Marriage heralds a crucial life stage, where life enters a beautiful phase. The finances and risk profile of a family as a unit as well as their lifestyle also undergoes a rapid change and so does the tax planning.

In the previous article, we explained how tax planning helps a young individual in saving tax. Going forward, let’s see how the tax planning scenario changes when the same individual takes a plunge forward in life and gets married.

In this article, let’s consider two scenarios for a newly married couple

- When both are working

- When wife is not working

First case:

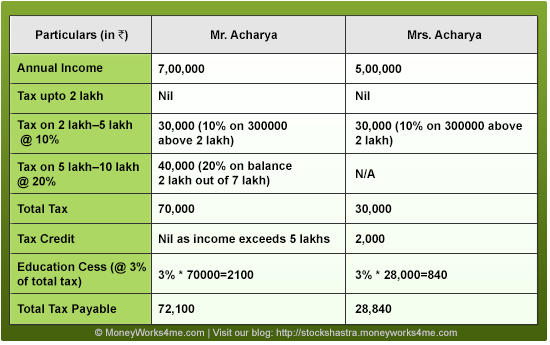

A newly married couple, Mr. & Mrs. Acharya, earns Rs. 7 lakhs and Rs. 5 lakhs p.a., respectively. As they start this new phase, they plan to buy a house rather than spending huge amount of money every month on rent.

Considering their current annual income, their tax liability comes out to Rs. 72,100 and Rs. 28,840, respectively. In total, Rs. 1,00,940 is paid as tax.

By doing planned investments, this tax liability can be reduced to a large extent. Let us see how this can be done.

As both are earning, the dependency factor is comparatively less here and thus, they can opt for relatively higher risk. Suggested allocation in equity linked investments would be ~50-60% and preferably in NPS. Its merits over ELSS have already been discussed in previous article. If they have some medium term financial goal (10-15 years) to be met then they can invest approx. ~20-30% in PPF. They can keep aside approx. ~10% in FD for immediate future plans like buying a car in let’s say next 5 years.

As they are married and both are working, they are considered not entirely dependent on each other. But having their parents as dependents, life & health insurance for themselves must be considered. Moreover, they must buy only term plans; the criterion for choosing one has already been discussed in the previous article.

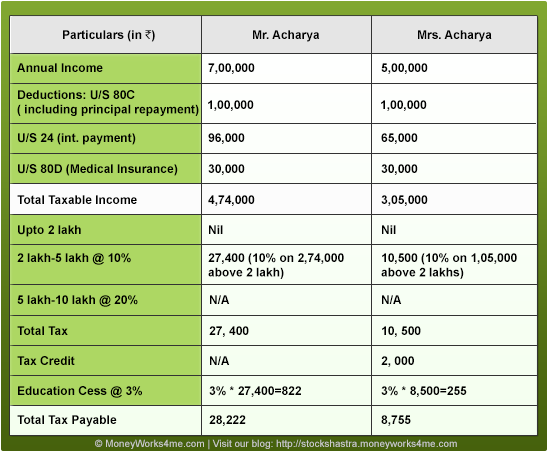

The Acharya’s also plan to buy a home in this financial year itself for around Rs. 30 lakhs. As the Acharya’s are first time home buyers and their home loan does not exceed Rs. 25 lakhs, they can avail tax deductions under the newly introduced section 80EE, for house loan interest payment of Rs. 1 lakh. This deduction is over and above the Rs. 1.5 lakh deduction available U/S 24. Also, if they have not paid the entire additional Rs. 1 lakh interest payable on loan, they can still carry forward the balance amount in next FY 14-15. This takes the total deduction available to each of the the Acharya’s to Rs. 2.5 lakhs or actual interest paid, whichever is lower.

# Assuming a loan of Rs. 25 lakhs @ 10.33% interest for 15 years.

# Assuming a loan of Rs. 25 lakhs @ 10.33% interest for 15 years.

So, by investing wisely, the Acharyas can get their tax liability reduced to Rs. 36,977 (28,222 + 8,755), saving Rs. 63,963.

Second case:

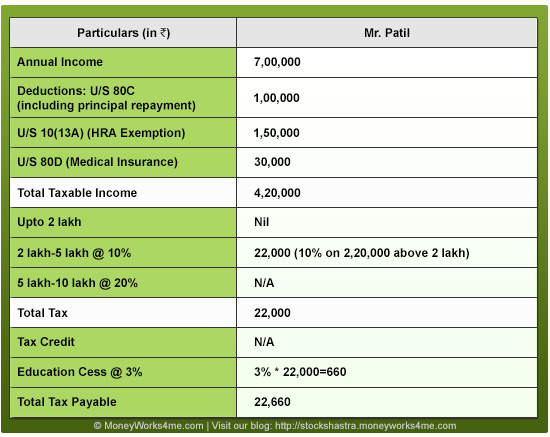

Mr. & Mrs. Patil got married recently with Mr. Patil’s annual income being Rs. 7 lakhs. They are staying with their parents and Mrs. Patil is not working.

Considering his annual income, Mr. Patil is liable to pay Rs. 72,100 as tax, as described above.

As only Mr. Patil is earning, he must opt for relatively less risk while doing tax planning. Hence, suggested allocation would be approx. 40-60% in NPS and 20-40% in PPF. They can keep aside approx. ~10-15% in FD for meeting their short term financial goals.

Mr. Patil must buy life insurance for himself, as now he has a dependent spouse as well as dependent parents. He must also buy health insurance to cover his parents’ and spouse’s health, for which term plans are best suited.

As he is staying with his parents, he has decided to enter into a rental agreement with his parents and pay them rent. This allows him to claim HRA tax deduction U/S 10(13A). However, his parents need to account the same under ‘Income from other sources’. As their income will be less than 2 lakhs, it will not be taxable, thus, saving the Patil’s some tax!

Here, Mr. Patil was initially paying Rs. 72,100 and now would be liable for only Rs. 22,660, which saves his tax by Rs. 49,440.

These are just a few pointers which may be helpful for a newly-wed couple and aid in efficient tax planning. In the above cases, we have not considered Hindu Undivided Family (HUF) as a tax saving option; reasons being too much of legal constraints associated with it and less benefit in trade off of high costs involved in running the HUF.

Identification of financial goals and corresponding tax planning done now would set the theme of well-being in the subsequent stages of life, when the expenses will be on a rise.

Also Read: A child brings Joy, Responsibilities & Tax Benefits!

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

As per my knowledge max deduction u/s 80GG is 24000

Thank you Vijay for correcting us. The required change has been made.