What are Flexi Cap Mutual Funds?

Flexi Cap Mutual Funds, as per SEBI's regulations, fall into the category of equity-focused mutual funds. These funds must allocate a minimum of 65% of their assets into stocks and stock-related instruments across different market capitalizations, with no strict upper or lower bounds.

An important characteristic of Flexi Cap Funds is their adaptability. Fund managers have the freedom to adjust their investments between large-cap, mid-cap, and small-cap stocks based on the current market conditions, liquidity considerations, and valuation assessments. This flexible approach allows fund managers to explore a wide range of stocks, offering them a broader scope to discover investment opportunities that could potentially outperform the market.

This flexibility can result in the potential for achieving better risk-adjusted returns for investors over the long term. Flexi Cap Mutual Funds provide a means to navigate the ever-changing landscape of the stock market, making them an appealing choice for those looking for diversified and adaptable equity investments.

Benefits of Flexi Cap Funds:

Diverse Exposure: Flexi Cap Funds offer exposure to stocks of various sizes and sectors, aligning with the dynamic landscape of the Indian economy.

Long-term Potential: These funds are well-suited for long-term financial goals with horizons extending beyond seven years, allowing investors to harness the potential of compounding over time.

Adaptive Portfolio Management: Flexi Cap Funds grant fund managers the flexibility to adjust portfolios according to changing market conditions, ensuring a responsive approach to maximize potential returns.

This article presents the top 10 Flexi Cap Mutual Funds for 2023, ranked by their five-year rolling returns. (For the latest and live updates, click here)

1. Quant Flexi Cap Fund (G)

Quant Flexi Cap Fund is an Equity - Flexi Cap Fund with an 920(Cr) AUM. It is Open Ended scheme launched on 23 Sep 2008. Currently, Ankit Pande and Sandeep Tandon as the fund managers managing the fund. The benchmark of the scheme is NIFTY 50 - TRI.

- How has the Quant Flexi Cap Fund Performed in the past?

The fund has delivered a 3/5/9 year average rolling returns of 21.59%, 18.03%, and 22.34% with a standard deviation of 12.19%, 6.13%, and 2.27% respectively.

It has demonstrated a CAGR of 35.45%, 23.79%, and 18.4% over 3/5/9 years.

The Average 3/5/9 year rolling Alpha is 9.69%, 6.83%, and 10.03%.

For the last 5 years, Investors have earned less returns than the Fund. This may indicate that Investors in the fund were not aligned to the investing process followed by the fund.

- How is the Quality of Quant Flexi Cap Fund?

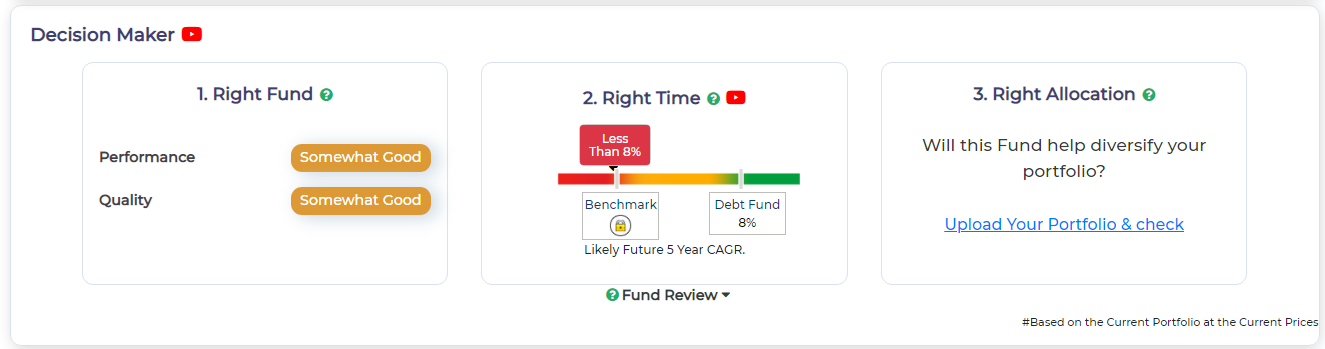

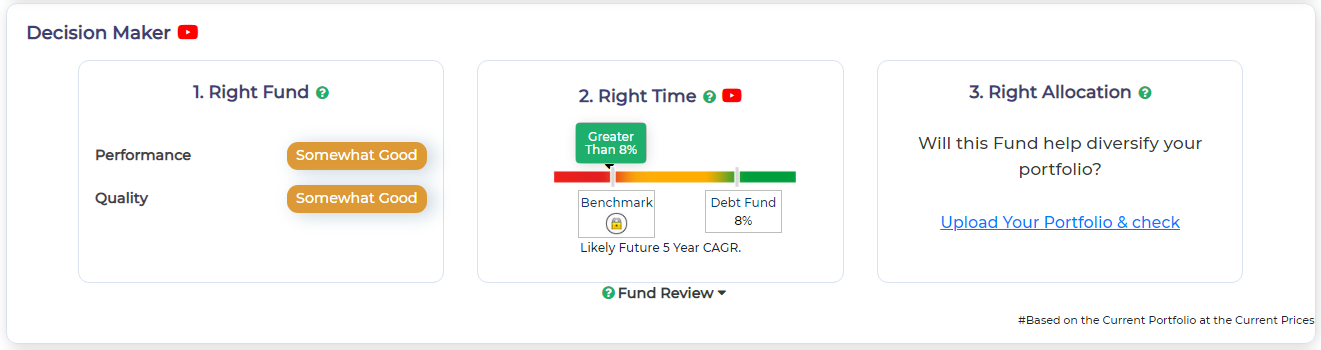

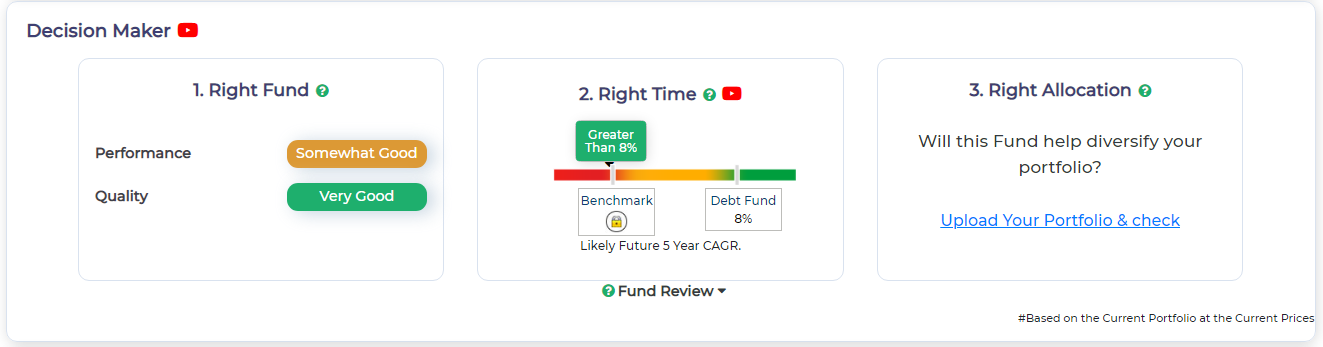

- Should you SIP in Quant Flexi Cap Fund?

- What are the Risks in the Quant Flexi Cap Fund?

2. Parag Parikh Flexi Cap Fund (G)

Parag Parikh Flexi Cap Fund is an Equity - Flexi Cap Fund with a 28,546(Cr) AUM. It is Open Ended scheme launched on 28 May 2013. Currently, Rajeev Thakkar and Rukun Tarachandani as the fund managers managing the fund. The benchmark of the scheme is NIFTY 500.

- How has the Parag Parikh Flexi Cap Fund Performed in the past?

On a 3-year rolling returns basis It has almost always outperformed the Benchmark..

The fund has delivered a 3/5/9 year average rolling returns of 19.05%, 17.34%, and 18.95% with a standard deviation of 6.52%, 4.00%, and 0.81% respectively.

It has demonstrated a CAGR of 26.24%, 19.72%, and 17.29% over 3/5/9 years.

The Average 3/5/9 year rolling Alpha is 6.17%, 6.01%, and 5.57%.

For the last 5 years, Investors have earned less returns than the Fund. This may indicate that Investors in the fund were not aligned to the investing process followed by the fund.

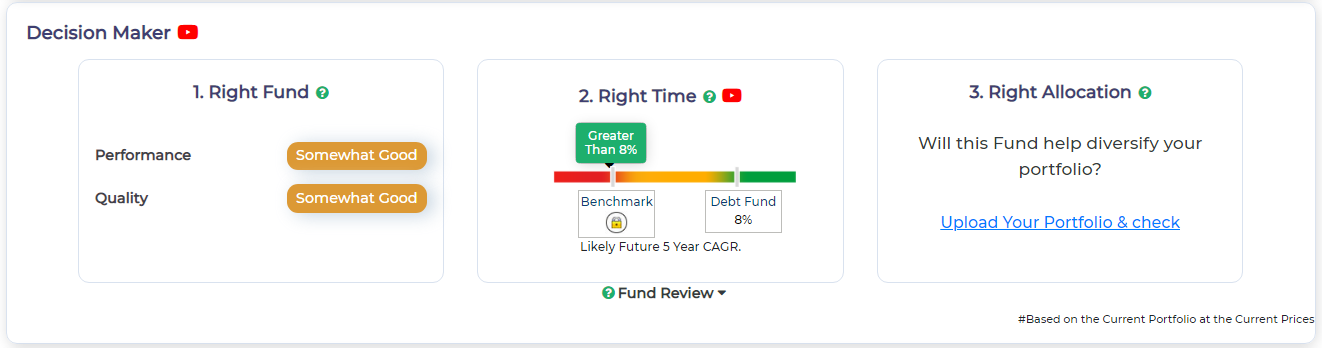

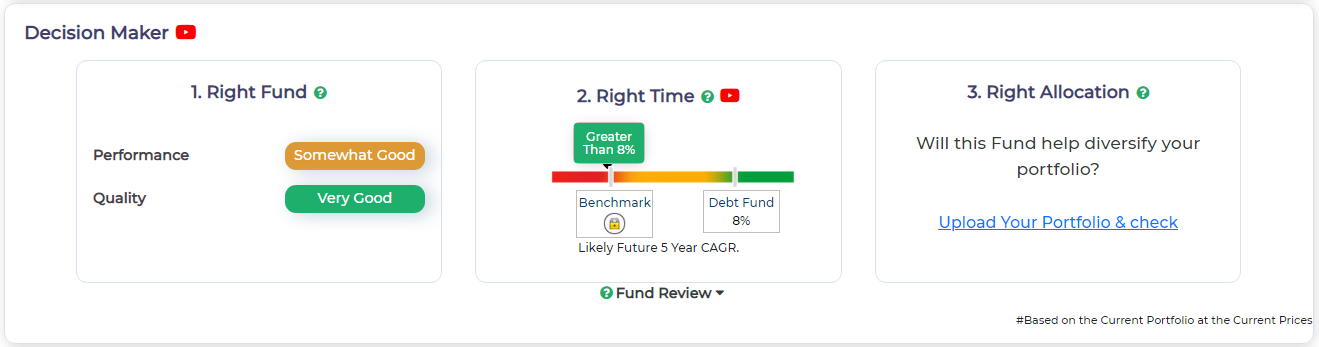

- How is the Quality of the Parag Parikh Flexi Cap Fund?

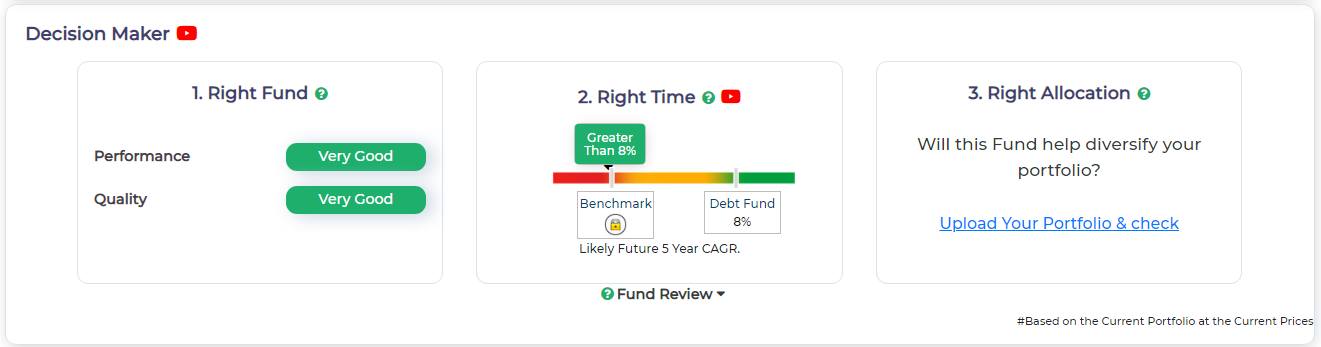

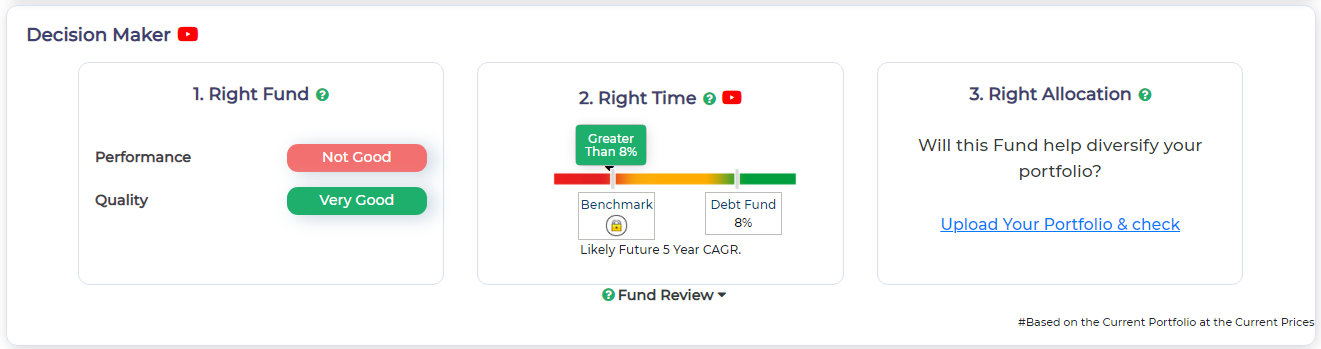

- Should you SIP in Parag Parikh Flexi Cap Fund?

- What are the Risks in the Parag Parikh Flexi Cap Fund?

3. PGIM India Flexi Cap Fund (G)

PGIM India Flexi Cap Fund is an Equity - Flexi Cap Fund with an 5,380(Cr) AUM. It is Open Ended scheme launched on 04 Mar 2015. Currently, Vinay Paharia and Anandha Padmanabhan Anjeneyan as the fund managers managing the fund. Benchmark of the scheme is NIFTY 500.

- How has the PGIM India Flexi Cap Fund Performed in the past?

The fund has delivered a 3/5/9 year average rolling returns of 17.73%, 16.61%, and 0.00% with a standard deviation of 9.26%, 4.57%, and 0.00% respectively.

It has demonstrated CAGR of 24.58%, 18.45%, and 0% over 3/5/9 years.

The Average 3/5/9 year rolling Alpha is 5.32%, 5.22%, and 0%.

For last 5 years, Investors have earned less returns than the Fund. This may indicate that Investors in the fund were not aligned to the investing process followed by the fund.

- How is the Quality of PGIM India Flexi Cap Fund?

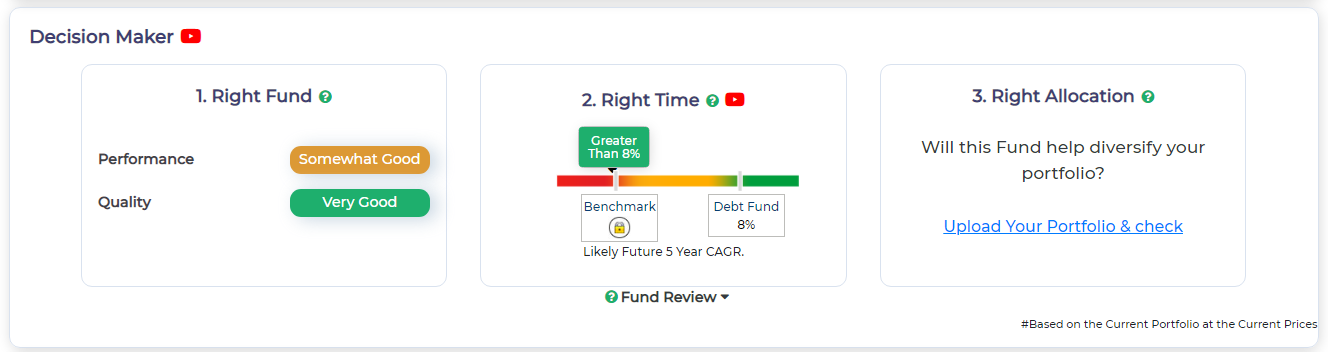

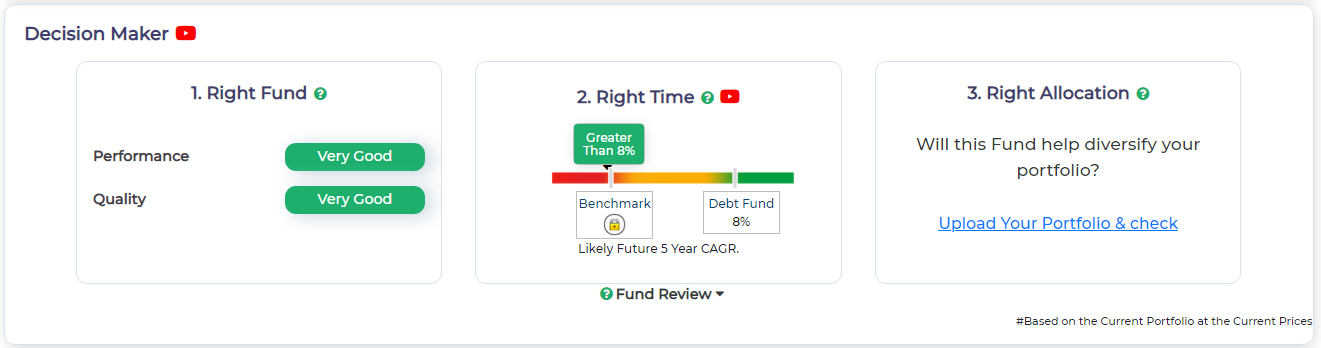

- Should you SIP in PGIM India Flexi Cap Fund?

- What are the Risks in the PGIM India Flexi Cap Fund?

4. Kotak Flexicap Fund (G)

Kotak Flexicap Fund is an Equity - Flexi Cap Fund with a 38,295(Cr) AUM. It is Open Ended scheme launched on 11 Sep 2009. Currently, Harsha Upadhyaya as the manager managing the fund. The benchmark of the scheme is NIFTY 500.

- How has the Kotak Flexicap Fund Performed in the past?

On a 3-year rolling returns basis It has not outperformed the Benchmark consistently.

The fund has delivered a 3/5/9 year average rolling returns of 16.52%, 15.11%, and 17.42% with a standard deviation of 6.78%, 4.60%, and 1.05% respectively.

It has demonstrated a CAGR of 22.39%, 13.74%, and 14.52% over 3/5/9 years.

The Average 3/5/9 year rolling Alpha is 3.68%, 3.56%, and 3.98%.

For the last 5 years, Investors have earned close to or more returns than the Fund. This may indicate that they were aligned to the investing process followed by the fund.

- How is the Quality of Kotak Flexicap Fund?

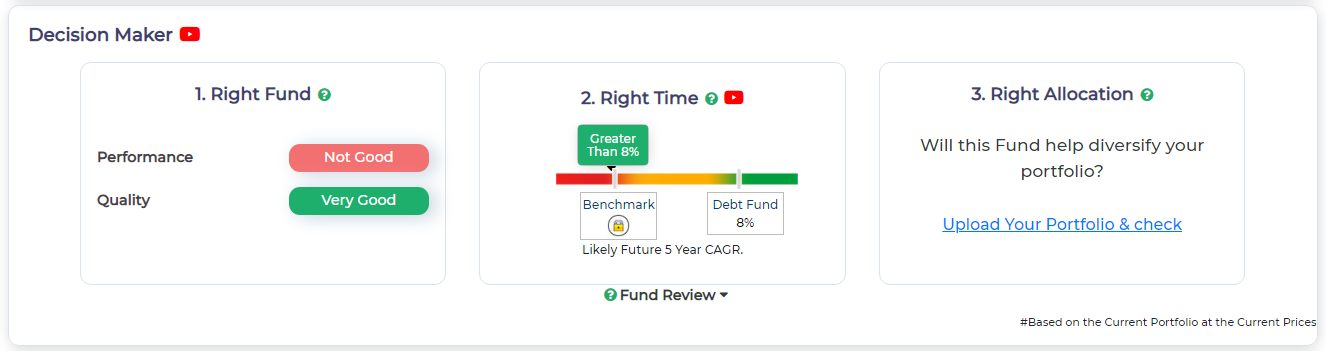

- Should you SIP in Kotak Flexicap Fund?

- What are the Risks in the Kotak Flexicap Fund?

5. SBI Flexicap Fund (G)

SBI Flexicap Fund is an Equity - Flexi Cap Fund with a 16,160(Cr) AUM. It is an open-ended scheme launched on 16 Sep 2005. Currently, R. Srinivasan and Mohit Jain as the fund managers managing the fund. The benchmark of the scheme is NIFTY 500.

- How has the SBI Flexicap Fund Performed in the past?

The fund has delivered a 3/5/9 year average rolling returns of 16.62%, 14.85%, and 17.56% with a standard deviation of 7.49%, 4.75%, and 1.17% respectively.

It has demonstrated a CAGR of 24.04%, 13.89%, and 14.42% over 3/5/9 years.

The Average 3/5/9 year rolling Alpha is 3.79%, 3.3%, and 4.12%.

For the last 5 years, Investors have earned close to or more returns than the Fund. This may indicate that they were aligned to the investing process followed by the fund.

- How is the Quality of the SBI Flexicap Fund?

- Should you SIP in the SBI Flexicap Fund?

- What are the Risks in the SBI Flexicap Fund?

6. Aditya Birla SL Flexi Cap Fund (G)

Aditya Birla Sun Life Flexi Cap Fund is an Equity - Flexi Cap Fund with a 16,805(Cr) AUM. It is Open Ended scheme launched on 27 Aug 1998. Currently, Anil Shah as the manager managing the fund. The benchmark of the scheme is NIFTY 500.

- How has the Aditya Birla Sun Life Flexi Cap Fund Performed in the past?

The fund has delivered a 3/5/9 year average rolling returns of 16.64%, 14.74%, and 17.40% with a standard deviation of 7.96%, 5.20%, and 1.61% respectively.

It has demonstrated a CAGR of 24.01%, 13.59%, and 14.16% over 3/5/9 years.

The Average 3/5/9 year rolling Alpha is 3.81%, 3.19%, and 3.96%.

For the last 5 years, Investors have earned close to or more returns than the Fund. This may indicate that they were aligned to the investing process followed by the fund.

- How is the Quality of the Aditya Birla Sun Life Flexi Cap Fund?

- Should you SIP in Aditya Birla Sun Life Flexi Cap Fund?

- What are the Risks in the Aditya Birla Sun Life Flexi Cap Fund?

7. DSP Flexi Cap Fund (G)

DSP Flexi Cap Fund is an Equity - Flexi Cap Fund with an 8,141(Cr) AUM. It is Open Ended scheme launched on 29 April 1997. Currently, Atul Bhole and Dhaval Gada as the fund managers managing the fund. The benchmark of the scheme is NIFTY 500.

- How has the DSP Flexi Cap Fund Performed in the past?

The fund has delivered a 3/5/9 year average rolling returns of 15.94%, 14.58%, and 16.48% with a standard deviation of 6.15%, 4.01%, and 1.11% respectively.

It has demonstrated a CAGR of 24.8%, 16.29%, and 13.81% over 3/5/9 years.

The Average 3/5/9 year rolling Alpha is 3.13%, 2.98%, and 3.03%.

For the last 5 years, Investors have earned close to or more returns than the Fund. This may indicate that they were aligned to the investing process followed by the fund.

- How is the Quality of the DSP Flexi Cap Fund?

- Should you SIP in the DSP Flexi Cap Fund?

- What are the Risks in the DSP Flexi Cap Fund?

8. UTI Flexi Cap Fund (G)

UTI Flexi Cap Fund is an Equity - Flexi Cap Fund with a 26,102(Cr) AUM. It is Open Ended scheme launched on 18 May 1992. Currently, Ajay Tyagi as the manager managing the fund. The benchmark of the scheme is NIFTY 500.

- How has the UTI Flexi Cap Fund Performed in the past?

The fund has delivered a 3/5/9 year average rolling returns of 15.71%, 14.49%, and 15.78% with a standard deviation of 5.70%, 4.22%, and 1.35% respectively.

It has demonstrated a CAGR of 19.91%, 13.12%, and 12.67% over 3/5/9 years.

The Average 3/5/9 year rolling Alpha is 2.87%, 2.95%, and 2.34%.

For the last 5 years, Investors have earned close to or more returns than the Fund. This may indicate that they were aligned to the investing process followed by the fund.

- How is the Quality of the UTI Flexi Cap Fund?

- Should you SIP in the UTI Flexi Cap Fund?

- What are the Risks in the UTI Flexi Cap Fund?

9. Canara Rob Flexi Cap Fund (G)

Canara Robeco Flexi Cap Fund is an Equity - Flexi Cap Fund with an 8,730(Cr) AUM. It is Open Ended scheme launched on 16 Sep 2003. Currently, Shridatta Bhandwaldar as the manager managing the fund. The benchmark of the scheme is NIFTY 500.

- How has the Canara Robeco Flexi Cap Fund Performed in the past?

On a 3-year rolling returns basis It has not outperformed the Benchmark consistently.

The fund has delivered a 3/5/9 year average rolling returns of 15.27%, 14.41%, and 15.65% with a standard deviation of 5.19%, 3.85%, and 0.92% respectively.

It has demonstrated a CAGR of 22.17%, 15.68%, and 13.34% over 3/5/9 years.

The Average 3/5/9 year rolling Alpha is 2.43%, 2.87%, and 2.21%.

For the last 5 years, Investors have earned close to or more returns than the Fund. This may indicate that they were aligned to the investing process followed by the fund.

- How is the Quality of the Canara Robeco Flexi Cap Fund?

- Should you SIP in the Canara Robeco Flexi Cap Fund?

- What are the Risks in the Canara Robeco Flexi Cap Fund?

10. Edelweiss Flexi Cap Fund (G)

Edelweiss Flexi Cap Fund is an Equity - Flexi Cap Fund with a 1,102(Cr) AUM. It is Open Ended scheme launched on 03 Feb 2015. Currently, Trideep Bhattacharya and Ashwani Agarwalla as the fund managers managing the fund. The benchmark of the scheme is NIFTY 500.

- How has the Edelweiss Flexi Cap Fund Performed in the past?

On a 3-year rolling returns basis It has almost always outperformed the Benchmark.

The fund has delivered a 3/5/9 year average rolling returns of 14.95%, 13.64%, and 0.00% with a standard deviation of 6.48%, 4.12%, and 0.00% respectively.

It has demonstrated a CAGR of 25.64%, 15.13%, and 0% over 3/5/9 years.

The Average 3/5/9 year rolling Alpha is 2.61%, 2.54%, and 0%.

For the last 5 years, Investors have earned close to or more returns than the Fund. This may indicate that they were aligned to the investing process followed by the fund.

- How is the Quality of the Edelweiss Flexi Cap Fund?

- Should you SIP in Edelweiss Flexi Cap Fund?

- What are the Risks in the Edelweiss Flexi Cap Fund?

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: