This article covers the following:

Sensex was up 2.8% in the month of July 2023

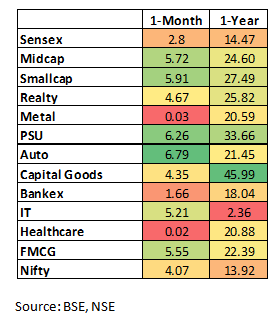

As we write this note in August, Sensex has gained 2.8% in the month of July 23 and 14.47% over the last one year. The major contributors to this growth in the last month are the Auto, PSU, and FMCG sectors. And the major performing sectors in the last year are Capital Goods, PSU, and Realty. Major events we talk about in detail below include the downgrading of US securities, India’s credit growth, and GST collections.

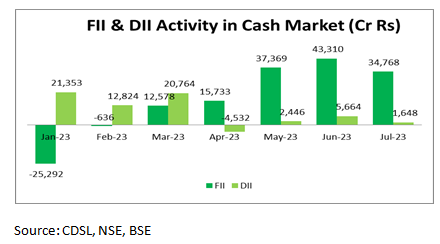

FIIs were net buyers with a total net purchase of Rs. 34,768 Crore in July. DIIs also showed a positive trend as net buyers, purchasing Rs. 1,648 Crore during the previous month. Both of these indicators reflect increased resilience in the Indian market.

Global real GDP growth is projected to decrease from 3.3% in 2022 to 2.7% in 2023, and further to 2.4% in 2024. The slowdown is due to high inflation and tightening monetary policies. Although economic growth is moderating, a global recession is not expected.

Fitch downgraded the creditworthiness of the U.S. government, lowering U.S. Treasury securities from AAA to AA+. This change could have significant long-term consequences for the United States and the global economy since U.S. Treasury debt has been a global benchmark for interest rates.

In July, the Federal Reserve increased interest rates by 25 basis points as part of its ongoing tightening measures aimed at curbing inflation. Previously, the challenging job market had hindered the Fed’s policy efforts. However, the situation in US market has been partially alleviated by a better labour force participation rate, especially among those aged 25-54.

Global demand challenges, particularly in Europe and the US, are affecting Indian manufacturers’ exports, while domestic demand remains strong. Chinese chemical supplies have increased after COVID-related measures eased, causing concern for Indian manufacturers due to higher Chinese exports and lower global chemical prices. This has intensified competition and further impacted the margins of select Indian chemical manufacturers.

The global economy is slowing down. Indian exports will have a significant impact because of that, but domestic demand will help curb the impact.

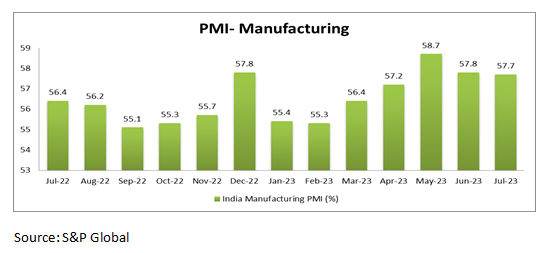

The Indian economy remains resilient even amid the global economic slowdown. Both high and low-frequency indicators continue to show strength and stability. PMI continues to be in an expansionary phase.

In July, S&P Global’s India services purchasing managers’ index increased to 62.3%, up from June’s 58.5%. Despite a decline in India’s manufacturing PMI to 57.7%, the strong performance of the services sector drove the overall S&P Global India Composite PMI Output Index to reach a 13-year high of 61.9%.

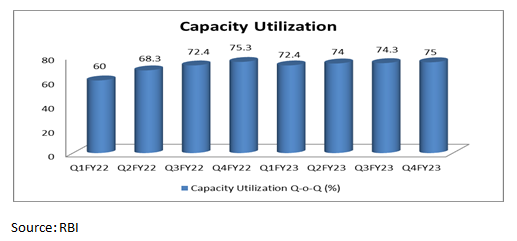

Capacity utilisation at manufacturing facilities was at a robust 75% in Q4 FY23, up from 74.3% in Q3 FY23. Capacity utilization is used to evaluate the extent to which manufacturing or production capacity is being effectively used. An increase in capacity utilization suggests a rise in demand for goods or services and also the necessity for new investment in additional capacity creation.

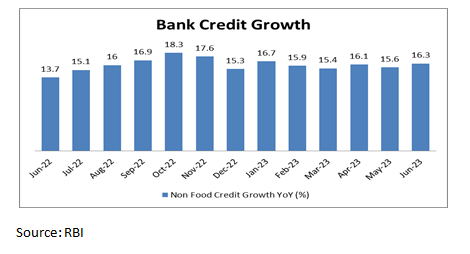

Credit growth is gaining momentum, primarily driven by the expansion in services, retail, and MSME sectors. The increase in bank credit signifies substantial lending activity in the economy, contributing to overall economic growth.

Late monsoon’s not playing a spoilsport-

In July, nearly all states have witnessed above-average rainfall. There is a high possibility that August’s rainfall will be significantly below the average level. El Nino will have some impact on the Indian GDP but not much on inflation. Historical data shows, El Nino has a limited impact on food inflation. But it will have a significant impact on agricultural produce since agriculture in India is predominantly dependent on the monsoon.

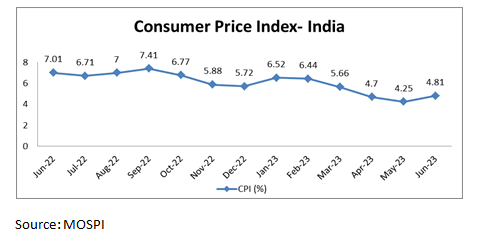

In June, India’s retail inflation rose to 4.81% from a 25-month low of 4.25% in May, as per data released by the Ministry of Statistics. The CPI inflation has consistently stayed within the RBI’s tolerance band of 2-6% for four consecutive months.

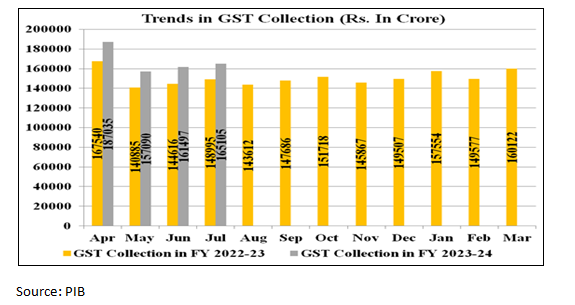

In July, India’s GST collections reached Rs. 1.65 lakh crore, marking an 11% year-on-year growth. This is the fifth time that gross GST collections have surpassed the Rs. 1.60 lakh crore mark.

On the back of the above-mentioned encouraging cues, Q1 earnings results also have indicated sustained demand momentum. Particularly, the small and midcap indices have surpassed larger benchmarks in the current quarter, thereby contributing to the trend of reducing valuation gaps. To gain deeper insight into the companies’ quarterly performances refer to our weekly result updates.

Indian outlook remains strong

India appears to be in a favourable position compared to the rest of the world, both in terms of cyclical and structural factors. Healthy growth in various domestic high-frequency indicators, such as GST collections, retail spending, consumer demand, credit growth, and PMI, indicates a significant level of economic activity.

Projections suggest that India is expected to be among the fastest-growing economies in 2023. Recent policy reforms, government-led capital expenditure focus, and stronger corporate balance sheets have potentially established a robust foundation for sustained growth over multiple quarters. However, in the short term, volatility may persist until global uncertainties subside.

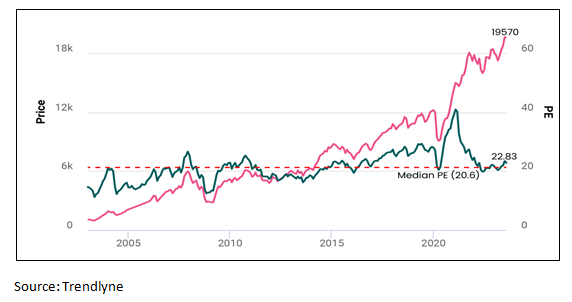

Nifty is trading marginally above long-term averages

On a PE basis, Nifty is trading above the historical median, showing bullish sentiment.

How are we looking at this?

The recent development of the shift of manufacturing from China to more domestic production supported by the government as well as the perception of companies to diversify their supply chains bodes well for the Indian Manufacturing sector. Government thrust on capex shall support growth in the infra sector with corollary growth benefits to Financials, construction materials, and allied industries.

With the US recession still a possibility, Germany already in recession, and Eurozone experiencing high inflation worries, even though domestic demand is good, there is muted demand in export due to a slowdown in advanced economies. This can be seen by the ramp-downs and project delays seen in the Indian IT space. Going ahead with recovery in exports the economy is expected to perform better than before.

What is MoneyWorks4me’s action plan for its subscribers?

We stay on course to look at individual securities with strong future outlooks and growth. While taking a portfolio view to diversify and make the most of the rising economy.

We have given a couple of BUY calls in the past few months. The market has rallied since then. Given the strong dynamics of the economy, we are excited to BUY existing opportunities or new ones in the near future. We are tracking more companies to add in our BUY zone; however, they are still ahead of our MRP.

The deleveraged balance sheets of Indian corporates, sub-par capacity addition in the past decade, and increasing utilisation levels give us confidence on the credit cycle. This combined with the underperformance of the financial sector in the last couple of years gives us confidence on the prospects of lenders (BFSI sector).

We believe that the current economy recovery is led by the credit growth cycle which remains definitive. Also, the Indian corporate sector is in the best position to gain pricing power and balance sheet strength. The majority of the sectors have seen consolidation. We are looking at sectors that will be early beneficiaries of these two themes.

Best Stocks From:

All Weather Alpha Case Screener Alpha Cases Business Houses Group

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | Ebook | WhatsApp: 9860359463

*Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

*Disclaimer: The securities quoted are for illustration only and are not recommendatory