This article covers the following:

Review

For the year ending Dec’2020, Nifty closed at 13,981, around 15% higher over last year. In the last 3 years, Nifty is up 33% translating into ~9.9% CAGR.

| Indices | Last 1 Year |

|---|---|

| Sensex | 14.00% |

| Nifty | 15.00% |

| Healthcare | 62.00% |

| Information Technology | 58.00% |

| Smallcap | 29.00% |

| Oil & Gas | 20.00% |

| Midcap | 18.00% |

| Consumer Durables | 17.00% |

| Metal | 15.00% |

| Fast Moving Consumer Goods | 13.00% |

| Auto | 12.00% |

| Capital Goods | 10.00% |

| Bankex | -5.00% |

Low-interest rates globally and optimism around vaccines have led to new highs for Nifty. The timeline for Vaccine approval and distribution remains uncertain for now. The recent rally is led by cyclical stocks which were beaten down due to uncertainty about economic recovery. Incremental macro data suggests an improvement in economic activity and better utilization. Unabated FII inflows into the emerging markets are leading to new highs for Nifty. We have written a note on What are FIIs seeing.

Stocks that benefitted from the Covid crisis may cool off but individual stocks that report good results will continue to perform well in lines with earnings.

After record inflows of Rs. 65,238 Cr in Nov’20, FII bought aggressively even in December 2020, with net inflow to the tune of Rs. 45,000 Cr. Like we shared in our internal blog, FII buying or selling doesn’t provide any hint on future market direction.

GDP contracted by 7.5% in the second quarter of the calendar year 2020. For this financial year, the contraction is around 15%. With an expected recovery in key parameters like e waybills, auto sales, cement offtake, IIP, and GST collections, it appears the next half will see good GDP recovery closer to pre-covid levels.

Outlook

As of date, the average upside of our coverage universe is likely to be less than 10% CAGR over the next 3 years basis based on current estimates. The Valuation of companies goes up every quarter if the company reports growth in earnings. This can improve the upside potential of stocks. If we see growth improving next year, we may see an upward revision in our estimates.

Nifty 50 index trades above its fair value while there are pockets of extreme overvaluation and undervaluation. A lot of liquidity helped beaten-down stocks to rally however, the economic indicator does not show full recovery in all sectors.

Even if there is news of reopening or Vaccine, focus on companies that have good earnings growth over the next few years. Companies in sectors like chemicals, pharmaceuticals, IT, Telecom, Utilities, and rural-focused companies will report good earnings growth this year.

We are looking at companies that have good earning triggers over the next 2 years as we are not certain whether broad-based recovery will happen immediately. We are investing in companies i) coming out of sector consolidation/debt reduction, or ii) introducing new products, or iii) commissioning new capacities, or iv) executing orders in hand. This gives certainty of growth rather than plain anticipation or, v) Export-oriented companies as economic recovery is better in western countries.

Many stocks with poor earnings temporarily have also rallied quite sharply. This might be in anticipation of recovery over the next 2 quarters. FII inflows have led to aggressive price recovery in banks and cyclical. Current prices in quite a few names already reflect growth thereby increasing downside risks.

We are looking at opportunities in building materials, export-oriented chemicals, textile or light engineering, and import substitute ideas. We recently added building materials and import substitute companies.

Register FREE | Schedule a DEMO | Solution Enquiry | Subscribe

Risks

Indian Economy

GDP data saw two-quarters of year-on-year decline, while the recent quarter was more reasonable 7.5% versus the previous quarter decline of 23%. Unfortunately, the cases are still on the rise as more people returned to work and started traveling.

Many sectors have reached at least 80% utilization in Nov’20. Popular high-frequency data like car registration, toll roads, diesel usage, and electricity generation show month-on-month improvement. A lot of the demand is coming from pent-up as well as festivity. Barring that, companies that export are reporting steady improvement either from the better economic recovery in the west or increase in market share of Indian companies.

RBI published a report that shows that the financial system is flooded with liquidity with very low credit growth. Even fast-growing lenders like Bajaj Finance have reported a decline in new loans over the last year. High liquidity with banks is negative for profit margins while low credit growth is negative for valuation multiples.

RBI also warns that the impact of COVID-19 could severely dent the health of the banks in the financial year 2020-21. The report points out that as of Aug-20, nearly 40% of loans given by banks and NBFCs were still under moratorium.

The RBI has done a stress test on a sample of banks and concluded that the actual gross NPAs as of September 2020 may be higher than the levels of NPAs in March 2020.

During the moratorium period of 6 months, corporates and individuals didn’t have to pay any interest. This led to higher savings and hence good collection efficiency for banks and NBFCs in the months of Sept-Nov’20. However, if the economic activity doesn’t recover sooner or jobs don’t come back, these borrowers will discontinue interest payment. No borrower wants to default unless it’s inevitable. A borrower will assess the situation for 2-3 quarters before he gives up and ultimately defaults. So NPAs will be visible only after a lag. However, banks have already moved up to pre-Covid levels.

Global Economy

Western countries are more vulnerable to a second wave of Covid-19 as their aging population can lead to higher fatalities. This has led to aggressive lockdown measures in countries like Germany, the UK, and some states of the US. This can slow down economic recovery.

An uneven economic recovery has also caused a sharp shortage in commodities leading to a rally in metals and commodity prices. This may sustain if supply doesn’t improve in the near future.

Central banks have been keeping liquidity high which has lowered the interest rate for government bonds and corporate bonds. Savings are finding their way into higher-yielding assets like stocks, emerging markets debt, and equity.

The low-interest-rate may continue till the time economy doesn’t come back to pre-covid levels. The current phase of liquidity has caused asset price inflation. If the banks start lending aggressively, we may start seeing inflation which might spark fear among central banks. This may compel them to raise rates or at least go slow on liquidity pumping. This is one risk to equity markets that are currently trading at a high valuation. We are tracking inflation in the US, EU to see if it’s structural in nature which might be negative for equity.

With Vaccine news stocks have rallied further, will they correct?

Currently market rallied on the back of the US election outcome and Vaccine news on Monday, 9th November 2020. While Vaccine news certainly is very positive, the market has already rallied pricing economic recovery in the next financial year.

Low-interest rates and liquidity is fuelling rallies across emerging markets. While the market does look expensive wherein few stocks are pricing in a very optimistic near-term future, we will see a pullback if the not deep correction in the near term. However, since the overall market is not in correction mode anymore, we expect individual stocks to do well based on business performance. We will indicate our subscribers when we start seeing corrections.

We have generated good returns, how to protect them?

MoneyWorks4me portfolio has earned 28% in the calendar year 2020 versus Nifty’s 15%. For the last 2 years, most advisors and Mutual Fund portfolios lagged Nifty as the rally was concentrated in just 10-15 stocks. In this year, volatility, as well as broad-based rally across stocks, helped us as our stocks too delivered returns in lines with their growth.

In long term (5 years+), or even medium-term (3 years), stock prices go up in lines with earning growth. Even if there is volatility in the interim, the stock prices of good companies recover to match respective earning growth. This is the reason we suggest focusing on the larger picture rather than interim events.

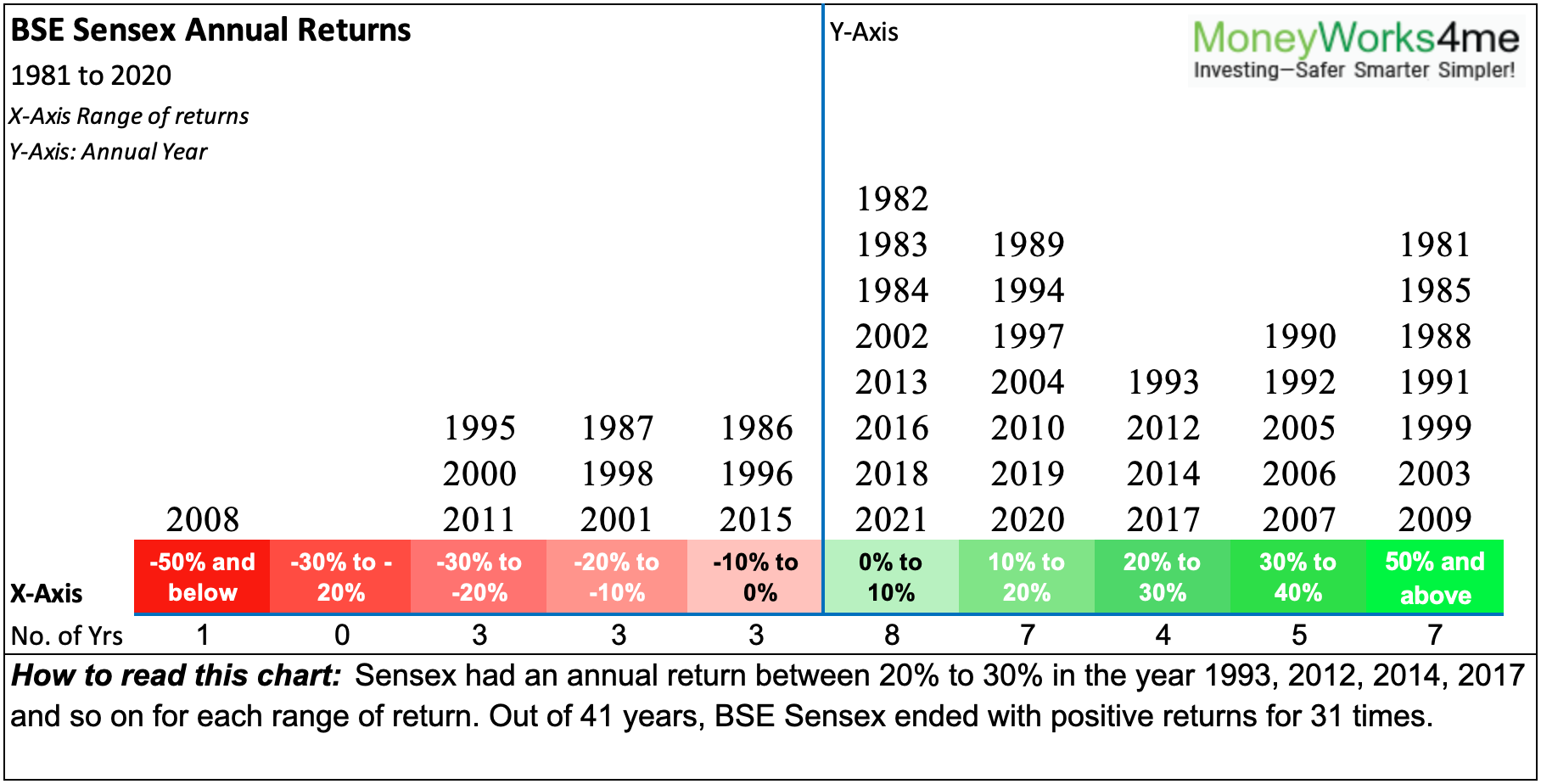

We would advise tracking returns on a longer timeframe like every year rather than every month or every quarter. For 31 out of 41 years, equity has delivered positive returns. Every bad year was followed by at least one very good year.

If one looks at Sensex Annual Returns, one would have a very different experience of equity investing versus fear of losing money in the short term.

How to think about market valuation:

Let’s assume Nifty is indeed 20% expensive! (Nifty – led by a concentrated portfolio of Top 10 stocks – is around 20% higher than its fair price, not true for all stocks).

If Nifty were to give 13% CAGR returns over the next 10 years, buying 20% above fair value reduces your returns by 2% CAGR i.e. it will earn 11% CAGR versus 13% CAGR. Now it doesn’t look so bad.

Our portfolio is expected to deliver better than Nifty as its growth rate and valuation are better than Nifty. Even if there is a correction, stocks with improving fundamentals will recover and returns will be protected. Stocks that have risen without improvement in fundamentals are likely to give away current gains.

We can understand if one wishes to hold/raise 10-20% cash in the portfolio, we will inform you which stocks to be sold if we see evidence of correction. The rest of the portfolio can be held despite volatility based on news flow or a rise in the number of Covid cases. We can’t avoid volatility completely as markets move in unpredictable patterns.

We recommend equity investing only for long term savings so that near term events become irrelevant. We do not find any merit in second-guessing what’s going to happen in the next 6 months-1 year. If the shortlisted stocks are good companies, with good growth prospects, they will deliver returns in line with business performance. Picking the right stocks is easier than predicting the market direction.

We continue to recommend Gold Fund/Gold (up to 5-10% of the portfolio) as a hedge from contagion risks.

If you are afraid about the economy, people losing jobs, your own finances, commit lower than usual in equity. Say instead of Rs. 100 in equity in normal times, commit only 60 or 70. But don’t get scared of volatility.

How to allocate funds:

Restrict your allocation to 3-5-7% in each stock and diversify across 20-25 names. And not more than 25% in each mutual fund. This will keep you at peace, and not significantly dent your portfolio performance.

Avoid any type of regret while investing. Regret can come either missing stock or not adding enough to a winning stock. Rather focus on overall strategy as explained above.

Beyond this, tinkering with asset allocation will only reduce long-term returns thereby missing one’s target corpus. We have diversified our stocks portfolio, we have diversified assets and we have a long term horizon. Together this takes care of all potential risks in investing.

MoneyWorks4me Outlook:

To know MoneyWorks4me way of investing:

If you liked what you read and would like to put it into practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Register FREE | Schedule a DEMO | Solution Enquiry | Subscribe

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Why MoneyWorks4me | Why Register | Call: 020 6725 8333 | WhatsApp 8055769463