Excerpts from the FY22 Equitas Small Finance Bank Annual report-

“We target to achieve sustainable growth, above the industry average, by continuing to tap into the fast-transforming informal economy, that remains largely unbanked or under banked, even today.”

“We are also entering win-win partnerships to adopt disruptive technologies developed by fintechs, while extending them the trust and scale enjoyed by a robust banking franchise.”

“It would not be an overstatement to say that the Bank has weathered well the pounding of the three waves of the pandemic and its massive ripple effects. I believe we now have a Bank whose foundation is strong and will get stronger as it grows.”

“We are building on our digital assets to create exciting new product and monetisation opportunities – scaling segment-specific ecosystems in the small/ micro merchant space as well as in third-party products such as insurance and wealth management. Further, it enables us to enter new product segments such as Personal Loans, among others.” Source: FY22 Annual Report

Business Performance:

Total Income: Rs 2,577 Cr (16.29% growth)

Gross NPA: 4.06% (3.59% in FY21)

Net Profit: Rs 281 Cr (26.8% decline)

Total Customers: 56.8 Lakh (added 17.8 lakh, new customers)

Branches & ATMs: 861 & 339 respectively

Equitas Small Finance Bank’s Advances stood at Rs. 20,597 Cr for the FY22, registering a growth of 14.9% on yearly basis. Bank’s Net Interest Income was at Rs. 2,039 Cr for FY22, improving by 13.4%.

Savings Account Deposits grew by 78.32% to Rs.9,083 Cr while Current Account Deposits grew by 48.47% to Rs.772 Cr. Term Deposits stood at Rs.9,095 Cr declined by 15.62%.

CASA Deposits accounted for 52.01% of Total Deposits.

Cost of funds improved by 0.76% to 6.58% (7.34% in FY21).

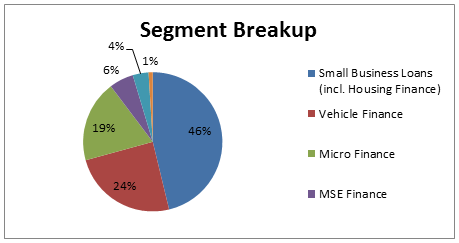

Healthy loan mix:

Small Business Loans (including Housing Finance) grew by 19.46% to 9,521.91 Cr.

Vehicle Finance grew by 11.41% to Rs. 5,046.97 Cr.

Micro Finance grew by 20.7.4% to Rs. 3,906.81 Cr.

MSE Finance (Working Capital) declined by 1.36% to Rs. 1,163.94 Cr.

Equitas SFB has improved the secured portion of the loan book to 81.3% in FY22.

Highlights & Future Prospects from Management:

Credit demand

Small Finance Bank (SFB) servicing underserved and unserved populations (including individuals and small businesses) since operating as NBFCs from the beginning, SFBs have carved a niche in financing the low-Income self-employed segment. An addressable credit gap of Rs. 25.8 Trillion in the MSME space provides an untapped opportunity for SFB to grow in the small ticket segment. Despite of large contribution of 47% of GDP, the rural segment’s share in credit remains fairly low at ~9-10% of the overall credit outstanding.

Formalisation of Credit

Informal credit channels have a major presence throughout the country. SFB with a requirement to open 25% of branches in unbanked rural geographies have the opportunity to expand in this vertical. Demand supply mismatch in lower income and ticket size allows SFB to grow, along with loan recovery experience & collection personnel. This allows SFB to forge a niche in lower ticket credit formalization in unbanked regions.

Growth momentum in loan book

Management guided positive growth in used commercial vehicles (CV) in the Vehicle finance segment, which had been on the decline due to covid. Small Business loan segment growth to remain robust due to demand-supply mismatch, higher share from smaller cities, and rising credit to new customers. Micro Finance portion of the loan book is to be capped at 15%, the bank will follow a cautious approach in this lending segment.

Asset Quality stabilising

The second wave of the pandemic dealt a strong blow to economic activities in the 1st quarter of FY22 and the absence of a moratorium available led to a surge in a restructured book. This has been stabilising with High-risk restructured loans at 0.18% of Gross Advances, and no further stress in asset quality is expected.

Improving the cost of borrowings

With improving operating leverage and declining cost funds, Equitas SFB will foray into newer segments while expanding offerings in the existing base. SFB will be able to move the cost of funds to universal banks.

Growth in Deposits

SFBs deposits are to grow by 40-45% till FY24, with a focus on popularising convenient banking habits to cover the last mile and by deepening penetration in untapped geographies. While Bank through its Fintech partnership (Niyo, Freo) is moving towards improving deposits while providing reliable banking franchise.

Risks

Bank focused on strengthening its risk management framework and stress testing its risk profile & capital position for extreme scenarios. Bank has improved its capital adequacy ratio (CRAR) at 25.16% (vs. 24.18% in FY21).

Annual Reports is a very elaborate document and shares a lot of information; at times doesn’t necessarily help to form an opinion about a company or its potential. We carve out only important information about the company’s strategy and future prospects for your benefit.

Best Stocks From:

Undervalued Nifty 50 Nifty 500 – Quality with Price Strength Screener Alpha Cases 5 Stars Rated Stocks from Nifty 500 Business Houses Group

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | Ebook | WhatsApp: 9860359463