Glenmark Life Sciences Details:

IPO Date: July 27th to July 29th, 2021

Total Shares for subscription: ~2 Cr

IPO Size: ~Rs. 1,500 Cr

Lot Size: 20 shares

Price Band: Rs. 695-720/ share

Market Capitalization: ~8,800 Cr

Recommendation: Subscribe for risk takers

About Glenmark Life Sciences Limited

Glenmark Life Sciences Limited (“GLS”) is a Rs. 2,000 Cr developer and manufacturer of select active pharmaceutical ingredients (“APIs”) in chronic therapeutic areas. It is a subsidiary of Glenmark Pharmaceuticals.

Predominantly it manufactures cardiovascular disease (“CVS”), central nervous system disease (“CNS”), pain management, and diabetes. Almost 45% comes from the CVS segment.

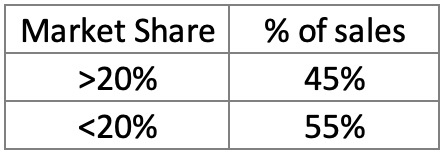

The API portfolio comprises specialized and profitable products, including niche and technically complex molecules, which reflects their capability to branch into other high-value products. Glenmark Life Sciences has a strong market share in select specialized APIs such as Telmisartan (anti-hypertensive), Atovaquone (anti-parasitic), Perindopril (anti-hypertensive), Teneligliptin (diabetes), Zonisamide (CNS), and Adapalene (dermatology). Almost 45% of total sales come from products with more than 20% market share. This ensures a higher margin from economies of scale and a relatively high barrier to entry from the competition.

They are also increasingly providing contract development and manufacturing operations (“CDMO”) services to a range of multinational and specialty pharmaceutical companies. Currently contributes 8% of total sales.

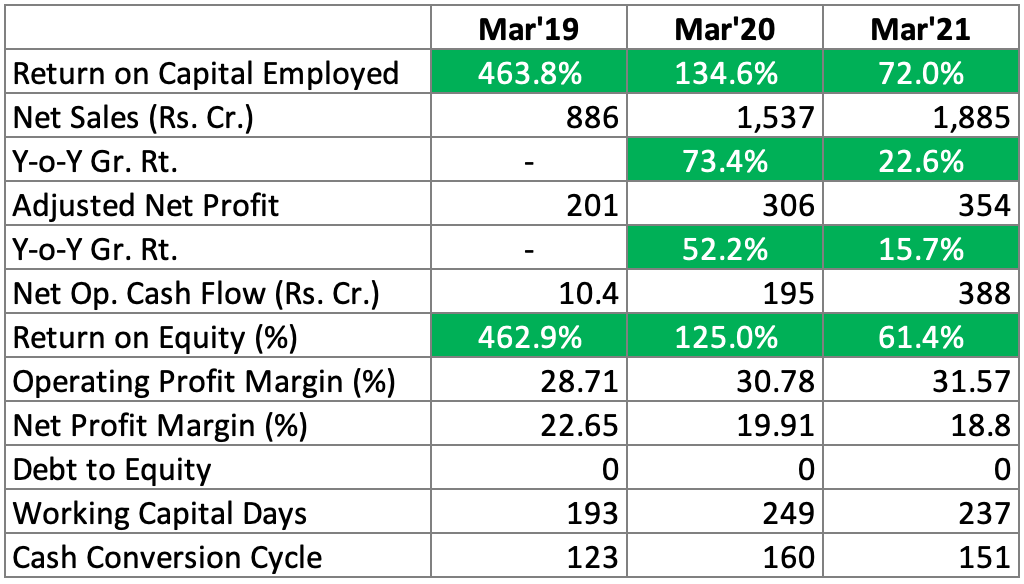

Financials of Glenmark Life Sciences Ltd:

Glenmark Life Sciences has sales of Rs. 1,885 Cr and net profit of Rs. 354 Cr. Since it was recently demerged from the parent company into a wholly-owned subsidiary, the company did not report a long-term track record of only the API segment.

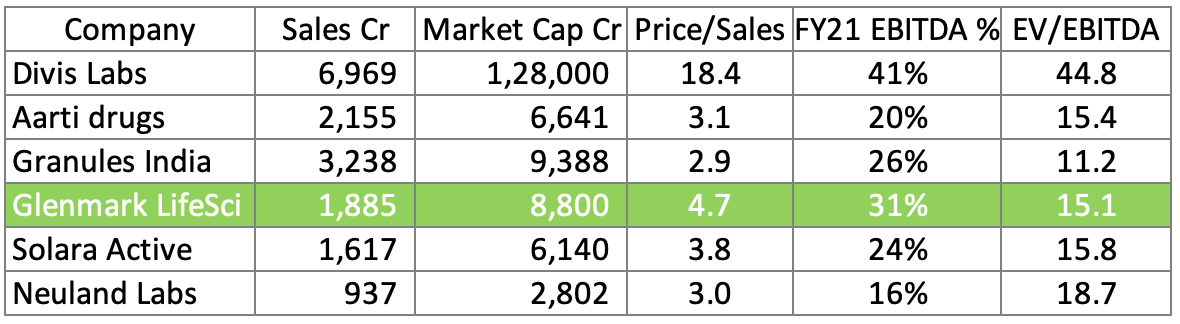

If we compare with all predominantly API companies, Glenmark Life Sciences size is in the middle range with API business earning above-average operating margin. We believe the tall ask for Price/Sales is in line with better profitability. We believe that part of the profitability is sustainable as 45% of the sales come from API with a high market share, giving it economies of scale to sustain and fight competition.

Management

Yasir Rawjee: He leads the overall operations of Glenmark Life Sciences and is the Chief Executive Officer business strategy of the Company. He holds a bachelor’s degree in science from St. Xavier’s College, University of Bombay, and a bachelor’s degree in science (technology) from the University Department of Chemical Technology, University of Bombay. He also holds a Ph.D. from Texas A&M University, U.S.A. Prior to joining Glenmark Life Sciences, he was the head of global API operations at Mylan Laboratories Limited. He was also the senior vice president at Matrix Laboratories Limited and has worked in GlaxoSmithKline in the USA.

Glenn Saldanha: He holds a bachelor’s degree in pharmaceutical sciences from the University of Bombay. He also holds a master’s degree in business administration from the Leonard N. Stern School of Business at New York University. He is also the chairman and managing director of Promoter, Glenmark Pharmaceuticals Limited.

Positives:

- Profitable track record from large scale and first movers in select drugs

- A high market share in few drugs can maintain profitability.

Risks:

- If USFDA finds out any violations in the manufacturing process, it can have an impact on sales till it resolves all the concerns

- While a high market share in few drugs is sticky, the rest of the drugs can face huge competition as API are inherently commoditized with no barrier to entry.

MoneyWorks4me Opinion

How is the business model? Great, Good, or Gruesome?

Good. Manufacturing of pharmaceuticals in India, either ingredients or formulations is a very profitable business model. A few of the reasons for bright future prospects are low cost of operations, limited regulations with respect to environmental and large addressable market like US and other developed markets where drugs go off-patent inviting competition from generics drugs.

Glenmark Life Sciences has a large share of revenue coming in from few key therapies like CVS and CNS. It has managed to maintain a high market share in the same. Since one or two large manufacturers exist in a particular API, a new competition will be reluctant to enter as they won’t be able to compete with incumbents’ scale of operations and lower cost.

Valuation – High risk, high return?

While API manufacturing has its positives, it can’t sustainably have very high profitability as it can attract competition. All API companies are producing very commoditized drugs which can be replicated by new entrants. High profitability attracts more competition, this keeps profitability in check.

While valuing such companies we assume moderate ROE and adjust growth rate to reflect current capacity expansion and order book.

The current valuation of EV/EBITDA of 15x puts it in a reasonable range but trailing EBITDA margins are higher versus past. We believe as the supply issues from China or elsewhere resolve, the margins will come off to a steady-state of the mid-20s, implying EV/EBITDA of 19x which is quite fully priced.

Given the current scenario of better demand for Indian API as the developed market diversifies away from China, API manufacturing can enjoy better growth prospects and hence remain a market favorite.

We recommend BUY for listing gains; we would wait for a margin of safety on the purchase price to buy companies in this space. We have invested in many pharma companies all through 2018-19-20 as they offered good future prospects and enough margin of safety. Today, the prices are quite elevated.

Higher risk takers can invest for long term too.

| IPO Activity | Date |

| IPO Open Date | Jul 27, 2021 |

| IPO Close Date | Jul 29, 2021 |

| Basis of Allotment Date | Aug 3, 2021 |

| Refunds Initiation | Aug 4, 2021 |

| A credit of Shares to Demat Account | Aug 5, 2021 |

| IPO Listing Date | Aug 6, 2021 |

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 20 | ₹ 14,400 |

| Maximum | 13 | 260 | ₹ 187,200 |

| Date | QIB | NII | Retail | Total |

| Jul 27, 2021 | 0.00x | 0.86x | 5.17x | 2.78x |

| Jul 28, 2021 | 1.38x | 3.39x | 9.28x | 5.78x |

| Jul 29, 2021 | 36.97x | 122.54x | 14.63x | 44.17x |

When will the Glenmark Life Sciences Limited IPO open?

Glenmark Life Sciences limited IPO will open for subscription on Tuesday, July 27, and will close on Thursday, July 29.

What is the price band of Glenmark Life Sciences Limited IPO?

The price band for Glenmark Life Sciences limited IPO is Rs. 695-720.

What is the lot size for Glenmark Life Sciences Limited IPO?

Retail investors can subscribe to the IPO minimum lot size is 20 shares, up to a maximum of 13 lots i.e. Rs. 1,87,200.

What is the issue size of Glenmark Life Sciences Limited IPO?

The total issue size is ~ Rs. 1,500 Cr.

What is the quota reserved for retail investors in Glenmark Life Sciences Limited IPO?

The quota for retail investors in Glenmark Life Sciences limited IPO is fixed at 35% of the net offer.

When will the basis of allotment be out?

Allotment will be finalized on August 3rd and refunds will be initiated by August 4th. Shares allotment will be credited in Demat accounts by August 5th.

What is the listing date of Glenmark LifeSciences Limited IPO?

The tentative listing of Glenmark Life Sciences limited IPO is August 6th.

Where could we check the Glenmark Life Sciences Limited IPO allotment?

One can check the subscription status on KFintech Private Limited.

Who are the leading book managers to the issue?

DAM Capital Advisors (Formerly known as IDFC Securities), BOB Capital Markets, and SBI Capital Markets are the books running lead managers to the issue

What does Glenmark Life Sciences limited do?

Glenmark Life Sciences is into the manufacturing ingredients (APIs) for large innovator and generics companies in the pharmaceuticals sector. A large portion of sales comes from drugs in Cardiovascular and central nervous systems therapy areas.

Who are the peers of Glenmark Life Sciences limited?

Divis, Granules, Laurus, Aarti Drugs are some of the peers. We have compared them with Glenmark Life Sciences under the financials section.

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me PRO solution which provides you with exhaustive research-backed recommendations on strong companies, mutual funds, and index funds. You get all this for a price which can be as low as Rs. 4,999. The MoneyWorks4me PRO provides a guide to building a strong portfolio for beginners to become PRO.

Click here, for the Recent IPO complete list and IPO Historic data 2021.

If you liked what you read and would like to put it into practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Why MoneyWorks4me | Call: 020 6725 8333 | WhatsApp: 8055769463