Ravi, 34, plans to quit his job and start his own business

Ravi, 34, has worked as a consultant for almost 10 years now, while his wife, Rohini, works in a bank. They have a 5 year old son Rewansh. They started saving with vigor once their son was born. Together they have managed to put aside 10 lacs for retirement through PF, PPF, etc and have another 15 lacs mainly in fixed deposits.

Thankfully their future expenses do not include saving for their parents. Both, Ravi and Rohini’s parents have their own house. Having lived a life driven by the need for security, both their parents have worked in secure jobs their whole life and retired peacefully. Ravi, however, doesn’t want this to be his story too.

He wishes to retire at 45 and if possible earlier, to start his own food related business. Ravi is an excellent and passionate cook. His wife has been very supportive of the idea and plans to continue working until Ravi’s venture takes off. In fact, Rohini also supported Ravi’s idea of living in a rented apartment to help them save aggressively for this.

Ravi also wants to go on a month long world tour with Rohini and Rewansh, before starting his venture. Ravi found the MoneyWorks4me Financial Planning Tool, FPT and quickly realised that he could build a concrete plan with ease.

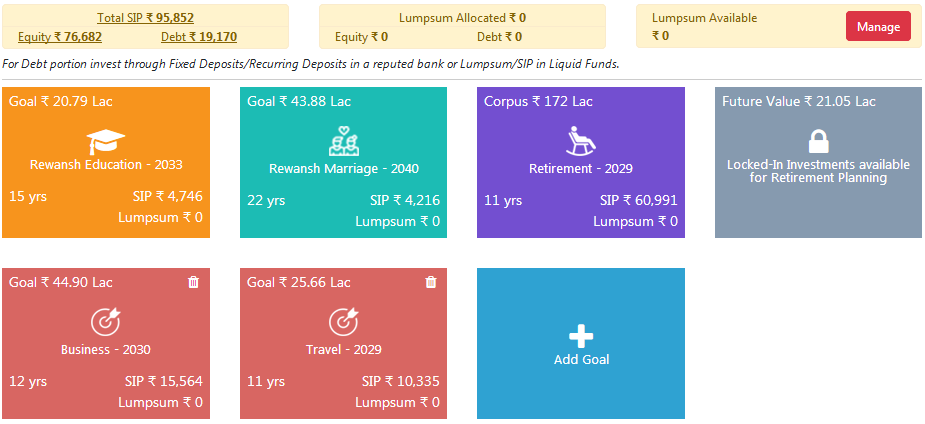

After filling the details and adjusting the expense estimates for his specific plans, his initial financial plan looks like this:

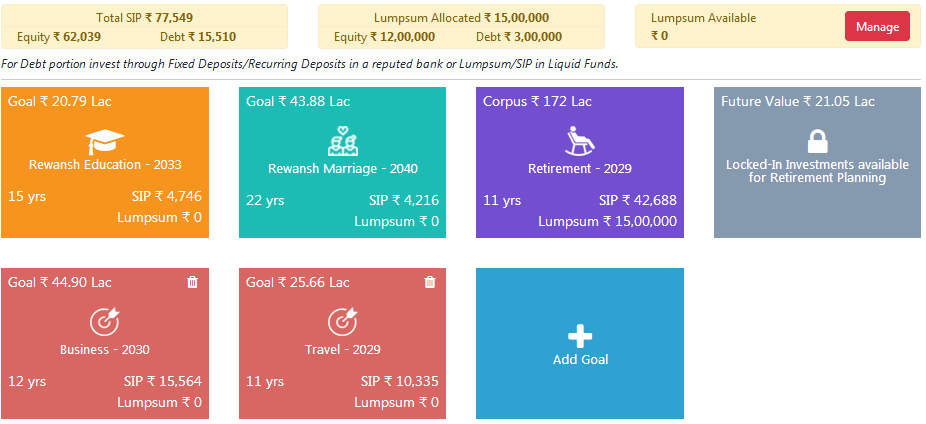

Ravi and his spouse together earned close to 1.3 lacs p.m. They ended up spending almost Rs 60000 in all the household expenses, rent, Rewansh’s education and extracurricular activities and the family’s outings. Saving 92000 seemed impossible; the best they could manage was more like Rs 70000. He then saw the he had not yet deployed his lumpsum saving. After deploying it he saw his plan as follows:

This brought his SIP down to almost Rs 77500. This would still be a stretch.

Not sure on how to provide for the shortfall, Ravi decided to share the plan with Rohini who was pretty good at these things. She pointed out that he had under planned for Rewansh’s education. What if he wanted to go abroad for higher studies? Ravi argued that an education loan could be taken. Rohini felt that a loan was an option but it would not be a very good one if his business venture was still struggling. She also pointed out that he had under-estimated what would be required to start his business. Ravi agreed.

All this clearly pointed to a larger amount of saving which he was not sure how they could manage. Rohini then pointed out that the plan provided for their entire expense post retirement. This would not be required because she planned to work when he started the business. So there was some room to increase the amount required for the business.

Rohini then asked with a mischievous look in her eyes “Are we planning never to buy a house? “. Ravi asked “what do you have in mind. Can we afford to?”

Rohini turned the computer on which Ravi was working and said, why don’t you make a cup of tea for both of us and let me see if this tool helps me think of a way.

Ravi disappeared into the kitchen where he was more comfortable than trying to build a more robust financial plan. Rohini added a goal – ‘House’. She thought for a moment, what is the right time to buy a house? They currently paid a rent of about 20000 pm which could be paid as an EMI as well. That would pay the EMI for a loan of about 20 lacs for 20 years. A decent house would cost around 50 lacs. She entered the amount. Then out of a whim she thought- what would we need to do if we wanted the house one year from now. She did a quick back of the envelop calculation. They had 15 lacs saved which could be used for down payment. They would take a 35 to 40 lac loan which would mean 35K EMI from the loan she would take from her bank. They would save 20K from rent so an additional 15K as expenses.

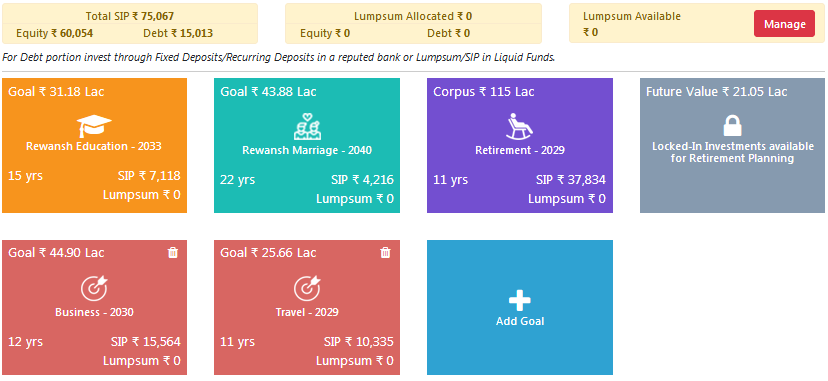

She edited Ravi’s profile and brought the lumpsum saving to zero. She reduced the monthly expenses for retirement planning to Rs 30000 and increased Rewansh’s education current expenses estimate by 5 lacs. She then looked at the new plan. The monthly SIP required was 75K. This would be a stretch considering the current monthly saving possible after paying the EMI on the planned house.

However, they both would get an increment by then and they would have to compromise on their current lifestyle, well not much if she put her mind to it.

Ravi walked in with two cups of tea and saw a smug look on Rohini’s face. “What mischief are you up to?”

“We are going to buy a house within the next 12 months”

“What! Have you gone off your rockers? “

“No. It’s just good planning”

Rohini explained the changes she had made. Ravi was surprised that it was possible.

“It looks good. I never thought we could afford a house if I quit my job early. But it means you would have to work for the next 20 years”

“Yes. But that is what I am currently planning anyway. And buying a house means we will have one less expense when we retire, so essentially we need a smaller retirement corpus”

“That’s pretty awesome. Yes, this plan is very smart indeed”

“Yes. Frankly, I was surprised too. I wasn’t planning on us buying a house, but looking at the plan you made, I had a feeling we could pull it off without killing ourselves or sacrificing our dreams”

“How do you implement this plan?”

Both Ravi and Rohini looked at the Moneyworks4me FPT and found that all they had to do was click on the Monthly SIP tab to find the answer

Half an hour later they had all the answers they needed. They both felt they deserved to celebrate.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463