Idea Cellular Limited: Is it time to ‘GET IDEA’?

Idea Cellular – Company Highlights:

India’s leading GSM telecom Services provider

Market View of Idea Cellular’s Stock Price (24th Feb’11):

Current Stock Price of Idea Cellular: Rs. 58.35

Current Stock Price of Idea Cellular: Rs. 58.35

52 Week-High Stock Price: Rs. 79.9

52 Week Low Stock Price: Rs. 48.65

Latest P/E: 22.64

Latest P/BV:1.69

Tell me about Idea Cellular Ltd:

Idea Cellular Limited is a part of the Aditya Birla Group (46.96% holding) and one of India’s leading GSM telecom Services provider. The company has licenses to operate in 22 telecom circles. It has over 81.8 million subscribers with a market share of around 11%. The company reports 1 billion minutes per day and is among top 10 national operators across the globe. The company offers basic voice and short message service (SMS), high-end value added services and general packet radio service (GPRS), such as Blackberry, Datacard, Mobile TV and Games. Their subsidiaries include Aditya Birla Telecom Ltd, Idea Cellular Services Ltd, Idea Cellular Infrastructure Services Ltd, Idea Cellular Towers Infrastructure Ltd, Swinder Singh Satara and Co. Ltd and Carlos Towers Ltd.

How has the financial performance of Idea Cellular been?

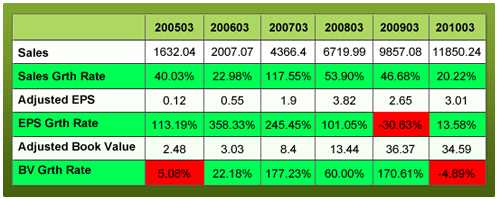

Idea Cellular has performed well on critical financial parameters in the last 10 years. Though, its profits have been hit recently by excessive competition, its other key financial parameters have grown robustly. The company’s Net Sales has increased from Rs. 150 Cr. in FY2000 to Rs. 11850 Cr. in FY10 with 9 years CAGR of more than 43%, showing a consistent demand for its products. The company has clocked good y-o-y growth rates in its EPS, but, for the last 2 years, where it witnessed de-growth. EPS has fallen mainly due to increased operating cost as the company has ventured into new mobile circles. It has also maintained more than 18% Return on Invested Capital (ROIC) for 6 years on an average indicating optimum management of funds by the company. Idea Cellular’s high Debt-to-Net Profit ratio (6.6) could be a cause of concern.

Looking at the overall performance of the company, we can say that the company’ 10 YEAR X-RAY is Green (Very Good).

High Debt: Idea has around Rs. 9300 Cr. as debt on its book due to very high 3G costs. Idea has won 3G spectrum in 11 out of 22 service areas in the recent auction and was amongst the highest spender in 3G and BWA (broadband wireless access) auction. This debt burden is further expected to increase by Rs. 3000 Cr. as the company has announced a Capex of Rs. 3000 Cr. for FY2011. This high debt has resulted in high debt–net profit ratio and a very high interest cost, resulting in lower profit margins.

Margin performance:

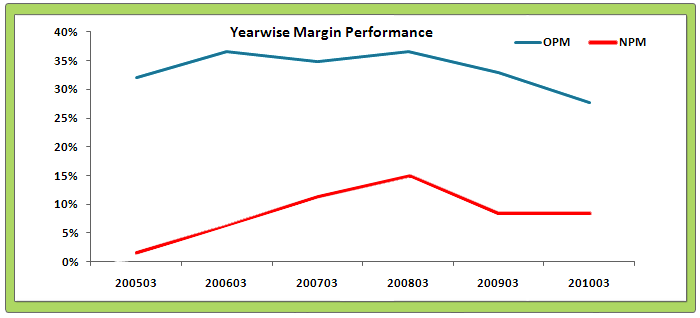

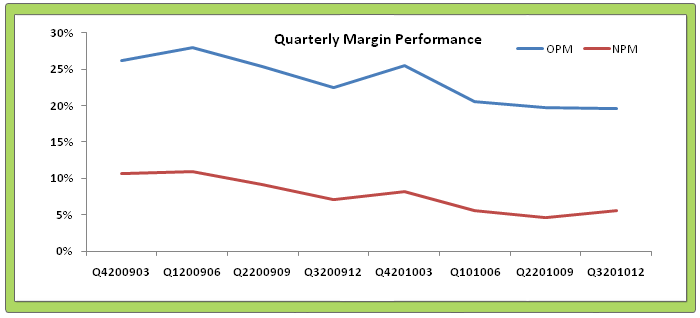

Over the last 6 years, Idea has maintained a healthy operating margin in the range of 30%-35%. Net profit margin has also shown a consistent improvement in last 6 years. But the company is witnessing depressed margins in last 7-8 quarters mainly due to high investment in new circles and increasing competition in telecom space. 9 out of 22 circles of Idea operations are currently operating at loss, as many of them in still in investment phase. This has also contributed to the lower margin. However, the decrease in profit margin has been marginally mitigated by higher earnings from its tower business, as the tenancy rates have gone up in recent past. Going forward, 3G service roll out will result in temporary decline in margins. But, once we see revenue from 3G flowing in, we can expect an increase in overall margins.

What can we expect in future? Here is the analysis of Idea Cellular…

In the Short term

Quarterly result: Robust performance

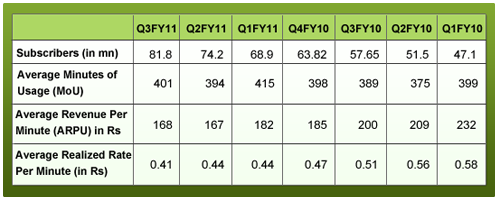

Compared to the poor performances in last four quarters, Idea has reported a good quarterly performance for Q3 FY2011. The company reported an impressive 26% Y-o-Y growth and 9% Q-o-Q growth in its revenues driven by increase in the subscriber base. Though the company’s Average Revenue per user (ARPU) declined on y-o-y basis to Rs 168 per month compared to Rs 188 in Q3 FY10, it reported a 0.6% Q-o-Q growth indicating stabilizing pricing pressure. Idea also witnessed a 15% decrease in the average revenue per minute (ARPM) at 42 paisa compared to 49 paisa during 3QFY10. The company has reported a jump in the minutes of usage (MoU) with reported 401 minutes per subscriber per month compared to 385 minutes in corresponding quarter last year.

Market after MNP (Mobile Number Portability)

Though initial reports suggests that the big 3 players have marginally lost their market share after the implementation of MNP, according to Idea’s management, MNP is not going to be a game changer for the industry. The fact that Idea has lost only 0.1% of its market due to MNP compared to 2.1% by Airtel and 1% by Vodafone indicates Idea’s stable and strong position among its users.

Despite intense competition, Idea has maintained its market share almost at the same level. Also the company is constantly increasing its revenue and minutes of usage. Latest quarterly increase in ARPU and subscriber base indicates Idea’s growing strength in the Indian telecom space. The company’s operational performance will continue to improve, especially given the fact that a lot of new players are finding it difficult to survive; we may also see a cancellation of few telecom licenses due to 2G scam. Large players like Idea are expected to gain due to these developments in the short term. The regulatory uncertainties are likely to keep investors away in the short term. Also we may not see any improvement in profit numbers due to huge 3G investments and debt servicing in next few quarters. With new players such as Videocon launching zero-paise plans and regional players like Aircel progressing to complete pan-India footprint, sector overcapacity seems to continue to remain a concern. For Idea, though the worst in terms of business performance might be over, pricing and competitive pressure will continue to linger on for few more quarters.

Hence, we can expect the short term outlook of Idea to be Orange (‘Somewhat Good’).

In the Long Term:

3G Launch:

The launch of 3G and wireless broadband will be the next phase of growth for telecom operators. Idea has got 3G license for 11 high revenue generating telecom circles. It has started 3G operation by rolling out services in Kerala in Jan 2011. The company is further expected to roll out its 3G network in all 11 circles over the next 3-4 quarters. Though this roll out may not result in immediate jump in profits, eventually it will lead substantial improvement in its net margin and also help protect its market share due to lower churn of high value customers providing some respite in the current environment of intense competition in 2G space.

Telecom Industry:

Expanding telecom networks to rural India, falling tariffs and continued reduction in handset costs, have been the key drivers for the growth of the telecom industry. In the long run, the Indian telecom market offers an attractive growth opportunity. The Indian telecom (service providers) sector is expected to grow at more than 20% CAGR in coming years. With an average addition of more than 12 million subscribers every month, the subscriber base is expected to cross 1 billion by 2012. At the end, we can say that, the telecom sector will continue to demonstrate attractive long term opportunities for one of the largest operator Idea Cellular.

What are the concerns?

Competition:

India is currently the fastest-growing and the most competitive mobile market, with 14 players locked in a margin-destroying price war. It has amongst the world’s lowest telecom tariffs ranging from about 0.5 paisa to 1 paisa for per second tariff plan and Rs 0.5 per minute for a per minute pulse plan. From January 2010 to December 2010, the four incumbent GSM operators – Airtel, Vodafone, Idea and BSNL – saw their combined mobile market share decline around 3.4% percentage points, from 62.6% at the end of January to 59.2% at the end of December 2010. Also in the wake of MNP, subscribers churn rate is expected to go up in favour of new players due to their aggressive acquisition strategies.

Regulatory Concern:

There is a lot of regulatory uncertainty going on in the telecom sector currently. Government may decide on 2G spectrum payouts at license renewals, roaming charge cuts and interconnect revisions.

Yes, competition is getting aggressive and in such an environment, the weaker players are likely to be more affected. Competition is expected to subside in the long run and the industry is expected to witness consolidation going forward. Considering Idea’s strong footing in the market and rapidly growing telecom market, we can expect it to be a successful player in the long run.

Considering all the above factors, Idea’s long-term outlook is Green (Very Good).

So, is it time to ‘GET IDEA’?

With the growing Indian economy, Indian telecom industry is expected to grow roughly by 20% in the next 5 years. This along with rapid mobile penetration will have a positive impact on Idea’s earnings.

While Idea Cellular is an investment worthy company, it is always best to invest in a company at an attractive valuation. Currently, Idea’s stock is trading at a price of Rs. 65. But, does this price offer an attractive discount to Idea’s right value (MRP) or is it over-priced? It is always best to invest at an attractive discount to its MRP, to get maximum returns at minimum risk. Become a member of MoneyWorks4me.com to know its sensible buy- price and hence take the right action for this company. For the first time MoneyWorks4me has come out with a 30 day free trial. To avail of this click here. Offer expires on 28th Feb’11.

Disclaimer: This publication has been prepared solely for information purpose and does not constitute a solicitation to any person to buy or sell a security. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations or needs of an individual client or a corporate/s or any entity/ies. The person should use his/her own judgment while taking investment decisions.