Portfolio construction is as important as selecting the right stocks. Picking right stocks just half the battle, the other half is how to allocate.

Few choose to construct a portfolio for a lot of aggression and get scared of volatility, while others might hold moderate return large cap stocks without attempting to improve potential returns.

We believe it doesn’t have to be Either/Or; holding only on one type of stocks is a less efficient strategy and does not take full advantage of the available opportunities.

Stocks exhibit a difference in how much returns they deliver and how volatile they are. So we looked for a combination that when put together to cancel out each other’s disadvantages to some extent, giving us an optimal outcome of moderate volatility and above average returns.

The following charts explain the advantages and disadvantages of Core and Booster stocks. We have taken Sensex Index as a proxy for Core Stocks and BSE Mid and Small Cap Index as Booster Stocks.

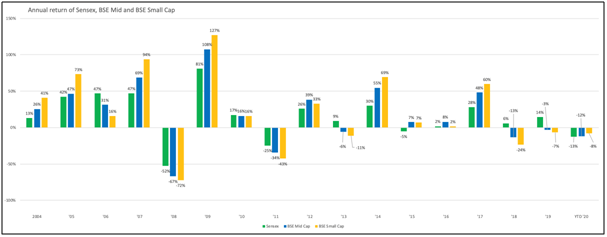

Annual Performance of Core & Booster Stocks

Fig. 1: BSE Mid and BSE Small Cap/Booster Stocks have delivered substantially higher returns than Sensex/Core Stocks (Green Bars) in every good year. While they have also lost more than Core Stocks during a correction. But on an aggregate, Booster Stocks would have boosted your returns.

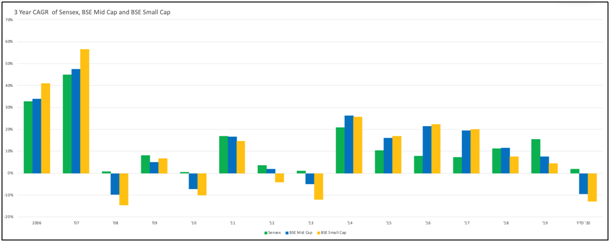

Rolling 3 years return of Core & Booster Stocks (Year ending 2006 means period of 2003-06, Year ending 2007 means period of 2004-07 and so on)

Fig. 2: Sensex/Core Stocks (Green Bars) has shown more consistency in returns. If you had bought Core and Booster stocks for any 3-year period ending from 2006 to 2020, your experience would have been better with Core Stocks with little to no impact on to principal amount invested. However, Booster Stocks would have delivered negative returns occasionally, despite holding them for 3 years, i.e. in 3 years ending 2008, ’10, ’12, ’13, ’20 in our limited sample study.

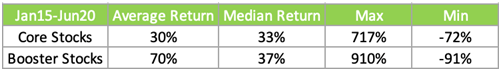

Core and Booster Stocks performance (assuming equal investment made in each stock instead of Index weighted)

Fig. 3: Booster Stocks have delivered a median return of 37% in the last 5 years versus Core stocks with 33%. Average and Maximum returns also show that Booster Stocks score higher than Core stocks. You may observe that Booster stocks have a minimum return of negative 91% as well, so exiting on time is also important. Picking the right stocks at the right price and exit at the first sign of business weakness is of utmost importance.

At MoneyWorks4me, we have come up with a solution of categorizing stocks into Core and Booster Stocks.

Core Stocks:

- These stocks are mostly leaders and highly efficient companies with low to moderate impact from an economic slowdown, competition, or governance i.e. consistently performing companies.

- These Stocks are predominantly large cap and non-cyclical and hence less volatile –lower corrections and quicker return to fair prices.

- They must be bought at reasonable prices (because they tend to get expensive) and held through thick and thin.

- Even though their returns will be moderate versus Booster this portion of the portfolio will be less volatile and more consistent.

- Examples of Core Stocks: Nestle, Titan, HDFC Bank.

Why you must have Core Stocks?

- More consistency in returns as seen in every 3-year period; helps you stay invested in the equity market.

Booster Stocks:

- Booster Stocks (predominantly mid and small cap and cyclical) consists of high growth, emerging companies in a sector, and shown execution track record but not tested for resilience from an economic slowdown, competition, etc.

- They need to be bought only if they are going to provide a boost to overall portfolio returns.

- If the prospects are deteriorating, they need to be sold quickly at small losses as chances are they may not recover to their earlier performance, unlike Core Stocks. This will result in more buy and sell from time to time.

- These stocks can earn high returns but their performance will be inconsistent. But because of the stability of Core Stocks, you will stick with Booster Stocks too.

- Examples of Booster Stocks: Escorts, Rallis, Muthoot Finance

Why you must have Booster Stocks?

- Better returns potential; Average return substantially higher than Core Stocks.

What are the benefits to classify stocks into these two baskets viz Core and Booster?

By separating stocks into two types, you will know how much you are exposed to each category. You will not be held back by one strategy and get control of your portfolio whenever you wish to add stability or boost returns.

- Core Stocks are more durable businesses and hence form a majority of your stocks portfolio while Booster Stocks must be a smaller portion. Core and Booster stocks split can be 60%:40% or 70:30 or 80:20 based on your risk-taking ability. This way, today’s typical Core Stocks investor can take an acceptable risk to earn superior returns, while Booster Stocks investor can have accumulated Core Stocks too instead of throwing caution to the wind.

- Having mental accounting for each type of stock helps you simplify your decision making, whether or not you are willing to accept temporary under-performance in a stock. Say, for example, Core stocks can be held on or better, averaged down with a fall in the share price. On the other hand, Booster stocks must be sold out on its share price decline and rotated into other performing stock. The aim of Booster stock is to boost returns, not eat into existing returns.

Ultimately your success depends on your behavior as an investor. Core and Booster categorization helps you behave differently and more effectively with these two buckets. And this ensures your higher success in stock investing.

Check out Core and Boosters Plan Now!

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Why MoneyWorks4me | Why Register | Call 020 6725 8333 | WhatsApp 8055769463