Excerpts of the Annual Report:

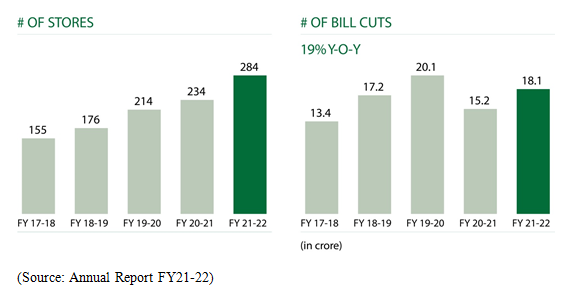

“DMart was conceived by value investor Mr. Radhakishan Damani in the year 2000, who at the time was operating a single store in Maharashtra. With a mission to be the lowest-priced retailer in its area of operation, DMart has grown steadily over the years and operates 284 stores in 10 States, 1 Union Territory, and NCR. The Company has delivered stable performance across stakeholder metrics by focusing on financial fundamentals, with fortitude and strong conviction.”

“Our fundamental business model thrives on the principle of doing more with less. Value retail is more supply chain than retail. Our ability to deliver good quality products in the most efficient manner and in a conducive work environment to our end consumer is the bedrock on which the business model was created and further strengthened.”

VISION and MISSION

“It is our continuous endeavor to investigate, identify and make available new products/categories for the customer’s everyday use and at the ‘best’ value than anybody else and to be the lowest priced retailer in the Action area of operation/city/region.”

PURPOSE

“Our purpose to deliver good products also means we make significant attempts to enhance the quality of products such that they have durability and long-lasting capability while also delivering great value to the shopper. Our view on quality is that it is relative to the evolution of the customer in that state or city. It is our constant attempt to nudge the customer to choose wisely, such that in the long term they get great value by choosing good-quality products.”

About Management:

MD & CEO:

Ignatius Navil Noronha: Joining Dmart in 2004 as Head of Business, Noronha holds a post-graduation degree in Marketing Management from Narsee Monjee Institute of Management Studies, Mumbai. He has over 20 years of experience in the consumer goods industry. Before joining Dmart, he had worked with Hindustan Unilever Limited for eight years.

Chairman & Independent Director:

Mr. Ramesh Damani: He holds a graduation degree in Commerce from H.R. College of Commerce and Economics from the University of Bombay. He holds a post-graduation degree in Business Administration, Marketing from California State University, Northridge. He has over 18 years of experience in the securities market.

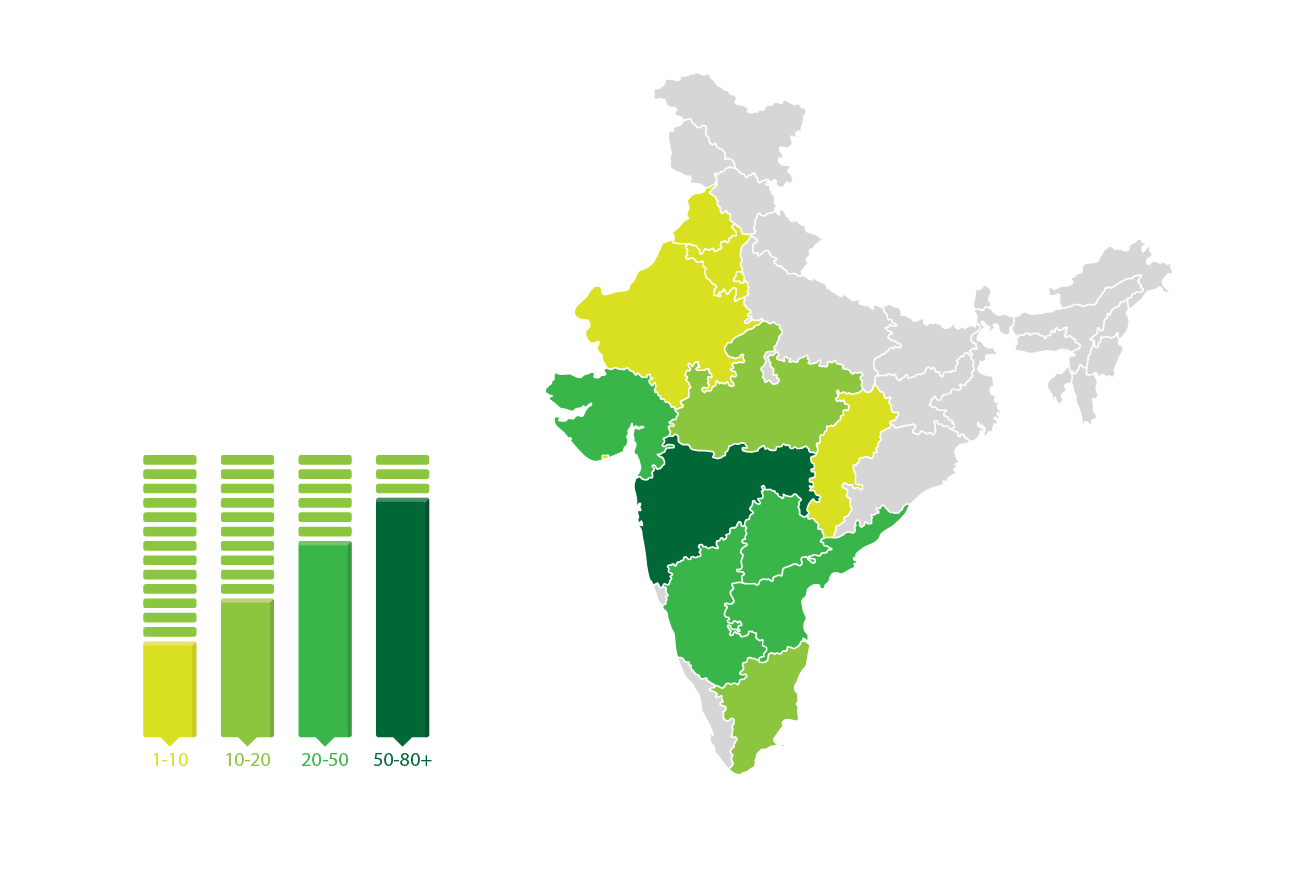

The state-wise density of D-mart Stores:

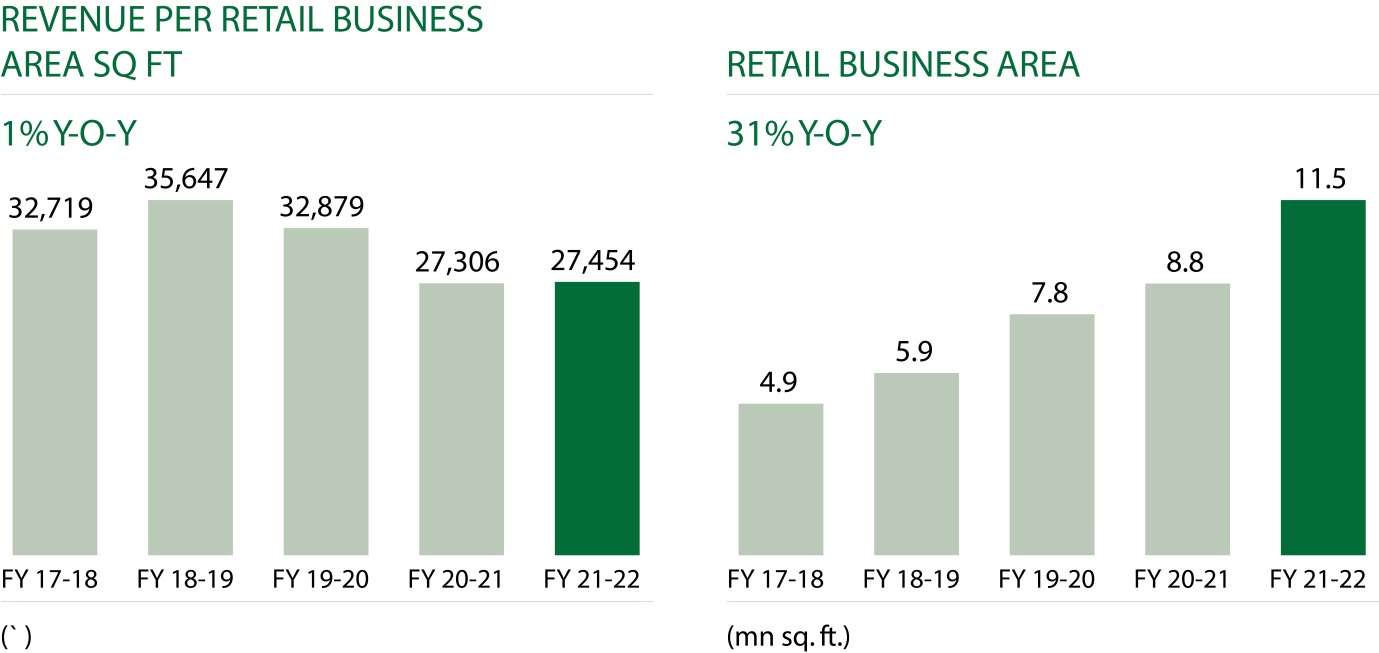

Key Performance Indicators:

Key Takeaways:

Avenue Supermarts Ltd., famously known as D-Mart has its name taken in every urban household today. This edge is received by being the lowest cost provider for the daily household needs of consumers. D-Mart owns most of its stores, unlike other chains. Thus, it is a consistently profitable retailer and has the best margins in the industry. The locations that D-mart chooses for their stores provide better accessibility to consumers which provides greater footfalls.

This financial year, the company opened 50 new stores. Revenue grew at 21% and 30% CAGR over the past 5 and 10 years respectively. This came with improved profitability of 26% and 38% CAGR. The top 2 states of Maharashtra & Gujarat account for 136 stores which are about 48% of the total stores. The top 5 states account for 77% of the same; this provides significant headroom for store openings in newer states.

The overall retail industry is estimated to have grown by 16-17% in FY 2021-22 and within this, the organized brick-and-mortar industry is estimated to have grown by 19-21% (Source: Crisil Research). Going ahead, even though normal growth can be expected in same-store sales, hyper-growth can be expected in new store openings. This on a blended level will bring the growth that is priced in the stock at this juncture.

Even though the company has been very successful in expansion plans and operations, there are still risks associated with scaling the business.

Below are some of the key risks and concerns in business as per the management:

- If the company is unable to continue to offer daily low prices pursuant to pricing strategy, it risks losing its distinct advantage and a substantial portion of customers, which will adversely affect the business, financial condition, and results of operations.

- Availability of commercially viable real estate properties at suitable locations for new stores.

- The continuous emergence of unorganized big local retailers and competitors like Reliance Retail might dent footfalls.

- The company’s inability to maintain an optimal level of inventory in stores may impact its operations adversely.

- Effective management of store expansions and operations in newer locations is a risk that will come with increasing size.

Best Stocks From:

Undervalued Nifty 50 Nifty 500 – Quality with Price Strength Screener Alpha Cases 5 Stars Rated Stocks from Nifty 500 Business Houses Group

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | Ebook | WhatsApp: 9860359463