Nazara Technologies IPO Details:

IPO Date: March 17th to March 19th, 2021

Total Shares for subscription: ~53 Lakh

IPO Size: ~Rs. 583 Cr

Lot Size: 13 shares

Price Band: Rs. 1100-1101/ share

Market Capitalization: ~3,100 Cr

Recommendation: Subscribe only for Listing gains

Purpose of Nazara Technologies Limited IPO

- To achieve the benefits of listing Equity Shares on the Stock Exchanges.

- Offer for Sales by the Existing Shareholders

About the Nazara Technologies Limited

Incorporated in 1999, Nazara Technologies Limited is the company engaged in offering interactive games, gamified learning, and new age Sports media and gaming subscription service.

It has a customer base across emerging and developed global markets such as Africa and North America for companies it acquired partial stakes.

Some of the popular games of the company include World Cricket Championship, CarromClash, Kiddopia in gamified early learning, Nodwin and Sportskeeda in eSports and eSports media, and Halaplay and Qunami in skill-based, fantasy and trivia games.

Business operations comprise offerings in (i) gamified early learning, (ii) eSports, (iii) telco subscription games, (iv) freemium mobile games and skill-based, (v) fantasy and trivia real money games.

Nazara was among the first entrants in India in eSports through Nodwin and cricket simulation through Nextwave.

Management of Nazara Technologies:

Vikash Mittersain is the Chairman and Managing Director of the company. He has been associated as Director of the Company since its incorporation. He holds a diploma in industrial electronics from Walchand College of Engineering, Sangli, and has several years of experience in multiple business sectors.

Nitish Mittersain is the Joint Managing Director of the company. He holds a bachelor of commerce degree from the University of Mumbai. He founded the company in 1999 and has been associated with the company for the last 20 years.

Manish Agarwal is the CEO of the company. He has ~20 years of experience in various fields including the gaming space and marketing. He was associated with Reliance Games for more than four years as a CEO of Zapak Mobile Games and COO of Zapak Digital Entertainment Limited. Prior to that, he was associated with UTV Software Communications Limited for ~2 years as a CEO. Further, He was also associated with Rediff.com India Limited, in the role of vice president marketing, and prior to rediff.com, he has worked with Hindustan Unilever Limited.

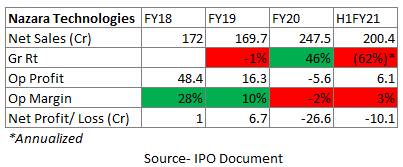

Financials of Nazara Technologies:

The company has grown its sales from Rs. 172 Cr to 400 Cr (annualized) over the last 3.5 years. Entire growth has come from acquiring controlling and non-controlling in other gaming companies.

The company has expanded its portfolio of business offerings through acquisition and successfully integrated these businesses into its operations. The company believes that it has been successful in selectively identifying strategic acquisition and investment targets in the past, and in integrating, developing, synergizing, and leveraging the existing businesses and brand equity of its past acquisitions and investments to enter into new business segments and geographies, diversify its revenue streams, obtain employee talent and thus expand its presence across the value chain.

MoneyWorks4me Opinion

Nazara Technologies operates in a high-growth industry propelling the digital story and consistent shift from traditional media backed by favorable demographics and increasing spends on entertainment.

Gaming companies tend to have sporadic rise and fall in sales depending on hits and miss in-game launches. Sometimes a game can take 7-10 years for launch, few others take 4-5 before they get popular. However, once it gets popular, it brings a windfall in sales from subscription fees or advertisement or merchandise.

Unfortunately, games have a much shorter life span as they lose traction and favoritism within the first 2-3 years of becoming popular.

Think of a lottery ticket. You rarely hit a jackpot but if you win, but when you do it will be huge. Nazara or any gaming company is like a lottery ticket.

To improve chances of winning a jackpot a company often prefers to expand its gaming portfolio by acquiring stakes in different companies to participate in their growth. What value accrues to the acquirer depends on its ability to find future winners and the price it pays for the stake in other companies.

We recommend viewing this company as a venture capital/private equity type of investment which will invest what it deems a good opportunity in the gaming space. This

Strengths:

- Presence in a high growth industry

- Led by a team of experienced to identify future winning games and capitalize on the same

Risks:

- Volatile sales

- Unpredictable profitability

Valuation:

There is no valuation model to evaluate the right value of this company. This company is like a fund of funds with the current CEO as its fund manager. He will allocate funds to what it deems the best bang for the buck.

Think of this company as a thematic stock to participate in the future of the gaming industry. This can be a small bet on the overall portfolio if you are a strong believer in the growth potential of the gaming industry.

For us, we intend to earn healthy-high returns in the market, not necessarily from every opportunity. There are many opportunities with better visibility and predictability. We are willing to give Nazara Technologies a pass for the long term.

Recommendation:

Long term: Avoid

Short term: Only listing gains

The current IPO market is quite hot due to large retail and HNI Participation, you can participate for listing gains. Only if you are interested in the long-term growth of the gaming industry, do not hold beyond the listing day.

Note: We do not recommend buy just because the IPO market is hot. We do not earn any commission or fee for promoting IPOs so expect an honest review from us on the business model and valuation.

| IPO Activity | Date |

| IPO Open Date | 17th March 2021 |

| IPO Close Date | 19th March 2021 |

| Basis of Allotment Finalisation Date | 24th March 2021 |

| Refunds Initiation | 25th March 2021 |

| A credit of Shares to Demat Account | 26th March 2021 |

| IPO Listing Date | 30th March 2021 |

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 13 | ₹ 14,313 |

| Maximum | 13 | 169 | ₹ 186,069 |

| Date | QIB | NII | Retail | Employee | Total |

| Mar 17, 2021, 05:00 | 0.36x | 2.85x | 16.75x | 2.28x | 4.01x |

| Mar 18, 2021, 05:00 | 0.72x | 7.73x | 44.47x | 5.33x | 10.55x |

| Mar 19, 2021, 05:00 | 103.77x | 389.89x | 75.29x | 7.55x | 175.46x |

When will the Nazara Technologies Ltd IPO open?

Nazara Technologies IPO will open for subscription on Wednesday, March 17, and will close on Friday, March 19.

What is the price band of Nazara Technologies Ltd IPO?

The price band for Nazara Technologies IPO is Rs. 1100-1101.

What is the lot size for Nazara Technologies Ltd IPO?

Retail investors can subscribe to the IPO minimum lot size is 13 shares, up to a maximum of 13 lots i.e. Rs. 1, 86,069.

What is the issue size of Nazara Technologies Ltd IPO?

The total issue size is ~53 Lakh shares raising ~ Rs. 583 Cr.

What is the quota reserved for retail investors in Nazara Technologies Ltd IPO?

The quota for retail investors in Nazara Technologies IPO is fixed at 10% of the net offer.

When will the basis of allotment be out?

Allotment will be finalized on March 24 and refunds will be credited by March 25. Shares allotment will be credited in Demat accounts by March 26.

What is the listing date of Nazara Technologies Ltd IPO?

The tentative listing of Nazara Technologies IPO is March 30.

Where could we check the Nazara Technologies Ltd IPO allotment?

One can check the subscription status on Link Intime.

Who are the leading book managers to the issue?

Book running lead managers to the IPO are ICICI Securities Ltd., IIFL Securities Ltd., Jefferies India Pvt. Ltd., and Nomura Financial Advisory and Securities India Pvt. Ltd.

What does Nazara Technologies Ltd do?

Nazara Technologies Limited is a company engaged in offering interactive games, gamified learning, and new-age Sports media and gaming subscription service. It has a customer base across emerging and developed global markets such as Africa and North America for companies it acquired partial stakes.

Who are the peers of Nazara Technologies Ltd?

There are no listed peers in this segment.

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me PRO solution which provides you with exhaustive research-backed recommendations on strong companies, mutual funds, and index funds. The MoneyWorks4me PRO is priced below Rs. 5000 but provides a guide to building a strong portfolio for beginners to become PRO.

Click here, for the Recent IPO complete list and IPO Historic data 2021.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Why MoneyWorks4me | Why Register | Call: 020 6725 8333 | WhatsApp 8055769463