Macrotech Developers IPO Details:

IPO Date: Apr 7th to Apr 9th, 2021

Total Shares for subscription: ~5.14 Cr

IPO Size: ~Rs. 2,500 Cr

Lot Size: 30 shares

Price Band: Rs. 483-486 /share

Market Cap: ~Rs. ~22,000 Cr

Recommendation: Avoid

Purpose of Macrotech Developers IPO

- To reduce the outstanding borrowings of the company

- To acquire land or land development rights

- To meet general corporate purposes

About Macrotech Developers Ltd (Lodha Developers )

Macrotech Developers Ltd (MDL), earlier known as Lodha Developers, is Rs. 13,000 Cr real estate developers primarily based out in Mumbai. The company’s core business is residential real estate developments with a focus on affordable and mid-income housing.

The company’s brands include “Lodha”, “CASA by Lodha” and “Crown – Lodha Quality Homes” for affordable and mid-income housing projects, the “Lodha” and “Lodha Luxury” brands for their premium and luxury housing projects, and the “iThink”, “Lodha Excelus” and “Lodha Supremus” brands for their office spaces.

Their in-house sales team is supported by a distribution network of multiple channels across India as well as key non-resident Indian markets, such as the Gulf Cooperation Council, United Kingdom, Singapore and the United States.

The Lodha group has been involved in the real estate business since 1986. The company commenced operations in Mumbai, developing affordable housing projects in the suburbs of Mumbai, and later diversified into other segments and regions in the MMR and Pune. The company is led by Abhishek M. Lodha, Managing Director, and Chief Executive Officer.

Key Projects

The company’s large ongoing portfolio of affordable and mid-income housing projects include Palava (Navi Mumbai, Dombivali Region), Upper Thane (Thane outskirts), Amara (Thane), Lodha Sterling (Thane), Lodha Luxuria (Thane), Crown Thane (Thane), Bel Air (Jogeshwari), Lodha Belmondo (Pune), Lodha Splendora (Thane) and Casa Maxima (Mira Road). Their large townships are located at Palava (Navi Mumbai, Dombivali Region) and Upper Thane (Thane outskirts). The company’s affordable and mid-income housing developments form ~60% of their overall residential sales.

Their premium and luxury housing projects include Lodha Park (Worli), Lodha World Towers (Lower Parel), Lodha Venezia (Parel), and New Cuffe Parade (Wadala). In addition, they have a few projects under the “Lodha Luxury” brand, which comprise small-scale, high-value developments such as Lodha Altamount (Altamount Road), Lodha Seamont (Walkeshwar), and Lodha Maison (Worli).

As of December 31, 2020, MDL has 91 completed projects comprising ~7.7 Cr sq ft of Developable Area, of which 5.9 Cr square feet is in affordable and mid-income housing, 1.2 Cr square feet is in premium and luxury housing, 52.1 lakh square feet is in office space and 7.4 lakh square feet is in retail space.

The company also has 36 ongoing projects comprising approximately 2.878 cr square feet of Developable Area, of which 2.357 cr square feet is in affordable and mid-income housing, 28 lakh square feet is in premium and luxury housing, 23.8 lakh square feet is in office space and 0.4 lakh square feet is in retail space, and 18 planned projects comprising approximately 4.508 lakh square feet of Developable Area, of which 3.548 lakh square feet is in affordable and mid-income housing, 20.4 lakh square feet is in premium and luxury housing, 71.3 lakh square feet is in office space and 4.3 lakh square feet is in retail space, as of December 31, 2020. In their logistics and industrial park portfolio, the company has an ongoing and planned development of approximately 290 and 540 acres, as of December 31, 2020, respectively. In addition to their ongoing and planned projects, as of December 31, 2020, the company has land reserves of approximately 3,803 acres for future development in the MMR, with the potential to develop approximately 32.2 cr square feet of Developable Area.

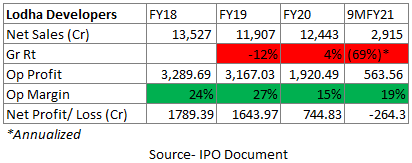

Financials of Macrotech Developers Ltd (Lodha Developers)

MDL reported almost flat sales growth over the last 3 years due to the slow-moving real estate sector post demonetization and the NBFC crisis.

MDL earns around 60% of sales from India and 40% from the UK through 2 key properties. Within India, it earns around 50% from affordable and mid-income and rests from luxury projects.

A lot of networth of the company is dominated by inventories like any real estate business, but debt is quite high with Rs. 18,500 Cr outstanding pre-IPO with less than 1.5x in interest coverage ratio. (pre-tax CFO/interest costs). 50% of current inventory is premium projects which are currently slow-moving.

Strengths:

- Strategically located parcels of land at competitive prices

- Robust pipeline of projects in the MMR as well as select tier-1 Indian cities

- Focused on affordable and mid-income housing projects which is a growing segment

Weakness:

- Cyclical Sector

- High Debt

- Irregular cash flows to ensure debt serving & project completion.

MoneyWorks4me Opinion

How is the business model? Good, Great, or Gruesome?

Gruesome. Real Estate business is steady and profitable only if executed well on an acquisition of land parcel, good marketing, timely construction, and handover to customers.

With several incidents of delay in possession and rouge developers, a lot of regulations like RERA have made real estate business very difficult in terms of profitability.

Post-demonetization, GST, and RERA, only a few organized players are likely to benefit immensely. Those with land parcels at prime locations can attract capital and volume growth.

Macrotech Developers (Lodha Developers) is one of the beneficiaries of this trend. It has large land parcels for the development of affordable housing and mid-income housing. Current sales from this segment are around 30% of total sales and 50% of sales from Indian operations. With additional inventories in affordable and mid-income housing, the share of this segment to rise in overall sales. This bodes well for the company.

Valuation of Macrotech Developers (Lodha Developers)

With sales at Rs. 13,000 Cr and operating margin of ~30%, EV/Sales of 3x or EV/EBITDA 10x is not very excessive on valuation. However, high debt makes valuation irrelevant. At current debt of Rs. 17,500 Cr approx. post IPO, debt forms 80% of the current market cap. Besides, strong political involvement is also a negative for long-term investment into this company.

We recommend AVOID on Macrotech Developers (Lodha Developers) due to erratic cash flows in the sector and high debt.

| IPO Activity | Date |

| IPO Open Date | Apr 7, 2021 |

| IPO Close Date | Apr 9, 2021 |

| Basis of Allotment Date | Apr 16, 2021 |

| Initiation of Refunds | Apr 19, 2021 |

| A credit of Shares to Demat Account | Apr 20, 2021 |

| IPO Listing Date | Apr 22, 2021 |

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 30 | ₹ 14,580 |

| Maximum | 13 | 390 | ₹ 189,540 |

| Date | QIB | NII | Retail | Employee | Total |

| Apr 7, 2021, 05:00 | 0.58x | 0.11x | 0.15x | 0.04x | 0.26x |

| Apr 8, 2021, 05:00 | 0.65x | 0.19x | 0.25x | 0.10x | 0.35x |

| Apr 9, 2021, 05:00 | 3.05x | 1.44x | 0.40x | 0.17x | 1.36x |

When will the Macrotech Developers Limited IPO open?

Macrotech Developers IPO will open for subscription on Wednesday, April 7, and will close on Friday, April 9.

What is the price band of Macrotech Developers Limited IPO?

The price band for Macrotech Developers IPO is Rs. 483-486.

What is the lot size for Macrotech Developers Limited IPO?

Retail investors can subscribe to the IPO minimum lot size is 30 shares, up to a maximum of 13 lots i.e. Rs. 1, 89,540.

What is the issue size of Macrotech Developers Limited IPO?

The total issue size is ~ 5.14 Cr shares raising ~ Rs. 2500 Cr.

What is the quota reserved for retail investors in Macrotech Developers Limited IPO?

The quota for retail investors in Macrotech Developers IPO is fixed at 35% of the net offer.

When will the basis of allotment be out?

Allotment will be finalized on April 16 and refunds will be credited by April 19. Shares allotment will be credited in Demat accounts by April 20.

What is the listing date of Macrotech Developers Limited IPO?

The tentative listing of Macrotech Developers IPO is April 20.

Where could we check the Macrotech Developers Limited IPO allotment?

One can check the subscription status on Link Intime.

Who are the leading book managers to the issue?

Book running lead managers to the IPO are Axis Capital Ltd., J.P. Morgan India Pvt. Ltd., Kotak Mahindra Capital Co. Ltd., ICICI Securities Ltd., Edelweiss Financial Services Ltd., IIFL Securities Ltd., JM Financial Ltd., Yes Securities (India) Ltd., SBI Capital Markets Ltd., and BOB Capital Markets Ltd.

What does Macrotech Developers Limited do?

Macrotech Developers Limited is one of the largest real estate developers in India. The company’s core business is residential real estate developments with a focus on affordable and mid-income housing.

Who are the peers of Macrotech Developers Limited?

The company is a real estate developer and its listed peers are- Sobha, DLF, Godrej Properties, Indiabulls Real Estate, etc.

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me PRO solution which provides you with exhaustive research-backed recommendations on strong companies, mutual funds, and index funds. The MoneyWorks4me PRO is priced below Rs. 5000 but provides a guide to building a strong portfolio for beginners to become PRO.

Click here, for the Recent IPO complete list and IPO Historic data 2021.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Why MoneyWorks4me | Why Register | Call: 020 6725 8333 | WhatsApp: 8055769463