Burger King IPO Details:

Burger King | Market Cap Rs. 2,300 Cr

Bid Price 60 | EV/Sales 3.66x FY20

IPO Date: 2nd December to 4th December

Total shares: 450 Cr

Price band: 59-60 per share

IPO Size: ~ Rs. 810 Cr

Lot Size: 250 shares and multiples thereof (retail individual investor can bid for a maximum of 3,250 shares)

Purpose of IPO:

Rolling out of new company-owned Burger King Restaurants and repayment/ prepayment of borrowings: Rs 450 Cr

Offer for sale up to 6 Cr shares: Rs 360 Cr

About the Burger King:

Burger King India Limited, a ~$100 million QSR (quick-service restaurant) chain, is an Indian subsidiary of US-based Restaurant Brands International Inc. via holding company ‘QSR Asia’. It has an exclusive right to establish, develop, and operate Burger King branded restaurants in the entire India.

Burger King brand, also known as the “HOME OF THE WHOPPER®”, was founded in 1954 in the United States and is owned by Restaurant Brands International Inc., which holds a portfolio of BURGER KING®, and TIM HORTONS® brands.

The Burger King brand is the 2nd largest fast-food burger brand globally with over 18,675 restaurants globally as on September 30, 2020.

Burger King India Limited (BKIL) aims to cater to Indian tastes and preferences by adding new food offerings to its product portfolio. The company establishes its branches in high traffic areas in key metropolitan areas and cities across the country.

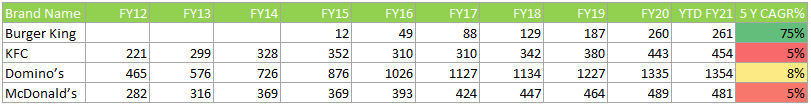

BKIL is the fastest-growing international QSR chain in India during the first five years of their operations based on the number of restaurants (as per reports from Technopak).

As of November 2020, the filing the date for red herring prospectus, BKIL had over 261 restaurants and nine sub-franchised restaurants, of which 249 were operational, including two sub-franchised Burger King Restaurants.

Under the Master Franchise and Development Agreement, the company is required to develop and open at least 700 restaurants (including Company-owned Burger King Restaurants and Sub-Franchised Burger King Restaurants) by December 31, 2026, which has recently been extended by one year from December 31, 2025 (due to the COVID-19 crisis).

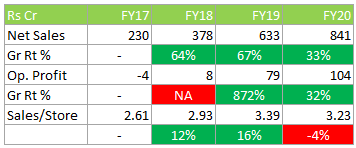

Financials

Burger King is growing at a fast clip thanks to store additions and healthy SSSG (Same-Store Sales Growth), a key metric in any retail format business.

Operating profit jumped by 19 due to new accounting rules and operating leverage (increase in sales at same cost adds directly to profits). Operating profit growth in FY20 shows sustained profit growth with rising profitability of new stores explained later.

Management

The company is promoted by QSR Asia which holds 99.39% of the stake in the company pre-IPO.

Rajeev Verman is the CEO and Whole Time Director of the Company since February 2014. He is responsible for the management and running of the business, both at the strategic and operational levels. He has over 20 years of work experience in the food and beverage industry. He has worked with Tricon/Taco Bell brand, Lal Enterprises Inc., and Burger King Corporation where he held the positions of franchisee business manager, national manager – franchise operations, senior director of franchise operations, general manager, vice president, and general manager, Canada and vice president & general manager, Northwest Europe.

MoneyWorks4me Opinion

How is the business model? Good, Great, or Gruesome?

Great! Retail and Quick Service Restaurants are one of the popular growth businesses wherein the success formula in one region is replicated in other regions in the country. This business model was Peter Lynch’s favourite, assuming the execution is extraordinary.

Companies in this segment not only earn a good return on investment from higher footfalls but also reinvest the profits into new stores across the country to compound capital.

Rolling out new stores can be easily done by raising new funds but it doesn’t create any value for shareholders if it is not backed by profitability. Wealth is created when the profits of an old store are used to fund a new store. Besides, an increase in sales of an existing store directly adds to overall profits which creates value.

Good execution includes, (i) rolling out stores (Store growth) and (ii) increasing sales in existing stores (SSSG) through higher footfalls, to improve profitability.

BKIL has been expanding its stores (75% CAGR) as well as driving SSS growth as seen by rising sales per store/Sales per sqft (~double digit %).

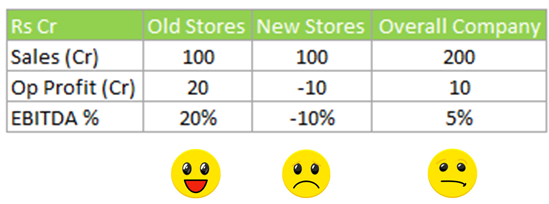

Why is BKIL reporting a loss if headline numbers indicate good execution?

In the retail business, till the time new store addition is significant % of overall stores, profits of the older/mature stores get masked by losses of newer stores.

Illustration, if Mr. ABC owns 10 stores with a 20% operating margin, and adds another 10 stores (100% store growth) with 10% operating margin loss in the initial years, Mr. ABC’s overall company profit will remain subdued, 10 Cr i.e. operating margin 5%.

But as new stores breakeven and become profitable, it will lead to very high earning growth in subsequent years. If we assume the same profitability for new stores, overall company profit will go to Rs. 40 Cr (incl 20 Cr from new stores as well) over time. This will lead to a 300% jump in profits from Rs. 10 Cr to Rs. 40 Cr. If this happens in next 3 years, earning growth will be around 60% CAGR in 3 years.

Currently, BKIL has expanded stores at a rapid clip which masked older stores’ profitability. As store addition is moderating versus exiting ones, profitability is getting reflected. The operating margin of the company now stands at 12% versus a loss 3 years ago (includes new accounting rules benefit). Operating profit margins are expected to improve with each passing year as existing stores’ profits will far exceed losses from new stores.

What is the future growth expectation?

Quick Services Restaurants are a fast-growing segment with a large young population, an urban lifestyle of dining out, and improved affordability from income growth as well as offerings from QSR. Sales growth across all QSRs is healthy confirming our hypothesis.

BKIL net sales growth rate was healthy 50%+CAGR but Covid lockdown dampened the run rate. Sales in the first half of FY21 were just Rs. 135 Cr versus Rs. 422 Cr in FY20 due to slow store expansion and lower footfalls for dine-in due to restrictions.

Under the Master Franchise and Development Agreement, the company is required to develop and open at least 700 restaurants (including Company-owned Burger King Restaurants and Sub-Franchised Burger King Restaurants) by December 31, 2026. This indicates at least an 18% CAGR in-store expansion. This may or may not add to value creation if the store expansion is funded through raising funds regularly. Only if the new stores are funded internally and the overall company is profitable (EBITDA +ve and ROE> 15%), we will see healthy stock price appreciation.

Parent company’s global expertise and execution track record give us confidence in their ability to create shareholder value. We expect BKIL’s future growth to be funded from internal accruals as the share of mature & profitable stores increases in total stores.

Log In | Register FREE | Schedule a DEMO | Solution Enquiry | Subscribe

Positives:

- Exclusive franchise rights in India complemented by strong brand value & customer loyalty.

- Experienced and professional management team.

- Vertically scalable supply chain to keep costs in control.

Risks:

- As an operator of Fast-food QSR restaurants, BKIL’s business is susceptible to increasing health awareness among the population.

- BKIL’s exclusive right to develop, operate, and franchise in India is dependent on the Master. The termination of the Master Franchise and Development Agreement will have a material adverse effect on Burger King’s business.

- BKIL’s reputation is dependent in part on the continued international success and reputation of its brand globally and locally.

Valuation

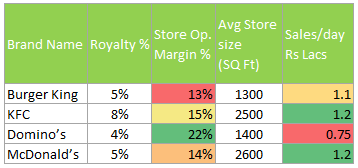

We believe Price to Sales is a better metric for the valuation of a retail business as using profit multiples (P/E, EV/EBITDA) may throw up incorrect conclusions due to temporarily subdued profits or each retail business might be at a different stage of expansion.

Using Enterprise Value to Sales metrics, we find that Westlife Development (McDonald’s) and Jubilant Foods trade at 5x and 8x FY20 sales respectively (using normal year sales versus the subdued number of FY21).

BKIL resembles McDonald’s in many ways (i) similar product offering (ii) similar online/offline mix, (iii) ticket size, (iv) Operating profit %

Implied enterprise valuation using bid prices is Rs. 3,100 Cr or Enterprise Value to FY20 Sales of ~3.66x.

Our expectation is that the top line of the company will grow at least 15-17% CAGR which will lead to even higher earnings growth. This makes the current valuation look reasonable. A lot of growth expectation is built into the valuation; this means it is vulnerable to the downside if the execution is not good.

In such situations, we have shied away from committing a large % of the portfolio. We do believe that a few of the high growth names do extremely well but the probability is lower versus more established, moderate growth stocks.

With just 2 Cr shares for the retail portion, we find that odds of getting an allotment are very low (only 80,000 demat accounts will receive one lot each).

Upon listing, if the share price is less than Rs. 70-75/share, you can buy up to 1-2% of the portfolio. Or else we will wait for other opportunities in the market. Conservative investors /Core portfolio investors can skip this IPO.

Burger King IPO FAQs:

What is Burger King IPO?

Burger King IPO is an IPO of 13.5 Cr equity shares with a face value of ₹10 aggregating up to ₹810.00 Cr. The issue is priced at a price band between ₹59 to ₹60 per share.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

When Burger King IPO will open?

The IPO opens on Dec 2, 2020, and closes on Dec 4, 2020, between 10.00 AM to 5.00 PM.

What is the lot size of Burger King IPO?

The lot size is in the multiple of 250 with a minimum order quantity of 250 Shares.

How to apply for Burger King IPO?

You can apply for Burger King IPO online using either UPI or ASBA as a payment method. ASBA IPO application is available in the net banking of your bank account. UPI IPO application is offered by brokers who don’t offer banking services like Zerodha.

When is the Burger King IPO allotment?

The final allotment for Burger King IPO will be known on 9th Dec 2020, and if you get the allotment, shares will be credited to your Demat account by 11th Dec 2020.

When is Burger King IPO listing date?

The Burger King IPO listing date is not yet announced. The tentative date of Burger King IPO listing is 14th Dec 2020.

Is it worth investing in Burger King IPO?

Our expectation is that the top line of the company will grow at least 15-17% CAGR which will lead to even higher earnings growth. This makes the current valuation look reasonable. A lot of growth expectation is built into the valuation; this means it is vulnerable to the downside if the execution is not good. In such situations, we have shied away from committing a large % of the portfolio.

We do believe that a few of the high growth names do extremely well but the probability is lower versus more established, moderate growth stocks.

What are the chances of allotment in Burger King IPO?

With just 2 Cr shares for the retail portion, we find that odds of getting an allotment are very low (only 80,000 Demat accounts will receive one lot each).

What if I do not get the allotment?

Upon listing, if the share price is less than Rs. 70-75/share, you can buy up to 1-2% of the portfolio. Or else we will wait for other opportunities in the market. Conservative investors /Core portfolio investors can skip this IPO.

Recent IPOs:

If you liked what you read and would like to put it into practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Why MoneyWorks4me | Why Register | Call 020 6725 8333 | WhatsApp 8055769463