You must be thinking this statement doesn’t apply to you. Yes, it does (with apologies to a rare few who do it differently). Ask any alcoholic, does he have a drinking problem and you can’t expect him to answer, ‘Yes, I do’. Getting an alcoholic to admit he has a problem is the first crucial step on the road to recovery. Why are we so certain that addiction to experts has endemic proportions among Stock Investors? Look around you. The stock investing world is filled to the brim with Mutual Funds, ULIPs, Brokers, Wealth Managers, Stock Tips in Print, TV and on the Web. And, as if this is not enough we also rely on “expert” friends and relatives. Our capacity to guzzle up what experts have to offer can only qualify us as addicts.

Why is an investor’s addiction to experts worse off than an addict?

An addict knows that his habit is bad for him; his problem is getting rid of it. Most investors don’t even know that their penchant for expert advice is harmful to them. They believe that investing in stocks is best left to experts. And, one last learning from addicts and addiction that is useful to us (before we end this very depressing line of comparison) – In case of addicts, the more they consume the lesser the strength they have to fight the addiction, and hence, the best chance to get rid of the addiction is to ‘Abruptly stop consuming and face the consequences.’

Let’s look at the two things required to help you get rid of this addiction of ‘listening’ to experts.

1. Proof that experts can’t win for us because they are actually handicapped by their circumstances

2. Thinking differently about investing directly in stocks

1. Experts can’t win for us, because they are actually handicapped by their circumstances

Consider Mutual Fund Managers :

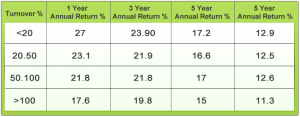

- The performance of a fund, and therefore, Fund Managers is evaluated every quarter, because of which their hands are tied. This forces them to focus excessively on the short-term, and some turn over their portfolio far too frequently. To give you an idea, the average portfolio turnover has surged over the years rising from roughly 20% in the past to nearly 100% as of now. A study was carried out by Morningstar for US equity funds which shows the following results:

Source: More Than You Know by Micheal J. Mauboussin

Source: More Than You Know by Micheal J. MauboussinThe above table clearly shows that high-turnover funds under-perform low-turnover funds over various time horizons. As seen in the table the higher the fund is turned over, the CAGR returns over different horizons are much lower.

- Also, no one can time the market. Thus a Fund Manager, even when s/he knows the market is headed towards irrational highs, can never sell. This is because s/he will have to suffer ridicule till the market peaks and falls back to the level when s/he sold. This is far too much pressure for any Fund Manager. Similarly, buying when the markets are very low and most others are not buying, requires great courage. So, what’s the safest bet for the Fund Managers – Follow their herd i.e. other Fund Managers/experts. In fact, even Brokers track the actions of Fund Managers – if they know a fund is going to sell off a particular share on a particular date, they make sure they advise their investors to sell the stock just before that. All this leads to falling prices when the herd sells, and rising prices when the herd buys. How can anyone make money like this?

Consider stock brokers –

- They make short-term recommendations that increase the number of transactions, and hence, their commission income. Though they know that investing with a long-term perspective works best, they always advise their investors to invest for the short-term, and hence, the typical recommendations from Brokerage houses.

- Also, they have no choice but to be confident about their advice, otherwise no one will trust them. And, when they have been proved wrong, they have many reasons for it. No one can learn with such an attitude. No wonder boom and bust cycles keep repeating ever so often.

So, in conclusion, it’s not about whether they are knowledgeable, experienced, have access to large information or have mind boggling analytical tools, these experts are prisoners of their circumstances, and cannot take decisions that will always benefit you as an investor. And, the biggest risk you run is that once you think of them as experts, as authority, your rational mind shuts off and has no way of adding to your decision-making.

2. Think differently about investing directly in stocks

When you invest directly in stocks, apart from the money, there are many other important things at stake. One of them is getting out of your comfort zone and taking responsibility for your decisions. What do many of us do when our decision appears to be wrong? We regret it, deeply sometimes, and because it is our decision we blame ourselves for it. We can hear a voice in our heads criticizing us, telling us you shouldn’t have done it, that you are not capable of making such decisions. Such thoughts shake our confidence, and we want to avoid being in such a situation ever again. Which is why we go to experts. Strangely, we are far more generous with the failures of our experts! We tell ourselves, ‘God, imagine an expert failed. I would have also failed miserably and suffered emotional pain. It’s okay to leave such things to experts.’

Now, to think differently. First, tell yourself that depending on experts is not an option. You need to have a dependable method of taking decisions, one that virtually guarantees a positive return i.e. no loss. You have read in the earlier blog that investing for the long term e.g. 10 years ensures this. So, you are a long term investor. You need to follow a methodology that enables you to select stocks of fundamentally strong company stocks at the right price. Read our blog under Stock Investment to be able to implement this.

Armed with all this you have a high probability of success. However, at times a few decisions may still seem wrong. Don’t fret over it. You can definitely learn from these mistakes and become a better investor. After all, everything you have mastered today was learnt at some point of time, and certainly you committed mistakes then. Did you stop because of these mistakes? Had you stopped, you wouldn’t have reached where you are today. Investing and making our money grow is an important life enhancing skill. You certainly can’t outsource it to experts, and remain ignorant. The good news is that you can beat the experts with all the tools you have today, something our fathers never had, for much of their life

To conclude,

- Get rid of the addition of listening to experts

- Take control and responsibility of your investing decisions, by following the right methodology and learning from every decision taken

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

even you come under the definition of an expert so you have just contradicted yourself.Pot calling the kettle black.

Mahesh,

Stock Shastra is an educational initiative by MoneyWorks4me.com, to help retail investors learn the right methodology to invest in stocks and help them act on it. Since the very inception of MoneyWorks4me.com, we have always encouraged a ‘Do it Yourself’ methodology.Our philosophy is based on value investing concepts followed by Investing Gurus – Benjamin Graham and Warren Buffet. At MoneyWorks4me.com, we have given a methodology that makes it easy for investors to implement these value investing concepts and select fundamentally strong companies, that are trading for less than their right value (intrinsic worth).

For this, we provide our members with a 10 YEAR X-RAY of the company which helps them access if the company has been fundamentally strong and also give them guidance for taking the right decisions on when to buy (Discount Price) and sell (MRP). If their view differs from our guidance, we have also given a place where they can do their own calculations.

Hence, we are very different from other websites/experts who give tips,recommendations etc.

You can read our Stock Shastras # 1 to #13 which has explained this methodology. The link for the same is http://bit.ly/aHBGTC

Also, visit our website MoneyWorks4me.com and let us know what you think. I am sure your view about us will change once you read these shastras and visit our website.

I agree you are offering something different and is basically a fine analysis of companies. I am a banker and analysing balance sheets for last 26 years. I will frankly admit that past analysis can only give some inkling about future but what will happen after 10 years is more of one’s destiny than any analysis. 10 years back Hindustan Lever at Rs.200 was a great investment, still it is by many parameters. But what is the return to an investor ? Contrast this with companies like Unitech, Sun Pharma, JP Associates, Hero Honda, ICICI Bank ? They gave fantastic returns but they were fundamentally very poor in comparison to HUL 10 years back. So this talk of Buffet type investing for 10-15 years is as uncertain as an investor with 1-3 years investment horizon.