What is Nifty@MRP?

As investors, we are used to seeing the Nifty move every minute. And to make investing more profitable and not a game of mere chance we need a solution. A solution which could help us ascertain whether the market is over-reacting or under-reacting, whether it is grossly depressed or irrationally exuberant. This is exactly what Nifty@MRP is!

Considering that the Nifty stocks are the top traded stocks of the country, we can expect them to be traded at their MRPs (fair value). In reality, the stocks are driven by their earnings over the long term. Hence, it is said that the market is a slave of the corporate earnings. Thus Nifty@MRP gives an indication of whether the Nifty is fairly valued or whether irrationality is driving the markets

The NSE index committee has replaced SAIL and Sterlite Industries with Lupin and Ultratech cement from 28th September 2012. We have calculated Nifty@MRP and Sensex@MRP with these changes.

Check our earlier reports on Nifty@MRP to learn more about this unique concept.

What is the latest Nifty@MRP value?

Considering the free float market capitalization at the MRP of individual stocks and considering the share price data as of 27th November, the Nifty@MRP comes out to 6067.63. On 27th November, NSE Nifty index closed at 5727.45, which is 5.61% or 340 points below the Nifty@MRP of 6067.63.

Considering the free float market capitalization at the MRP of individual stocks and considering the share price data as of 27th November, the Nifty@MRP comes out to 6067.63. On 27th November, NSE Nifty index closed at 5727.45, which is 5.61% or 340 points below the Nifty@MRP of 6067.63.

With similar calculation, the Sensex@MRP comes out to 20013. On 27th November, the Sensex closed at 18842, which is 5.86% or 1171 points below the Sensex@MRP of 20013.

With similar calculation, the Sensex@MRP comes out to 20013. On 27th November, the Sensex closed at 18842, which is 5.86% or 1171 points below the Sensex@MRP of 20013.

Though the gap between Nifty and Nifty@MRP has come down from 10% to 6%, but it still provides growth opportunity for investors.

Analysis of financial performance of Nifty companies

Quarterly performance

For the September 2012 quarter, the cumulative net sales of all Nifty companies have grown by 15.5% in Sep-11 quarter. On the profitability side, the operating profits of the Nifty companies have gone up by 11.38% in Sep-12 as compared to Sep-11 quarter. The operating profit has been affected due to higher raw material prices and increasing sales & promotion spend. As far as the net profitability of the Nifty companies is concerned, adjusted PAT grew by close to 30% as compared to September 2011 quarter on back of higher other income and relatively lower interest expense.

Analysis of the half-yearly performance of the Nifty companies reveals that, the cumulative net sales of the Nifty companies have grown by ~17% as compared to the first half year of FY12. On the other side, the cumulative operating profits (EBITDA) and net profit (PAT) increased by 8% and 12% respectively for the same period.

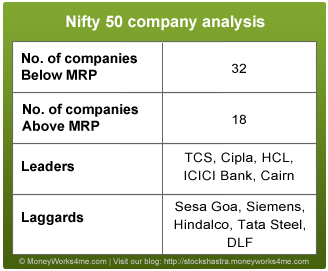

The highly capital intensive sectors such as Telecom, Power, Steel, Real-estate underperformed in the index while low capital intensive and defensive sectors such as IT, FMCG, Pharma outperformed in the index. Banks, majorly public sector banks, have shown poor performance due to increasing non-performing assets (NPA) on their books. However, private sector banks have performed well in the first half of the year on back of effective utilization of funds.

Overall, the growth was majorly supported by sectors like IT, Pharma, Cement and FMCG. The sectors, where growth was below average included Oil & Gas, Steel, Real-Estate and Telecom. HCL, Cipla, ICICI and Cairn outperformed in the IT, Pharma, Bank and Oil & Gas industries respectively. On the other side, Sesa goa, Siemens, DLF, Hindalco and Tata Steel underperformed in their respective industry.

Over all, out of 50 Nifty companies, around 32 companies are trading below their MRP (Under-valued) while only 18 companies are trading above their MRP (Over-valued).

Future Outlook:

On the domestic front, the Government of India has announced major economic reforms such as hike in diesel prices and FDI in Retail, Aviation, Insurance, Pension, etc. in September, 2012 to improve the investor sentiments in the market. While these reforms helped bring back positive sentiments in the market, for them to have a long term effect, the government needs to address more important concerns like the fiscal deficit, high interest and inflation rates. The Indian market rallied by almost ~8% in September month, post these reforms. Thereafter, the Indian market has been flat as the successful implementation of these reforms is dependent on the parliament approval. The winter session of parliament has started from 22nd November, 2012. Since then, the parliament has been adjourned due to strong opposition from the political parties on FDI in Retail. Looking at the uproar in the parliament, it seems that it would be very difficult for the Government of India to get parliamentary approval for most of these economic reforms.

A few days ago, Mr. Chidambaram, the finance minister of India, laid out fiscal consolidation plan through divestment, 2G auction and announcement of major reforms. In the last week, the telecom ministry auctioned 2G spectrum licenses but it was a big disappointment as there were no takers for more than half the airwaves on sale. Considering weak investor sentiments, it also seems that it would be very difficult for the government to raise around Rs 30000 Cr from its stake sale (divestment). Therefore, it is most likely that the Government of India would miss its fiscal deficit target of 5.3% of GDP.

Considering high inflation in the past, RBI too has not shown its interest in reducing interest rates despite strong push by Mr. Chidambaram. Now, that the inflation has subsided relatively, it seems that Mr. Subbarao, the RBI governor, may cut interest rates in the next monetary review. Considering above factors and sluggish growth in industrial production, declining service sector growth, we expect that the GDP growth is expected to drop in FY13.

On the global front, Mr. Barack Obama won the US election second time in November, 2012. Going forward, Mr. Obama’s ‘fiscal cliff’ (a fiscal deficit reduction plan) decision will decide the future movements in the global market. It is expected to be announced by the end of December. Will Mr. Obama compromise on GDP growth or Fiscal deficit? This critical decision will decide the future movements in the global market. On the other side, the last couple of months have been very good for the European markets due to major announcements such as unlimited debt buying programme by ECB, approval for ESM by German court and a deal over Greece’s bailout programme. With these developments in the Europe, Eurozone is expected to recover from its debt crisis which is a positive factor for the global markets. However, this may take a long time.

Therefore, the Global and Indian stock markets would remain volatile till the decision on fiscal cliff and the implementation of major economic reforms.

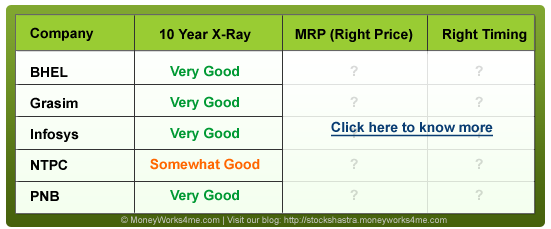

Looking at the numbers, Nifty is quoting around 5.61% discount to Nifty@MRP. We expect the Nifty to be volatile in the short term but the long term prospects seem to be good. Over the last couple of months, the Indian markets have moved northward on back of improved liquidity, huge FIIs investments, and announcement of major macro decisions. Considering ~6% discount to Nifty@MRP and strong long term growth prospects, we believe that the Indian stock market still provides good growth opportunity for long term investors. Currently, there are few fundamentally sound companies which are currently available at a hefty discount from their MRP with limited downside risk. Hence, you, as investors, should remain cautious in this volatile market while at the same time keep an eye on some bargain buys as indicated by our decision maker.

Considering the situation, investors would be best advised to buy fundamentally strong large companies at the right time and at the right price.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

Hi,

I really admire the work you people have put in building this great website, however i have one question for which i needed an answer, the criteria which you have for identify the right price of a stock holds true for a value stock but for a growth stock these criteria might not be 100 % correct, so some additional ratios like peg ratio would make better sense. Please let me know your views on this…

What is the Current MRP of Nifty