Confidence is sometimes, all that matters. As uncertainty over the Indian economy and government policies grows, business confidence is falling. In fact, according to a survey in 2013, India’s business confidence is at 4 year low. The battered Indian economy grapples with record high current account deficit, weak rupee and slowest growth in decade.

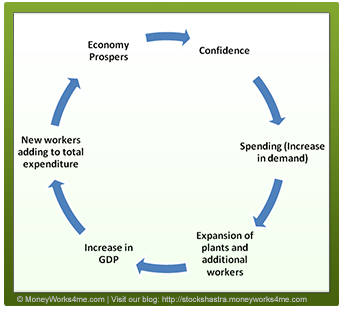

As shown in the diagram given above, confidence leads to spending, which eventually leads to expansion in the economy as reflected by rise in GDP, consequently strengthening its confidence. It is a circular, self-fulfilling prophesy. For example, if the price of an asset is widely expected to rise, it will result in its buying, ultimately pushing its prices higher. This shows how ‘confidence’ is self-fulfilling.

In Oak Tree Capital’s Howard Marks words, the confidence, which underlies economic gains and price increases only, has an impact as long as it exists. Once it dies, its effect turns out to be far from permanent.

We have tried to make a modest attempt to form the current view of the state of Indian economy by asking a series of questions. These questions probe our confidence in the economy as to how things will pan out in India, going forward the same way that Marks had done in his Investment Newsletter ‘The role of confidence’. While answering these questions, I came up to the conclusion that though short term and medium term perspectives is looking very bad from where we stand today, but here is the real wild card. When more things go bad, most likely is the self-correction in economy and politics. As a result, for now India’s long term outlook remains robust, unless we set ourselves in to this rut and never try and come out of it ever. In that case the fault would solely stand on – Us, the People of India, for failing the promises of our forefathers and for destroying the future of the next generations, by not becoming what we could have become.

In 2013, India surpassed Japan to become world’s third largest economy after US and China. However, India widely believed as an investment hub, is currently facing a big question mark.

Let’s see, if India has in itself?

In India:

- Will Indian central policies ever be active?

- Having always witnessed corrupt governments, will India ever be free from Scams?

- To what extent will the Red Tape for industries will increase?

- Witnessing the past political situations of India, how wrong would one be, to assume that post-election, if hung Parliament forms, it would not be able to sustain for more than 2-3 years, and, what are the chances that government failure will lead to a strong Government formation?

- With GDP figures dropping with each successive quarter, will Indian economy ever re-rate?

- India is seeing a low investment rate by the industry, with most Industrial Groups more keen on investing outside India than here, due to current political policy paralysis, increased red tapism and policy uncertainty. On the top of it, it is currently facing a risk of being graded as a low investment security if it does not get its act together soon. Will India stay quiet and see the game or work hard to push the economy?

- Will lacunae in India’s Industrial Investment Cycle ever be bridged?

Is there any ray of hope in current gloomy scenario?

- Though policies are not in action at the Centre, but many State Governments are quite active in implementing fast track local reforms and infrastructure projects. The issue, most likely, is weak leadership at the Centre.

- On the positive note, Central Government has already started huge project clearances. Surely, they won’t start immediately but how long the economy will take to realize the benefits from them?

- Inflation is still high but hasn’t anyone realized that WPI has come down from 10% in 2011 to 5-6% in 2013? With good monsoon in 2013, can’t India be assumed to have a good harvest? A good harvest can go a long way in correcting the inflation. Won’t this correction in inflation give RBI an opportunity to loosen its policy?

- How long will it take the investments to pick up, given the start of project clearances and RBI changing its policy stance to lower rates and more accommodative policy?

- India is certainly facing an economy slowdown. But, how far is it possible to downgrade the growth rate? Will it go to Hindu rate of growth of 2.5-3.5% as some Macro analysts are expecting?

- Even the most optimistic scenario today, paints that we are expected to grow at an average growth of 5-5.5%. Is it a matter of concern? Yes, certainly it is when the growth has tapered from a high of 8-9%. However, to what extent should we panic? Historically, how many economies in the world have been able to sustain such a high growth of 8-9%? Is the recent panic in economy just because of high expectations?

- What are the chances that the hung Parliament, in order to remain in power, will take strong decision that would have never been taken in normal situations (relaxing tax norms, disinvestment to attract investors etc.)? That may well turn out to be the joker in the pack.

And the last one, what if, all these dire economic condition results in a sharp political correction, leading to an election of a strong, reform oriented Government? With expectations so low, even an average performing Government should lead to more buoyant expectations from us in future.

Marks has pointed out the followings and, in fact, he warns that he doesn’t remember when his list of ‘uncertainties’ became this long…

In the U.S.:

- Will the recovery from the recession of 2008 ever gain vitality? Today it seems they are experiencing “two steps forward, one step back”, as even positive reports are regularly mixed with disappointments.

- How long will the Fed keep interest rates low? Three months? Three years?? In perpetuity??? What will happen when it doesn’t,? Will rates rise? If yes, then how much? Will the effect of higher rates on the cost of financing purchases and investments be enough to slow the economy? What will be the impact of higher rates on the government’s cost of financing, and thus, on the deficit?

- What are the implications of the fact that the Fed’s balance sheet has swelled to over $ 3 trillion? How does the Fed pay for the bonds, it buys under QE? Will it have to pay that money back? Where will it get the money? And where will the money go?

- Will US economy ever get back to the higher growth rates of the late twentieth century, or will it be stuck in a slow-growth mode?

- What will be the social ramifications of slow growth, high unemployment and increased income disparity?

- Will the U.S. devalue the dollar, the usual path to dealing with excessive national debt?

- Will slow growth lead to Japan-style deflation? Or will high-volume money printing to repay the debt lead to chronic inflation?

The mere fact that intelligent people worry, simultaneously about both these polar opposites, is, in itself, an indicator of the high level of uncertainty that’s present.

In Europe:

- Can the seemingly downward spiral in peripheral Europe’s economies be arrested?

- Can Europe’s excessive indebtedness be brought down? Can the chronic deficits, which led to such high levels of indebtedness, be trimmed through austerity?

- Will richer nations continue to support poorer, without insisting on the latter applying painful austerity?

- Won’t voters demand isolationism in the richer nations and relief from the pain of austerity in the poorer nations? Will elected leaders, offering anything else, not be ousted?

- Will the European nations prefer entrusting power to a central body over economies and financial institutions, required for an effective economic union?

- Will the EU remain intact? Is a political union, in which actions require unanimous support, practical? Can governance and coordination be further improved?

Regarding Leadership:

- Are there leaders – anywhere in the world – of the calibre we need, to sail us through these uncertain times?

- Will the successors to Geithner and Bernanke prove up to the task of continuing the recovery while weaning the economy from ultra-low interest rates?

- Is it conceivable that America’s elected leaders will create an environment, in which uncertainty over taxation, regulation and healthcare costs no longer discourages businesses from investing in plants and personnel

Miscellany:

- Will China’s credit-abetted economy experience a hard landing or a soft one?

- If China’s growth slows, what will be the effect on nations, such as Brazil, Australia and Canada that have prospered by supplying it with commodities? What will happen to commodity prices?

- Will fracking allow the U.S. to achieve energy self-sufficiency? If so, what will that do to its manufacturing competitiveness and to the price of oil? Will that help oil importing countries like India?

- What will happen in hot spots such as the Middle East, Iran and North Korea, especially if US is no more dependent on importing Oil from the Gulf?

Marks has noticed that uncertainty has become a certainty in the current investing market. It discourages optimism regarding the future and limits investors’ certainty that the future is knowable and controllable. In other words, it saps confidence.

In essence then the current volatility in Indian markets, thus, can be better understood when one looks at uncertainty prevalent in the Economic and Political environment. This uncertainty is what, is sapping confidence of market participants.

We have tried to make a modest attempt to form the current view of the state of Indian economy by asking a series of questions. These questions probe our confidence in the economy as to how things will pan out in India, going forward the same way that Marks had done in his Investment Newsletter ‘The role of confidence’.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

everything is sentiment driven. no fundamentals and no technicals work, only sentiments do – the way huge volatility seen last wk.

You are partially correct Stock market moves thru various phases as u mentioned is one of the phase where in no technical & fundamental really works but it is very small phase. Long Term Investors are least botherd about this, as they are confident.