoting IPOs so expect an honest review from us on the business model and valuation.

- IPO is usually steeply-priced as promoters look for bang for the buck. Since investors receive only 1-2 lots (<30K), occasionally we do recommend BUY for listing gains or small allocation.

| IPO Activity | Date |

| IPO Open Date | 12th March 2021 |

| IPO Close Date | 16th March 2021 |

| Basis of Allotment Finalisation Date | 19th March 2021 |

| Refunds Initiation | 22nd March 2021 |

| A credit of Shares to Demat Account | 23rd March 2021 |

| IPO Listing Date | 24th March 2021 |

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 27 | ₹ 14,985 |

| Maximum | 13 | 351 | ₹ 194,805 |

| Date | QIB | NII | Retail | Employee | Total |

| Mar 12, 2021, 05:00 | 0.00x | 0.09x | 2.58x | 0.30x | 1.29x |

| Mar 15, 2021, 05:00 | 0.37x | 1.39x | 6.60x | 0.93x | 3.64x |

| Mar 16, 2021, 05:00 | 65.74x | 97.42x | 10.77x | 1.71x | 44.06x |

When will the Anupam Rasayan India Ltd IPO open?

Anupam Rasayan IPO will open for subscription on Friday, March 12, and will close on Tuesday, March 16.

What is the price band of Anupam Rasayan India Ltd IPO?

The price band for Anupam Rasayan IPO is Rs. 553-555.

What is the lot size for Anupam Rasayan India Ltd IPO?

Retail investors can subscribe to the IPO minimum lot size is 27 shares, up to a maximum of 13 lots i.e. Rs. 1, 94,805.

What is the issue size of Anupam Rasayan India Ltd IPO?

The total issue size is ~1.37 Cr shares raising Rs. 760 Cr.

What is the quota reserved for retail investors in Anupam Rasayan India Ltd IPO?

The quota for retail investors in Anupam Rasayan IPO is fixed at 10% of the net offer.

When will the basis of allotment be out?

Allotment will be finalized on March 19 and refunds will be credited by March 22. Shares allotment will be credited in Demat accounts by March 23.

What is the listing date of Anupam Rasayan India Ltd IPO?

The tentative listing of Anupam Rasayan IPO is March 24.

Where could we check the Anupam Rasayan India Ltd IPO allotment?

One can check the subscription status on Kfin Technologies.

Who are the leading book managers to the issue?

Book running lead managers to the IPO are Ambit Private Limited, Axis Capital Limited, IIFL Holdings Limited, and JM Financial Consultants Private Limited.

What does Anupam Rasayan India Ltd do?

Anupam Rasayan is one of the leading companies engaged in the custom synthesis and manufacturing of specialty chemicals in India. The business has 2 verticals- Life Science related specialty chemicals that are used in agrochemicals, personal care, and pharmaceutical sector; Other specialty chemicals i.e. pigment & dyes, polymer additives, etc. Anupam Rasayan manufactures 41 products catering to diverse end-users.

Who are the peers of Anupam Rasayan India Ltd?

The peers of Anupam Rasayan India Ltd are PI industries, Aarti Industries.

What if I do not get the allotment?

If not allotted then subscribe to MoneyWorks4me PRO.

Know more: Indian IPO Historic Data 2021

MoneyWorks4me Solutions:

If you liked what you read and would like to put it into practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Why MoneyWorks4me | Why Register | Call: 020 6725 8333 | WhatsApp 8055769463