What is Nifty@MRP?

As investors, we constantly track the Nifty movements. To make investing more profitable and not a game of mere chance, we need a solution, a solution which could help us identify whether the market is grossly depressed or irrationally exuberant. This is exactly what Nifty @ MRP is for!

What is the latest value of Nifty@MRP?

The Nifty has rallied close to 400 points since the start of the year and managed to breach the psychological 9000 level post budget. This, despite the continuing earnings downgrade in the Dec 14 quarter. What has fuelled this rally?

Sentiments have been positive for a while now on expectations of an economic recovery, falling interest rates and hopes of an improving earnings outlook. All this in turn took the FII inflow to the highest level in any year at net $43.5 billion in FY15. Investment in debt was mainly due to the interest rate arbitrage and a stable currency as compared to other emerging markets. Investments in equity were backed by high expectations from the Modi-led government to turn-around the sluggish economy.

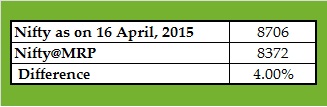

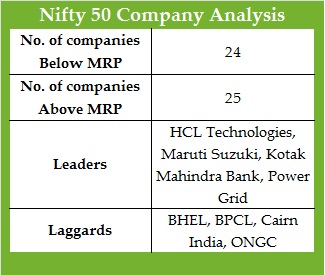

For Dec 14, considering the free float market capitalization at the MRP of individual stocks and the share price data as of 16th April, the Nifty@MRP is at 8372. On 16th April, NSE Nifty index closed at 8706, which is ~4% or 334 points above the Nifty@MRP. It indicates that the index is fairly valued.

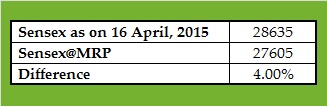

On similar lines, the Sensex@MRP is 27605.82. On 16th April, the Sensex closed at 28635, which is about 4% or 1029.18 points above the Sensex@MRP.

Future Outlook

While the Sensex has risen 17% since elections on hopes of Modi-magic, growth in companies’ bottom lines remains stagnant. The government has definitely done many good things like controlling deficit and inflation, coal auctions, telecom auctions, the new package for power producers.

However, it takes time to fix labour and land policies, making approval processes simpler and transparent, and ensuring resources for projects.In fact it may take another 3-4 quarters for investments to take off. Also, the huge FII inflow that has been a key factor in keeping the markets buoyant seems to be at risk. With the Fed expected to raise interest rates and RBI expected to reduce interest rates, the arbitrage opportunity in India is set to decrease.

However, it takes time to fix labour and land policies, making approval processes simpler and transparent, and ensuring resources for projects.In fact it may take another 3-4 quarters for investments to take off. Also, the huge FII inflow that has been a key factor in keeping the markets buoyant seems to be at risk. With the Fed expected to raise interest rates and RBI expected to reduce interest rates, the arbitrage opportunity in India is set to decrease.

On the global front too there have been signs of distress. Greece has recently been downgraded to junk status by S&P. This has had a huge negative impact on European markets and some of it is expected to rub off on the Indian markets.

All is not lost, though. The fact remains that there will still be high liquidity in global markets, with the ECB and Bank of Japan pursuing quantitative easing for some more time. This along with lower crude oil prices will continue to support valuation.

On the valuation front, investors have more than rewarded quality stocks taking valuations of some individual stocks into bubble territory. What is worrying is that some of these stocks have run up even without earnings support.

The fact that the earnings season is unlikely to be extremely great would mean that the markets cannot go significantly higher from where we are at this point of time. Disappointments may lead to correction in few stocks. So its good news for value investors like us. We require only a few great opportunities to earn great returns in the market. And this correction will only open up more doors for us.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463