The finance minister, Pranab Mukherjee will rise to present the Union Budget for FY12-13 on 16th March 2012. To a passionate person it might seem like the dusk (and not a mere blip) of the India growth story. The very foundations of the edifice of growth are under stress. This budget is being announced at a time when the economy is showing distinct signs of a slowdown and inflation, which while declining, is facing headwind from a renewed rise in global commodity prices. Additionally, with the FY11-12 fiscal deficit likely to exceed the budgeted target by nearly 1% of GDP, there is considerable pressure to get back on the path of fiscal consolidation. Most stakeholders are looking for a boost from the government through appropriate policy announcements. Thus it will be a critical Budget as it sets the tone for policy stance relating to not just fiscal issues but also monetary policy and economic reforms. Both domestic as well as the global investors would also be looking for signals from the finance minister and the tone of his speech to gauge the way forward.

Great Expectations vs. Shattered Illusion – 2011 vs. 2012

The last budget had an enhanced focus on infrastructure spending with the government allocating more than 48% of the total planned expenditure to it. However, many of the new projects could not take off due to delays in approvals and due to paralysis in the government’s decision making. As a result new project launches have dropped by 32% in 2011-12 compared to the previous year. Even the growth rate of core infrastructure industries has slowed down to 4.4% for the first 9 months of 2011-12 against 5.7% growth achieved in the first 9 months of 2010-11. Moreover, with gross fixed capital formation coming down to 29% (advance estimates for 2011-12), investment slowdown remains imminent. While farm growth has remained robust, a slowdown in manufacturing has resulted in most of the growth estimates being toned down.

Reckless spending and less than expected revenue has led to problem of increasing Fiscal Deficit, a problem area which needs urgent attention. Fiscal Deficit was targeted at 4.6% of the Gross Domestic Product (GDP) for FY11-12 in the last budget. However, fiscal deficit is likely to slip to 5.5-5.7% of GDP, on account of three reasons:

a) Sharp increase in expenditures and

b) Fall in revenues as a result of higher spending on oil subsidies and other social welfare programs

c) Lower tax collections due to the slowdown in the economy.

Fiscal deficit has already reached 92.3% of the target in the first nine months of FY11-12.

As per the PMEAC review of economy, a GDP growth rate of 7.5-8% has been projected for 2012-13. For the current fiscal, the Council has pegged the growth rate at 7.1%, marginally more than 6.9% projected by the Central Statistical Organization (CSO). The quick estimates (QE) released at the end of January 2012 have led to a upward revision of the growth estimate for 2009-10 from 8.0 to 8.4%, while marginally reducing the estimates for 2010-11, from 8.5% to 8.4%.

Reclaiming the lost ground

The Union Budget 2012-13 is expected to provide a road map to make up for the lost ground by the next fiscal year. The government is expected to take a number of key steps to revive growth, maintain fiscal prudence and rein in inflation. This may sound like too difficult a task. However it can be achieved by a strong will and desire. Some of the most important factors that the government ought to consider or do are outlined below.

- The key area of importance should remain fiscal consolidation. The FY11-12 fiscal deficit could exceed the initial target of 4.6% of GDP by nearly 1% of GDP. If so, markets would scrutinise all the assumptions behind the FY12-13 budget even more closely. The government is expected to cap fiscal deficit gap to 5% of GDP for the next fiscal year. The last three budgets have all been populist budgets, with little regard for fiscal discipline. Therefore, returning to a sustainable fiscal path must be a policy priority.

- Growth, particularly investment activity, has decelerated substantially and demands immediate policy attention. While inflation has slowed, it has yet to settle within the RBI’s comfort zone. An uncertain global environment adds to the difficulty. This is all the more important because the RBI has indicated that its ability to ease monetary policy depends on the extent of fiscal consolidation.

- The FY13-14 budget (to be presented in February 2013) will be the last before the 2014 national elections and is likely to be a populist one. Logically, the FY12-13 budget is therefore the one to push through, for some hard decisions.

- FY13 will also be the first year of the 12th Five-Year Plan. A reorientation of expenditure to meet its objectives will be a critical challenge for this budget, given that close to 40% of the resource requirements for the Five-Year Plans are allocated from the budget.

Expectations from the Budget 2012-2013

Like a good story which has something for all its readers, the budget is expected to offer something for everyone. Pranab Mukherjee surely has a difficult task on his hands. In this backdrop, we look at the key expectations from the budget.

Growth – To be back on track

The Government’s primary objective in the budget should be restoring the growth momentum. India has been one of the fastest growing economies in the world for many years now. However, some of that sheen is coming off as investors start becoming more cautious about the long term prospects of the economy. Jim O’ Neill, the progenitor of BRICs, and one of the most bullish voices on India till recently, has also started doubting the course of the Indian economy. It is expected that recovery in economic growth would be possible by the second half of FY13, if there are no more headwinds in the global economy and the RBI starts monetary easing in a few months. Growth target for this year may be around 7.5% with an inflation of around 6-6.5%.

Fiscal Consolidation – Absolutely Imperative

The government has been a wasteful spender for the last two years. This has resulted in a high fiscal deficit which increases the susceptibility of the economy to any internal or external economic shocks. It also increases the cost of borrowing and decreases the competitiveness of the businesses. While the deterioration in fiscal health cannot be repaired in a single year, the Government is expected to bring fiscal deficit under control over a period of time and provide a realistic roadmap rather than an ambitious, unattainable target. Therefore, transition to the Fiscal Responsibility and Budget Management (FRBM) Act may be expected to be in a phased manner. Overtime, not only the ratio of Fiscal Deficit to GDP should be reduced, but the composition also needs to be changed and without expenditure restructuring, fiscal consolidation cannot be successful. The fiscal deficit ratio would be targeted at around 5% of GDP, which will be an improvement over the revised estimate of 5.5-5.7% for FY12.

Industry Taxation – Deficit Pangs

Given that the fiscal deficit is likely to be at elevated levels and the fall in tax collections during the first nine months of FY12, one can expect that the Finance Ministry would try and increase revenue collections by increasing excise duty and service tax from 10% to 12%, therefore also paving the way for GST at 12%. The other sources of increasing tax collections may be as follows:

- Increasing taxes on cigarettes, etc. in order to improve human and fiscal health

- Increase import duty on crude oil from 0% to 5%

- Though a bit of a stretch, abolishment of Kerosene subsidy may be looked at

- A reduction in the overall CenVAT rate may be considered. The revenue risk could be compensated by a non-refundable cess on polluting goods and services

- Rationalization and simplification in terms of reduction in surcharges for corporates, withdrawal of some tax exemptions and increase in the rate of Minimum Alternate Tax (MAT)

Personal taxation – Ahoy Savings & Investments!

This may bring cheer to the salaried and tax-paying public who like to save and invest. Deduction under section 80C may be revised to `1,50,000 from the existing limit of `1,00,000 to provide enhanced options of investment. There could also be some concessions given to interest on bank deposits to encourage savings. The limit of deduction on interest paid against self-occupied property may be revised up to `3,50,000.

Capital markets – Fodder for the Bulls?

This is one of the areas that will be keenly watched by the markets. The most important step relates to Securities Transaction Tax (STT). Currently STT paid on purchase or sale of equity shares, derivatives, equity oriented funds and equity oriented mutual funds, etc. is not allowed as deduction under capital gains’ head, and allowed only under profit and gains from business or profession only if the assesse is engaged in the trading of shares. The STT paid may be included in the cost of acquisition and selling expenses under Capital Gains. This will reduce the costs associated in trading. Should this be announced, it will help the capital markets immensely.

Agriculture – Most important politically

Though the dependency of the economy on agriculture has reduced, farmers still remain one of the most important political constituencies which any government would ignore at its own peril. The focus going ahead will be on increasing agricultural productivity as India still lags by a vast margin in this area. With food prices soaring and increasing the burden of inflation on the common man some quick steps need to be taken. A second green revolution is the need of the hour. With this in view a definite road map needs to be laid. The Agriculture Ministry has also demanded lowering of interest rates on crop loans to 3% from 4% for those farmers who pay in time. Ministry has also suggested that the target of credit flow to agriculture sector by banks and FIs be retained at `4,75,000 crore in FY13 as well. Further, strong emphasis is laid on rural infrastructure to provide impetus to rural demand.

Food Security Bill – Who will foot the bill?

The Finance ministry should roll out the Food Security Bill in the Budget FY13. It is believed that the implementation of the bill would take place in the later part of FY13. However the allotment of around `5,000 crore could be made in the Budget itself. Currently the food subsidy stands at `63,000 crore and the Ministry expects that the subsidies provided under this Bill would increase the expenditure to the extent of 2% of the current expenditure.

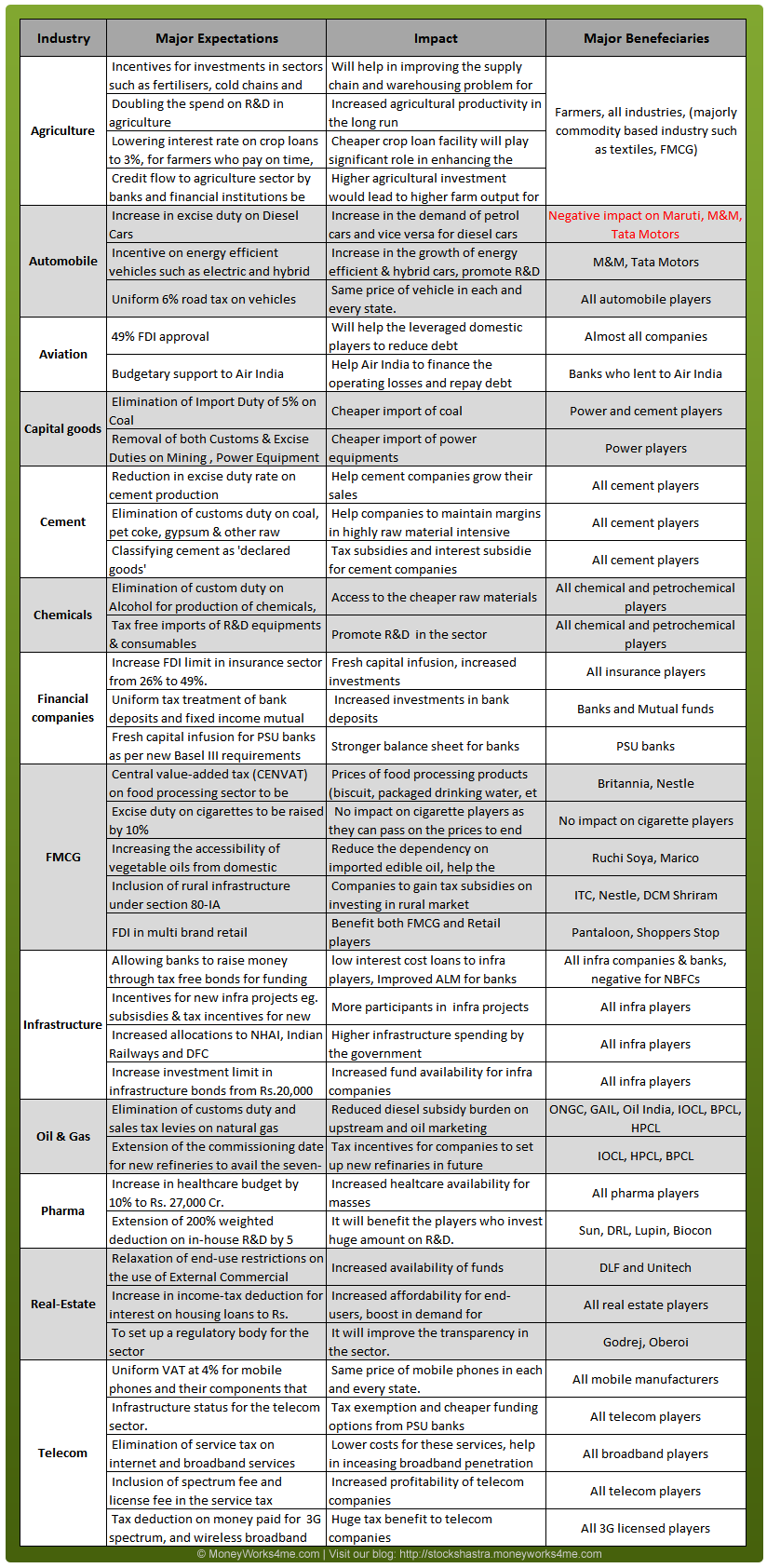

Industry expectations:

The final words

Pranab Da has been the fire fighter for this government – the go to man. And he has used all his political acumen and wisdom to pull the government from the abyss it has dug for itself. However, the task that awaits him when he presents this budget is much bigger and more difficult than any he has faced till now. He needs to awaken the economy from its stupor and spur the weak economic growth, control the widening fiscal deficit and please various political constituencies in laying the groundwork for General Elections in 2014. He is expected to do all this and some more. However, with some agility and grit he may be able to pull everything together and lead the Indian economy to a new dawn of progress.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

@e84b340184998b6226ceee01155ddd8f:disqus An increase in the import duty on crude oil will lead to increse in the fuel prices. Regrading DTC, it is expected that the government will implement certain provisions in this budget. However, the full code is expected to be implemented in next yers’s budget, as it will be a populist one and closer to the general elections.

But what will be the benefit of the import duty increase,since there is already pressure put on the govt to reduce taxes on it so as to make it cheaper

Maddy1768: The benefit of increasing import duty is that it will lead to

additional revenue for the government to bridge the fiscal deficit. Oil Marketing Companies (OMC) are not the sole importers of Crude Oil. Chemical companies (eg. Reliance) also import crude. Now even Aviation companies have been allowed to import Aviation Turbine Fuel (ATF).

If the government goes for a pragmatic budget rather than a populist one it will look to bring fiscal deficit to an acceptable level. It will look to decrease sops on other fuels, Kerosene, Diesel and LPG and increase revenue from Petrol. This might lead to a short term pain but longer term effects (if the government stops profligacy) would be positive.

And if the government goes for populism and reduces/doesn’t change price of petroleum products, it will lead to an even higher fiscal deficit and a burden to the common man in form of slower growth and weaker economy, higher interest rates and probably higher inflation.