Axis Bank Ltd: Is it an investment-worthy stock? Here’s the analysis….

Axis Bank – Bank Highlights

Axis Bank: India’s third largest private-sector bank

Market View of Axis Bank’s Stock Price (17th March, 2011)

Current Stock Price: Rs. 1292.70

52 Week-High Stock Price: Rs. 1608

52 Week Low Stock Price: Rs. 1112

Latest P/BV: 3.30

Latest P/E: 16.93

Tell me more about Axis Bank Ltd.

Axis Bank, formerly UTI Bank, is India’s third largest private-sector bank after the significantly larger ICICI Bank and HDFC Bank. It is engaged in Large & Mid Corporate Banking, Retail Banking, SME banking, Agri-business banking, International Banking, treasury etc. It has the largest EDC (Electronic Data Capturing) network, the third largest ATM network and the fourth largest base of debit cards in India.

Axis Bank, formerly UTI Bank, is India’s third largest private-sector bank after the significantly larger ICICI Bank and HDFC Bank. It is engaged in Large & Mid Corporate Banking, Retail Banking, SME banking, Agri-business banking, International Banking, treasury etc. It has the largest EDC (Electronic Data Capturing) network, the third largest ATM network and the fourth largest base of debit cards in India.

As of 31st December, 2010 it had a very wide network of more than 1281 branches including 169 Service Branches and over 5303 ATMs. With a customer base of over 150 lakh, it also has overseas branches at Singapore, Hong Kong and Dubai and representative offices at Shanghai and Dubai.

Since its inception, Axis Bank has been jointly promoted by UTI-I, LIC, GIC and four other PSU insurance companies, i.e. National Insurance Company Ltd., The New India Assurance Company Ltd., The Oriental Insurance Company Ltd. and United India Insurance Company Ltd. Promoters hold 37.35% stake in Axis Bank as on 31st December, 2010 out of which UTI-I holds 23.72% stake, LIC 9.58%, and GIC 1.87%.

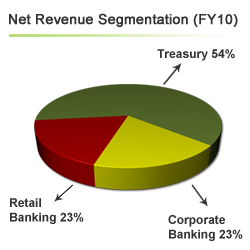

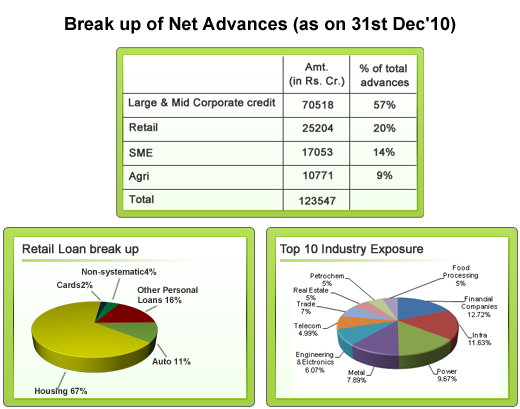

Above charts show, Axis Bank’s net advances are skewed towards the corporate segment, of which the financial industry, infra, power, and metal together make up around 42%. Only 20% of the net advances are in retail banking, with a major exposure to the housing segment followed auto loans. Each of them (corporate and retail banking) contribute 23% to the net revenue of the Bank.

How has the financial performance of Axis Bank Ltd been?

The net interest income (NII) of Axis Bank, over the last 10 years, has rocketed by 54.8% CAGR from Rs. 98 Cr. in FY01 to Rs. Rs. 5004 Cr. in FY10; and its total income has grown by 34.9%CAGR. During the same period its book value and EPS have jumped by 37% and 28% resp.

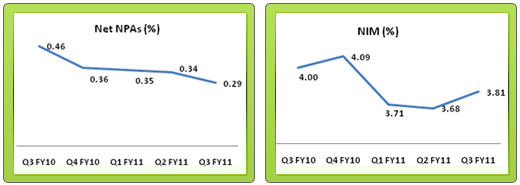

The bank has maintained its net profit to total fund ratios between 1 and 1.25 during FY05 to FY08, whereas in the last two financial years, this ratio has been above 1.25. This increasing trend of net profit to total fund ratio shows that it has continuously increased its efficiency of utilizing funds. The non-performing assets (NPA) to net advances ratio has also shown a decreasing trend from 3.46% in FY02 to 0.4% in FY10 which shows the bank has continuously increased its assets quality. It has also maintained a very good capital adequacy ratio (CAR) of 15.8% at the end of FY10, well above the RBI guide line of 9%, which indicates that it can easily cover all the associated risks.

Hence, the 10 YEAR X-RAY of Axis Bank is Green (Very Good).

Why are these parameters necessary and sufficient for a bank’s analysis? Click here to know

What can we expect in the future? Here is the analysis of Axis Bank Ltd..

In the short-term

Axis Bank’s target for FY11: –

• Business growth(Advances + Deposits) of 25%

• Opening 200-250 new branches and 1000 new ATMs

Axis Bank has reported a strong performance in December, 2010 quarter:

• It has shown a 36% jump in the Net Profit at Rs. 891.36 Cr. and a 28% rise in the Net Interest Income to Rs. 1733.12 Cr. on the back of robust 46% credit growth.

• The other income of the Bank inched up by 16% to Rs. 1147.71 Cr. mainly on the back of 21% jump in the fee income at Rs. 968 Cr.

• CAR has decreased to 12.46% in Q3 FY11, compared to 16.8% in the same quarter last year

• Its Net Interest Margin (NIM) stood at 3.81% during Q3 FY11, compared to 4% during Q2FY10 (much higher than the industry standard of 2-2.5%)

• The net NPAs of Axis Bank stood at 0.29% in Q3 FY11, which is amongst the lowest in the banking industry; the provision coverage ratio stood at 82.69%, much higher than the regulatory requirement of 70%

Advances of the Bank have reported a strong growth of 46% on y-o-y basis and 12% on q-o-q basis to Rs. 123547 Cr. in the December 2010 quarter. The growth in the advances was driven by 69% jump in the corporate segments at Rs. 70518 Cr. and 33% rise in the retail segment at Rs. 25204 Cr. Agri & microfinance loan book grew by 24% to Rs. 10772 Cr. and SME by 9% to Rs. 17053 Cr. Exposure to the Microfinance institutions is around 1% of advance book and that of telecom (mainly 2G license advances) constitutes 6% of total advance book.

For the nine months ended December 2010, Axis Bank has reported 37% rise in the NII at Rs 4861.99 Cr., 19% in fee-based income at Rs. 2559 Cr., and 6% in the other income at Rs 3181.73 Cr. compared to that of corresponding quarter last year respectively. In FY11, so far, it has opened 142 branches and 1010 ATMs. Thus, the bank is on line to achieve its target for FY11.

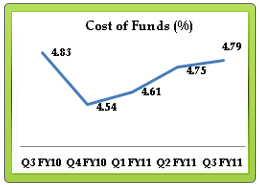

Increasing cost of funds is a cause for concern:

Increasing cost of funds is a cause for concern:

The RBI has increased the Repo rate, Reverse repo rate, and CRR in the last one and a half year in several phases to control inflation. This has lead to lower loanable fund availability in the bank and continuous increase in cost of funds, which can be seen in the chart. As, the inflation rate is still on the higher side, tight monetary policy is expected to continue in the short-term. So, we expect that the cost of funds will also increase further in the short-term, which will keep margins under pressure.

RBI, recently, has increased provisioning percentage on housing, real estate, and many other types of loans. This will affect the profitability of the bank because, in the retail segment, it finances almost 70% advances in housing.

Considering above factors, we expect that the short-term future prospects of Axis Bank will be Orange (‘Somewhat Good’)

In the long-term

Strength of Axis Bank:

• It is India’s third largest private bank, with 1281 branches and 5303 ATMs, and a customer base of over 150 Lakh as on 31st Dec, 2010

• It has the largest EDC network, the third largest ATM network, and the fourth largest base of debit cards in India.

• It already has branches in Singapore, Hong Kong and Dubai International Financial Centre. About 14% of the bank’s asset book is from international operations. It is further going to set up a subsidiary in London and upgrade its representative office in Shanghai to a branch.

• 100% core banking facilities with advanced technology

• On-line trading facilities in alliance with Geojit BNP Paribas

In Jan 2011, Axis Bank, , announced the launch of AxisDirect, an online trading platform – a product of its wholly-owned subsidiary, Axis Securities and Sales Ltd. AxisDirect will offer trading in cash, derivatives, IPO segments through NSE and BSE; and provide well-researched information about various corporate, access to independent third-party research, stock research and analysis tools.

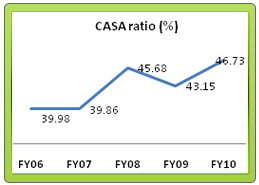

Axis Bank has maintained a very good Current Account Savings Account (CASA) ratio, above 40% in the last three years, which is higher than the industry standard of 35-40%. CASA plays a very significant role in keeping cost of funds low and margins high. Only four other banks – SBI, PNB, HDFC Bank, and ICICI Bank – have more that 40% CASA ratio.

Axis Bank has maintained a very good Current Account Savings Account (CASA) ratio, above 40% in the last three years, which is higher than the industry standard of 35-40%. CASA plays a very significant role in keeping cost of funds low and margins high. Only four other banks – SBI, PNB, HDFC Bank, and ICICI Bank – have more that 40% CASA ratio.

Product strategy designed to benefit customers:

To beat the market, Axis Bank is adopting different product strategies. Recently, it has extended the repayment period of the standard home loan to the maximum tenure of 25 years. In the step down product (a type of home loan product), the customer has to pay a higher EMI when the combined family income is higher and a lower EMI when the family income has reduced over a period of time. Apart from this, the Bank has given option to its customers to close the loan before its maturity with no prepayment penalty.

Banking Sector – Heading towards a high-performing sector:

The banking sector is poised to grow in line with the growth of the economy. The Indian economy is expected to have a high growth in the long-term and so is the Indian banking sector, which is currently in consolidation stage. According to Mckinsey Report on India Banking 2010, ‘The banking index has grown at a compounded annual rate of over 51% since April 2001 as compared to a 27% growth in the market index for the same period (2001 to 2010)’. The report says that the Indian banking sector is heading towards a high-performing sector. Axis Bank, being the third largest private bank in India, is ready to take full advantage of this growth opportunity.

Financial Inclusion Program:

Under Financial Inclusion Program, RBI is taking initiative to provide banking services at affordable costs to the weaker sections of society or the unbanked segment, which does not have any access to the formal banking system. As of now, it is estimated that 60% of the Indian population does not have access to formal banking facility and RBI is keen on achieving 100% financial inclusion for sustaining equitable growth. Axis Bank is taking following initiatives under this Program:

- Targets to cover 12,000 villages in the next 5 years: Axis Bank plans to cover 5,500 villages for financial inclusion by March 2011 and scale it up to 12,000 villages in five years time. It is looking at opening 18-lakh no-frills accounts, Rs. 40 Cr. of deposits, and Rs. 10 Cr. of advances. The 18-lakh account would include 12-lakh accounts that they have already opened for government-sponsored scheme. The bank is looking at several low-cost delivery models such as smart card, mobile banking and point of transaction device.

- Tie up with Janalakshmi Social Services to tap urban poor: To tap unbanked population in urban areas, Axis Bank has tied up with a Bangalore-based microfinance institution, Janalakshmi Social Services. Janalakshmi will use its client base to provide banking services of Axis Bank and will work as business correspondent to sell other products of the Bank. This service would be spread from Bangalore to 50 other cities in the near future.

- MoU with Idea to test a Branchless Banking Model: Axis Bank has signed a Memorandum of Understanding with Idea Cellular to test a ‘Branchless Banking’ model through a mobile enabled remittance pilot. Idea will act as a ‘Business Correspondent’ of Axis Bank to provide an entire range of financial products and services offered by the Bank, through the mobile operator’s retail outlets. Idea’s network will help Axis Bank gain access to widespread distribution reach and a low-cost delivery channel for offering financial products and services, based on the mobile platform. On the other hand, Idea can offer value-added services to its customers by offering financial products and services.

There is still a question mark on the viability of Financial Inclusion Program which primarily targets the low-income group. This leaves little scope of high margins under this program. However, this initiative is expected to help in economic development, and hence is expected to be fruitful in the long-term.

Diversified into non-banking financial services:

Axis Bank has started non-banking financial services to carry out investment and lending activities with a focus on infrastructure and other activities. It has five wholly-owned subsidiaries:

1. Axis Securities and Sales Ltd. – to market credit cards , retail asset products and online trading facilities

2. Axis Private Equity Ltd. – to manage equity investments & provide venture capital to support businesses

3. Axis Trustee Services Ltd. – to engage in trusteeship activities

4. Axis Asset Management Companies Ltd. – to carry on the activities of managing mutual fund business

5. Axis Mutual Fund Trustee Ltd. – to act as the trustee for the mutual fund business

Acquisition of Enam’s investment banking business expected to fill the gap in their portfolio:

Axis Bank has acquired Enam’s investment banking and institutional broking businesses for R.s 2,064 Cr. in a stock-swap deal. Pursuant to the scheme and in consideration for the proposed demerger, Enam shareholders will receive 5.7 shares of Axis Bank for every 1 share held in Enam; translating into an approximately 3.37% shareholding in Axis Bank. While the acquisition appears to be at a slight premium, it will help Axis Bank fill a key gap in portfolio, increase fee-based income and bring significant long-term benefits. Also, as these businesses are profit-making and enjoy one of the highest margins in the industry, they will contribute to Axis Bank’s profits and will be earnings accretive.

Risks & Concerns

• Low exposure in high-margin retail banking

• New Bank License would hamper banks’ profits: RBI is providing banking licenses to selected NBFCs from 2011. This would increase competition among banks which would consequently hampers their profits

• RBI, in Bancon 2010 held in Mumbai, has indicated that Indian Banks should operate at lower margin, in line with global standard. They should decrease lending rate and increase savings rate to help in achieving double digit economic growth. RBI may also increase Capital Adequacy Ratio benchmark from 2013.

• As the banks have mainly financial assets, they have to manage several risks such as credit risk, market risk, liquidity risk, country risk etc. So, banking business, as a whole, is considered as risky business

• Government regulation increases uncertainty in the banking sector: The Government of India frequently changes monetary policies by changing CRR, repo rate, reverse repo rate etc. to maintain stability in the economy. It increases uncertainty in the banking sector.

Considering the strong position that Axis Bank has established for itself in the banking industry and its recent acquisition of Enam, we can expect that the long-term future prospects of Axis Bank will be Green (Very Good).

So, is it an investment- worthy Bank?

The economy is expected to grow roughly by 5-7% in the next 5 years. The banking sector is poised to grow in line with the growth of the economy. Considering the bank’s large size and its strengths, we can expect this economic growth to have a positive impact on Axis Bank’s growth.

Yes, Axis Bank is an investment worthy bank, but only at the right price. Currently, it is trading at a price of Rs. 1304.65. But, does this price offer an attractive discount to its right value (MRP) or is it over-priced? It is always best to invest at an attractive discount to its MRP, to get maximum returns at minimum risk. Become a member of MoneyWorks4me.com to know its sensible buy- price and hence take the right action for this company.

To read related blogs on how to analyse banking stocks Click here

Disclaimer: This publication has been prepared solely for information purpose and does not constitute a solicitation to any person to buy or sell a security. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations or needs of an individual client or a corporate/s or any entity/ies. The person should use his/her own judgment while taking investment decisions.

High Price to book value (P/BV) is not a concern for a company’s financial health or its future prospects. But, yes, it can be a concern for an investor, if he wants to invest in that particular stock/bank because high P/BV indicates that its share price may be on the higher side (overvalued stock).

If we talk about Axis Bank’s P/BV…… yes, you are absolutely right that its P/BV is higher than its peer companies. But, if you’ll look at its historical P/BV, it has maintained an average P/BV ratio of 3 in the last 6 years. So, we can say that it is slightly higher than its historical P/BV too.

Also, there are three other banks – Kotak Mahindra Bank, HDFC Bank, and Yes Bank – which maintain even higher P/BV than Axis Banks

Hi,

When you compare the stock price of the above mentioned banks, you may feel that ING Vysya Bank is lower, but just comparing the price of 2 stocks is not enough. More importantly, what you need to look at, is the strength of the past financials, its short-term and long-term future prospects. The Company Shastra by MoneyWorks4me,com is an initiative to help retail investors understand the right way to analyse stocks i.e. by understanding the strength of its business model, its 10 year financial track record and how bright are its future prospects. To illustrate the importance of this further, if you look at the 10 year financial performance of ING Vysya, you will find that Axis Bank has done much better in the past. Once you find a company which has been a winner in all the above aspects, only then does the price become the deciding factor. Here, while deciding whether the stock is overvalued/undervalued you need to look at the MRP (i.e. the real worth) of the stock.

To read more on the analysis of banking stocks http://bit.ly/hNmoO9

.

very good analysis

Thanks a lot for the appreciation. Please keep reading and posting your feedback.

I congratulate to author of the article for writing a worthy article on Axis Bank. Very well written…. The article is truely an eye opener for financial planning, investment and to know about the market risks.

Hi,

Thanks a lot for the appreciation. We are glad that you have liked the article and it has been of help to you. Please keep reading and posting your feedback.

Yes, indeed Axis Bank is a stock worth investing in and as agreed by you, an investor needs to look at whether its current price is overvalued/undervalued.

It has been our constant endeavor to keep our analysis as simple as possible. And yes, keep looking at this space for more articles like this; we release our Company Shastras twice every month.

Thanks a lot for the appreciation.

This article is really an eye opener both in terms of General Banking in India and Axis Bank in particular……The continuity of such good articles in future can make people plan their investment in banking sector and more investment can be made in Axis Bank in particular like i have decided that i am definitely gonna invest in Axis Bank shares.

Thanks a lot for guiding my investment with this article

I am very much impressed with your writing skills and with the layout on your blog. It is a good investment option. Axis Bank Car Loan is the banking relationship manager today.

Thanks….!!!!!!!