Dabur at a glance:

By the end of last fiscal, Dabur had a total of 18 brands with sales greater than Rs. 100 crore. At the end of fiscal 2021-22, this number has increased to 20 with Meswak and Real Drinks joining the coveted billion-rupee turnover club. Now, we have 14 brands that are above Rs. 100 Crore in size; 2 brands that are over Rs. 500 Crore but less than Rs. 1,000 Crore in size, and another 4 brands that have a turnover of more than Rs. 1,000 crores. Another big achievement this year is for the Coconut Oil brand Anmol, which has now emerged as the second-largest coconut oil brand in the country.

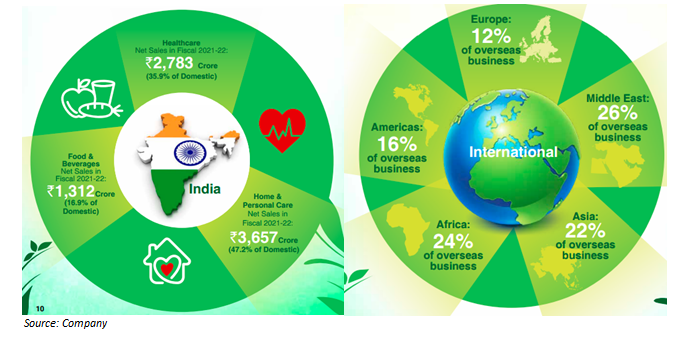

Overview of Dabur Indian FMCG Business:

Food & Beverage Business

Dabur’s Food & Beverages business was the key growth engine for the company in fiscal 2021-22, reporting a growth of 47.7% to become 16.9% of the India FMCG Business. This business, which had reported a decline in the previous year, bounced back with mobility improvement and demand for healthy food products gaining traction.

Health Care

The Ayurvedic Health Care business continues to be Dabur’s USP in a cluttered FMCG market. This business caters to growing consumer needs for health and well-being and offers tailored products to meet the growing consumer demand for nature-based solutions. The Health Care business contributes to 35.9% of Dabur’s India FMCG business and the category witnessed a growth of 5.2% during the year 2021-22 with a 2-year CAGR of 17.8%. This vertical comprises sub-categories like Health Supplements, Digestives, OTC, and Ayurvedic Ethicals.

Health Supplements

Dabur’s flagship health supplements brands viz. Dabur Chyawanprash and Dabur Honey staved off heightened competition from new entrants and existing players to report strong market share gains. Dabur expanded the Health Supplements portfolio this year with the launch of a new Health Food Drink named Dabur Vita, in addition to the introduction of newer formats in both brands. Dabur Chyawanprash, a time-tested formulation of more than 40 Ayurvedic herbs, saw its market share improve by ~2.5% during the year. The sugar-free variant, Dabur Chyawanprakash, recorded double-digit growth in fiscal 2021-22. Dabur Honey closed the year with a ~3% increase in market share in the branded honey market in India.

Digestives

The Digestive business contributed 5.5% to Dabur’s India FMCG Business and reported 12.6% growth during fiscal 2021-22. Dabur operates in the herbal digestive category with household brands like Hajmola, PudinHara, Hingoli, Dabur Nature Care, and Sat Isabgol.

Dabur Hajmola, our flagship brand in the digestives category, continued to be the No. 1 herbal digestive brand and saw its market share increase by more than 4% during the year. The Hajmola franchise saw double-digit growth and crossed the Rs. 300 crore turnover mark during the year. This growth was broad-based with all variants seeing double-digit growths.

Home & Personal Care

Dabur’s Home & Personal care vertical accounts for 47.2% of the India FMCG business and reported 12.7% growth in fiscal 2021-22. This business covers key highly competitive consumer product categories like Hair Care, Oral Care, Skin Care, and Home Care. Despite the heavy competitive intensity in each category, Dabur reported strong growth and market share gains across all businesses.

Sales & Distribution – India

It also invested aggressively to ramp up its distribution. Its direct coverage increased to 1.31 million outlets from 1.28mn, taking the total reach to 6.9mn outlets (compared to HUL’s 9mn, ITC’s 7mn, and Marico’s 5.6mn). Its village coverage saw a significant jump to 89,840 villages across the country from 59,217 villages last year.

It also invested aggressively to ramp up its distribution. Its direct coverage increased to 1.31 million outlets from 1.28mn, taking the total reach to 6.9mn outlets (compared to HUL’s 9mn, ITC’s 7mn, and Marico’s 5.6mn). Its village coverage saw a significant jump to 89,840 villages across the country from 59,217 villages last year.

Dabur is also coming up with “Pragati” where the Top 3,000 retailers from the Top 8 towns will be turned into perfect Dabur stores with an emphasis on the entire Dabur portfolio presence along with multiple paid visibility elements.

Business Performance

Strategy

Modernising Ayurveda

It will continue to strategically focus on the ‘herbal and natural’ proposition as its core philosophy, both in India and abroad. In addition, the emphasis on health and wellness is its USP and makes Dabur a differentiated player in the consumer products market.

Power Brands

Dabur has identified 9 Power Brands that together account for 70% of its revenue. These include 8 brands in India and one in the overseas markets. Most of its Power Brands operate in the Healthcare space. This is also in line with the Company’s vision of being dedicated to every household’s health & well-being.

The 9 power brands are: Dabur Chywanaprash, Dabur Honitus, Dabur PudinHara, Dabur Amla, Dabur Honey, Dabur Lal Tail, Real, Dabur Red Paste, Vatika.

Digital Transformation

During fiscal 2021-22, almost a quarter of its marketing spending was towards digital, and we also saw its e-comm saliency increase to 6.5%. It will continue to offer modern and easy-to-use formats that are relevant and in sync with the needs of our modern-day consumers. In the last two years, it has stepped on the pedal in terms of innovations which form the cornerstone of our strategy. New products contributed to around 5% of our revenue in the year.

Rural Expansion

Rural markets in India have grown significantly, and these consumers are now more aware and conscious of their buying decisions and habits. Rural masses in India have significantly propelled the Digital revolution, exposing companies to better marketing options and making villagers the potential consumers for FMCG (Fast Moving Consumer Goods) companies. The growing affluence in the hinterland and the deeper penetration of media and smartphones have led to a sizeable jump in consumerism for branded consumer goods.

This market is one of the key strategic focus areas for Dabur. Rural India accounts for nearly 47% of Dabur’s domestic market sales. Dabur has been concentrating on increasing its direct reach to villages across the country to tap into this growing consumer base. It has increased our distribution infrastructure and reached around 1.3 million outlets and approximately 90,000 villages. Project Yoddha has been instrumental in expanding its village coverage ahead of the envisioned target of 80,000 villages. Even the doctor coverage crossed the mark of 80,000 and is now at 81,210 at the end of fiscal 2021-22.

Annual Reports is a very elaborate document and shares a lot of information; at times doesn’t necessarily help to form an opinion about a company or its potential. We carve out only important information about the company’s strategy and future prospects for your benefit.

Click here to read the entire annual report

Best Stocks From:

Undervalued Nifty 50 Undervalued Nifty 100 Screener Alpha Cases 5 stars rated stocks from Nifty 500

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | Ebook | WhatsApp: 9860359463