Hanung Toys and Textiles Ltd. – Should you invest in this stock?

Company Highlights

Hanung Toys and Textiles Ltd – India’s largest manufacturer and exporter of soft toys and home furnishings

Market View of Hanung Toys and Textiles Stock Price (16th June’11):

Latest Stock Price: Rs. 156.05

Latest Market Cap.: Rs. 393.08 Cr. (Small-cap stock)

52 Week High Price: Rs. 414.30

52 Week Low Price: Rs. 154.25

Latest P/E: 3.25

Latest P/BV: 0.77

Tell me more about Hanung Toys and Textiles…

Hanung Toys & Textiles Ltd. is engaged in the manufacturing of Stuffed Toys/Plush Toys and Home Furnishings. It is regarded as India`s largest manufacturer and exporter of Soft Toys Decorative Cushions and Children`s Room Furnishings. It is the licensee of Walt Disney characters for soft toys in India. The company owns ‘Play-n-Pets’ and ‘Muskan’ brands in stuffed toys and ‘Splash’ in Home Furnishings.

Hanung gets around 75% of its revenues from overseas markets (Europe, USA, Latin America and Australia) while the remaining 25% comes from the domestic market. It caters to more than 100 distributors for the stuffed toys under the brand ‘Play-n-Pets’ and ‘Muskan’ across the country, including multi-brand outlets like Lifestyle, Shopper’s Stop, Westside, Big Bazaar (Pantaloon group), Pyramid, Globus, Landmark and all other leading stores. Its overseas clients include IKEA (Sweden), Debenhams (UK), Wal-Mart ASDA (UK), Metro Group (Germany/Italy) and Marko Group (Poland). It was incorporated in 1990 and went public in 2006.

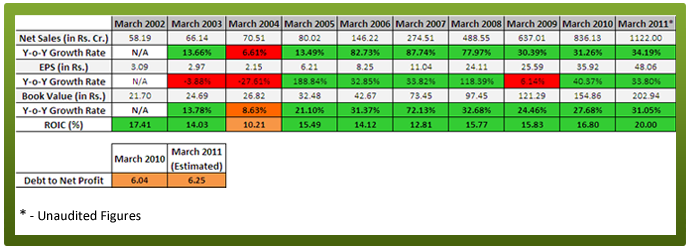

How has the financial performance of Hanung Toys been? Here’s the review

As seen above, the financial performance of Hanung Toys and Textiles has been very good over the past 10 years. Net Sales has consistently grown at rates well above our benchmark of 12%. The company has registered a CAGR of close to 39% over the last 10 years increasing its Net Sales from Rs. 58 Cr. in FY 2002 to Rs. 1122 Cr. in FY 2011.

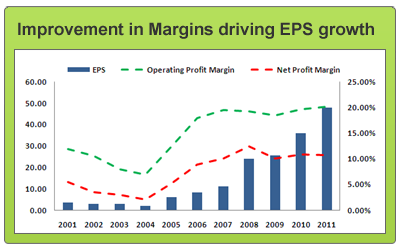

Hanung’s operating profit margins have been close to 19% on an average over the last 6 years whereas Net Profit margin 6 year average stands at 10.5%. Margins have shown considerable improvement since 2005 which has enabled the company to maintain good profitability levels leading to considerable growth in EPS with a 9 Year CAGR of 35.6%. In FY2009 the EPS growth was a bit sluggish mainly due to higher interest costs and depreciation.

The BVPS has also grown considerably at a CAGR of 28.2% (9 Yr.). The 6 year average Return on Invested Capital is close to 15%.

High debt on books, a concern:

A point of concern for the company is the Debt to Net Profit ratio of 6.04 (for FY 2010) which is higher than our benchmark of 3. As of March 2010, the company had Rs. 546.7 Cr. debt on its books. This figure increased to Rs. 754.3 Cr. as of September 2010. For FY 2011, we estimate the Debt to Net Profit ratio to be close to 6.25.

Around 70% of the total debt taken by the company in FY 2010 is for working capital requirements which indicates that the company is working capital intensive. Further, the company has reported that it is looking to expand its capacity and has tied up Rs. 550 Cr. with its bankers for the same. Thus going ahead the debt level could increase further.

Thus, considering this, we can say that the 10 YEAR X-RAY of Hanung Toys is Orange (‘Somewhat Good’).

What can we expect in the future? Here is the fundamental analysis of Hanung Toys

In the short term:

Latest quarterly results – Drop in profits despite good growth in sales:

The latest quarterly results have not been very good for the company. For the March 2011 quarter, Net Sales registered a healthy growth of 17.2% to grow to Rs. 318 Cr. from Rs. 271.5 Cr. in March 2010. However, this growth was not passed to the Net Profits which registered a drop of 2.9% to Rs. 32.3 Cr. from Rs. 33.28 Cr. in March 2010. The major reason for this was the interest cost (as a result of higher debt) which jumped by 46% to Rs. 22.6 Cr. from Rs. 15.48 Cr. in March 2010.

Expansion plans for FY 2012-13:

Hanung has planned for capacity expansion worth Rs. 720 Cr. for FY 2012-13. The capex program has already begun in 2011 and the remaining expansion will be done in the next 18 months. This will help the company in increasing its toy capacities, production capacities in weaving, dyeing, painting and made-ups. Hanung is going in for backward-integration by putting up a spinning unit with 1 Lakh spindles which will help it reduce its raw material cost.

Of the Rs. 720 Cr. required for expansion, Hanung has already received a sanction of Rs. 550 Cr. from its bankers. The remaining amount will be funded by the company from its internal accruals. The company expects that on completion of capex over two years, its sales will exceed Rs. 2,000 Cr. and its textiles EBITDA will improve by 7 to 8%.

Acquisition of Cody Direct Corp. expected to improve margins from exports:

In the U.S markets, wholesalers act as middlemen and secure orders from major retail chains and distribute it amongst suppliers. Over the years, Hanung has developed good relations with many wholesalers. Now, that the company has established a reputation for itself, it is now looking at entering the U.S. market aggressively by acquiring a wholesaler. Accordingly, it has acquired a controlling stake in a U.S. company M/s. Cody Direct Corp. – an 18 years Home Furnishing ‘Marketing and Distribution’ Company based out of New York. The acquisition fits in well with the company’s business and its growth strategy. It is expected to enable Hanung to service the North American market directly and help improve its operating profit margins further.

Going ahead, the higher interest costs may depress the profitability of the company until the additional capacity becomes operational. Hence, we expect the Short Term Future Prospects of the company to be Orange (“Somewhat Good”)

In the long term:

Indian Toy Market poised for robust growth:

The Indian Toy market which currently stands at ~Rs. 6000 Cr. is expected to grow at 20-30% CAGR for the next few years. A major portion of the market is dominated by the unorganised sector. However, with increasing disposable incomes, the organized players with established brands have been increasing their share steadily. The industry growth will be driven by factors such as increasing disposable incomes, increasing spend on toys, increasing demand for safe toys, rise in nuclear families and increasing trend of gifting toys.

Hanung’s business model:

Majority of Hanung’s revenues are derived from exports. The company gets into long term contracts (usually 2-3 years) with its buyers. For example: In 2010 it signed export order tie-up with a leading US buyer for exporting home furnishing to the extent of $ 60 million to be completed by December 2012.

This is not a standard practice in the textile industry, as international retailers tend to alter their sourcing plans based on changing fashions. However, Hanung has managed to build good relations with wholesalers and a reputation for quality products which enables it to get into long term contracts. In the backdrop of concerns of a slowdown in US imports, the long-term nature of the contracts provides greater visibility to Hanung’s revenue stream. At present, the company has a healthy order book of around Rs. 1500 Cr. distributed evenly between toys & textiles of which major part is from long term orders, which are executable over a period of 2.5 years. Geographically, the orders have been directed equally towards US & UK. With its recent acquisition of Cody Inc. it can service its North American customers directly which will help it to improve its operating margins.

Expanding retail presence:

Hanung is looking to expand its retail presence through the brand name FUNLAND. It is planning to open about 400 stores including up to 150 Company Owned Franchisee Operated (COFO) stores and balance as Franchisee Owned Franchisee Operated (FOFO) stores in the next three to four years. These stores will have traditional toys including soft toys, educational toys, electronic gaming and sports accessories. This effort from Hanung to increase its geographical presence and widen its distribution network is expected to increase sales from retail stores in the coming years.

Tax exemption benefits:

Hanung`s production units consist of toys manufacturing facility, home furnishing production facility and textile processing facility located at Noida, Roorkee & Bhiwandi. It’s toys manufacturing units is established in the Noida Special Economic Zone (NSEZ) wherein it gets the benefits of duty free imports and single window clearance for imports/exports. Company`s new production units in Roorkee and NSEZ also enjoy 100% tax holiday for first five years.

So, are there any concerns?

• High Debt on books: As on September, 2010 Hanung had ~Rs. 754 Cr. of debt on its books. We estimate the Debt-to-Net Profit ratio for the company to be close to 6.25 for the year ended March 2011 which is quite high. Around 70% of the total debt of the company has been taken as Working Capital Advances which indicates that the company’s working capital requirement is quite high.

• High working capital as a result of high inventory: The high working capital requirement of the company is a result of high inventory on the books. Inventory turnover days as of March 2010 stood at close to 180 days. This high number is largely due to high raw material inventory which seems to be as a result of its long term contracts. Thus, going ahead as its revenues grow, the company’s working capital requirements may further go up and strain its balance sheet.

• Threat of competition: Competition from Chinese companies and unorganized sector is a concern for the company. There have been safety concerns about toys from Chinese companies which have led to more stringent quality checks for toys.

• Dependence on exports: As the company gets substantial revenues from exports, the company faces the risk of fluctuations in exchange rates.

With aggressive expansion plans, improving margins & increasing focus on capturing the retail market, Hanung Toys and Textiles Ltd. is well placed to capitalize on the growing market opportunities. We can say that the Long Term Future Prospects for the company are Green (Very Good).

So, should you invest in Hanung Toys and Textiles Ltd.?

A strong order book, increased capacity utilization and strong growth prospects augur well for Hanung Toy’s and Textiles future and the company is expected to record robust growth in the coming years. With good growth prospects, Hanung Toys and Textiles Ltd. is well placed to record robust growth in the coming years.

Yes, Hanung Toys Ltd. is an investment worthy company, but only at the right price. With a market capitalisation of ~Rs.400 Cr., Hanung Toys and Textiles Ltd. is a small-cap stock. Small cap stocks offer greater potential returns albeit at higher risk and volatility.

Currently, its stock price is at Rs. 165 (as on 7th June’ 2011). But, does this price offer an attractive discount to its right value (MRP) or is it over-priced? It is always best to invest at an attractive discount to its MRP, to get maximum returns at minimum risk. Become a member of MoneyWorks4me.com to know its sensible buy- price and hence take the right action for this company.

Disclaimer: This publication has been prepared solely for information purpose and does not constitute a solicitation to any person to buy or sell a security. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations or needs of an individual client or a corporate/s or any entity/ies. The person should use his/her own judgment while taking investment decisions.