A business exists to earn profits. Nobody would want to run or invest in a business which is in losses. But while profits are important for a company, so is the ability to generate positive cash flow. This is because, ultimately, cash is needed to pay employees, suppliers, and others to continue as a going concern. A company that generates positive cash flow has more flexibility in funding needed investments and taking advantage of attractive business opportunities, than an otherwise comparable company without positive cash flow.

A business exists to earn profits. Nobody would want to run or invest in a business which is in losses. But while profits are important for a company, so is the ability to generate positive cash flow. This is because, ultimately, cash is needed to pay employees, suppliers, and others to continue as a going concern. A company that generates positive cash flow has more flexibility in funding needed investments and taking advantage of attractive business opportunities, than an otherwise comparable company without positive cash flow.

Additionally, cash flow is the source of returns to providers of capital. Therefore, the expected level of future cash flows is important in valuing corporate securities and in determining the company ’s ability to meet its obligations. It is no wonder then that the cash flow statement is one of the most important financial statements for management and analysts alike. It is also believed that while management can use the flexibility in accounting standards to boost or reduce earnings as needed, it is more difficult to manipulate the cash flow statement.

But there are ways in which companies can temporarily boost cash flows. Before we find out how this can be done, let’s first look at what is a cash flow statement?

The cash flow statement and its structure

The balance sheet gives a one-time snapshot of a company’s assets and liabilities. And the income statement indicates the business’s profitability during a certain period. The cash flow statement differs from these financial statements because it acts as a kind of corporate checkbook that reconciles the other two statements. Simply put, the cash flow statement records the company’s cash transactions (the inflows and outflows) during the given period. It shows whether all those lovely revenues booked on the income statement have actually been collected.

The statement of cash flow for companies consists of three main parts:

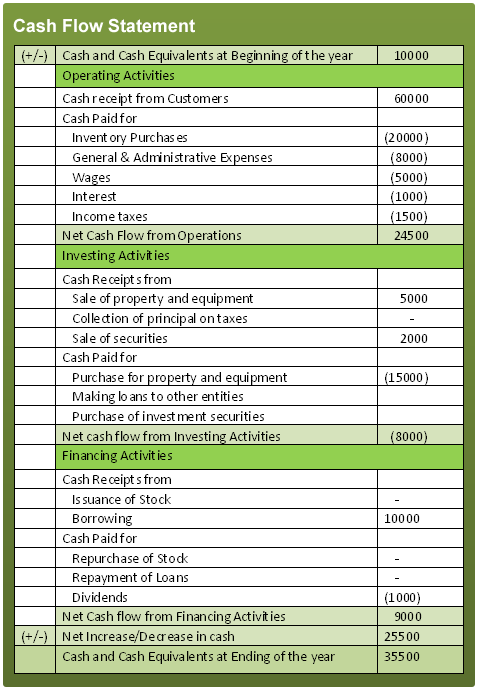

- Cash flow from Operating activities – This includes the cash used in or generated from the day-to-day activities or normal operations of a business. Activities like selling products or providing services (cash inflow), payment to suppliers, salaries, taxes (all leading to cash outflow) etc. lead to a change in cash flow from operating activities.

- Cash flow from Investing activities – This includes purchasing and selling investments. Investments include property, plant, and equipment; intangible assets; other long – term assets; and both long-term and short-term investments in the equity and debt (bonds and loans) issued by other companies.

- Cash flow from Financing activities – This section measures the flow of cash between a firm and its owners and creditors. Activities like issuance or repayment of debt, dividend payment, raising new equity can lead to changes in this section.

Given below is a simple cash flow statement:

Now, would you like your business to earn cash from selling its products or from raising debt or selling assets? Selling products of course! So, ideally we would like to see that the primary source of cash flow for a company is from operating activities (as opposed to investing or financing activities). Thus, Cash Flow from Operations (CFFO) is the most important section for investors and a primary target for the management to manipulate. So, let’s see what techniques can be used for manipulation.

What are the techniques used for manipulating cash flow statement?

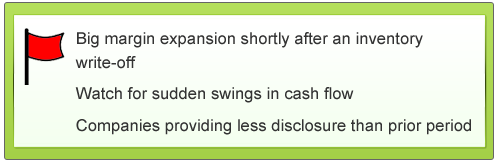

Inflating Cash Inflows

1. Recording Bogus CFFO

This technique involves the shifting of financing cash inflows to the operating section. Let’s understand this with the help of an example. Jack is the CEO of Jack Corporation, which manufactures precious metals. The company is currently going through a rough patch. Jack knows quite well that analysts closely track the CFFO and his stock would take a beating if he failed to report good growth numbers for the CFFO. So, Jack came up with a fantastic idea to sell the precious metals inventory to Bank XYZ. Not surprisingly, the bank had no interest in buying the inventory. But Jack had considered this and drafted an agreement accordingly. The agreement said that Bank XYZ would be able to sell back the inventory to Jack Corporation after the year end, albeit at a small premium. What this transaction really meant is that Jack Corporation took a loan from Bank XYZ and kept the inventory as collateral. But Jack Corporation went on to record this cash as an operating inflow, thereby inflating CFFO falsely. The transaction should have actually been recorded as a financing Inflow and increased the liability of the company.

2. Selling Accounts receivable

Now, Jack’s Corporation, also has a lot of payments due from customers in the form of account receivables. But the payments are due only in the next year. But since, Jack Corporation needs the money, it decides to sell these receivables to a third party now, rather than waiting to collect the money from customers later. This is also called securitizing. The agency buying the accounts receivable pays the company a certain amount of money, and the company passes off to this agency the entitlement to receive the money that customers owe. In doing so, Jack Corporation shifted the future period cash flows to the current period, thereby again inflating the CFFO. The time between sales and collection is shortened, but the company actually receives less money than if it had just waited for the customers to pay.

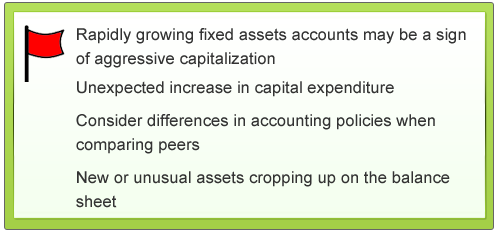

Deflating Operating Cash Outflows

1. Improperly capitalizing operating costs

Operating costs are the costs incurred by the business in its day-to-day activities like payment to suppliers for raw material, salaries etc. However, sometimes companies can record some costs as an asset and shift it to the cash flow from investing section. For instance, WorldCom, classified billions of dollars of operating costs as capital equipment purchases. It thus improperly inflated its earnings by recording its line costs (an operating cost) as an asset rather than an expense. This move allowed WorldCom to present strong operating cash flow; purchases of capital assets (called ‘Capital expenditures’) were reported as cash outflow for investing activities. Simply put, WorldCom shifted a large cash outflow from operating to investing section.

2. Recording purchase of inventory as Investing Outflow

Cost of goods sold (COGS) are the direct expenses incurred by a company in acquiring or producing its goods inventory. These expenses are subtracted from the sales to arrive at the company’s profit. Curiously, some companies falsely treat these purchases as an investing outflow. In doing so, they shift the cash outflow from the operating to investing section. Result is an inappropriate increase in the CFFO figures.

To summarize though it is difficult manipulate a cash flow statement, there are still many ways in which a company can manipulate it. Given below is a checklist that will help us investors in detecting such manipulations.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

I am a retired senior banker. it is really worth reading and very good for all the bankers specifically keeping in view the following guidelines of RBI

ALL BANKS SHOULD TRY TO FOLLOW THE ASSESSMENT OF WORKING CAPITAL REQUIREMENT ON THE BASIS OF CASH AND FUND FLOW STATEMENT INSTEAD OF 2ND METHOD OF LENDING. The Banks are still follwoing 2nd method of lending or turnover method keeeping in view the exposure except IT, contractors etc. Wonderful. keep it up.

R.K.GUPTA

Thanks a lot for the appreciation. Yes, you are right in saying that banks should assess the cash and funds flow statement. It would help them to avoid lending to fraudulent companies.

Good explanation. It seems we cannot directly take the total figures as granted.

By examining each section and each entry only, we can identify any fault.

Thanks for the explanation with examples.

Thanks a lot for the appreciation. Yes, we do agree with you that it is the best for us investors to shortlist a few companies and then analyse them thoroughly. Do keep reading and posting your feedback.

wonderful post