Large cap funds invest in the top 100 companies based on market capitalization. These companies are more stable and they can handle economic slowdown better than mid and smaller size companies. This is also reflected by their tendency to experience lower volatility.

This article covers the following:

- What are large cap funds?

- Who should invest in Large cap funds and for how long?

- How to choose the Best Large cap Mutual Funds?

- How do you find the best Large Cap funds based on the above analysis?

- Top 10 Large Cap funds 2019

- Why look at Rolling Returns instead of Past returns?

- Why Direct Plans over Regular Plans?

What are large cap funds?

Large cap funds invest in the top 100 companies according to market capitalization (usually companies with more than 20000 crore market cap).

[bctt tweet=”Investment in Equity & Equity-related instruments of Large-Cap companies is a minimum of 80% of total assets.” username=”MoneyWorks4ME”]These companies have many years of financial track record and hence their performance across the market and economic cycles are known.

Most often large cap companies are leaders in their respective fields with established products and services. Their performance is, therefore, more predictable than smaller companies. This makes large cap funds less risky than other funds.

Who should invest in Large cap funds and for how long?

Large cap funds are characterized as less risky and close to market returns. They are therefore best suited for investors who want inflation beating returns over the long term and do not want to take a medium to high risk.

The real growth of their surplus comes from staying invested for long 5+ years. Investing lumpsum when the markets are high (usually, it means the large cap stocks are also high) exposes investors to a likely correction and drop in their portfolio value.

It is important that investors are able to manage their fear and stay invested. However, if an investor requires money during such times and ends up selling, he could experience a real loss and certainly poor returns even though he has invested in a large cap fund.

How to choose the Best Large cap Mutual Funds?

1. Portfolio Quality

When you buy a mutual fund, what you are really buying is the stock portfolio of that particular fund. It’s then the common sense that the first thing you check is its portfolio quality. And how does it compare with other large cap funds?

What is the proportion of risky companies? Since safety is of primary importance when investing in a large cap fund, you’re better off staying with the best quality funds.

2. Rolling Return

A quick google search for best large cap funds to invest in will lead you to many sites recommending top-performing funds based on the past 3 years, 5 years and 10 years. However, this method is inadequate and misleading.

A better way to assess a fund’s return performance is to look at rolling returns across different time periods, say 3 or 5 years. This removes the starting/ending point bias present in point to point past performance used across the industry.

3. Consistent Performer

Past performance is no guarantee for the future. Thus, choosing a mere top past performer is unlikely to be a winning strategy.

However, a manager who has outperformed his benchmark across market cycles is more likely to do so in the future too. Avoiding funds with poor return consistency will take a step closer to building a winning portfolio.

4. Low cost

Every fund charges you with a fee to manage your funds, more commonly known as the expense ratio. So among the fund that fulfills your other criteria, choose the fund with the lowest expense ratio.

However, apart from this, there are other hidden costs in an MF such as brokerage and impact cost. These can be reduced by choosing a fund that churns the portfolio less frequently. At the end of the day, these costs do reduce your returns.

How do you find the best Large Cap funds based on the above analysis?

Look no further than MoneyWorks4me, where we provide data on all the four parameters for free (link is given below). This will help simplify your investment decision without compromising on quality.

Before we give you a list, here are some important guidelines on how we look at the data.

- Portfolio Quality: Funds holding a larger proportion of good quality companies are colour coded Green, while those with a higher percentage of risky quality companies are shown as RED.

- Similarly, funds with a good return consistency are indicated as Green, while those with poor return consistency are coded Red. As mentioned above you should prefer a lower turnover fund between two funds that are close to the other parameters.

- A good thumb rule is to avoid Red i.e. a riskier portfolio and/or a less consistent performer in favour of others with similar or even slightly lower rolling returns.

Arrange the list in the descending order of the 5-year rolling returns so that the fund with the highest return is on the top. Compare these funds across the parameters mentioned above and shortlist the few that you need to go into details before making a decision.

While you can see the full list on our site, given below are the Top 10 Large Cap funds based on these criteria.

Top 10 Large Cap funds based on 5-year rolling returns

Updated On: Nov 05, 2019

| Scheme Name | Q | P | Returns Since inception | 5 Year Rolling Return (%) |

|

|

|

15.5 | 18.40 | |

|

|

|

20 | 15.65 | |

| ICICI Prudential Bluechip Fund |

|

|

13.7 | 15.56 |

|

|

|

18.4 | 15.02 | |

|

|

|

10.8 | 14.06 | |

| Axis Bluechip Fund |

|

|

12.2 | 14.05 |

|

|

|

13.4 | 14.01 | |

| Franklin India Bluechip Fund |

|

|

15.09 | 13.60 |

| Invesco India Largecap Fund |

|

|

11.1 | 13.43 |

|

|

|

20.3 | 13.33 |

Q – Quality; P – Performance (*for the complete & updated list click here)

Now the last thing you want to do is jump and invest based on the above. What you can do is have a meaningful discussion with your advisor using this above.

Why look at Rolling Returns instead of Past returns?

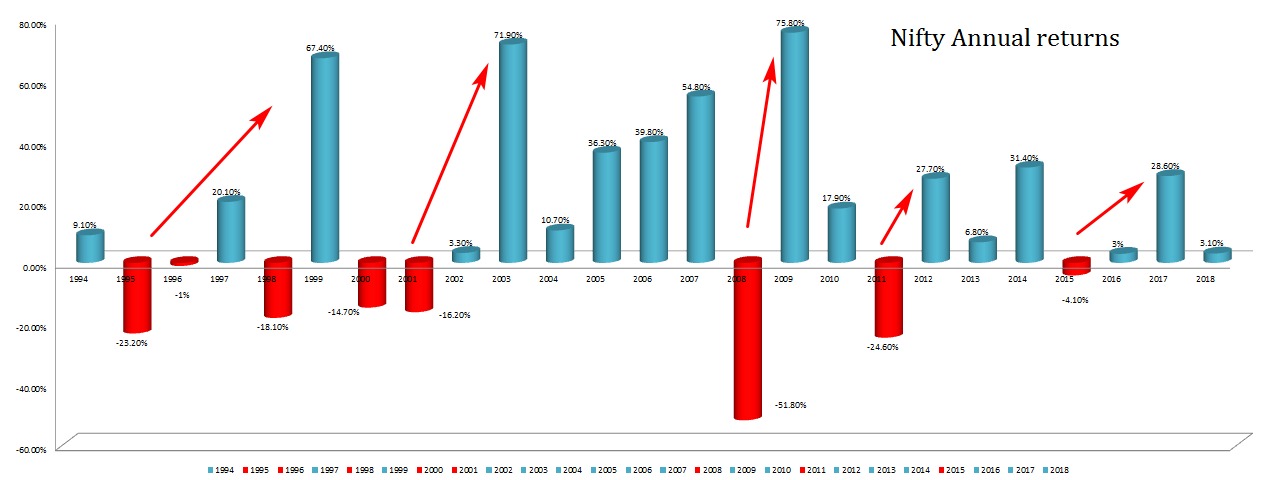

Equity returns aren’t linear meaning, Equities do not generate return every year like Fixed Deposits. Look at the graph below.

Assessing a fund’s return based on past performance has the biases of when you started and how the markets are doing at the time of measuring the performance.

For example, in 2015 all funds would have been underperforming their benchmark. Average 5-year rolling returns removes this bias and gives you a better way to assess the fund’s track record.

Why Direct Plans over Regular Plans?

The difference in returns between direct and regular is between 1-2%. For example, the average 5-year rolling return for the top-performing fund in the table above, Mirae Asset Large Cap fund was 18.82% for the regular plan. Direct plan of the same fund earned 20.91% returns.

Let us explain the math to make it more realistic. If you invested Rs 10,000 per month for 20 years in Regular Plans you will earn Rs 99.9 lacs (returns assumed 12%) versus Rs 1.15 crores in Direct Plan (returns assumed 13%) i.e an additional Rs 14.6 lacs. Even after reducing the effect of fees you would pay for getting the investment advice the difference will be more than Rs 10 lacs.

Read the next article to know: Top 10 Multicap Mutual Funds 2019

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463