The first month of the new year 2012 has been very good for the stock markets. The month of January saw the Nifty go up by 12.4% – the best monthly returns over the last 30 months! This rise has been fueled to a large extent by FIIs who were net buyers of more than Rs. 26,000 Cr. The month also saw many companies announce their December i.e. 3rd quarter financial results. Out of the BSE 500 companies as many as 212 companies have announced their results so far.

Let’s take a look at the report card for the December quarter and what it reveals:

The 212 companies which have reported their results so far (till 1st Feb’12) have clocked a healthy growth of 26.8% in Net Sales as compared to December 2010 figures. However, this growth hasn’t resulted into increased profitability as higher inflation and high interest costs have reduced operating and net profit margins considerably. As a result, operating profits have grown by just 6.49% whereas Net Profits were further affected registering a growth of only 1.46%. The high interest rates especially have had a negative impact on profitability with interest costs for these companies rising close to 50% on a Y-o-Y basis.

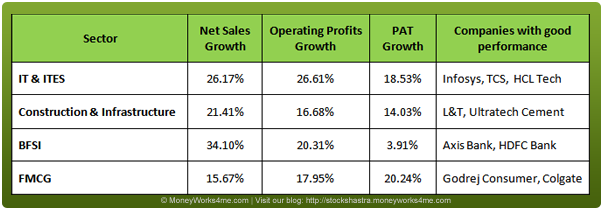

As far as sectoral performance is considered, the table given below gives the top performing sectors for this quarter. Despite a jittery global scenario, the IT & ITES sector companies have recorded robust financial performance till now with a cumulative net sales growth of 26% and PAT growth of 18.5%. They were helped by the depreciation of the rupee against the dollar which increased price realisations. The companies which performed well included the leading players – Infosys, TCS and HCL Technologies. However, their stock prices dropped a little owing to the cautious outlook given by their management for the coming quarters primarily due to demand slowdown and reduced budgets of clients.

Construction & Infrastructure has also been a positive surprise, recording good growth in both sales and profits led primarily by cement companies. With better realisations owing to price hikes, these companies also witnessed a 15% drop in interest costs leading to better profitability.

Another sector which surprised with its performance was the banking sector. Despite the high interest rate scenario, many banks reported good results along with lower than expected NPA (Non performing assets) which tend to increase during a slowdown. FMCG which is a defensive sector has also lived up to the expectations with Godrej Consumer Products and Colgate leading the pack.

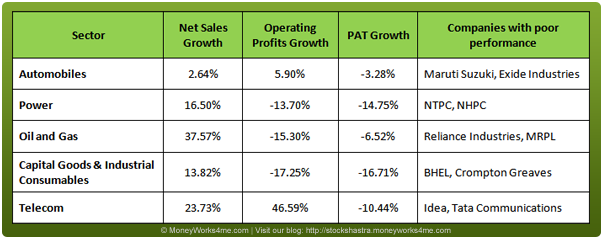

Now, let’s talk about sectors which have not done so well so far. The table given below gives you the list of the sectors whose performance was affected by the economic scenario.

As expected the sectors whose performance was affected include capital intensive sectors like Automobiles, Power, Capital Goods and Power. Automobile companies were affected by the drop in demand as interest rates acted as a deterrent to consumers. The fall in demand is reflected by the growth of just 2.6% in Net Sales recorded by the Auto companies.

Oil & Gas sector was also affected with Reliance Industries – the country’s largest company – recording dismal quarterly numbers owing to declining refining margins. Power sector recorded a growth of 16.5% in Net Sales but profits registered a drop of close to 15% owing to high coal prices and bad health of SEBs combined with high interest costs.

Telecom sector has consistently been an underperformer over the last few quarters and results of Idea and Tata Communications indicate that it will continue to underperform this quarter as well. Regulatory issues along with high competition has proven to be a bane for the sector over the last year or so.

Thus, all in all, the results are nothing to be happy about. The global economic scenario continues to remain gloomy. There have been some positive signs on the domestic front like a slowdown in inflation and good PMI and IIP numbers. However, domestic headwinds like high interest rates, government inaction and rising fiscal deficit are expected to continue to depress the financial performance of India Inc in the coming quarters.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463