Hindalco Industries Ltd. – Should you invest in this aluminium stock?

Hindalco Industries Ltd. – Company Highlights

Hindalco – Largest Aluminium producer in India

Market View of Hindalco Industries Stock Price (5th May’11):

Latest Stock Price: Rs. 201.65

52 Week-High Stock Price: Rs. 251.9

52 Week Low Stock Price: Rs. 129.25

Latest P/E: 18.44

Latest P/BV: 1.38

Tell me more about Hindalco Industries….

Hindalco Industries Ltd., a Aditya Birla group company, is the largest aluminum producer in India and one of the world’s largest aluminium rolling companies. It is also one of the biggest producers of primary aluminium in Asia. The company has captive bauxite mines, that source around 70% of its requirements for its 1.5 mtpa (million tonne per annum) alumina refinery, and its 0.54 mtpa smelting capacity.

The company also produces copper and its copper smelting capacity is the largest in Asia. Hindalco’s products include standard and speciality grade aluminas and hydrates, aluminium ingots, billets, wire rods, flat rolled products, extrusions, foil, alloy wheels copper cathodes, continuous cast copper rods along with other by-products, including gold, silver and DAP (Di Ammonium Phosphate) fertilisers. On a consolidated basis, Hindalco is a global player operating through its global subsidiary Novelis (global leader in aluminium rolled products and aluminum beverage can recycling) which has 32 plants in 11 countries.

How has the Financial Performance of Hindalco been? Here’s the review…

Standalone Basis:

The 10 YEAR X-RAY of Hindalco shows a mixed performance by the company over the last ten years. In initial years (2000-2003) its key financials (Net Sales, EPS and BVPS) grew slowly and erratically. From FY03 to FY07, Hindalco registered an impressive financial performance. But again from 2008, its growth rates started declining and infact reached the lowest in FY 2010. This dismal performance in last few years is a result of global economic meltdown, lower global metal demand and hence lower metal prices. Though, the company’s Net Sales has grown from Rs. 2013.1 Cr. in 2000 to Rs. 19408 Cr. in FY 2009 with more than 27% CAGR growth rate over 9 years period, its EPS has only shown a marginal improvement (1.1% CAGR) mainly due to its continuously increasing equity base (for expansion purpose). Due to the same reason, its BVPS also registered a growth of 10% CAGR over the years.

Though Hindalco has been able to maintain an average return on invested capital (ROIC) of 13.71% over the last 6 years, its trend has been declining. The company has a debt of Rs. 6350 Cr. on its books, a major chunk of this debt was taken during the acquisition of Novelis in FY07. This has resulted in a Debt-to-Net Profit Ratio of 3.36.

Looking at its overall financial performance, we can say that the company’s 10 YEAR X-RAY is Orange (‘Somewhat Good’).

Consolidated Basis:

Hindalco took over Novelis in FY07, a company that is 3 times its size. Hence, on a consolidated basis the company’s sales grew from Rs. 19096 Cr. in FY07 to Rs. 59696 Cr. in FY08 and to a current level of Rs. 60562 Cr. As far as profits are concerned, Novelis has recently witnessed a turnaround. The company’s debt on a consolidated basis is much higher at ~ Rs. 24000 Cr. mainly due to the Novelis debt on its books.

What can we expect in the future? Here is the fundamental analysis of Hindalco Industries…

In the Short-Term

Good growth in Profit and Sales over the last four quarters:

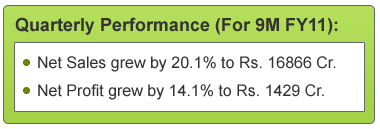

Hindalco has been performing well since the last four quarters on standalone as well as on consolidated basis. It has reported good growth in Net Sales and Profits in the last 4 quarters as a result of better price realisation and rising demand in domestic markets. Also, on a consolidated basis, Novelis recently witnessed a turnaround and has significantly contributed to the rapid growth of Hindalco in FY11. Novelis continues to enjoy pricing power in the developed markets due to recovery in demand and has been able to increase product prices continuously this year. However, the rise in sales realisation has not been fully converted in net profit mainly because of higher coal (a key raw material) prices. A slight dampener to the company’s copper business was planned shutdown of 3 weeks in one of its smelters. With the buoyant demand from domestic and global market, we can expect the growth to continue in coming quarters as well.

Rising Metal Prices To Boost Higher Realisation:

Aluminium and Copper prices have seen a massive run in the last year. Aluminium prices have gone from US$ 1800-1900 per tonne in June 2010 to ~US$ 2750 per tonne in April 2011. Similarly, Copper prices have also gone up by more than 50%. Being one of the largest integrated players in the field, Hindalco has benefitted the most due to the rise in prices. Given the recovering demand from auto and beverages industries in Europe and expected demand from after-quake recovering Japan we can expect metal prices to continue to rise in near future as well. This will further extend the gains to Hindalco in coming quarters.

Also, aluminum prices are likely to firm up in the coming months due to rising demand from China. China is becoming a net importer of the white metal after the recession. Hence, rising copper & alumina prices will enhance the company’s profitability in coming months.

The domestic copper and aluminium demand scenario is expected to improve in coming quarters. Demand from power generation, automobile and engineering equipment producers is also expected to increase in coming months. All these factors are expected to increase Hindalco’s sales in coming quarter which will eventually benefit the bottom line too. However, the rising coal prices may affect profit and result in slightly lower margin in the coming quarters. Considering all these factors, we expect that the short term future outlook of Hindalco will be Green (Very Good).

In the Long-term

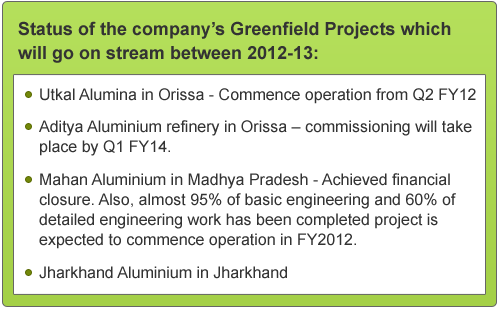

Robust Capacity Expansion planned: Aluminum

Hindalco is the industry leader with a strong global and domestic presence in aluminum and copper segments and is one of the world’s largest aluminium rolling companies. To strengthen its position further, the Company is planning to enhance its refining capacity from 1.7 million tons at present to 6.15 million tons by 2015.

With these we can expect its aluminum smelting capacity will reach 1,638 kt by FY 2015 from 535 kt at present. These expansions will further strengthen Hindalco’s position in global as well as domestic market.

Competitive Advantage in its Copper business:

Birla Copper, Hindalco’s copper unit, has the unique distinction of being one of the largest single-location copper smelters in the world. The smelter has a capacity of 500,000 tpa. Birla Copper also produces precious metals, fertilisers and sulphuric and phosphoric acid. The unit has captive power plants for continuous power generation and a captive jetty to facilitate logistics and transportation. The company has launched various brands like Everlast roofing sheets, Freshwrapp kitchen foil and Freshpakk semi-rigid containers. These brands will help enhance its pricing power and hence in better price realisations.

Novelis Financial Inclusion with Hindalco to help fund expansion plan:

The acquisition of Novelis, a company three times its size, has given Hindalco competitive advantages like global market leadership, cutting edge technology and going up the value chain in the largest segment of value added products. The enhanced scale of Hindalco’s aluminum business has transformed the company into a globally-integrated player. Recently, Hindalco has completed its financial integration with Novelis. This financial integration will help Hindalco to use Novelis cash reserve to fund its growth plans in domestic market. Going forward, Novelis will be assisting Hindalco to fund its Rs. 23,000 crore-plus expansion plan in India.

Global Expansion of Novelis:

With its recent turnaround, Novelis is now aggressively expanding its production in Brazil, Korea and other emerging market. Novelis is planning to increase production by around 20% by 2014. Its planned $300-million expansion at Pinda, Brazil is the largest for Novelis. This expansion will help Novelis to double the capacity and help it cater the huge market of Brazil and other South American nations.

Relocation of ‘can body’ making plant to India:

Hindalco has relocated its high-cost can body making plant from the UK to Hirakud, Orissa. With this relocation, Hindalco is aiming to become the cheapest can body stock producer in the world. The plan is to produce 500 ktpa of aluminium sheets out of which 130 ktpa will be up and functional in the next six months at an initial investment of Rs. 600 crore. This can body plant will even be able to compete with highly subsidized Chinese can manufacturers. This plant has already won orders from two companies, Rexam and Can-Pack, and many more are expected to make a similar order in near future.

Aluminum & Copper Industry Outlook:

Given the low per-capita consumption of aluminium and copper in India, there is tremendous growth potential in the years ahead. Due to aluminium’s inherent advantage, it is increasingly repeating other metals, thus leading to an additional demand boost. Aluminum provides favorable weight-to-strength ratio and better conductivity which helps increase mileage and reduces emissions. Also, as India and other developing economies progress, a lot of aluminium might find its way into the packaging and industrial applications, the penetration of which is currently on the lower side.

On the copper front, we can expect a massive demand increase due to high demand from emerging economies. China, which is the world’s largest copper consumer is expected to account for half of the world’s copper demand by 2020. The copper demand will be surging as the nation seeks to build more homes, autos and appliances, and upgrade power-grid networks. Overall, the demand for aluminium and copper will grow rapidly in coming years. Being the largest players in the industry, Hindalco will benefit the most with these developments.

Key Concerns

Massive Global Exposure: Hindalco has a massive presence in global aluminum and copper market. Today 76% of its US $ 13 billion sales at the consolidated level are from outside India. Also, 61% of its mining assets are spread across the world. Though all these factors make it a global metal giant, they also make it vulnerable to global turbulence like political instability, currency fluctuations etc. For example, last year, the weak global metals scenario during the liquidity crisis and an appreciating rupee compounded the situation for Hindalco more than its competitors.

Rising Coal Prices: Power is a vital input for its smelting and refining works, as it accounts for 40% of the total cost. Although Hindalco has captive power units, any rise in coal prices results in the higher electricity cost and hence lower profit margin for the company. Since Hindalco operates in lower value segments in domestic market it has been unable to pass on the rising cost to consumers.

A strong presence across the value chain and synergies between operations has given Hindalco a dominant share in the value-added products market globally. The company will continue to strengthen its leadership position due to its cost competitiveness, quality and global reach. Substantial increase in capacities, improved cost optimization, higher productivity and strong fundamentals augur well for the Company in the years to come. Thus considering all these points, we expect that the company’s long Term Future Prospects will be Green (Very Good).

So, should you invest in Hindalco Industries?

The demand for aluminium and copper is expected to grow rapidly in the coming years. Hindalco is the largest player in the above segments and with its expansion plans it is likely to benefit the most from the rise in demand for aluminum and copper.

Yes, Hindalco Industries Ltd. is an investment worthy company, but only at the right price. Currently, its stock price is at Rs. 219 (as on 28 April’ 2011). But, does this price offer an attractive discount to its right value (MRP) or is it over-priced? It is always best to invest at an attractive discount to its MRP, to get maximum returns at minimum risk. Become a member of MoneyWorks4me.com to know its sensible buy- price and hence take the right action for this company.

Disclaimer: This publication has been prepared solely for information purpose and does not constitute a solicitation to any person to buy or sell a security. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations or needs of an individual client or a corporate/s or any entity/ies. The person should use his/her own judgment while taking investment decisions.

So, should you invest in Hindalco Industries?

The demand for aluminium and copper is expected to grow rapidly in the coming years. Hindalco is the largest player in the above segments and with its expansion plans it is likely to benefit the most from therise in demand for aluminum and copper. Also, with Novelis’ recent turnaround the company is likely to register good growth rates on a consolidated level too.

Yes, Hindalco Industries Ltd. is an investment worthy company, but only at the right price. Currently, its stock price is at Rs. 219 (as on 28 April’ 2011). But, does this price offer an attractive discount to its right value (MRP) or is it over-priced? It is always best to invest at an attractive discount to its MRP, to get maximum returns at minimum risk. Become a member of MoneyWorks4me.com to know its sensible buy- price and hence take the right action for this company.

Disclaimer: This publication has been prepared solely for information purpose and does not constitute a solicitation to any person to buy or sell a security. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations or needs of an individual client or a corporate/s or any entity/ies. The person should use his/her own judgment while taking investment decisions.

what should be the buying price of HINDALCO for long term i.e for 1 year.

aptly covered…perfectly synced analysis.