The simple and straightforward answer to this question is No, Omega is not expensive. Compared to other options Omega is very reasonably priced and substantially lower.

But is it not expensive on an absolute amount basis? No. Even on an absolute basis to Omega is very reasonably priced and valuable.

Here’s a comparison of fees that you will pay for Omega and PMS/MF-Regular

| Service | Fees structure | |

| PMS | · Upfront Fee (2%) (if purchased through a broker)

· Other Expenses including Brokerage/ DP Charges/ Custodian Charges assumed at 0.70% · Management Fee (2-2.5%) · Exit Load 2% for the first 12 months Profit-sharing on crossing a hurdle rate eg 10-15% returns (15-25% of excess returns). Some reduce Mgmt Fees in Profit sharing Lock-in: usually 3 years |

Typical will be about 5% if bought through a broker and 3% per year if bought directly-without exit load and profit-sharing

For large AUM eg 5cr+ fees could be lower

Typical Fees for 1 cr Rs 3lacs per year |

|

Mutual Funds-Regular MFD –Bank/IFA acts as |

2 to 2.5% on the entire amount | Same fees for any amount bought. For 1 cr Rs 2 to 2.5 lacs |

| Omega | Omega fees are inclusive of GST.

· From 25 L up to 1 Cr: – 1% for first 6 months and thereafter 0.4% every six months · From 1 Cr up to 2 Cr: – 0.8% for first 6 months and thereafter 0.35% every six months · From 2 Cr +:– 0.7% for first 6 months and thereafter 0.3% every six months |

Omega fees for 1cr: Rs 80K for 1st Six months and just 35K every six months thereafter. So in 3 years period, your total fee goes to 255K (2.5% for 3 years which is just 0.83% per annum)

If 50% invested in Mutual funds: Rs 0.5 to 0.6 lacs additional (Direct Plans) + Brokerage charges incurred by an investor |

As can been seen from the above table Omega with 100% Direct Stocks as a service is comparable to PMS while its fees are significantly lesser, only one-third of a PMS. Compared to fees paid for Mutual Funds-Regular Plans, Omega fees are still lower, despite many benefits explained below

Omega is a zero-conflict advisor something an investor needs first and foremost. PMS and MF are products and solutions that are available and an advisor may advise the client to invest in them depending on what is right for the client. Omega recommends Direct Stocks and Mutual Funds for equity. But when we recommend Mutual Funds it is worth the extra cost clients incur because:

- The MFs recommended by us complement our Direct Stocks strategy. This ensures the portfolio performs reasonably well across different market cycles and it ensures investors stay invested even through volatile times

- Also, Investors can confidently invest a large portion-75%+ of their entire investable surplus through the Omega-Multi-asset solution.

- Omega recommends MFs which have a good upside potential (not past performance) thereby ensuring better returns than funds that have already run-up.

- We can and will replace active (high cost) funds with low-cost passive Index Funds when appropriate, thereby reducing cost substantially

When the investable surplus is low we recommend clients to stay with 100% mutual funds till it makes sense to invest in stocks directly. Even then Omega fees+Direct Plan charges are not higher than Regular Plans.

Mature investors understand the value of having a zero-conflict advisor to manage to grow their portfolio as well as becoming better investors themselves. Some retail investors can wonder if they really need an advisor. A cursory search on google could lead them to the free advice which says ‘Investing in an Index Fund is all that is required to get market returns.’ Then why pay fees at all?

This advice is simple but not easy to implement seriously. By that we mean it’s not easy to invest much of your investable surplus maybe a few lacs or a few crores into an Index fund and sit tight for the next 10-20 years. The toughest thing to do in investing is doing nothing at all. When the market goes through its gyrations-imagine a roller-coaster ride, the best amongst us cling on to our seats and thank god for safety belts. It’s what sees us through the ride. A zero-conflict advisor is required even if you were to put all or most of your money in an Index Fund if you have to stay invested and complete the ride i.e reach your goals. Don’t believe it. Here’s some data that proves why you need an advisor to earn even market returns.

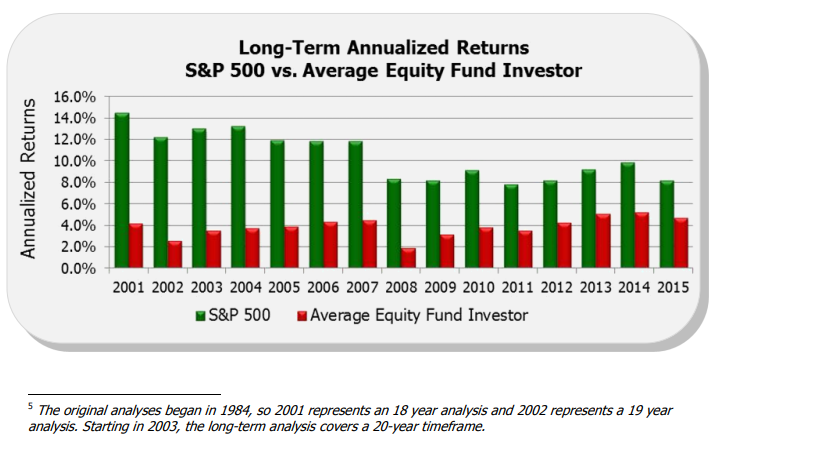

Source Dalbar’s 22nd annual QAIB (Quantitative Analysis of Investor Behaviour)Study ended 31 Dec, 2015.

This shows that “In 2015, the 20-year annualized S&P return was 8.19% while the 20-year annualized return for the average equity mutual fund investor was only 4.67%, a gap of 3.52%” i.e 42% lower!

And this is in the USA where investors are better informed and perhaps more experienced than in India. The data for India is not easily available but it is well accepted that Investor Returns on Mutual funds are lower than the fund returns. The average period for which retail investors stay invested in most funds is about 2 years which indicates that most retail investors do not earn the long-term returns generated by the active funds!

Great quality unbiased research and hand-holding are two very large value addition that we at MoneyWorks4me do for our Omega clients. Together this ensures you reach your financial goals.

If you liked what you read and would like to put it into practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463