Mirae Asset Mutual Fund has launched NYSE FANG+ Index ETF to participate in top-performing new-age businesses based out in the US. It is a very narrow portfolio of winners picked in hindsight. If you wish to add a fund for the long term, a broad-based index or fund like S&P500/Nasdaq 100 brings more to the table by adding the right diversification versus NYSE FANG+

Table of Content:

- What is a FANG+ Index?

- Why is it introduced now?

- What are other characteristics of this ETF or international ETFs?

- Should you invest in Mirae Asset NYSE FANG+ ETF?

Mirae Asset Mutual Fund has launched an international ETF with a narrow index of 10 stocks called FANG+ ETF. The deadline for NFO is April 30th.

What is a FANG+ Index?

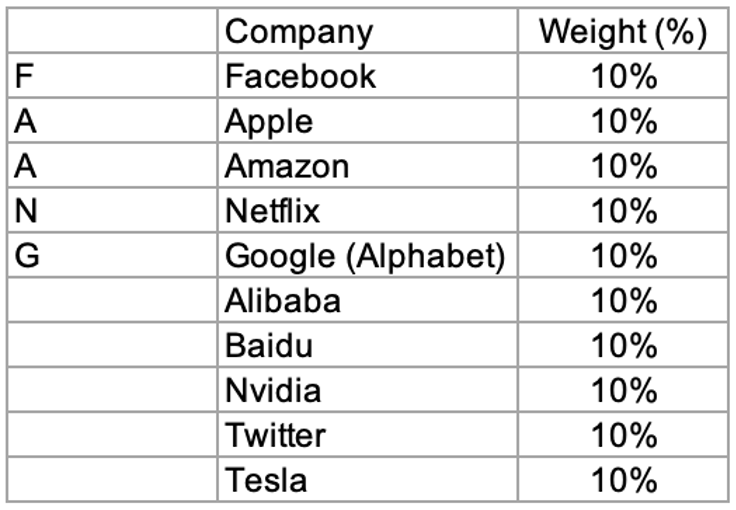

FANG+ Index was created to track the equal-weight performance of FAANG stocks -an additional five more actively traded technology companies including Alibaba, Tesla, etc.

Why is it introduced now?

For the last 10 years, FAANG stocks have gone from strength to strength as they spearhead their respective sectors. The technology sector often exhibits a “Winner takes all” kind of business model where out of multiple companies only a few turn out winners.

Source: TradingView.com

FAANG stocks have clocked phenomenal returns in the last 6 years versus S&P500. Four out of 5 companies have a very resilient business model and consistent growth track record. Valuations were high, for better future prospects, but were not excessive in the last 5-6 years.

FANG+ index is basically compiling these winners into an Equal Weight portfolio to cater to investors’ demand for such stocks.

FANG+ is constructed in hindsight, after seeing momentum in these stocks. We find this index construction strategy very speculative as it simply identified stocks that are in infancy and formed an index.

We believe a broader-based technology/international index fund ETF makes more sense than concentrated winners chosen in hindsight.

We are more optimistic about companies like Facebook, Microsoft, Amazon, or Google versus Netflix, Tesla, Twitter, and Nvidia. Latter names have a higher risk than former in terms of business model or unconventional method of valuation.

What are other characteristics of this ETF or international ETFs?

- Low cost: Since it is an index ETF (NYSE FANG+ Index), it is a very cheap way to invest in US. Just the expense ratio of Mirae AMC.

- Currency depreciation: Indian investors also enjoy returns from currency depreciation as currency is not hedged in most international funds. In the last 20 years, it has averaged around 3% p.a.

- High taxation versus Indian Equity: Foreign debt funds are taxed like debt funds in India. Since Equity funds must be held longer than 3 years, taxation on international equity after 3 years is 20% on capital gains with indexation.

Should you invest in Mirae Asset NYSE FANG+ ETF?

We recommend Avoid on Mirae Asset NYSE FANG+, as adding this product will increase funds in your portfolio without adding significant diversification. We recommend to choose S&P500 index or Nasdaq 100 over a concentrated & relatively new index called NYSE FANG+

US Market prospects:

We shared with our subscribers in Oct’20 to opt for the SIP route to International Index ETF as valuation in the US is high versus other markets including India.

US market upside potential over the next decade is likely to be lower due to i) market has been valued w.r.t. lower benchmark rate ii) higher valuation on normalized margins, etc. As a result, US market return* from current prices may not cross Indian investors’ hurdle rate for equity return.

*Observation only for Index Funds, not individual stocks. Return assumption for the next 10 year period. US market has stayed expensive as it adjusted to a lower rate of interest in the economy.

If you liked what you read and would like to put it into practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Why MoneyWorks4me | Why Register | Call: 020 6725 8333 |WhatsApp: 8055769463