Over the last few weeks we have been trying to look at probable economic outcomes and stock market scenarios given different possible political outcomes after the 2014 General Election. An Investor desiring safety needs to run such thought exercises if he is investing in India. For a simple reason that the economic policy understanding that existed among the political parties of various hues in between 1991-2004 (even if it was in fits and starts) has somehow broken down over the last few years. As such political outcomes have a very strong impact on the economic scenarios that can play out.

This time we would like to see what if contrary to most opinion polls Congress still ends up showing a strong performance even if say, it’s worse than 2009 but still sufficient to form the government in one form or the other. In spite of very strong headwinds against Congress there are reasons to believe that this need not necessarily be an unlikely possibility. Let me point to three reasons:

- Strong Rural incomes: Rural wage growth rates have tapered a bit over last but continue to grow at strong rates. Strong rural performance may still end up giving benefit to Congress which has a strong organizational presence in rural India.

Src: Morgan Stanley (India Economics- Macro Indicators Chartbook)

- Congress typically gets under represented by pollsters in opinion polls. So pollsters may be overestimating the rout that Congress may really see.

- Importantly, it’s relatively e easier for Congress to form alliances compared to BJP, this allows Congress more headroom in forming post poll alliances to secure the necessary numbers.

Before we move forward towards understanding the economic outcome and its impact on the markets, let’s recap what we have deduced from our thought exercises till now.

In our last two analysis of the current political situation we ran through two probable outcomes. In the first one we saw what can happen if we see a strong Centre Right party (BJP) forms a government in Centre. If one has taken even a cursory glance at the market one can easily deduce that perhaps most market participants are factoring this very outcome. But as we argued last time that one must not discount the probability of occurrence of other possibilities especially the one where in the Centre Right party forms a weak coalition government at the center. As our thought exercise last time did point one interesting aspect of this possibility.

We realized that if the second scenario were to play out:

- Reforms process could be just half baked, in many cases given the lack of political consensus we could actually see more band aid solutions rather than a case of addressing the real structural problems.

- However the policy shift would still be noticeable: from Entitlement based socio-economic policies that lead to inclusive development and hope that this would drives economic growth. This would shift to Investment based policies towards economic growth with a hope of trickle down inclusive development.

- Very low possibility of second generation macro reforms moving through the legislature. Though micro reforms may happen in fits and starts.

This then begs us to ask ourselves are we being too over optimistic about the election outcome then.

The outcome of our second thought exercise is substantially subdued and forces one to consider if the current market optimism is driven by ‘hope’ or careful thought out analysis? Is the market reacting more to hype or looking at most probable event given that a lot can change in politics from now till the last day of election?

Charlie Munger in his speech given to Harvard Law School calls this psychology of human misjudgment as ‘deprival super reaction syndrome’. Where in when we are deprived of something (India growth story, economic reforms) and then when we suddenly get it back we react more positively (a super reaction) than might have been warranted in normal circumstances.

Economic scenario if Congress forms the government:

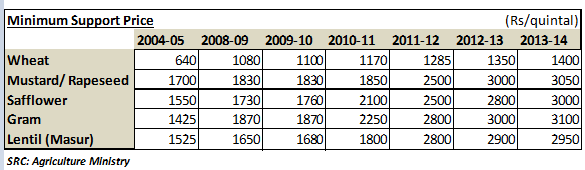

If one were to analyze the socio-economic policies pursued by the UPA government over the last 10 years and especially after 2009 election it’s not hard to see the broad stroke of rights based entitlement forming the major backbone of most of its policies (Right to Education, NREGA, Food Security Bill). Even the Land Acquisition Bill substantially increases the rights of the people who are the beneficiary of the land being acquired (different from right of just land owners) and the compensation they should get from the Industry/Organization that are acquiring land. Similarly one can see the same in the way Minimum Support Price have also tended to increase over the last decade (this is substantially different from previous time as MSP have also have tended to come down at times in previous decades).

There have been some exceptions like JNNURM for infrastructure SEZ Act for industry, but these seem to be one of rather than a concentrated policy towards creation of Investment through polices.

We believe that this scheme of things will continue to run if UPA were to form the next government. The Congress scion alluded to something similar in his recent rally at Dehradun. We do not think that this is just a typical poll promise that politician make but is a broader template of bringing entitlement based legislation based on experience of states to the national level. NREGA or rural employment guarantee scheme was an idea picked up from similar state legislation at Maharashtra. Food Security is similarly an idea picked up from experience of Chhattisgarh. Right to Health to which the Congress leader was alluding from Rajasthan. And since Congress had spearheaded it in Rajasthan it has a good starting point to work towards this as a national strategy.

Long term economic cost of rights based policies:

While rights based entitlements have been used in may developed countries to support the weaker sections of the society in recent years they have come under some criticism amongst economists because of the sticky nature of the financial burden on the government. This means that at times when government earnings may be under pressure, government cannot simultaneously cut down these welfare schemes which results in ever increasing fiscal balloon. A historically high fiscal deficit we know leads to a very high level of Debt to GDP ratio which can severely restrict governments’ ability to support the economy during deep recessions.

Short-Medium term benefits of rights based policies:

Used rightly welfare economics can help government in reducing inequality, in seeing that benefits of the economic wellbeing are more widely shared. These are known to reduce class tension within the society and alleviate poverty. Welfare economists also believe that if benefits are targeted at appropriate groups it can also simulate economic demand through increased consumption.

Industries that will get impacted positively as a result of these policies:

Low cost India focused Pharmaceutical companies:

We believe companies that have over the years developed sizable cost competitiveness in delivering low cost drugs across the developing and underdeveloped world would be major beneficiaries of a right to health legislative. Eg: Cipla

FMCG players with strong rural/ BoP (Bottom of Pyramid) presence:

More benefits to the weaker section would lead to a much higher disposable income in this section of the population. FMCG companies with strong rural focus and or products targeted at bottom of the pyramid would continue to see strong revenue growth.

Auto companies with strong consumer purchase profile:

Two wheeler companies and agriculture equipment companies would see a strong demand for their products as a direct result of a strong rural and agricultural income due to continued government policy of higher MSP (minimum support price) for food grains.

Export oriented service/product companies:

Export companies especially services export companies like IT companies are likely to get benefit as a result of continued weakness in the Indian Rupee with respect to global currencies on the back drop of high fiscal deficit, high inflation and low FDI in India.

Caution while making investments:

Given weak economic environment and a government with welfare bias there would be little the Government can do to address structural issue of the economies. As a result we believe we may continue to see very high levels of sticky inflation rate, high fiscal deficit, low FDI investment profile compared to other Emerging Markets and hence comparatively high level of interest rate. Under this scenario one needs to be cautious with the overall market and especially with companies having high leverage or dependency on government support for its business model (Oil Marketing companies, fertilizer companies and even companies like Sintex who continue to see a large part of their working capital stuck due to slow disbursement by government.)

In conclusion:

We believe that Congress continues to remain a formidable force in spite of what opinion polls may suggest. While its vote share may have slipped down over last two decades however it remains the dominant Centre Left political party in India. As such we need to wait and see how the elections play out. A Congress win would mean that we would continue to see more entitlement based programs being implemented. Some of them may play a huge role in decreasing inequality and bringing critical government services to the door step of weaker sections of the society. However, given the low level of industry and youth confidence in the Indian economic future, it is hard to anticipate a very strong economic revival anytime soon.

Under such scenarios investors are well advised to concentrate portfolio within industries with strong consumption or export based themes and companies with extremely strong consumer moats. Defensive investment strategy may be the best offensive strategy in such an economic scenario.

Next week we would like to run one of our last thought exercise in this special election series wherein we would like to see what all other possible combinations can come out post the general election, how they will impact the economy and the markets.

We will close this series by looking at what should be the fair estimation of the expected market behavior. We would use, as the former Defense Secretary of USA Donald Rumsfield says, the known-known, known-unknowns, given their probabilities to work out what the future might look like.

Disclaimer: This publication has been prepared solely for information purpose and does not constitute a solicitation to any person to buy or sell a security. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations or needs of an individual client or a corporate/s or any entity/ies. The person should use his/her own judgment while taking investment decisions.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

It is all speculation.It all depends on the new Prime minister.If the person is strong and not at all like Mr.MMS the economy will prosper.The person should not crawl before you know who .The person should not bow down to coalition compulsion.Honesty is not the only qualification.

You seem to be right as I remember a prediction of an astrologer in BBC news opining a decade ago that Mrs. Sonia Gandhi would become the Prime Minister of India in 2014. And according to my estimate of Indian market – Nifty will rise till 8000 mark before there is a market crash.