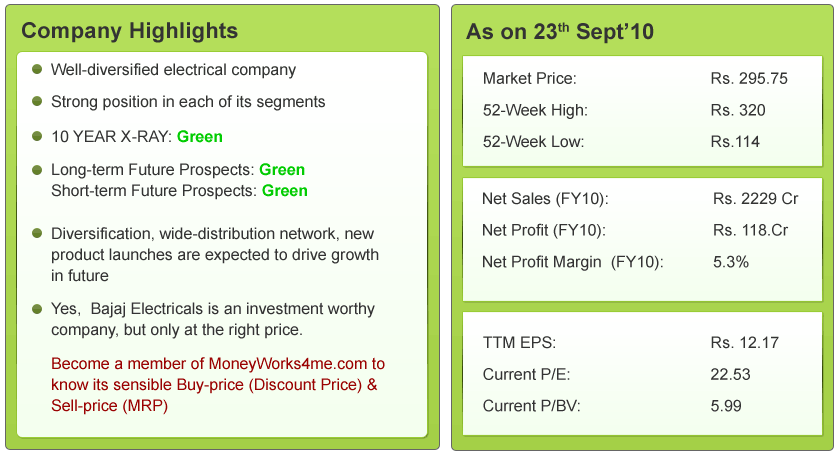

Bajaj Electricals Ltd. : Will its diversification strategy continue to fuel growth?

BEL’s 10 YEAR X-RAY: Green(Very Good)

BEL in Brief:

Bajaj Electricals is a household name for many. Let’s see what the company is really about?

Bajaj Electricals is a well-diversified electrical company. Its operations are divided into the following strategic business units (SBU) –

a) Engineering and Projects – leader in turnkey illumination projects.

b) Appliances – market leader in small appliances category (i.e. brown goods segment) like micro-wave ovens, room coolers, water heaters, juicers & grinders, irons, water purifiers etc

c) Fans – 3rd largest player

d) Luminaries

e) Lighting – one of the largest players offering a wide range of General Lighting Service (GLS) filament lamps, Fluorescent tube lights (FTL), etc

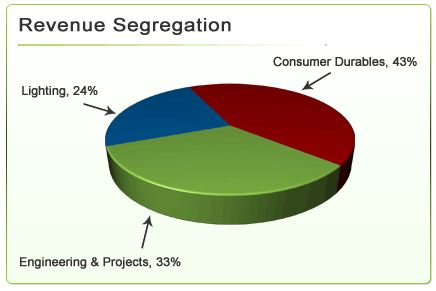

As seen above, in each of these SBU’s BEL commands a strong position. These units are further categorized into 3 revenue segments. i.e. Lighting ( SBU – Luminaries & Lighting), Consumer Durables (SBU – Appliances, Fans) and Engineering & Projects. It also has tie-up with Morphy Richards (electrical appliances) of UK for the marketing & selling of its products in India.

Bajaj Electricals is supported by a chain of about 600 distributors, 3000 authorized dealers and over 3,00,000 retail outlets. It mainly operates in the domestic market.

Shareholding Pattern:

The promoter shareholding in the company as on 30th June 2010 is 65.5 % whereas 34.5% is the non-promoter holding. As of FY09 the promoters shareholding was 74.5% which the company has reduced to 65.5% in the current year. Foreign Institutional Investors holding stands at 3.5% and Mutual Funds hold 15.5%.

What does BEL’s past say?

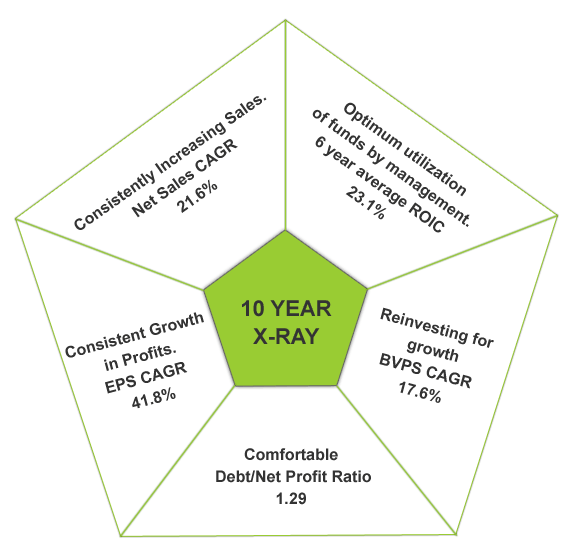

BEL has performed robustly in all its parameters over the last 10 years. Its impressive fundamentals in the past form a strong base for its future.

It has grown its Net Sales with a good CAGR of 21.6% showing consistent increase in demand. It has registered an impressive EPS CAGR of 41.8%, owing to the increasing margins and strong re-investment back into the business. The company’s margins have improved from an average of 7% earlier to 11% in the last few years owing to the clear diversification into segments like Engineering and increase in Consumer Durables segment.

The company has managed its funds efficiently, indicated through a good ROIC average of 23% in the last 6 years. BEL has reduced its debt to net profit ratio from 2.4 (FY09) to 1.29 (FY10) which is a comfortable position. The company has paid off Rs. 60 Cr. of debt in the last year through a QIP raised in the year.

Hence, the 10 YEAR X-RAY of BEL is Green (Very Good).

To view its past 10 year performance in a simple color-coded 10 Year X-Ray, visit Moneyworks4me.com

What is BEL’s short-term outlook?

Looking forward (FY11), what is in store for the company?

Good Order Visibility in the Engineering & Projects Division: The company has a healthy order book of Rs. 1150 Cr. Recently the company won 2 orders worth over Rs. 400 Cr. from the government. The orders are in the space of construction of double-circuit transmissions lines and also high masts and street lights. This shows good revenue visibility over the next few quarters.

QIP raised in FY10: In the last year BEL had raised a QIP of approx. Rs. 160 Cr, a portion of which was used to pay off its debt whereas the rest is going to be used for acquisitions. The company is planning on inorganic growth, where it can acquire companies that have a strong manufacturing base to support its robust distribution system.

Fluctuations in commodity prices: Prices of copper and zinc seem to be on a rise since the last few months whereas those of aluminum and steel have shown a declining trend. Zinc and steel are used mainly for engineering projects, whereas aluminum and zinc for consumer durables. Hence, the margins are expected to remain constant with the rise in 2 commodities being off-set by the fall in the other two.

The rise in consumption expenditure is expected to augur well for consumer durables and lighting segment. Also, the company has given a good guidance of top-line growth of around 25%. Hence, BEL is well-poised for growth in the short-term.

Hence, we can expect the short-term outlook of BEL to be Green (Very Good).

What is BEL’s long-term outlook?

BEL has a strong past with great growth rates in financials. It has gone from being solely a consumer durables company to being a well-diversified company in 3 segments.

How will this help the company grow in future?

1) Well-diversified into different segments of electrical industry with a strong leadership position in each: The company was originally into consumer durables and diversified into lighting & engineering segments in 2005. Two significant advantages that the company has gained by doing so:

• It reduced volatility in the top line performance of the company. Lighting & Consumer Durables segment are more cyclical in nature while the E&P segment directly benefits from the Government spending which remains consistent as planned. In FY09 & FY10, Consumer Durables and Lighting segment was affected due to fall in consumption expenditure; this was offset by the phenomenal growth in E&P segment.

• Through this diversification, the company has improved its margins, too. Where lighting gives an average margin of 6%, consumer durables ranges from 9-12% and Engineering around 10-11%. This has helped the company improve its margins from a meager 7% to its current average of 11%.

• Through this diversification, the company has improved its margins, too. Where lighting gives an average margin of 6%, consumer durables ranges from 9-12% and Engineering around 10-11%. This has helped the company improve its margins from a meager 7% to its current average of 11%.

Also, the company has a Strong Leadership position in each of the above segments (as seen above in the ‘Bajaj Electricals in Brief’)

2) Engineering & Projects division to drive growth: The engineering and projects business is expected to be driven by the growth and government spending in infrastructure and power. Right now, it contributes more than 30% of the company’s revenues. The company is the leader in turnkey illumination projects and high mast lighting system, including Design, Supply, Installation, Testing and Commissioning. It has a healthy order book of Rs. 1150 Cr. for this segment alone over the next 1.5 to 2 years. Also, this segment has grown by an impressive 30% CAGR over the last 5 years. Going forward it is expected to drive the revenues of the company

3) Foray into New Products like Water Purification and Pressure cookers: Bajaj Electricals Limited has decided to foray into the water purification business in the country and plans to roll out its water purifier product in the current financial year. The company sees a huge opportunity in the water purification business in the country the size of which is estimated at Rs 2,000 crore per annum and is growing at the rate of around 20%. But, this is a very competitive segment. With Tatas rolling out Tata Swach, the most inexpensive purifier priced at Rs. 749, the company will have to be ready for such competition. Also, Bajaj is planning to come out with electrical pressure cookers within a couple of months. Though in the same segment of consumer durables, this foray throws light on the company’s diversification into new products in the same segment.

4) Strong Distribution Network: The company has a strong distribution network to support its operations. It has 19 branch offices spread in different parts of the country. It is supported by a chain of about 600 distributors, 3000 authorized dealers, over 3,00,000 retail outlets and over 230 Customer Care centers. BEL is planning to increase its 3,00,000 franchise outlets across urban and rural India to over 5,00,000 within three years. This wide network helps the company be present closer to the customer and builds brand visibility.

So after seeing all the positive points, is there anything you should be concerned about?

a) Competition from strong players: For eg- Crompton Greaves and Havells in the fan segment. In fact Crompton Greaves is the market leader for fans in India. Also the market for unorganized products in brown goods and lighting is large(around 50% for many of the products), which is a cause for concern

b) Fluctuations in raw material prices: The key raw materials include zinc and steel used in manufacturing of products of engineering and aluminum and copper for the consumer durables segment. This fluctuations which depend on the demand & supply of commodities affects the margins of the company

c) The company has a long debtors cycle of 120 days with 1/3rd of the outstanding in debtors stuck for more than six months. This indicates a lot of cash stuck in debtors and is a cause for concern

Despite these concerns, the company is targeting a top-line of Rs. 5000 Cr. by FY13 driven by it Engineering segment and the new products in the pipe-line. The rise in consumption expenditure is expected to drive its consumer durables & lighting segment and the expected boost in infrastructure and power sector to drive its engineering segment. Also, with rising incomes, there is a shift expected from unbranded to branded products in consumer durables. Hence, we can expect the long-term future prospects of the company to be Green (Very Good).

Conclusion:

Bajaj Electricals holds a strong position in its 3 segments. It is well-poised for growth based on its strong diversification in these segments, the new product launches and robust distribution network.

Yes, Bajaj Electricals is an investment-worthy company, but is it at a good price to buy? Or is the market overvaluing it? To find out what investment decision you must take on BEL right now, become a member of www.MoneyWorks4me.com to find its right value.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

I am really impressed with your analysis & seen your 2 reports till now but it really differentiate your logical analysis from other brokers + your analysis really holds me while reading and makes me feel like if i will not read then i will miss important point…

I am expecting some learning from you by asking some questions to you, hope you will agree on this point ?

completely agree with you yash, the way the diversification explained in longterm makes u feelu suddenly learnt so much.I heard of your analysisreports from a friend and how now serached thru gogle. will i get added in the site.

Great work guys& great analysis. Always knew BE as a fan making co. You have now expanded my knowledge.

Thank you

Excellent Analysis.. I have started stocks investment a year back, but never got this kind of information(what an investor need to buy).. This site will be very good for long term investors and value based investors.. Thanks for your effort.. Are you still offering OUTLOOK Money as gift for your subscription..

Thanks a lot for all your appreciation.

Our outlook profit offer closed on 31st August.Even without the offer we can assure you that the current price is a value-buy and you are sure to benefit from it as Moneyworks4me.com is tailor made for long-term/value investors.

u ppl doing a very good job……

keep it up……$

Thanks a lot for the appreciation. Do keep reading and posting your comments.

the way you have expressed all is very easy to decide what to do for this share but one point i have not got from you is how you people predict the next year’s growth rate of the company , that i went through company’s Annual Report + other researcher’s reports to find but couldn’t get the idea so please I request you to guide me the way of base on which you have estimated the future growth rate ?

Hi Yash,

Thanks a lot for all your appreciation. We do not predict the next year’s growth rate of the company. In fact, we believe that in the long-term, the future price of the stock corrects on the basis of its future earnings capacity and we calculate the MRP (the right value) of the stock based on this. Hence, we do a more long-term analysis of the earnings of a company. To read our complete methodology click on the following link – http://bit.ly/cUvnGM . If you need any further clarifications on the same please do let us know.

good blend of analyis and interest factor in the first para & diversificatn part……..Excellent work

Bythe way how do i register for ur weekly analysis report. have been coming tru serch eng since last few times…. let me know

@Praha 34 @ Rohini – Hi, you will have to register for our weekly newsletter. You will get a Stock Shastra every Tuesday and the Company Shastra every Friday. Registration is a very simple process. Just click on this link https://www.moneyworks4me.com/investmentshastra/. Enter your name and email id on the right hand top corner and sign up for our newsletter.

Thanks a lot for all the appreciation. Do keep reading and posting your comments.