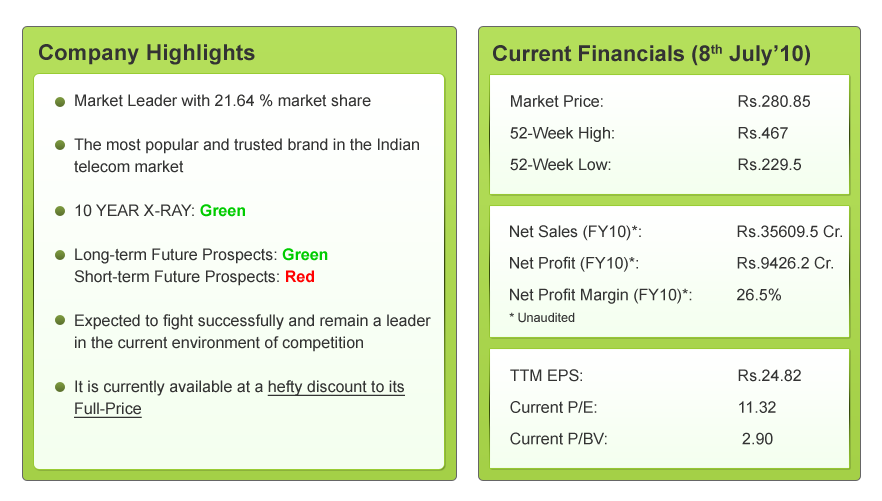

Bharti Airtel Ltd.- Will it beat the heat?

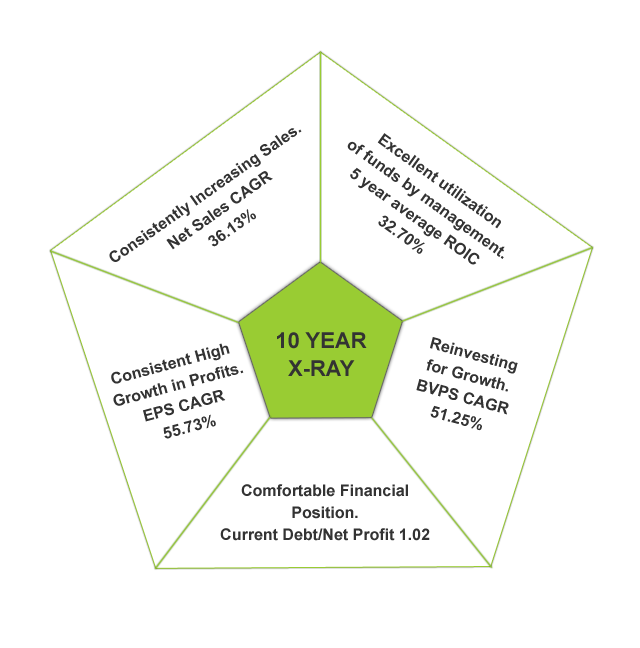

Bharti Airtel’s 10 YEAR X-RAY: Green (Very Good)*

*(Its debt is likely to increase substantially for FY11, due to its Zain acquisition and high 3G fee payment)

Bharti Airtel, in brief

Bharti Airtel Ltd. is a leading Indian telecommunication service provider with 21. 64% market share. It has more than 127.5 mn subscribers in India – the world’s second largest wireless market by users. It has three strategic business units namely Mobile Services, Telemedia Services and Enterprise Data Services. The company provides services to all 23 telecom circles of India. Bharti’s mobile network covers approximately 81% of the country’s population. Bharti Airtel has been the leader in market share (on subscriber base) as well as on turnover basis. Also, it generates the maximum Average Revenue Per User.

What does Bharti Airtel’s past say?

Bharti has been a market leader and its increasing user/subscriber base has helped the company grow its Sales with a CAGR of 35.13% over the last 5 years.

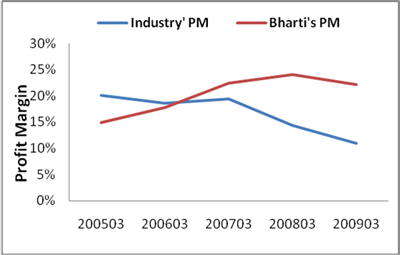

Bharti Vs Telecom Industry:

Bharti Vs Telecom Industry:

- Outperformed the industry’s Net Profit Margin in the last 3 years.

- Where the industry profit margin has shown a declining trend since 2007, Bharti has mantained a stable Net Profit margin

- Inspite of intense competition, it mantained 20%+ Net Profit Margin in the last 8 quarters

Bharti has always maintained an impressive profit margin, which has helped the company register a robust 5 year EPS CAGR of 50.73%. The major concern for the future is the its debt/ net profit ratio, which is expected to increase with its Zain acquisition for which the company has taken a six-year $8.5 billion loan at interest of LIBOR+2% points. The company’s borrowing is also expected to go up, due to high 3G license payment Bharti Airtel has performed robustly in all its parameters over the last 10 years. Hence its 10 Year X-Ray is Green (Very Good)

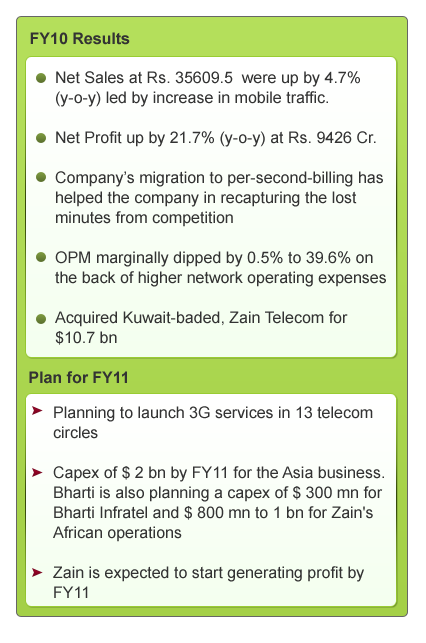

What is Bharti Airtel’s Short-Term Outlook?

Successful DTH Business: The company is faring well in the Direct to Home (DTH) business. It has about 22 million subscriber base (about 10 million households added in last one year). The company accounts for about 25% of the gross subscriber additions in DTH.

Increasing Competition: Though, the monthly churn in pre-paid dropped from 6.5% in Q3 FY10 to 5.9% in Q4 FY10, it still remained quite higher than historical average 3-4% level. It clearly shows that the company has been severally impacted by the competition from new entrants and is struggling to maintain its customer base.

High 3G Cost: A combination of scarcity of slots and the auction format resulted in extremely high price levels for 3G. Bharti is the highest spender in 3G and BWA (broadband wireless access) auction. Bharti’s total outgo is Rs. 15,609 Cr. towards 3G and BWA. While it spent Rs.12,295 Cr. on 3G spectrum, it would pay Rs. 3314 Cr. for BWA bandwidth. This will further pressurize Bharti’s balance sheet and affect its profit margin.

Expected rise in Debt Levels: For its recent acquisition of Zain Telecom, Bharti Airtel has taken a six-year $8.5 billion loan at interest of LIBOR+2% points. This huge debt will increase its Debt-to-Net Profit & Debt-to-Equity ratios substantially. We can expect that Bharti’s profitability will be affected for at least 2-3 quarters till Zain starts generating profit. Also, high payout for 3G and Broadband Wireless Access (Rs 15,609 crore) will again lead to increase in debt position. In addition to this, proposed hike in 2G Spectrum charges will impact its wireless margins by about 1.5%.

With new players such as Videocon launching operations and regional players like Aircel progressing to complete pan-India footprint, sector overcapacity seems to continue to remain a concern. For Bharti Airtel, the worst in terms of business performance might still linger for another 3-4 quarters. Hence, we can expect the short term outlook of Bharti Airtel to be Red (Not Good)

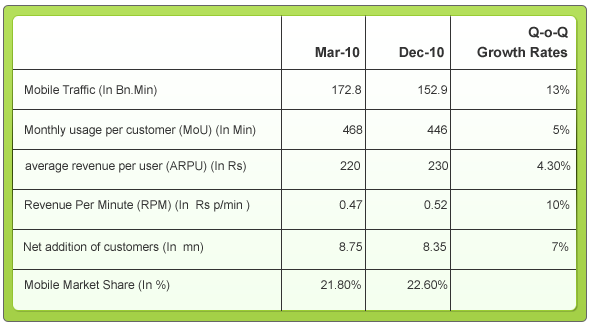

Bharti’s March’10 quarter performance on key parameters

What is Bharti Airtel’s Long-Term Outlook?

Bharti has a great past and has performed better than its peers. But, it has a short-term that is threatened by competition. In this environment of intense competition, will Bharti remain a leader/winner in the future?

Established advantages to drive growth: Bharti Airtel has few advantages that will help it drive its growth in future.

- Largest player in the telecom industry,

- A market leadership position in a growing telecom market,

- A very strong brand which has helped it maintain customer loyalty

- Minute-Factory model: This model allows Bharti to minimize its costs substantially. In this model, Bharti partners with local players for its basic infrastructure needs and hence converts fixed cost to variable costs. The beauty of the Minute-Factory, is that it can add small capacities fairly rapidly and economically which is not possible in subscriber-led model.

Global Acquisitions: To fight the intense competition, Bharti has sought overseas businesses in the South Asian and African market. It has acquired Kuwait-based Zain Telecom’s African assets for $10.7 bn and 70% stake in Bangladesh’s Warid Telecom. The Company has planned to export its ‘minute factory model’ (lowest-cost/min) to Zain Africa and Warid Bangladesh. Currently, Bharti has over 136.73 million subscribers (As on May 2010, TRAI June 2010 report) in India and after these deals; the company would get access to over 90 mn customers abroad. We can expect that these acquisitions will enhance the company’s global presence in telecom space and will help it to increase its profitability in the coming years

3G Auction: The launch of 3G and wireless broadband will be the next phase of growth for telecom operators. Considering the expansive pan Indian permit for 3G, Bharti is better placed than other telecom companies due to its strong balance sheet. Bharti has got 3G license for 13 high revenue generating telecom circles. It expects the start of high-speed services to boost “voice efficiencies” and the high speed of data downloads. Moving to 3G network could help Bharti protect its revenue and market share due to lower churn of high value customers; providing some respite in the current environment of intense competition in 2G space. Japan was the 1st country to launch 3G service in 2004, which became a huge success within one year of the launch. It resulted in substantial profits for the telecom operators. But, the same was not true for European telecom players as they faced infrastructural bottlenecks and unavailability of reasonably priced 3G enabled mobile phones. Indian companies are well-equipped with the infrastructure to provide 3G services. Also, considering expected flood of cheap 3G phones in India, we can expect the Japanese kind of growth story for Indian telecom players

Beating Competition: India is the fastest-growing and the most competitive mobile market, with 14 players locked in a margin-destroying price war. India currently has amongst the world’s lowest telecom tariffs ranging from about Rs 0.05 to 0.1 for per second tariff plan and Rs 0.5 per minute for a per minute pulse plan. Despite intense competition, Bharti is still way ahead of its peers in terms of turnover, ARPU and subscriber base; reporting an increasing addition of subscribers every month.

Telecom Industry: Expanding telecom networks to rural India, falling tariffs and continued reduction in handset costs, have been the key drivers for the growth of the telecom industry. In the long run, the Indian telecom market offers an attractive growth opportunity. The Indian telecom (service providers) sector is expected to grow with more than 20% CAGR in coming years. TRAI has reported 16.30 million new additions in wireless subscriber base in the month of May 2010, taking the total subscriber base to 653.92 mn. With an average addition of more than 12 million subscribers every month, the subscriber base is expected to cross 1 billion by 2012. At the end, we can say that, the telecom sector will continue to demonstrate attractive long term opportunities for its largest operator Bharti Airtel.

Yes, competition is getting aggressive and in such an environment, the weaker players are likely to be more affected. But, considering the fact that Bharti is a well-established and successful player, it is likely to overcome the current roadblocks and remain successful.

Considering all the above factors, Bharti Airtel’s long-term outlook is Green (Very Good).

Conclusion:

Bharti Airtel has proved itself in the past by performing better than all its peers. It is well-poised for growth in the long term due to the growing telecom market, the competitive advantage of its leadership position and opportunities available in the 3G space. Competition is giving it a bumpy ride right now, but it is well-armed to fight and remain successful

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

good analysis keep it up doing good service to genuine investors rangan

What according to you is the full price of this stock and by what time frame will it be there ?

excellent analysys.last few days scrip was in my mind and i was eager to buy but whatever your short term veiw, same was concerning me but as per your long term out look resolve my concern and now i can buy it.thank you very much.r

your analysis is good in about 2 years time bharti will excel

really bharti airtel is a pioneer in telcom sectors,but like other big companieis bharti is not generous in giving high dividends

like infosys,l& t & the others.to gain the confidence of minority iinvestors,bharti management must come forward with some sound

attractive bonus/dividend to theier investors who r very much hopeful with the progress of the company.

a trustworthy co.must follow my advise & act upon in the larger interest of the both.obviously there is a genuine butty right sharing in the growth/brightness/prospect of a company.

i m staying strongly with this company for the last 2 yrs when the stock prise was somewhat abt 400/& above.

should i hope the company management will come forward to serve the interest of minority investors,

thanks & regards.

kailash thakur,retd.joint commissioner

a trustworthy company always look after the interest of their minority investors should the bharthi investors team management disclose their mind as what steps they r taking to safeguard the interest of theier investors who have invested money when the stock value was above 400/

kailash thakur

Thanks a lot for your appreciation. Though Bharti is witnessing troubled times right now, with time it is expected to excel.

Thanks a lot for your appreciation. Yes, its short-term outlook is a cause for concern, but considering the large and successful player that Bharti is, its long-term is expected to be bright.

Thanks a lot for your appreciation. Do keep reading and posting us your feedback.

As mentioned in the Shastra, the company is at a good discount to its Full-Price. At MoneyWorks4me.com, we consider a margin of safety of 50% from its Full-Price. To know more on Bharti's Full-Price, visit http://www.moneyworks4me.com/

A company has 2 options of dealing with its profits. It either retains a whole/part of it, to reinvest in the business for growth/expansion or may give out a chunk of it to minority shareholders as dividend. Companies that reinvest into the business need to prove it by growing their EPS robustly. Logically, this growth in earnings will drive its stock price in the long run; a benefit to investors.

Bharti is a growing company, and with its latest acquisition of Zain, it is clear that the company is expanding. Also, over the years Bharti has managed its funds in an appropriate manner, which is evident in its good ROIC %,ROE% and impressive growth rates in its EPS

Good Analysis….Currently, Airtel is at 313. Till what price you consider it to be good buy. When this analysis was done the price as shown here was at 280.

Hi,

To know till what price, Bharti can be considered a good buy, you will have to log on to MoneyWorks4me.com . Here, we have provided the Discount Price (Benchmark for Buy-Price) and MRP (Benchmark for Sell-Price) of over a 1000 stocks

How do you interpret : Current Debt / Net Profit =1.02?

And Stockshatra is one of the best websites..guys ull rock …I find this website very helpful considering that im an aspiring Equity Analyst!!