Results: Bharti Airtel reported Rs. 23,000 Cr in loss due to the exceptional item (~30,000 Cr) of Annual Gross Revenue (AGR) Fees as described in our previous note.

However, before exceptional items, the operating profit has improved almost 20%+ from the previous year backed by sales growth of 5.6% year on year and cost reduction in sales/marketing and employees.

Outlook: We are very hopeful that the government will soon announce a relief package for telcos as the industry is in stress. This is not the first time that the government would be intervening to save the industry looking at the financial conditions, either self-made or circumstantial.

In the recent past, the government has put import duty on steel imports to save the steel industry as they were reeling under debt burden and stress on banks’ balance sheets.

Currently, the market’s expectation is it will be a three-player market (excl. PSUs) and not duopoly. The government’s skin in the game is much larger than just AGR dues from respective players.

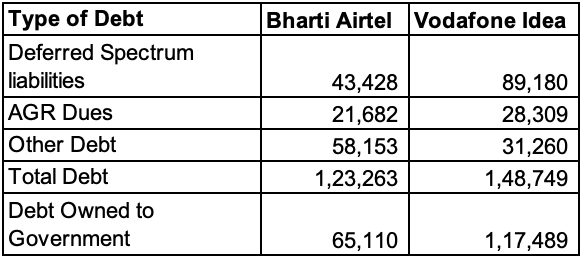

To name a few, the government is the biggest lender to the telecom players (spectrum debt), PSB is the largest lender to telecom, the government is a big beneficiary of competition in telecom to earn good sum for 5G spectrum.

Here is the break-up of telcos’ debt with the government and banks/others. (in Rs. Crs.)

Besides there is another loss of income that would happen if Vodafone Idea were to default like recapitalization for PSBs and tax revenues from Bharti Infratel & Indus towers, etc.

Besides there is another loss of income that would happen if Vodafone Idea were to default like recapitalization for PSBs and tax revenues from Bharti Infratel & Indus towers, etc.

We believe that the Supreme Court order can’t be violated and hence these dues will be collected. However, the government may come up with a plan to reduce the interest burden on an existing debt of telcos that they owe to the government itself.

Besides, the government can also come up with i) Floor price for tariff so that it ensures everyone in the industry makes profits and survive to pay dues/liabilities ii) Allow delay in annual license fees payment iii) Lowering of license fees itself.

We saw some negative commentary from Vodafone/Idea promoters over business solvency, to us, it appears a tactic to pressurize the government to act in their favor.

While some of our subscribers asked us why we can’t invest in Vodafone Idea, we continue with our stance that Vodafone Idea shareholder may or may not benefit from this relief as Vodafone Idea continues to struggle to generate operating cash flows.

We rather invest in Bharti Airtel, which has a lower debt to equity ratio, a more diversified sales base (Africa, DTH, Airtel Business, etc.) and operating cash flow recovery.

What is our stance on Bharti Infratel? Because of pressure on business, Vodafone Idea may cut down on it’s spent on marketing and towers. If the company decides to cut down on areas they serve, it may affect Bharti Infratel severely.

We believe that Bharti Infratel’s profitability may come down if instead of 2 customers using a tower, only one exists. Hence, we aren’t very gung-ho on Bharti Infratel as of now even if it appears undervalued on past profitability.

Eventually, we may see Bharti Infratel gaining back and we may participate at a later date.

For now, we find Bharti Airtel in a better position in times of uncertainty as either outcome is inclined in shareholder’s favor versus the other candidates. Read why we say so Link

We retain our BUY stance on Bharti Airtel. We will revisit our hypotheses again when the government announces some relief measures for the industry.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463