Home First Finance Company IPO Details:

IPO Date: Jan 21 to Jan 25, 2021

Total Shares for subscription: ~8.73 Cr

IPO Size: ~Rs. 1,153 Cr

Lot Size: 28 shares

Price Band: Rs. 517-518/share

Market Cap: ~Rs. 4,500 Cr

Recommendation: Subscribe

Purpose of HFFC IPO

- Fresh Issue (Rs 268 Cr) to be utilized for augmenting equity capital base for meeting future growth requirements.

- Proceeds of Offer for Sale (Rs. 888 Cr) to be received by Selling Shareholder only (True North, Bessemer)

Home First Finance Company India Limited (HFF), with Rs. 4,000 loans under management, is a technology-driven affordable housing finance company that targets first time home buyers in low and middle- income groups. It was incorporated in 2010 and completed 10 years of operations.

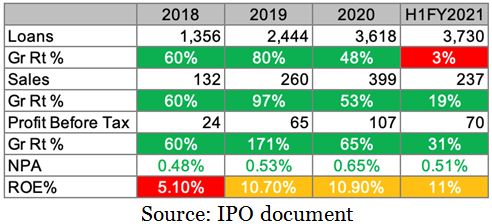

HFF primarily offers customers housing loans for the purchase or construction of homes, which comprised 92.1% of the Gross Loan Assets, as of September 30, 2020. The Gross Loan Assets have grown at a CAGR of 63.4% between the financial years 2018-2020 and increased to ₹ 3,730.01 crore as of September 30, 2020.

The company serves salaried and self-employed customers. Salaried customers account for 73.1% of its Gross Loan Assets and self-employed customers account for 25% of Gross Loan Assets as of September 30, 2020. They serviced 44,796 active loan accounts, as of September 30, 2020.

HFF has grown at 60% CAGR from FY15-20.

Strengths

- HFF is a technology-driven company with a scalable operating model. To make the tech-oriented model successful it has set up a robust collections management system wherein approximately 93 percent of collections for the financial year 2020 were non-cash based.

- HFF has a well-diversified and cost-effective financing profile. Its sourcing comes from private and public sector banks and National Housing Bank.

- HFF boasts marquee private equity players as its shareholders including Bessemer, True North Fund, etc. This association helps it raise finance from bankers and investors.

Weakness

The small size might become a hindrance to refinance borrowings during times of distress.

- The cost of borrowing might rise in bad times, pressuring margins.

How is the business model? Good, Great, or Gruesome?

Good. Housing Finance has a structural growth over the next decade. Urbanization and nuclear families are the key drivers for housing demand.

Financial companies have four key parameters to be analyzed.

- Financing Strategy

- Lending Strategy

- Risk Management (Asset Quality)

- Management Integrity and succession planning

Financing strategy: HFF has mixed sources of financing from public and private sector banks. It has renowned private equity players as its shareholders which helps in raising funds based on trust and track record.

Lending Strategy: The government’s push for affordable housing has led to an acceleration in new projects. Lower interest rates and buyer-friendly RERA regulations have accelerated demand for homes.

Rapid growth in affordable housing bodes well for HFF’s growth as it operates in small ticket size home loans (~10 L) versus peers (18-24L).

The sourcing of customers is tech-enabled which helps the company to maintain a lower cost of acquisition and operations versus peers.

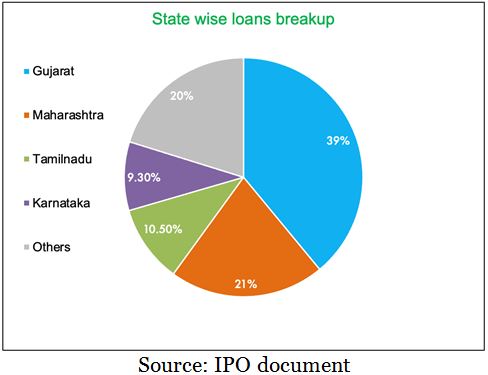

80% of HFF’s loan under management is in the states of Gujarat, Tamilnadu, Maharashtra, and Karnataka.

Risk Management: HFF’s collection efficiency has been superior in the recent past. However, it doesn’t give us a perspective on its underwriting practices. The pursuit of high growth leads to inferior underwriting practices which lead to an increase in NPA after 2-3 years.

Even if borrower quality is not good, default doesn’t happen in the initial years as basic checks on income are conducted on the most recent financial records. But eventually, vulnerable borrowers might get financially stressed from job loss, loss from business, and skip monthly payments. However, in the case of HFF, we believe that the higher management has a long track record in lending and risk management.

Management Pedigree: Anything involving money needs the highest integrity. While integrity is important in any publicly listed company, it is more important in a financial company for the sustainability of a business.

Money is the raw material for a financial company. If management integrity comes into question, raising and refinance funds will get hindered causing immediate bankruptcy of a company versus a non-financial company where it can pare hard assets to raise funds in short term.

HFF’s founders and management include Mr. Jerry Rao (Founder and Ex-CEO of Mphasis), Manoj Viswanathan (Ex-Citi personal loans), and PS Jayakumar (Ex-MD of Bank of Baroda, Ex-Country Head, Citi Consumer loans). Management and board of directors come from having a strong background and very good experience.

Since promoters of the company are reputed private equity players, they will ensure good succession planning.

Based on the above data, HFF appears to be an above-average financial company.

Valuation

With annualized EPS of 13.2 per share, HFF trades at a P/E ratio of 39x. We believe IPO is priced for the very high growth of 30% over the next 5-7 years and the assumption of no equity dilution from new fundraising.

HFF’s ROE profile of < 12% is a cause of concern for future growth. It will have to keep raising funds for growing at 30%+. Raising funds at higher valuation doesn’t dilute existing shareholders. But if equity markets are not doing well, it will have difficulty to raise funds at a valuation such that it doesn’t dilute existing equity shareholders.

Recommendation

The higher growth rate on a low base, structural demand for housing, and good management pedigree make HFF IPO worth applying for.

We recommend investing in 1-2 lots. We may see good listing gains as the housing sector is doing well in markets.

Home First Finance Company

| IPO Activity | Date |

|---|---|

| IPO Open Date | 21th Jan 2021 |

| IPO Close Date | 25th Jan 2021 |

| Basis of Allotment Finalisation Date | 29th Jan 2021 |

| Refunds Initiation | 1st Feb 2021 |

| A credit of Shares to Demat Account | 2nd Feb 2021 |

| IPO Listing Date | 3rd Feb 2021 |

Home First Finance CompanySubscription Status:

| Date | QIB | NII | Retail | Total |

| Jan 21, 2021, 05:00 | 1.28x | 0.13x | 1.29x | 1.04x |

| Jan 22, 2021, 05:00 | 1.36x | 0.61x | 3.40x | 2.22x |

| Jan 25, 2021, 05:00 | 52.53x | 39.00x | 6.59x | 26.66x |

Home First Finance Company

What is Home First Finance Company IPO?

Home First Finance Company IPO is an IPO of 8.73 Cr equity shares with a face value of ₹10 aggregating up to ~₹1,153 Cr. The issue is priced at a price band between ₹517 to ₹518 per share.

KFintech Private Limited is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

When Home First Finance Company IPO will open?

The IPO opens on Jan 21, 2021, and closes on Jan 25, 2021, between 10.00 AM to 5.00 PM.

What is the lot size of Home First Finance Company IPO?

The lot size is in the multiple of 28 with a minimum order quantity of 28 Shares.

How to apply for Home First Finance Company IPO?

You can apply for Home First Finance IPO online using either UPI or ASBA as a payment method. ASBA IPO application is available in the net banking of your bank account. UPI IPO application is offered by brokers who don’t offer banking services like Zerodha.

When is the Home First Finance Company allotment?

The finalization of the Basis of Allotment for Home First Finance Company IPO will be done on 29th Jan 2021 and the allotted shares will be credited to your Demat account by 2nd Feb 2021.

When is the Home First Finance Company listing date?

The Home First Finance Company IPO listing date is not yet announced. The tentative date of Home First Finance Company IPO listing is 3rd Feb 2020.

Is it worth investing in Home First Finance Company IPO?

The higher growth rate on a low base, structural demand for housing, and good management pedigree make HFF IPO worth applying for. We recommend investing in 1-2 lots. We may see good listing gains as the housing sector is doing well in markets.

What if I do not get the allotment?

We suggest waiting for other opportunities in the Housing Finance sector. HDFC Can Fin Homes are some names in this sector. These stocks can be bought during market volatility.

Know more: Indian IPO Historic Data 2021

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Why MoneyWorks4me | Why Register | Call: 020 6725 8333 | WhatsApp 8055769463