It was not very long back that our parents put their investments in fixed deposits. They always stated that in 5 years the money would be double (now that’s a compounded growth rate of 14.87%, not bad!!). We have come a long way from those times; today the interest rate we get on our savings is 7.5% or less. So, today the interest rate has almost halved.

So, what should you do? Obviously you have to take a different path. You can no longer sit idle and let your savings earn low returns. Probably you need to take higher risk to get better returns. Even more than before investment in stocks has become a necessity. The need is to make safe investments and earn higher returns due to the low interest rate on fixed deposits, bonds etc.

But before getting into the specifics of the impact of interest rate on economy and stock market, let’s start from the basics.

Why should you know about the interest rate?

Interest Rate in simple words means the cost of borrowing funds. It is the payment we make to the lender for the facility of using his money for our own purpose. Many times our spending decisions are also guided by the interest burden that we would be bearing.

We as a country save more because we get higher interest rate on our savings than other countries like US. But, more than the returns we should be concentrating on real returns on our savings (real return = interest rate- inflation)

Even as consumers, interest rate is an integral part of our spending habit as we borrow from the bank for buying house, cars, house old items etc. For the business community interest rate is also very imp0rtant as they borrow money from bank for investment activities like capacity expansion, setting up of plants, acquisitions, modernization etc.

Why investment in stock in today’s time is a must?

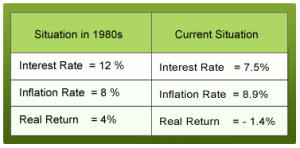

Check out what our parents in 1980s earned on their fixed deposits and what we earn today on our savings in banks.

With a real return of 4% our parents didn’t need to think about investing anywhere. They did not have any incentive of looking for investment in other avenues as they got good returns on their deposits. But for us the tables have turned red!! With inflation at 8.9% our real return is actually negative 1.4%. Now, we cannot be happy with -1.4%, can we? In today’s world we have lot many options; the foremost of it is stock market. You can manage to earn a return of 15% CAGR by investing in stocks. Obviously, you have to put more effort towards investing in stocks rather than mindlessly putting it in FDs and bonds. So, investing in stocks is very important because of the lower interest rate and even lower returns.

It is quite well established by now that interest rate is crucial for everyone in the economy but who controls this crucial macroeconomic variable?

The interest rate in India is not market determined but controlled by the RBI through its monetary policy. Primarily there are two main reasons for the fluctuation in interest rate:

- Government alters interest rate to affect the investments- When an economy goes into recession it does not come back by its own. The US government during the recent downturn of 2008-09 lowered its interest rate to around 1-2% in order to propel private investment & for consumers to borrow and spend more.

- Inflation- Interest Rate Linkage- When the inflation in a country starts rising the central bank or the RBI responds by increasing the interest rate in the economy to reduce the money supply in the economy. Over the last 1 year RBI has been tackling inflation by increasing the interest rate. This To know more about it click on Stock Shastra 28)

Now, what is the link between interest rate and the stock market?

Interest rate does not have a direct impact on stock prices but its indirect impact cannot be undermined. As you can see from the diagram there are two sides of the economy a) The Business Side b) The Consumer Side.

A continuous rise in interest rate affects the stock price from both the investment and consumption side. Combining the effects from both the sides, it spells a gloomy situation for the economy. The overall future revenue growth of the companies would be adversely effected which would lead to negative sentiments in the market leading to deflated stock prices. Also, at higher interest rate, people tend to invest more in fixed deposits and bonds as it would be offering higher returns at very low risk. Hence it moves funds out of stock market affecting the stock prices adversely.

Let us look at the impact of interest rate on different sectors.

- In the short term: The immediate impact of rise in interest rate is on companies with high debt in their balance sheet .The interest payment made by them rises which reduces their EPS. Thus there would be negative sentiments for such stock; resulting into depleted stock price.

- Over a longer term, high interest rate would have more sector specific impact. The sectors which are most impacted by high interest rate is the real estate, automobile and all the capital intensive industries. So, any investment by you in these sectors must be taken with a lot of caution during the situation of high interest rates.

- Banking sector is likely to benefit most due to high interest rates. The Net Interest Margins (It is the difference between the interest they earn on the money they lend and the interest they pay to the depositors) for banks is likely to increase leading to growth in profits & the stock prices.

- Other sectors like pharmaceuticals, FMCG, IT etc are some of the least affected sector, look towards directing your investment in such sectors.

If interest rate continues to rise for a longer duration then it will have an all round negative impact on the economy, leading it into a recessionary mode.

Let us take a different route from the stock market and think about the marginal borrowers like the farmers. They borrow money from banks and micro-finance institutions to buy land, fertilizers, seeds, tractors etc. Higher cost of borrowings would act as a deterrent for farmers to improve agricultural productivity. Since agriculture is the backbone of Indian economy, high interest rate would act as a road block to the entire growth process.

So, definitely High interest rate is not the way to go about for the country (now you can know why India’s economy was not that fast growing back in 1980s.)

What about very low interest rate, is that great for us?

When the interest rate is very low, you would be obviously saving less and consuming more. This would leave the banks with much lower money to lend out to the borrowers, and their profit margins would also be affected by lower interest rate. Thus there would be fall in consumption & investment activities in the economy. The government in this situation would resort to printing of currency to infuse more money in the economy. This would lead to inflationary situation in the country. Also, FIIs and FDIs pace their decision on the basis of difference in interest rates between economies among other things. At very low interest rate the inflows are likely to be reduced.

Thus, for a developing country like India, the right path would be maintaining a moderate inflation & interest rate over a period of time which keeps both the banks, business community and the consumers happy which is very crucial for the smooth running of the economy.

So, what should your action point be due to changes in interest rate?

- Sectors like Real estate, automobiles, and capital intensive industries would be most affected by high interest rates but when the interest rates are lower they would be gaining the most. Check your investment in such sectors and avoid it if interest rate keeps rising.

- Sectors like IT and pharmaceutical are less affected by interest rate change, look for some amount of your total investment in such sectors.

- During high interest rates, avoid the companies with high debt situation as their interest cost on existing debt would go up affecting their EPS and ultimately the stock prices. But during low interest rate the leveraged companies would stand to gain.

- Look for companies with very low or zero debt situation as they won’t be affected by changes in interest rate ( for this check the 5 key financial parameters you should look at)

- High interest rate usually leads to rise in Net interest Margins for the banks. This is the time you could see their profits, EPS and stock prices rising. But lower interest rate has an adverse impact on banking stocks.

Looking at the current situation, it becomes even more important to understand the impact of macro-economic variables like interest rate and make an informed decision by investing in fundamentally strong companies with good future prospects and at the right price.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

THANKS A LOT FOR SHARING THIS PIECE OF ARTICLE IT WAS A GREAT HELP FOR ME FOR THE UNDERSTANDING