Devyani International IPO Details:

IPO Date: August 4th to August 6th, 2021

Total Shares for subscription: 20.4 Crore

IPO Size: Rs. 1,838 Cr

Lot Size: 165 shares

Price Band: Rs. 86-90/share

Market Cap: Rs. 10,823 Cr

Recommendation: Subscribe for listing gains

Purpose of Devyani International IPO

- To make repayment/ prepayment of borrowings fully or partially

- General corporate purposes

About Devyani International Limited

Incorporated in December 1991, Devyani International Limited is the largest franchisee of Yum Brands in India and is among the largest chain operators of quick-service restaurants (“QSR”) in India on a non-exclusive basis. It operated 696 stores across 166 cities in India, as of June 2021. The company was originally incorporated as ‘Universal Ice Creams Private Limited’ in December 1991 in New Delhi.

Yum! Brands Inc. operates brands such as KFC, Pizza Hut, and Taco Bell and has a presence globally with more than 50,000 restaurants in over 150 countries, as of December 2020. In addition, DIL is a franchisee for the Costa Coffee brand and stores in India.

Business of Devyani International

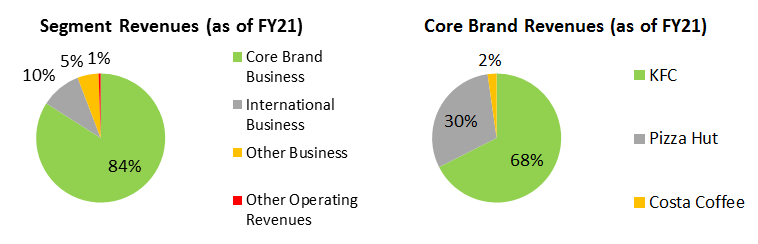

The company’s business is broadly classified into 3 verticals:

- Stores of KFC, Pizza Hut, and Costa Coffee operated in India (KFC, Pizza Hut, and Costa Coffee referred to as “Core Brands”, and such business in India referred to as the “Core Brands Business”);

- Stores operated outside India primarily comprising KFC and Pizza Hut stores operated in Nepal and Nigeria (“International Business”); and

- Other operations in the F&B industry, including stores of their own brands such as Vaango and Food Street (“Other Business”).

DIL has a strong 25-year long relationship with Yum, and Yum holds strategic equity in the company. Yum! Brands Inc. through its affiliates also has a minor equity stake in its other franchisee of KFC and Pizza Hut stores, located in Brazil.

As of June 2021, the company operated 284 KFC stores and 317 Pizza Hut stores, and 44 Costa Coffee stores in India. In their Core Brands Business, they had an extensive presence in 26 states and 3 union territories in India.

Devyani International collaborates with Yum across various aspects of their operations for KFC and Pizza Hut for the franchisor’s brand protection and management, including product innovation and development, brand strategy, and technology initiatives. For Costa Coffee, retain flexibility over their operations with respect to similar parameters and are supported by Costa in determining their menu, ingredients, suppliers, and distributors

Management of Devyani International

The Promoters of the company are Ravi Kant Jaipuria, Varun Jaipuria, and RJ Corp. Currently, the Promoters, in aggregate, hold 76% of the issued, subscribed, and paid-up Equity Share capital of the company.

Ravi Kant Jaipuria is the Non-Executive Director and Chairman of the Board of the company. He is a promoter of the company and has over 3 decades of experience in conceptualizing, executing, developing, and expanding the food, beverages, and dairy business in South Asia and Africa.

Varun Jaipuria is the Non-Executive Director of the company. He is a promoter of the company and has 12 years of experience in the soft drinks industry.

Virag Joshi is the Whole-time Director (President & CEO) of the company. He has been a key strategist in an expansion of Pizza Hut, KFC, Costa Coffee outlets from a small base of 5 restaurants in 2002 to 600 plus outlets in the last 19 years. He has been earlier associated with Indian Hotels Company Ltd, Domino’s Pizza India Ltd, Milkfood Ltd, and Priya Village Roadshow Ltd. He has been a Director on the Board since November 10, 2004.

Manish Dawar is the Whole-time Director and CFO of the Company. He has wide experience in various industry domains and across various geographies in the world. He has worked in various corporate setups including Reebok India, Reckitt Benckiser, Vedanta, DEN Networks Ltd, and Vodafone India Ltd.

Financials of Devyani International

Over the period FY19-21 revenues have grown at a CAGR of 18.5%.

Their growth across the Core Brands has been facilitated by a well-defined new-store rollout process that enables them to identify locations and build their stores quickly, consistently, and efficiently. Despite the ongoing COVID-19 pandemic, DIL has continued to expand their store network and in the 6 months ended March 31, 2021, they opened 109 stores in their Core Brands Business.

Strengths:

- Portfolio of highly recognized global brands catering to a range of customer preferences

- Comprehensive QSR player

- Presence across key consumption markets with a cluster-based approach

- Distinguished Board and experienced senior management team

MoneyWorks4me Opinion

Is business good bad or gruesome?

Great! Retail and Quick Service Restaurants are one of the popular growth businesses wherein the success formula in one region is replicated in other regions in the country. This business model was Peter Lynch’s favorite, assuming the execution is extraordinary.

Companies in this segment not only earn a good return on investment from higher footfalls but also reinvest the profits into new stores across the country to compound capital.

Rolling out new stores can be easily done by raising new funds but it doesn’t create any value for shareholders if it is not backed by profitability. Wealth is created when the profits of an old store are used to fund a new store. Besides, an increase in sales of an existing store directly adds to overall profits which creates value.

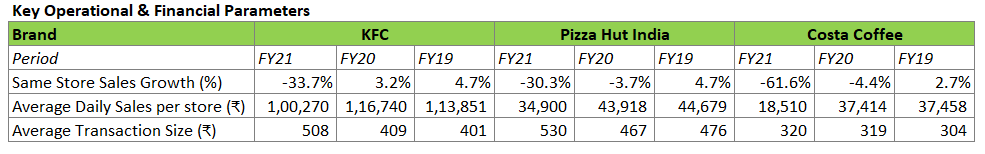

Good execution includes, (i) rolling out stores (Store growth) and (ii) increasing sales in existing stores (SSSG) through higher footfalls, to improve profitability.

Why is Devyani International reporting a loss if headline numbers indicate good execution?

In the retail business, till the time new store addition is significant % of overall stores, profits of the older/mature stores get masked by losses of newer stores.

Illustration, if Mr. ABC owns 10 stores with a 20% operating margin, and adds another 10 stores (100% store growth) with 10% operating margin loss in the initial years, Mr. ABC’s overall company profit will remain subdued, 10 Cr i.e. operating margin 5%.

But as new stores break even and become profitable, it will lead to very high earning growth in subsequent years. If we assume the same profitability for new stores, overall company profit will go to Rs. 40 Cr (incl 20 Cr from new stores as well) over time. This will lead to a 300% jump in profits from Rs. 10 Cr to Rs. 40 Cr. If this happens in the next 3 years, earning growth will be around 60% CAGR in 3 years.

Currently, Devyani International has expanded stores at a rapid clip which masked older stores’ profitability. As store addition is moderating versus exiting ones, profitability is getting reflected. Operating profit margins are expected to improve with each passing year as existing stores’ profits will far exceed losses from new stores.

Devyani International expanded its Core brands store growth at 13.5% CAGR in the last 3 years.

What is the future growth expectation?

Quick Services Restaurants are a fast-growing segment with a large young population, an urban lifestyle of dining out, and improved affordability from income growth as well as offerings from QSR. Sales growth across all QSRs is healthy confirming our hypothesis. As expected the market for the QSR industry is going to expand at ~13% CAGR from FY20 – FY25 to Rs. 2,00,000 Cr as per market research reported in IPO document. We expect Devyani International also to grow at a similar pace and profit growth to be higher as the share of mature and profitable stores increases as a percentage of total stores.

Valuation

Since Devyani International doesn’t have profitability we assume sales multiple to compare with peers.

Firstly, Devyani International requires higher investment in stores of Pizza Hut, KFC as their business model includes in-store dining predominantly. This leads to a relatively lower return on capital employed versus peers.

Secondly, Devyani International has not yet reported profits to fund future growth hence it is warranted to trade at a discount. We believe such investments make sense only for aggressive investors.

Recommendation: Subscribe for listing gains only; Aggressive investors can Subscribe for the long-term.

P.S. Our IPO calls are mostly to take advantage of IPO allotment in sectors that are in favor. We would not recommend a large allocation soon as we are yet to see company performance and execution post listing hence we don’t recommend buy immediately after listing unless we are convinced about the business model or price.

| IPO Activity | Date |

| IPO Open Date | Aug 4, 2021 |

| IPO Close Date | Aug 6, 2021 |

| Basis of Allotment Date | Aug 11, 2021 |

| Refunds Initiation | Aug 12, 2021 |

| A credit of Shares to Demat Account | Aug 13, 2021 |

| IPO Listing Date | Aug 16, 2021 |

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 165 | ₹ 14,850 |

| Maximum | 13 | 2145 | ₹ 193,050 |

| Date | QIB | NII | Retail | Employee | Total |

| Aug 04, 2021 | 0.77x | 0.77x | 11.37x | 1.56x | 2.69x |

| Aug 05, 2021 | 1.32x | 6.68x | 23.16x | 3.12x | 6.73x |

| Aug 06, 2021 | 95.27x | 213.06x | 39.36x | 4.70x | 116.68x |

When will the Devyani International Limited IPO open?

Devyani International Limited IPO will open for subscription on Wednesday, August 4, and will close on Friday, August 6.

What is the price band of Devyani International Limited IPO?

The price band for Devyani International limited IPO is Rs. 86-90.

What is the lot size for Devyani International Limited IPO?

Retail investors can subscribe to the IPO minimum lot size is 165 shares, up to a maximum of 13 lots i.e. Rs. 1,93,050.

What is the issue size of Devyani International Limited IPO?

The total issue size is ~ Rs. 1,838 Cr.

What is the quota reserved for retail investors in Devyani International Limited IPO?

The quota for retail investors in Devyani International limited IPO is fixed at 10% of the net offer.

When will the basis of allotment be out?

Allotment will be finalized on August 11th and refunds will be initiated by August 12th. Shares allotment will be credited in Demat accounts by August 13th.

What is the listing date of Devyani International Limited IPO?

The tentative listing of Devyani International limited IPO is August 16th.

Where could we check the Devyani International Limited IPO allotment?

One can check the subscription status on Link Intime India Private Ltd.

Who are the leading book managers to the issue?

Kotak Mahindra Capital Company Ltd, CLSA India Pvt Ltd, Edelweiss Financial Services Ltd, and Motilal Oswal Investment Advisors Ltd are the book running lead managers for Devyani International Limited

What does Devyani International limited do?

Devyani International Limited is the largest franchisee of Yum Brands in India and is among the largest chain operators of quick-service restaurants (“QSR”) in India on a non-exclusive basis

Who are the peers of Devyani International limited?

Jubilant Foodworks, Burger King, and Westlife Developers (McDonald’s) are peers of Devyani International Limited.

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me PRO solution which provides you with exhaustive research-backed recommendations on strong companies, mutual funds, and index funds. You get all this for a price which can be as low as Rs. 4,999. The MoneyWorks4me PRO provides a guide to building a strong portfolio for beginners to become PRO.

Click here, for the Recent IPO complete list and IPO Historic data 2021.

If you liked what you read and would like to put it into practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Why MoneyWorks4me | Call: 020 6725 8333 | WhatsApp: 8055769463