Infosys Technologies Ltd. – What makes it a Winner?

Infosys’ 10 YEAR X-RAY*: Green (Very Good)

(* 10 YEAR X-RAY shows the financial performance of a company in the last 10 years.)

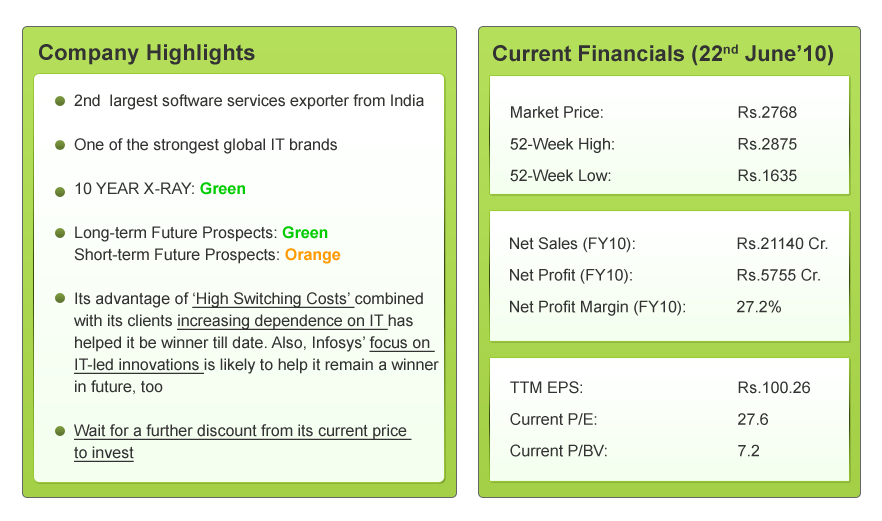

Infosys is the 2nd largest software services exporter from India. It is a global technology services company that provides end-to-end business solutions to its clients. It defines, designs and delivers technology-enabled business solutions that help companies win in a Flat World

It’s banking solution product – Finacle is a chosen solution in over 130 banks across 65 countries helping them serve more than 30,000 branches. Infosys has a global footprint with over 50 offices and development centers in India, China, Australia, the Czech Republic, Poland, the UK, Canada and Japan. Almost 99% of its revenues comes from global operations. Infosys and its subsidiaries have 113,796 employees as on March 31, 2010

What does Infosys’ past say?

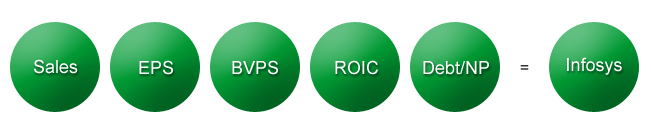

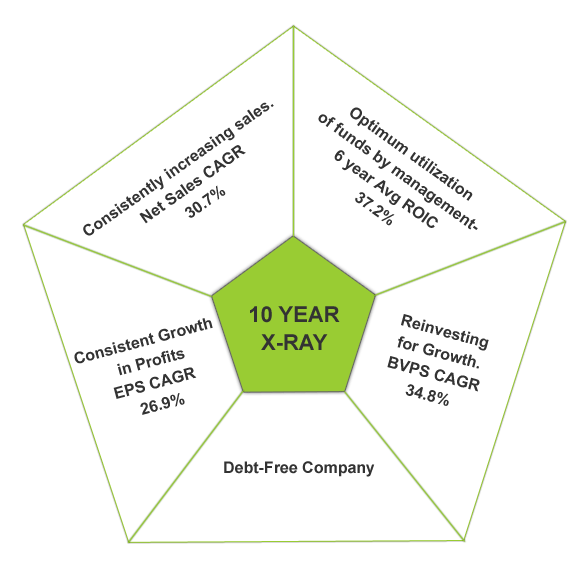

Infosys has performed robustly in all its parameters over the last 10 years. Its impressive fundamentals in the past form a strong base for its future

Infosys has been able to convert its competitive advantage of having ‘high switching cost’ into an excellent financial track record. More than 95%+ of its revenues are generated from repeat business from same clientele. Also, over the years, it has been adding new clients. This has resulted in an impressive Net Sales CAGR of 30.7%. Average operating margins for Infosys has been 36% for the last 6 years, much higher than its peers. It appears that Infosys has been able to command a pricing power with its clients, which has helped it maintain a consistent high operating margin. This has led to a consistent growth in profits, registering an EPS CAGR of 26.9%.

Hence, the 10 YEAR X-RAY of Infosys is Green (Very Good)

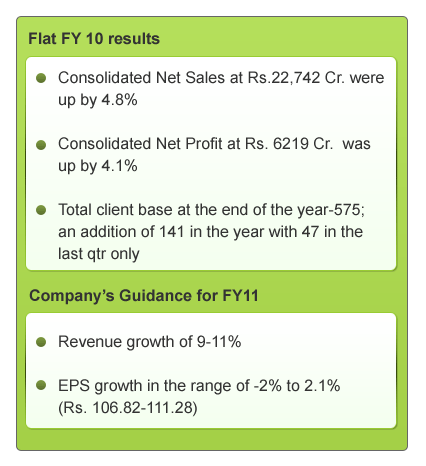

What is Infosys’ Short-term Outlook?

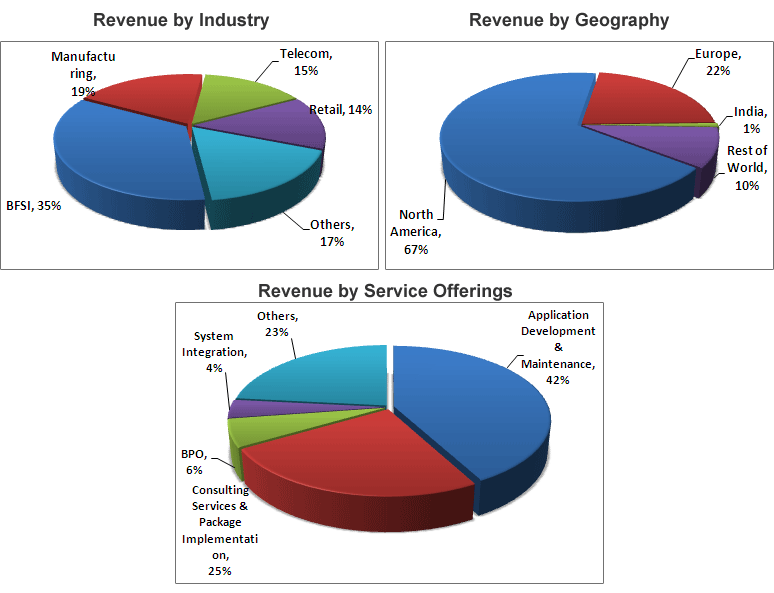

- Revenue Growth in FY 10 was led by:

> Services such as consulting, package implementation (PI) and system integration (SI). With service lines like PI showing growth; it shows that clients are now more willing to go for more complete solutions;

> Industries like manufacturing & BFSI

> Geographies like Europe, especially continental Europe(Germany & France) & US

- Margins were subdued due to wage-hike of Rs. 590 Cr, 6% appreciation in rupee, higher tax impact

- In a troubled IT environment, Infosys bagged 5 large deals in the March,10 qtr; 2 of them worth more than $ 150 mn each

Outlook For FY 11 –

- Infosys is now witnessing more specific commitments from its clients for the short-term, unlike it was, till a few months ago. Infosys expects the IT budgets of its clients to rise marginally. However, clients are refraining from entering multi-year deals & are focusing on short-term contracts. Due to this expected increase in budgets, Infosys is likely to witness improved order inflow in the short-term

- Infosys acquired McCamish Systems which is a business process solutions provider to the US insurance and financial services sector. The acquisition has already started contributing to its consolidated revenues & will help Infosys bag larger deals in the US insurance & financial market

- Finacle is expected to lead the order wins. In FY 10 itself it won 31 deals. Further, as per RBI guideline all the RRBs have to migrate to CBS (Core Banking Solutions) by September 2011. Out of 86 RRB’s in India, 13 have finished implementing Finacle CBS solution. Recently Finacle has launched a slew of innovative offerings – Finacle Advisor, Finacle Treasury-in-a-box, Finacle Core Banking for RRBs & Finacle Financial Inclusion. All this will be a big growth driver for Infosys to draw more revenues from domestic market in the short term

- Infosys plans on hiring 30,000 employees in FY11; this throws light on an improved demand scenario

- Margins likely to witness pressure:

- The company has planned a wage-hike of 14% for offshore employees and 2-3% for onsite; a decision most likely taken to curb the increasing attrition rate

- With most of their Software Technology Parks completing their tax-exemption periods, the effective tax rate will be higher. Its tax rate increased from 13% to 20%+ in the 2009 itself

The company’s revenue guidance is good, with services like packaged implementation & consulting and verticals like Manufacturing, BFSI & Retail expected to drive growth. But the EPS guidance seems subdued; the company is expected to witness margin pressure (with the wage hikes and the appreciation in the Indian Rupee) and a higher tax rate in 2010-11. Also, with the European crisis becoming bigger with time, Infosys is likely to witness some risk, here. Hence, we can expect the short-term outlook of Infosys to be Orange (‘Somewhat Good’)

What is Infosys’ Long-term Outlook?

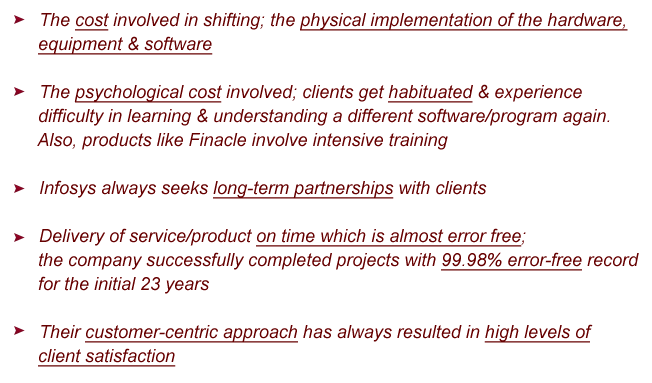

Products & Software services with ‘High Switching Costs’ are a competitive advantage: Stock Shastra #8 highlights the importance of having ‘high switching costs’ as a competitive advantage. Infosys is a very good example of how this unique advantage has helped the company to be a winner. Let’s see how

Infosys has always been a preferred outsourcing partner, compared to other companies. Also, it generates most of its revenues from repeat business. In the last year, the company derived 97.3% of its revenues from repeat business from its same clients. The company’s banking solution- Finacle (Core Banking Solution) is a great banking solution. As the bank grows in terms of business, branches etc its use of Finacle grows with it. This leads to consistent increasing revenues for Infosys. Finacle’s success story includes solution in over 130 banks spanning over 30,000 branches. Also, it has reached an unparalleled performance benchmark of 104mn effective transactions per hour

When clients go to Infosys for the first time they know they are partnering with one of the most competent software companies. But what is it that keeps them from switching to other IT partners; several reasons for this are:

This advantage has helped the company increase business from existing & new clients. This has ensured consistently growing sales. Infosys has an average operating margin of 36% over the last 6 years. This is higher than that of its peers. Knowing that your clients are not going to switch always gives a company the advantage of pricing power or power to shift increased cost to its clients. This has helped Infosys maintain a consistently high operating margins over the years. This, combined with increasing sales has led to increasing profits

Future Opportunities inseparably linked with IT: Combined with this advantage of high switching costs is its clients ever-increasing dependence on technology. While moving up the growth path, every client depends more and more on technology for every task. Also, Infosys endeavors to continuously increase its scope for IT-led solutions & innovations with every client. Once a client selects Infosys as its partner, for each and every upgrade/new system on technology the client prefers to go back to Infosys. The client is virtually stuck with Infosys as its partner; obviously a partner they are happy and satisfied with. Also, once Infosys understands a client’s way of working, business model & processes, the client is comfortable with Infosys as a partner, making it even more difficult to switch from.

Hence, from being just a partner that gives a client a certain set of products & services, Infosys has the opportunity to become partner in more strategic areas. (Read more on this in the Infosys’s Annual Report-2010)

Acquisition of McCamish Systems LLC

In FY10 Infosys acquired Atlanta-based McCamish Systems LLC- a business process solutions provider to the US insurance and financial services sector. This acquisition is likely to enhance Infosys’s capability to deliver end-to-end business solutions to the BFSI sector. The company has already started contributing revenues to Infosys. Through this acquisition Infosys gained 39 clients and an onsite delivery centre to service its clients. The strength and capability of Infosys combined with the domain expertise of McCamish will enable Infosys to bag bigger deals from larger clients

Moving to NEM Model – Traditionally IT projects are priced on effort (Time & Material) or on fixed price basis. Another pricing model, New Engagement Model is gaining popularity among IT companies. Infosys is aiming to move to this new model of pricing, which links the cost of the service to the values derived from it. An underlying theme to this approach is to be able to say to clients ‘Pay us for results, not for our effort’ This model is based more on outcomes & results, rather than time & resources. Though Infosys is at a higher risk, it appears that clients will be more than willing to move to this model because it decreases their cost of operations. Since the model is linked with results, Infosys will be able to command a certain premium on pricing.

US Government IT Spend: A big opportunity

Where TCS & Wipro have already addressed the opportunity of the US government outsourcing market, Infosys has been slightly late in the same. For this, Infosys established a separate subsidiary in the US. With the US government poised to spend over $100 billion on modernization of its healthcare and other government systems, this is a huge opportunity for Infosys

Concerns

- Geography wise, its revenues are highly dependent on clients located in the U.S. and Europe, industry wise in Banking, Manufacturing and Telecom industries; an economic slowdown in these countries/industries may affect its business

- Currency fluctuations may affect the results of its operations

- There is intense competition in the market for technology services which could reduce its business from clients and decrease its revenues. It competes with global firms such as Accenture Limited, Capgemini, Hewlett-Packard Company, IBM & Indian firms TCS, and Wipro etc.

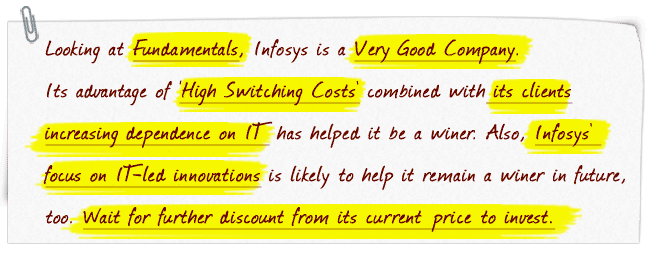

Despite these concerns, Infosys is well-positioned in an IT outsourcing market which is poised to grow at 15%+ CAGR for the next 10-12 years. In today’s changing world, opportunities have become inseparably linked with advances in IT & Infosys’s focus on building its IT capabilities. Also, the increasing demand from user-industries like BFSI, Manufacturing, Retail will enhance its revenue growth. Hence, we can expect the long-term future of Infosys to be Green (Very Good)

CONCLUSION:

Infosys has been the gold standard for the IT industry. Its ability to generate repeat business from its strong client base has been its major growth driver till today & with our ever-increasing dependence on technology solutions, a company like Infosys is poised for good growth in the future

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

company shastra is very effective, and useful. thank you………R M HEGDE.

Thanks for the appreciation.

Very Good Analysis of Infosys stock.

Thanks for the appreciation.

From the analysis of infosys above, it is expected the company will continue to perform well and it is a investor delight.Thanks for the

very the good analysis.

Sanjit Chakraborty

Thanks for the appreciation.

very good analysis with adequate depth…..!!!!thanks.